7 days

30 days

All time

Recent

Popular

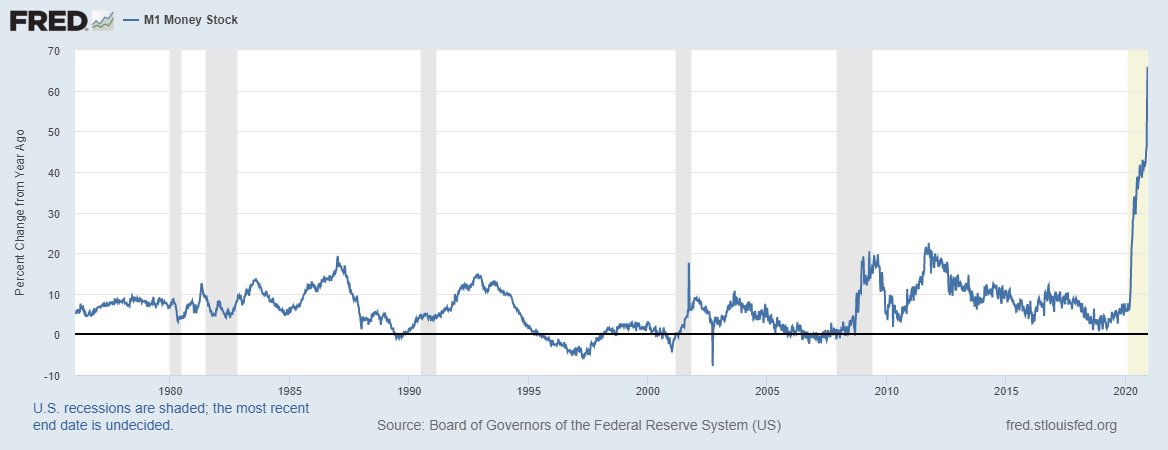

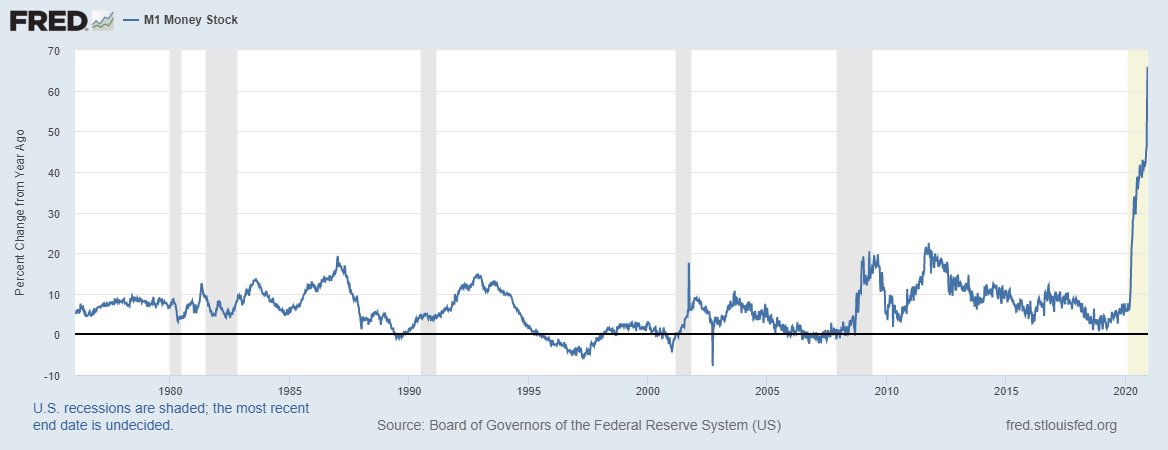

M1 money supply is rising at nearly 70% year over year

What is going on and does this mean inflation is coming?

Shorter Answer: No

Longer Answer: Not from the monetary channel

1)

Money supply started to accelerate at the end of March, almost 9 months ago

Inflation was the concern at the time.

"Not in the short-term" but over the long-run was the phrase

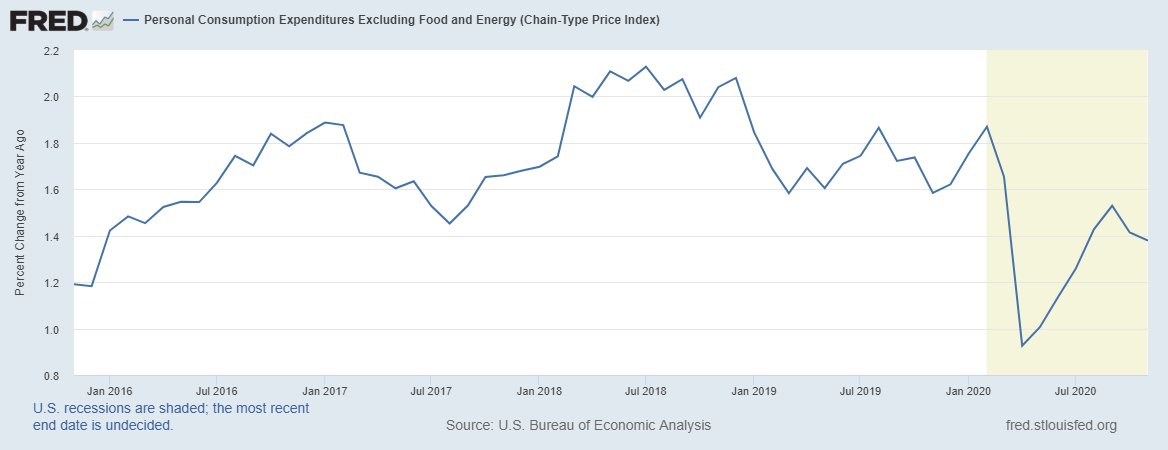

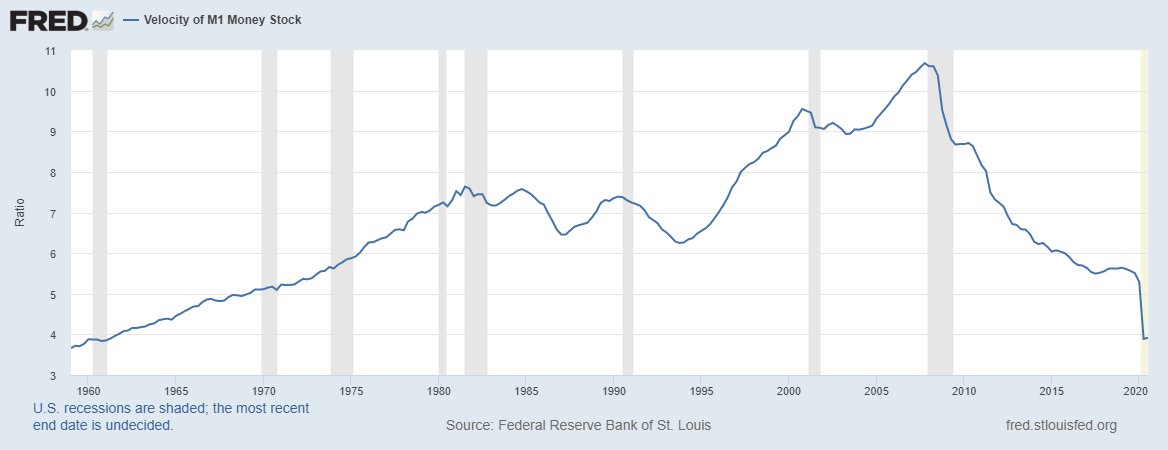

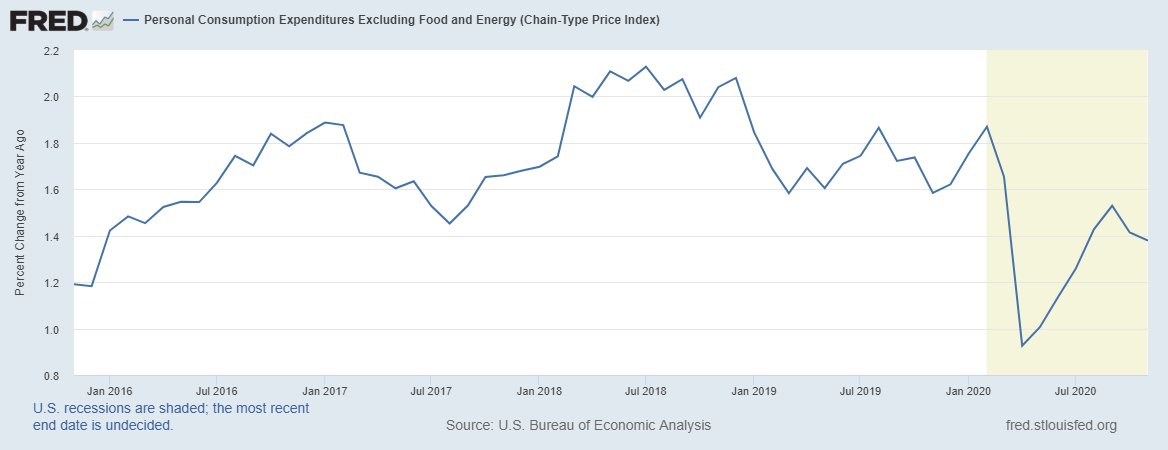

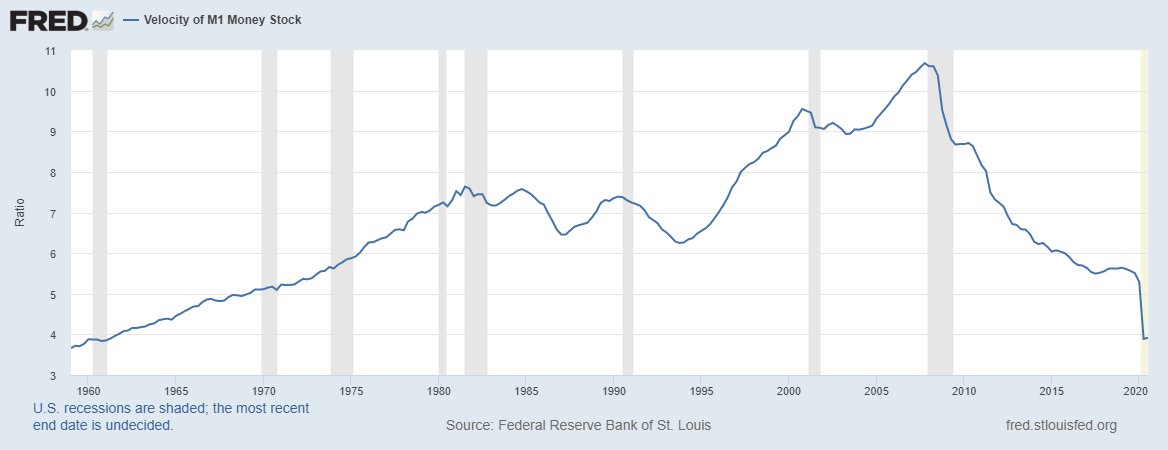

9 months later & inflation is lower than when the pandemic started because velocity collapsed

2)

There is a cyclical upturn ongoing in the manufacturing sector which is giving rise to "goods" inflation but that is wholly separate from the (lack of) inflation emerging from the monetary channel that many fear with posts of M1 or M2 money growth.

For inflation to emerge from the monetary channel, we need to see rising money growth with *at least* stable velocity and increasing bank loans.

Right now, only condition #1 is satisfied which is why inflation is declining with record money growth.

4)

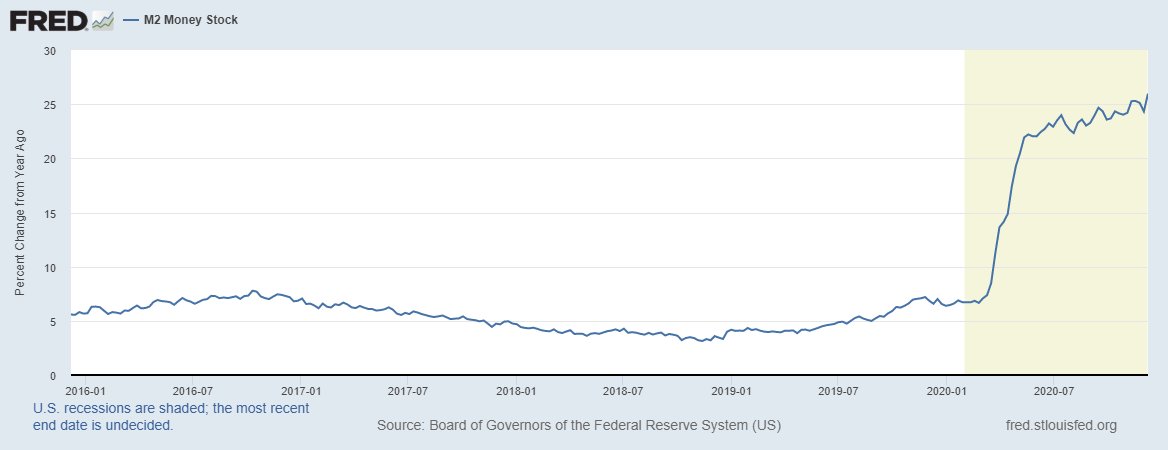

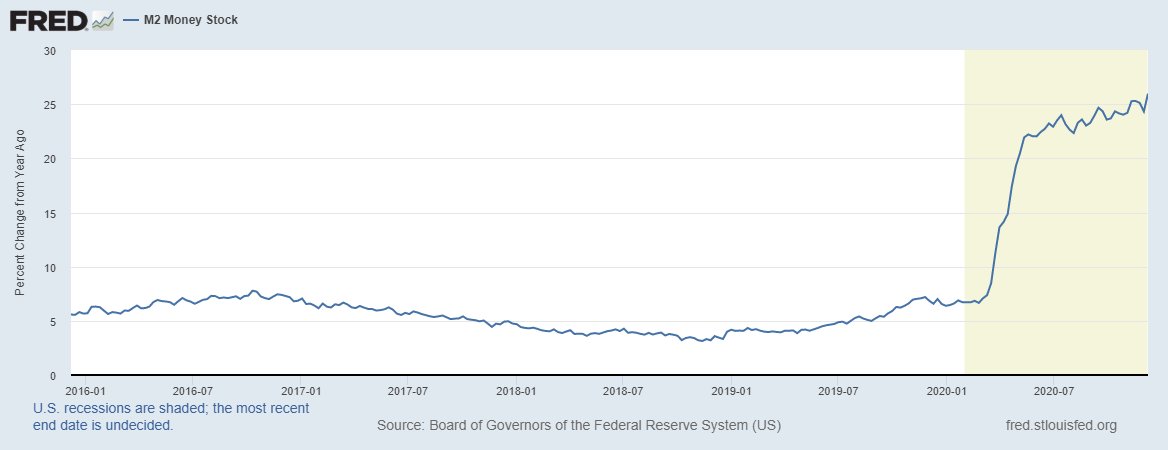

M1 money supply is rising nearly 70% year over year compared to M2 growth which is rising about 25% year over year.

5)

What is going on and does this mean inflation is coming?

Shorter Answer: No

Longer Answer: Not from the monetary channel

1)

Money supply started to accelerate at the end of March, almost 9 months ago

Inflation was the concern at the time.

"Not in the short-term" but over the long-run was the phrase

9 months later & inflation is lower than when the pandemic started because velocity collapsed

2)

There is a cyclical upturn ongoing in the manufacturing sector which is giving rise to "goods" inflation but that is wholly separate from the (lack of) inflation emerging from the monetary channel that many fear with posts of M1 or M2 money growth.

Goods inflation (manufacturing upturn)

— Eric Basmajian (@EPBResearch) December 7, 2020

vs.

Services disinflation (social distance rules / changing consumer behavior). pic.twitter.com/mXEoI7OvEL

For inflation to emerge from the monetary channel, we need to see rising money growth with *at least* stable velocity and increasing bank loans.

Right now, only condition #1 is satisfied which is why inflation is declining with record money growth.

4)

M1 money supply is rising nearly 70% year over year compared to M2 growth which is rising about 25% year over year.

5)