Mollyycolllinss Categories Crypto

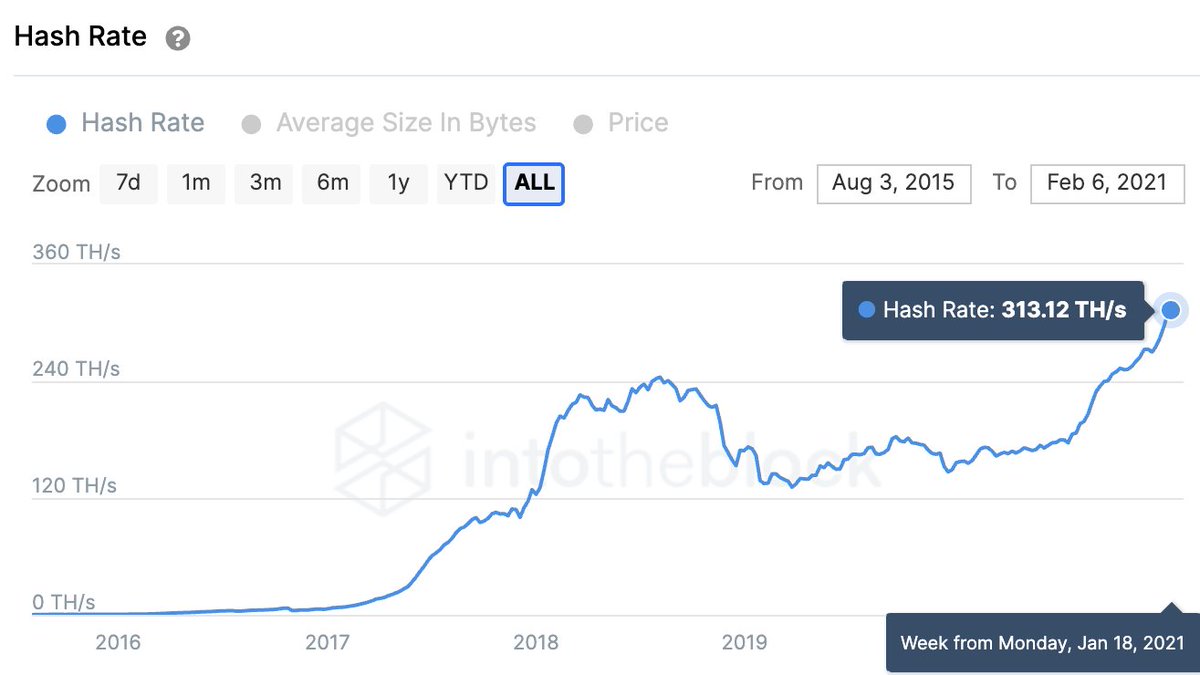

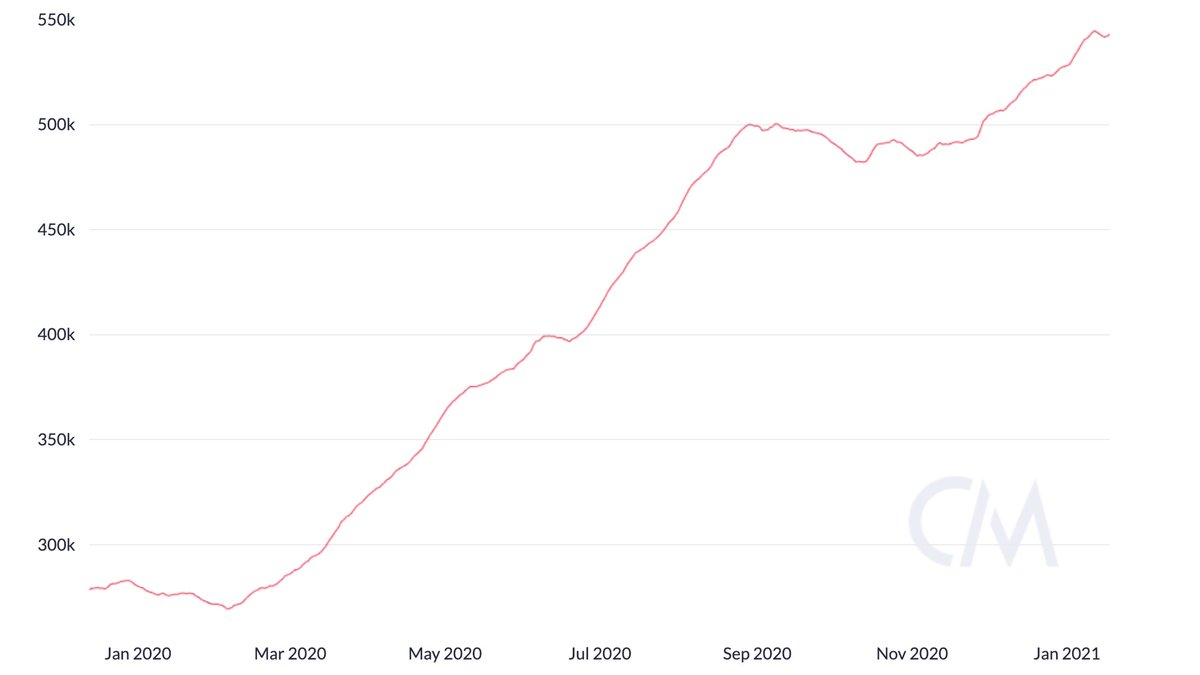

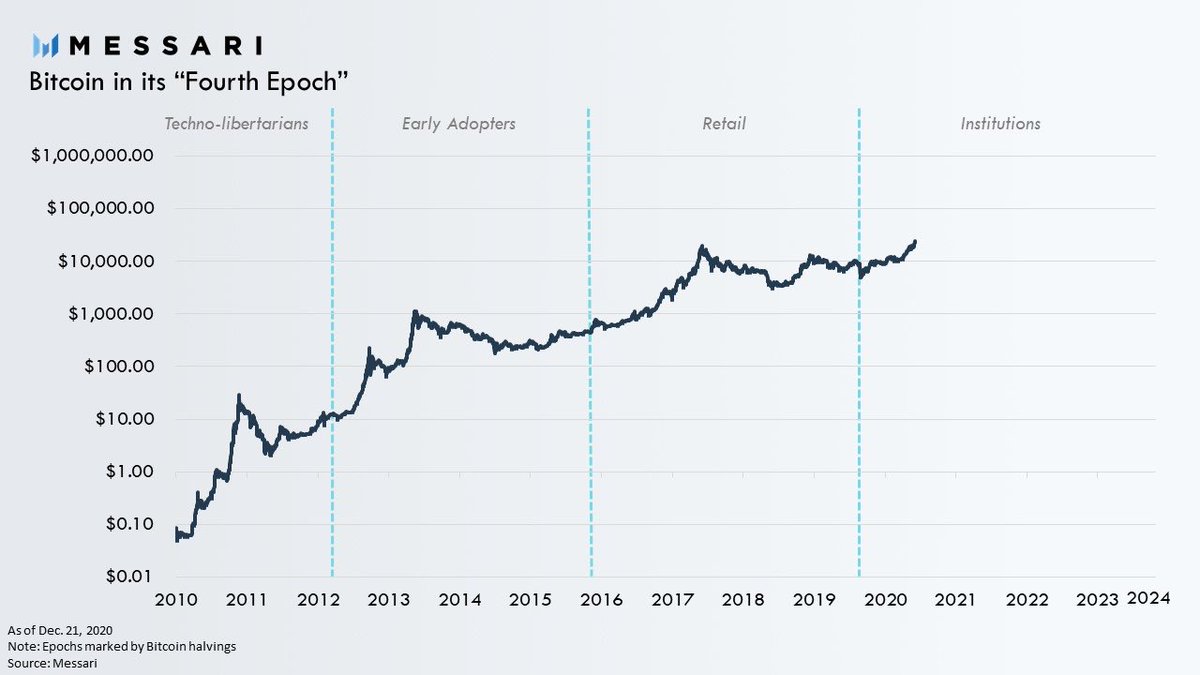

2020 will be remembered as the year the long fabled institutions finally arrived and #Bitcoin became a bonafide macroeconomic asset.

Below are the top highlights of each month for Bitcoin’s historic year.

1/

Bitcoin is now at all-time highs capping off an extremely successful year.

But it was by no means stable ride up.

2020 was a historically volatile year.

@YoungCryptoPM and I provided a detailed overview of every month of 2020 in all its

Jan.

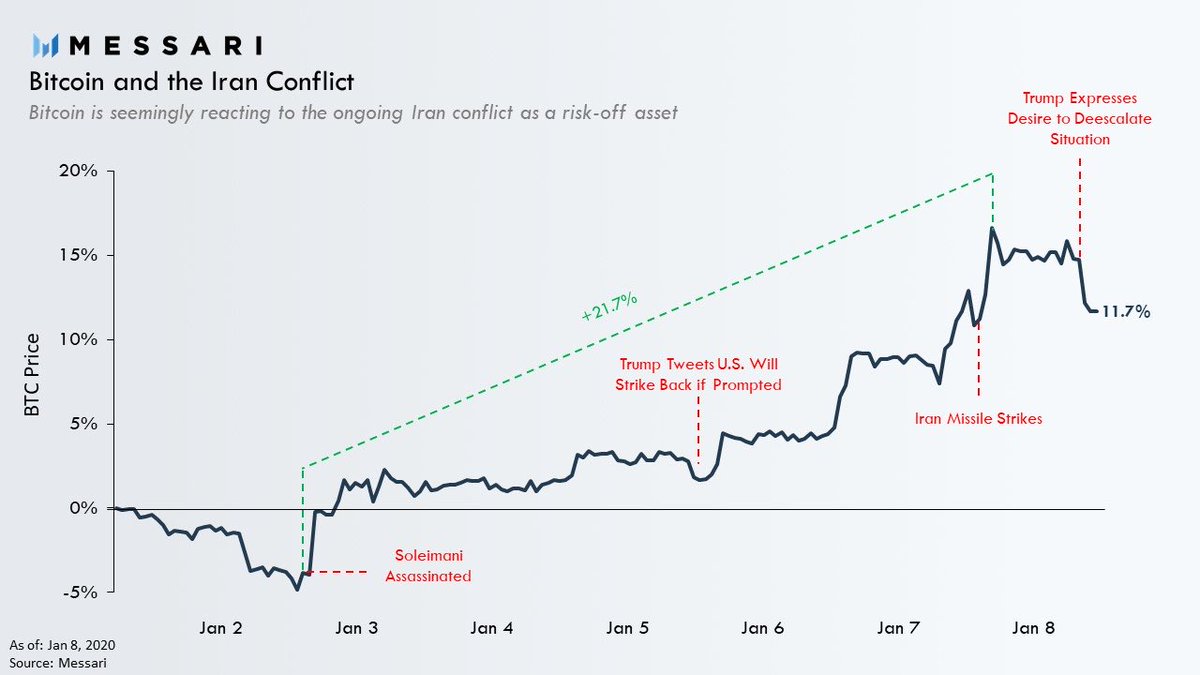

3 days into the new year the US assassinated Iran’s top general Soleimani.

BTC surprisingly reacted to the events behaving like a safe haven as the risk of war increased.

The events provided the first hints of BTC potentially having graduated to a legitimate macro asset.

Feb.

COVID-19 reached a tipping point causing markets to crash.

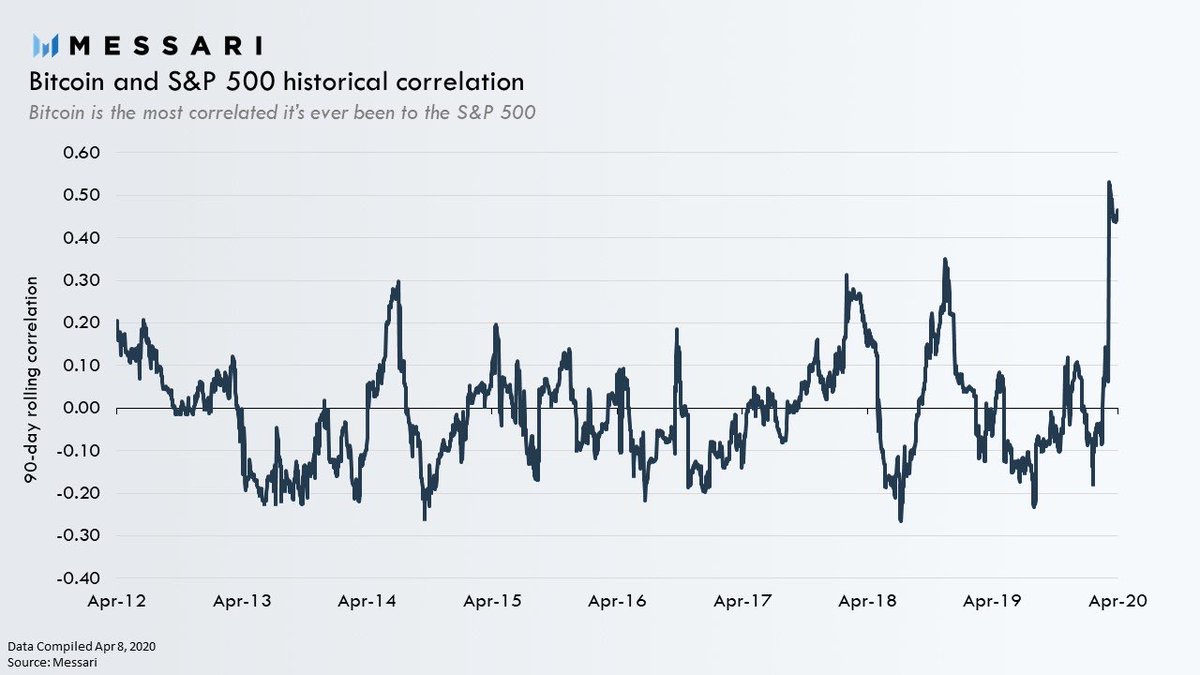

BTC’s correlation with the S&P 500 reached an ATH in the following weeks.

This is when everyone learned BTC was not a recession hedge, it was a hedge against inflation and loss of confidence in fiat currencies. https://t.co/JB7dJ3qp6M

1/ Figure I should get out ahead of this issue:

— Dan McArdle (@robustus) June 22, 2018

Bitcoin is a hedge against inflation & loss of confidence in fiat, NOT a hedge against a typical recession.

Mar.

Financial markets in free fall.

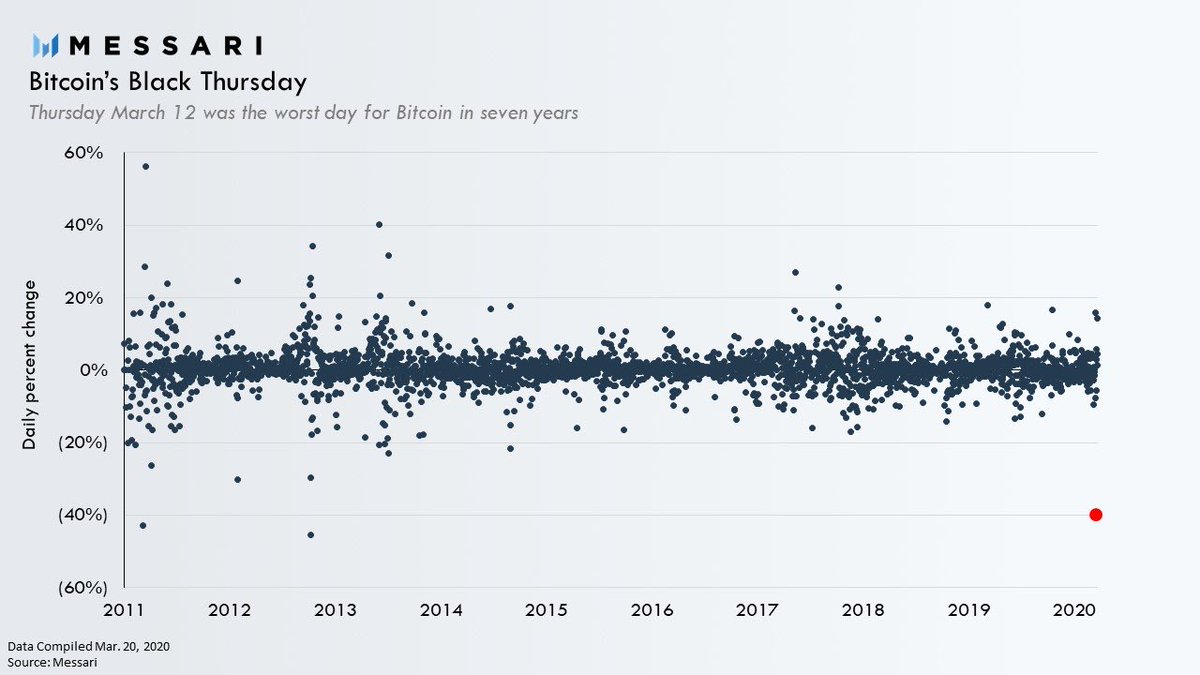

The liquidity crisis was so severe BTC experienced one of it’s worst days ever.

Now known as Black Thursday, on March 12, BTC plummeted as much as 50% to below $4,000 at its lowest point on the day.

BTC closed the day down 40%

Bitcoin answers that question.

Thread:

1/11

— Michael Pettis (@michaelxpettis) January 11, 2021

An article worth thinking about: \u201cAs changes to the world structure accelerate, China\u2019s rule is in sharp contrast with the turmoil in the West,\u201d says Beijing.

I agree, but I draw a different conclusion. The world is certainly currently going...https://t.co/ugha7ygqqx

World economies currently suffer four major redistribution challenges:

The most important is increasing government stealth use of the monetary system to confiscate assets from productive actors.

/2

That process is exacerbated by "Cantillon Effect" transfers to interest groups close to government ("the entitled class," public sector workers, the medical industrial complex, academia, etc....), which is destroying much of that wealth /3

The shadow nature (see Keynes) of government inflation makes the process unidentifiable, un-addressable and undemocratic.

The biggest victims (America's poorly educated young) are unequipped to counter generational confiscation tactics of today's wily senior beneficiaries. /4

Government control of the numéraire in key economic statistics (GDP, inflation, etc...) makes it impossible for economic actors to measure progress and liabilities. /5

This is bad. Continue reading why and how to avoid this in the future.

👇👇👇

2/ Before you go all rage on the flaws of my analysis, please read the whole Twitter thread for disclaimers and caveats.

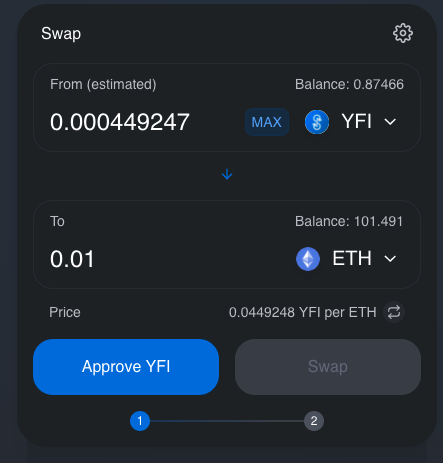

3/ approve() is an unnecessary step of ERC-20 tokens when they interact with smart contracts.

You know this because when you do a Uniswap trade you need press two transaction buttons instead of one.

4/ Why there is approve() - you can read the history in this Twitter

1/ I just spend my Saturday morning on a call with a crypto fund explaining to them how #Ethereum ERC-20 token approve() function works

— \U0001f42e Mikko Ohtamaa (@moo9000) August 29, 2020

I am too old for this shit. pic.twitter.com/7EYfOaRP5L

5/ I queried all approve() transactions on Google BigQuery public dataset and calculated their ETH cost and then converted this to the USD with the current ETH price.

Step 1: $BTC has a huge correction. Every range starts with either a pump (or dump) and then follows with a dump (or pump). In this case, #Bitcoin pumped and is now pulling back. This is

If you want #Altseason, you should want $BTC to make a decent sized pullback. Ranges start after huge moves in both directions, IMO we need to see some cooling off before the ranging starts. Plz give 26k. #Bitcoin pic.twitter.com/yLG9xSrbKz

— Altcoin Sherpa (@AltcoinSherpa) January 3, 2021

Step 2: $BTC ranges big once it finds a bottom. This will allow it to reaccumulate for a big summer run in 2021. This is HEALTHY IMO.

Step 3: Once $BTC finds a bottom and starts to grind up again, I expect $ALTS to do very very well in both alt/usd and alt/btc pairs. ALTSZN is almost always characterized by strong alt/btc pairs moving- I've already accumulated most and have done my final buying today and more.

$BTC.D typically has a very nice time during this time of the year. I was off on December prediction bc I thought $BTC was going to pull back by then but oh well! #Altcoins will start their pumping time VERY soon now.

$BTC.D: This is the chart for inverse #Bitcoin Dominance, the macro chart you need to check out for #Altcoins and when they have their runs. Still potentially more pain to go for $ALTS but I'm thinking that they will turn around strong when $BTC is done w. its run. pic.twitter.com/Q8ewTSRywp

— Altcoin Sherpa (@AltcoinSherpa) December 27, 2020

More information on what #Altseason is and $ALTS market

Big #Altcoin thread for $ALTS: Where are we at in the cycle, how long do we have, is this #ALTSEASON, what are the relationships like, all of that. $BTC #Bitcoin $ETH $LINK #Altcoins pic.twitter.com/nwVjgZu4fw

— Altcoin Sherpa (@AltcoinSherpa) November 9, 2020

Can anyone tell me an estimated time frame that Nexgen could be permitted, start building their mine and be producing #uranium ??? @quakes99 @JekyllCapital @travmcph @NexGenEnergy $nxe

— Michael Pierce (@Big_U_Dawg) January 22, 2021

2/ Given the scale and cost structure of Arrow, it makes sense that investors are intensely focused on its delivery timeline. This thread will discuss possible timelines, current market expectations (i.e., what’s “priced in”) & how different Arrow scenarios will impact the mkt.

3/ As you can see from the litany of responses to Michael’s tweet, there is great skepticism in the market regarding Arrow’s timeline. This is largely due to a bearish narrative conveyed by competing CEO’s whose assets only hold value if Arrow is substantially delayed.

4/ Those who played “King of the Hill” as a child would remember that it is the person at the top who is constantly attacked, not the kid sitting at the bottom of the hill in the mud. No one cares enough about that kid to attack them. This is a good parable for $NXE & Uranium.

5/ First a quick note on “this cycle” – Segra generally defines this cycle as the deficits forecasted from the mid-2020s to late-2030s. When people imply an asset producing in the mid-to-late 2020s will “miss the cycle”, they clearly have not done any real S/D modelling.

ok, I lied. but strictly it's not a new graph, just a new trendline (now a quadratic on the log plot). looks um... quite a good fit. so I'd say that was interesting. pic.twitter.com/qkgyMf1ya8

— James Ward (@JamesWard73) January 27, 2021

WARNING: this is a long thread, and it’s a bit of a roller-coaster. We find some apparently strong patterns in the data, and then start to unpick them a bit. So if you start getting excited half way through you might find you’re less excited at the end. But we’ll see…

First we first have to go back a bit. @bristoliver posted a thread a few days ago explaining why, with a constant vaccination rate, a log plot of cases should show a quadratic form. In other words, it should fit an equation like: a + b.x + c.x^2

I meant to link in the model thread there - here it is

Been thinking about where we are, where we might be going, what effect vaccines might have and how to tell. This thread may not happen all at once, and will get a bit mathematical in a couple of places (sorry!), but I will put in pictures. It's yet another argument for log scales

— Oliver Johnson (@BristOliver) January 24, 2021

the quadratic coefficient – the ‘c’ in that equation – gives an estimate of the % of the population who are being newly protected by the vaccine each day. Please note ‘protected by the vaccine’, not ‘vaccinated’ – as we don't expect 100% protection after the first dose