AnmolNarula11's Categories

AnmolNarula11's Authors

Latest Saves

Such opportunities only come once in a few years.

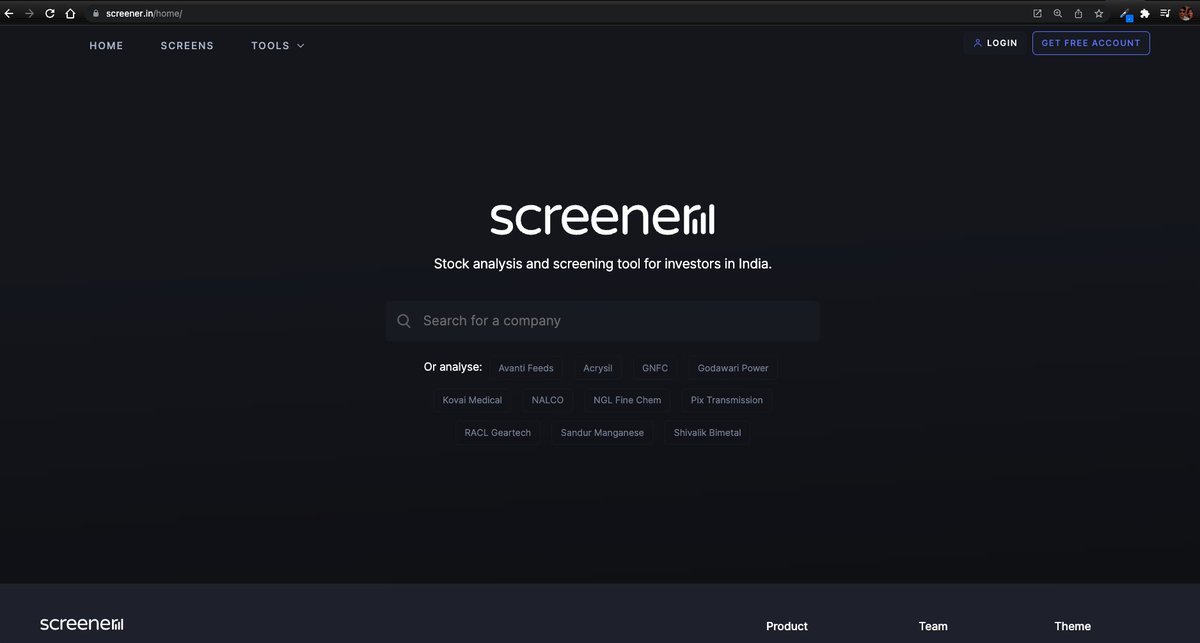

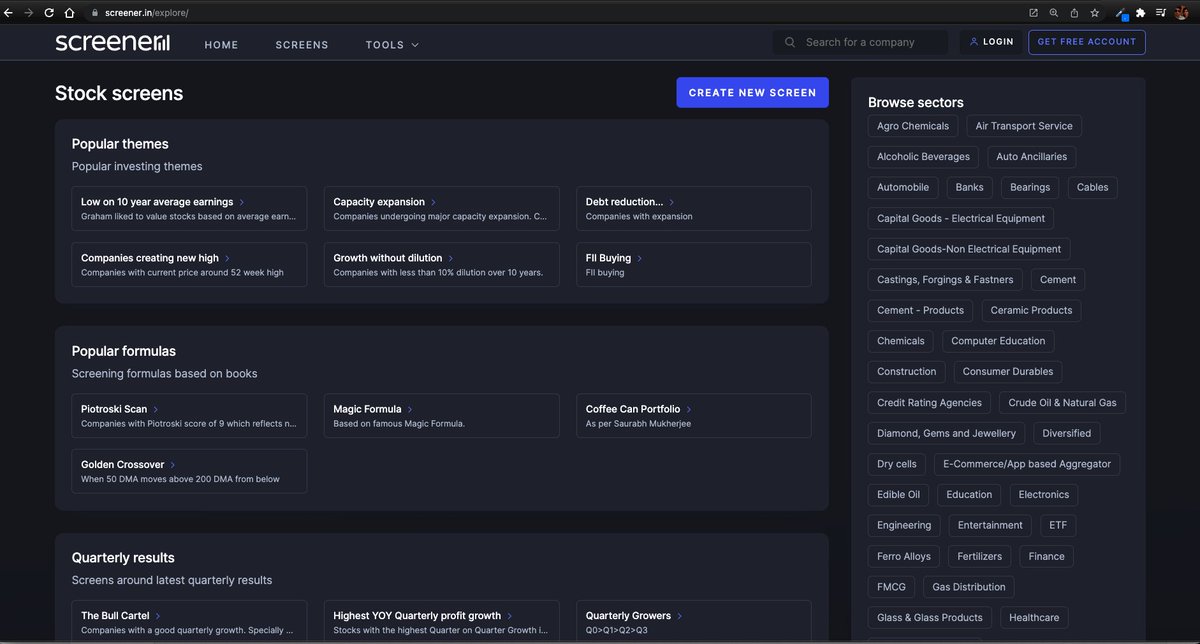

Step-by-step: how to use (the free) @screener_in to generate investment ideas.

Do retweet if you find it useful to benefit max investors. 🙏🙏

Ready or not, 🧵🧵⤵️

I will use the free screener version so that everyone can follow along.

Outline

1. Stepwise Guide

2. Practical Example: CoffeeCan Companies

3. Practical Example: Smallcap Consistent compounders

4. Practical Example: Smallcap turnaround

5. Key Takeaway

1. Stepwise Guide

Step1

Go to https://t.co/jtOL2Bpoys

Step2

Go to "SCREENS" tab

Step3

Go to "CREATE NEW SCREEN"

At this point you need to register. No charges. I did that with my brother's email id. This is what you see after that.

Step-by-step: how to use (the free) @screener_in to generate investment ideas.

Do retweet if you find it useful to benefit max investors. 🙏🙏

Ready or not, 🧵🧵⤵️

I will use the free screener version so that everyone can follow along.

Outline

1. Stepwise Guide

2. Practical Example: CoffeeCan Companies

3. Practical Example: Smallcap Consistent compounders

4. Practical Example: Smallcap turnaround

5. Key Takeaway

1. Stepwise Guide

Step1

Go to https://t.co/jtOL2Bpoys

Step2

Go to "SCREENS" tab

Step3

Go to "CREATE NEW SCREEN"

At this point you need to register. No charges. I did that with my brother's email id. This is what you see after that.

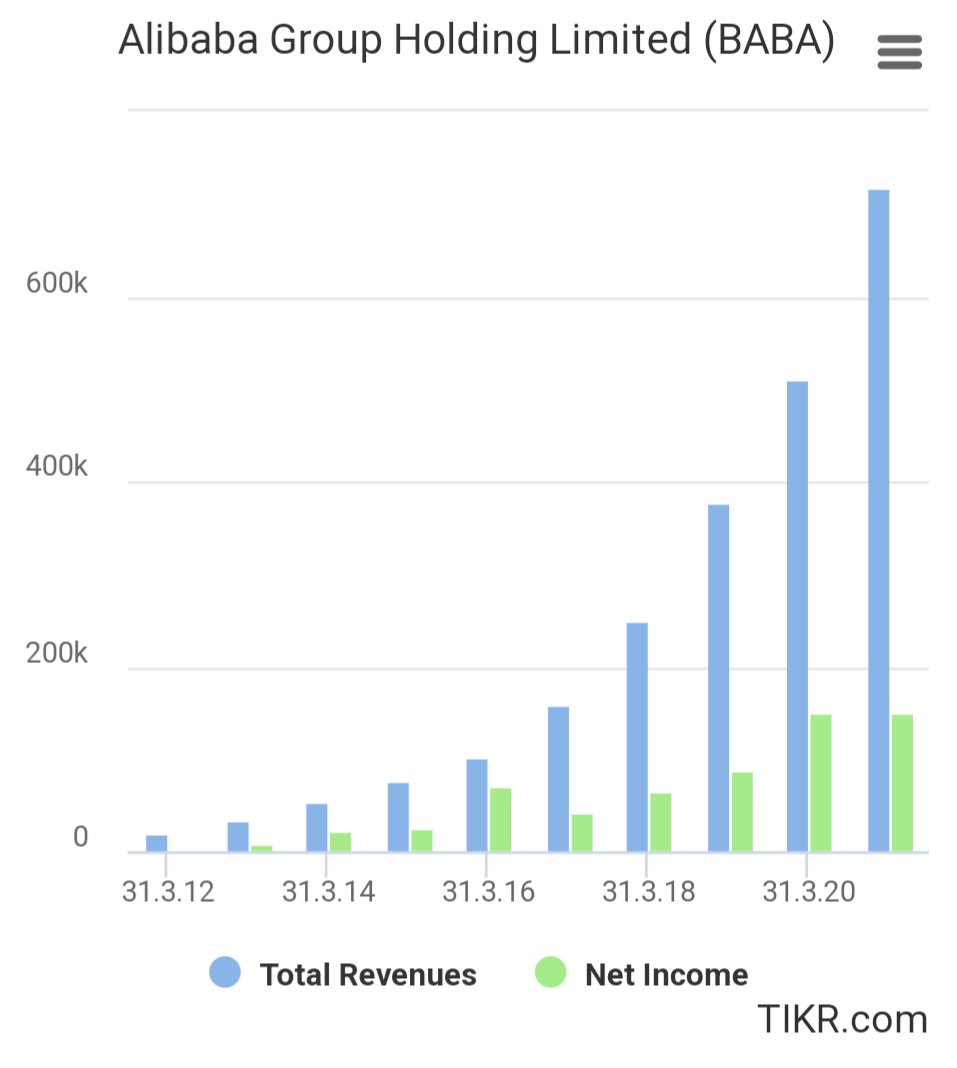

When we put a high multiple to sales, the most important thing to worry about is - what could disrupt those cash flows. A lower multiple to sales (like a 1x or 2x) justifies Yo-Yo cyclicality and 10x sales implies relatively stable gross margins, cash flow and business economics.

It's amazing \U0001f60a 25% NP

— Avinash (@Aviral_Bharat) February 17, 2022

$8b revenue

$2b Profit

$92b MCap

At 11 times revenue, it seems to be cheap compared to\U0001f609

1/ Some signs to look for that suggest your startup equity won't be worth shit

(note: there are probably exceptions but generally, these will steer you right)

2/ Companies who talk about innovation in HR and other functions more than they talk about innovating on the product

Gimmicky isht like this is never a good sign

3/ Billion dollar valuation pre-product

4/ Mid- to later-stage company and the about us page is all about their investors

That's ok at the early stages but eventually you gotta build some shit for customers

If you're bragging about your investors at Series B, C, the actual biz model is fundraising

5/ Where the revenue/raised ratio is totally f^cked aka low

This is co revenue / total raised

Esp problematic as companies get more mature

The best companies are machines at turning $ raised into revenue at some point

Bit more here

(note: there are probably exceptions but generally, these will steer you right)

2/ Companies who talk about innovation in HR and other functions more than they talk about innovating on the product

Gimmicky isht like this is never a good sign

3/ Billion dollar valuation pre-product

4/ Mid- to later-stage company and the about us page is all about their investors

That's ok at the early stages but eventually you gotta build some shit for customers

If you're bragging about your investors at Series B, C, the actual biz model is fundraising

5/ Where the revenue/raised ratio is totally f^cked aka low

This is co revenue / total raised

Esp problematic as companies get more mature

The best companies are machines at turning $ raised into revenue at some point

Bit more here

Some SaaS revenue/raise ratios of cos (anonymized) who've raised in last 3 months.

— Anand Sanwal (@asanwal) November 30, 2018

Collaboration software = 0.25-0.37x

Research & data analytics = 0.28x

Biz Intelligence = 0.12x

Some comparison points

Domo pre-IPO = 0.16x

Tableau (at IPO) = 8.51x

Frothy out there or rational?

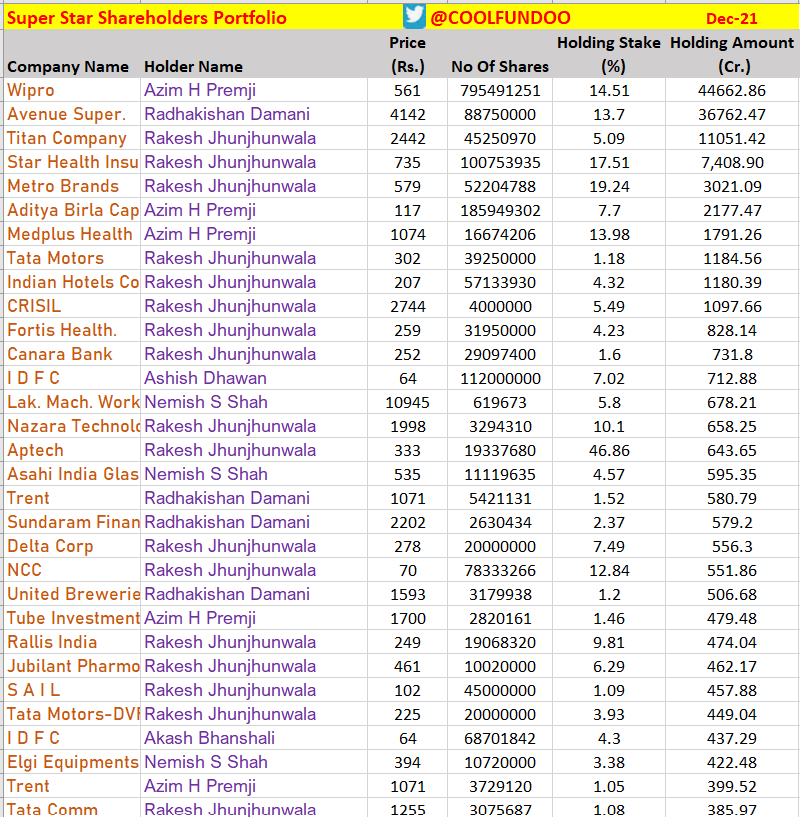

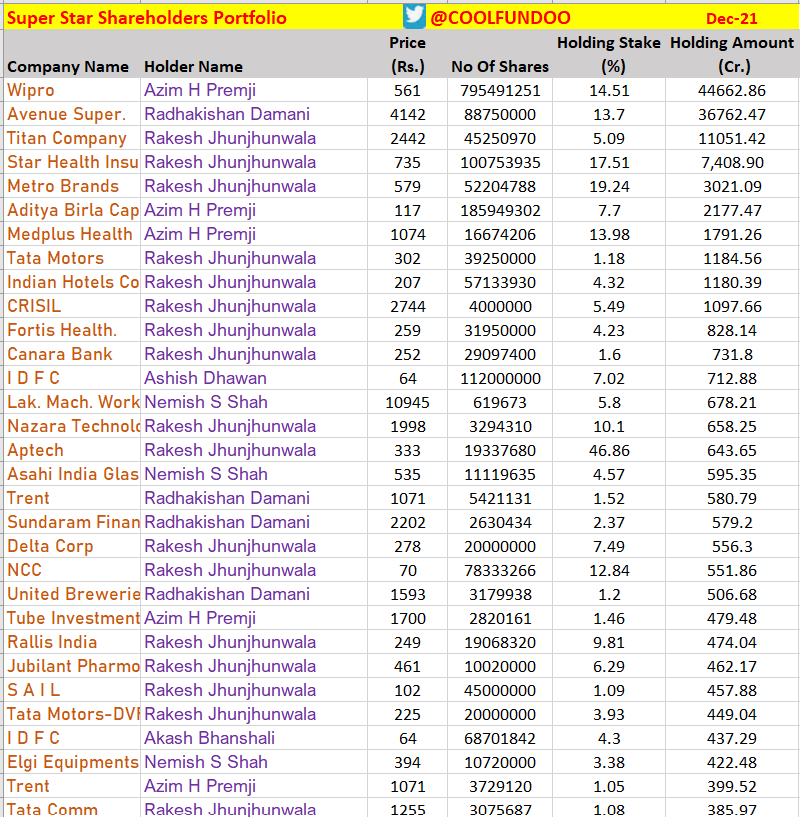

📢Superstar Shareholders Portfolio as of Dec-2021 (Latest Data available)

⚡️Arranged with Highest Holding Amount on Top !

So it's their Highest Conviction as per their Allocation/Action/Karma.

Hope this helps in your decision in picking companies during this downturn.

https://t.co/mb6nbXUNfv

⚡️Arranged with Highest Holding Amount on Top !

So it's their Highest Conviction as per their Allocation/Action/Karma.

Hope this helps in your decision in picking companies during this downturn.

https://t.co/mb6nbXUNfv

\U0001f4e2Stocks where 2 or more Superstar Shareholders have investment as of Dec-2021 (latest data)

— Sachin K Rai (@Coolfundoo) February 15, 2022

Hope this helps in your decision making !

If you find this useful feel free to share & re-tweet !@abhymurarka pic.twitter.com/2VU2OVvamX