Iamitahuja Authors Aditya Todmal

Collaborated with @niki_poojary

Here's what you'll learn in this thread:

1. Capture Overnight Theta Decay

2. Trading Opening Range Breakouts

3. Reversal Trading Setups

4. Selling strangles and straddles in Bank Nifty

6. NR4 + IB

7. NR 21-Vwap Strategy

Let's dive in ↓

1/ STBT option Selling (Positional Setup):

The setup uses price action to sell options for overnight theta decay.

Check Bank Nifty at 3:15 everyday.

Sell directional credit spreads with capped

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

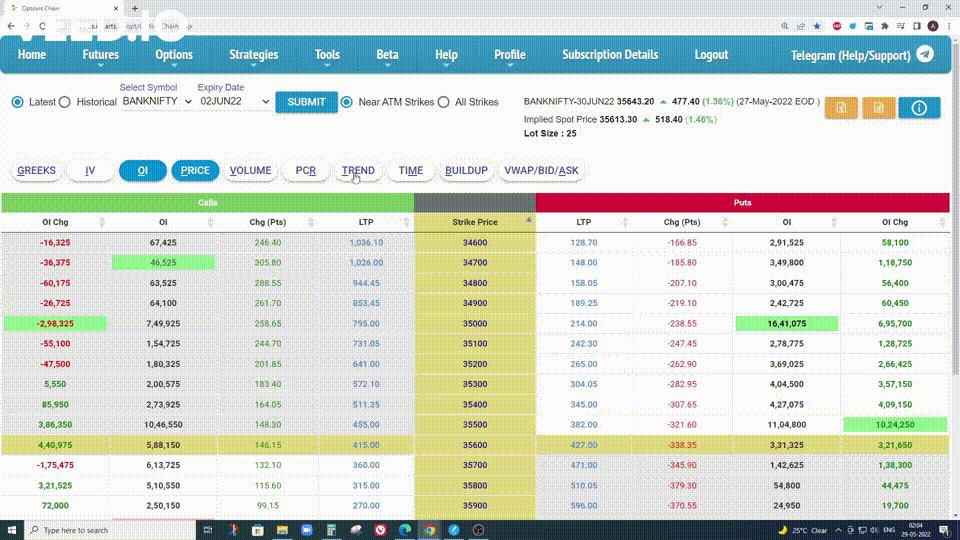

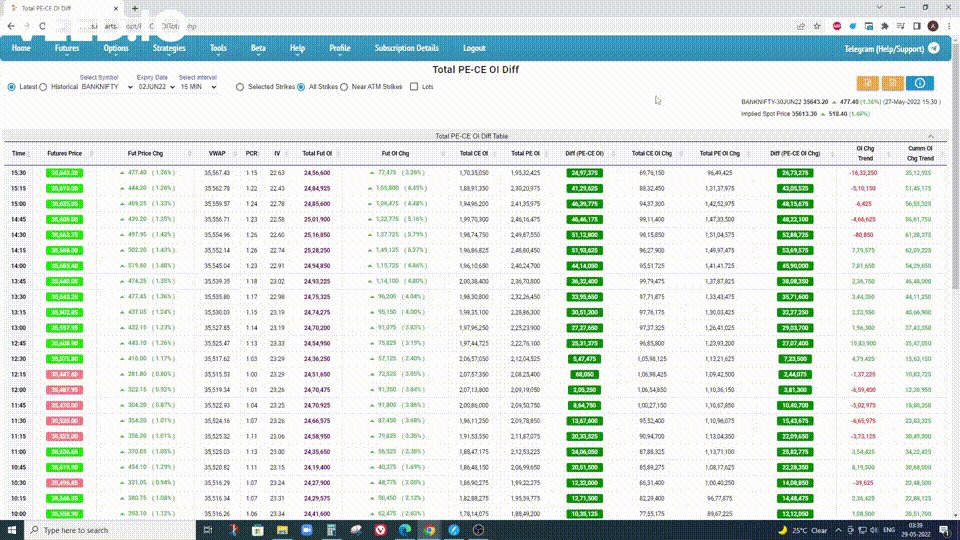

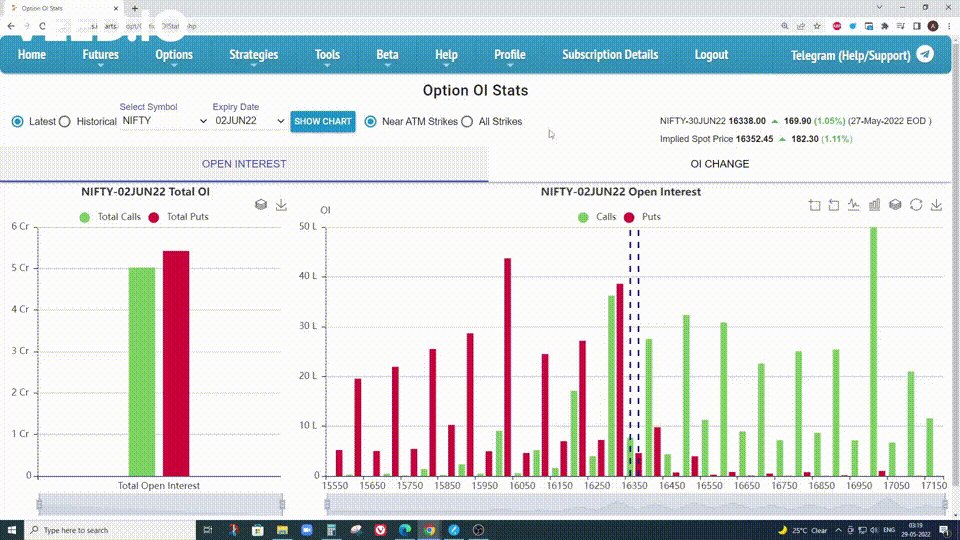

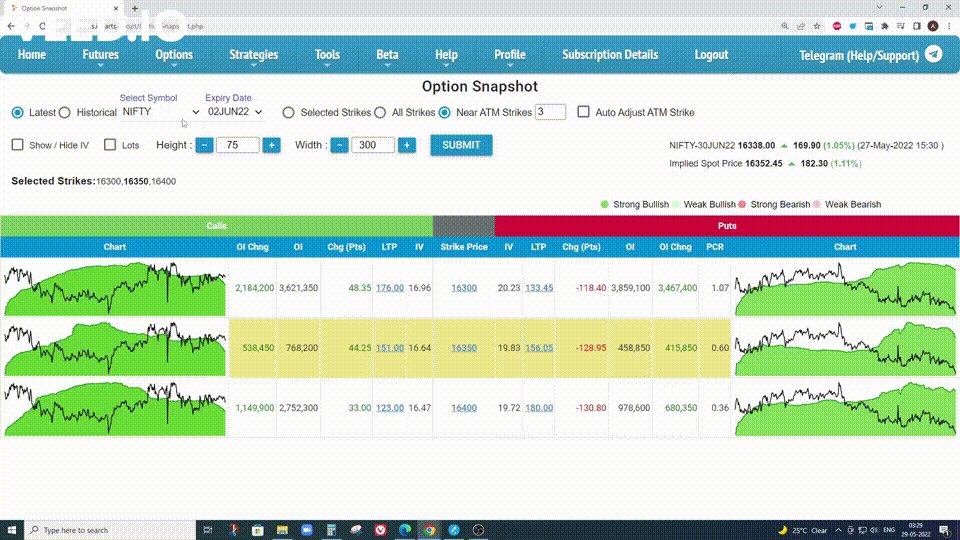

@jigspatel1988 2/ Selling Strangles in Bank Nifty based on Open Interest Data

Don't trade till 9:45 Am.

Identify the highest OI on puts and calls.

Check combined premium and put a stop on individual

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

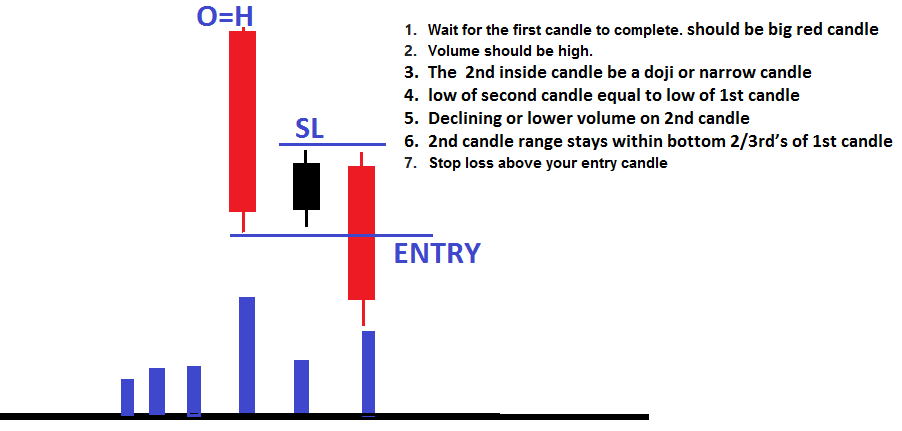

@jigspatel1988 3/ Open Drive (Intraday)

This is an opening range breakout setup with a few conditions.

To be used when the market opens above yesterday's day high

or Below yesterday's day's

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

14 "must-try" trading strategies you can start using today: 🧵

Collaborated with @niki_poojary

We'll break these into portions of:

1. Intraday Trading Techniques

2. Positional Trading Techniques

3. Indicator Applications

1/ 6 Intraday Strategies 🧵

How to Filter Stocks for Intraday

How you can filter stocks for Intraday trades - \U0001f9f5

— Sheetal Rijhwani (@RijhwaniSheetal) August 15, 2021

As a kid, we would do homework before school the next day - you have to do homework here too. A specific sector performs on a particular day and studying things a day before will help you spot that particular sector. (1/11)

2/ Intraday BNF strangle based on OI data. 🧵

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

3/ A few setups to make intraday trading easy.

A few setups/strategies that can make your intraday trading easy. I follow them personally:

— Sheetal Rijhwani (@RijhwaniSheetal) September 12, 2021

Add these stocks in your watchlist for next few days -

-If a stock closed exactly at resistance with good volumes or it has been consolidating near resistance for a long time. (1/10)

Collaborated with @niki_poojary

1. Best Sources of knowledge for a beginner in option selling?

Zerodha Varsity from @Nithin0dha's team & the @tastytrade financial network.

Links:

2. Top YouTube Channel for Options Learning?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

15 Learnings from Power of Stocks: \U0001f9f5

— Aditya Todmal (@AdityaTodmal) January 23, 2022

Collaborated with @niki_poojary

3. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high probability trades.

4. Risk Management is a must for option selling

If you don't learn to manage your risk, making money in trading is going to be an extremely difficult endeavor

Have some rules:

1. Risk no more than 0.25% per trade as a beginner

2. Risk no more than 2% in a day for the first year

Collaborated with @niki_poojary

Listing all scanners from @Pathik_Trader Sir first.

1. Open Drive

https://t.co/darjwgqtMc

2. 80-20 Reversal Setup

https://t.co/H5JEz6KNYs

3. Fake paradise

https://t.co/QDV0MFAcf6

4. Open = High and Open = Low

https://t.co/ohhDNHzSR9

But 98.8% forget 20% of what they read.

Here are 10 threads you must re-read:

Topic: Reversals in Option Selling via

Few weeks ago @Ronak_Unadkat Sir conducted an exclusive session for me & @adityatodmal to explain how he trades.

— Nikita Poojary (@niki_poojary) November 14, 2021

He was kind enough to share all his trade strategies and was patient enough to answer our doubts.

Thought of making a \U0001f9f5for the benefit of the larger audience here.

@niki_poojary Topic: 2 Setups for Trending Days & 2 Setups for Reversal

For intraday trader all v need is either TRENDING Day/Reversal Day 2 get a good move wid more conviction

— Pathik (@Pathik_Trader) May 16, 2019

So i shared 2 setups 2 identify Trending Day & Reversal Day on particular underlying

Make best use of these, practise 50 trades on both setup u ll not search 4 anything else

@niki_poojary @Pathik_Trader Topic: Mistakes not to be repeated by a Pro Option

10 mistakes in my 14 years of trading as an option seller \U0001f9f5

— Sarang Sood (@SarangSood) March 19, 2022

@niki_poojary @Pathik_Trader @SarangSood Topic: How Mitesh Sir does Positional Option

A Thread on the Boss himself @Mitesh_Engr

— Aditya Todmal (@AdityaTodmal) July 4, 2021

Mitesh Sir's Positional Option Selling 101:

\u2022 How to find direction

\u2022 Which options to sell

\u2022 How to deploy capital

\u2022 Exit criteria

\u2022 What ROI he targets weekly

\u2022 What % risk he takes

Done with the help of @niki_poojary pic.twitter.com/tcTKV02oO2

But most of that growth came from 9 threads - which on their own generated 46,00,000 views.

So here's a recap of those 9 threads (and what they can help you with):🧵

Collaborated with @niki_poojary

I spoke to a ton of Charted Accountants as I hated paying a lot of tax last year.

I then got to know that I could've saved a lot of money by forming a Pvt Ltd Company and trading in it.

Then, I compiled all the benefits of a corporate

How to save tax when income is above 50 lakhs?

— Aditya Todmal (@AdityaTodmal) March 1, 2022

Here are 9 benefits of trading in a corporate account: \U0001f9f5

Collaborated with @niki_poojary

I used Trading View daily for a year but wasn't using it to the best of its abilities.

Most people purchase costly Tradingview plans.

Here are 9 free hacks to use Tradingview for

TradingView isn't just charts

— Aditya Todmal (@AdityaTodmal) February 6, 2022

It's much more powerful than you think

9 things TradingView can do, you'll wish you knew yesterday: \U0001f9f5

Collaborated with @niki_poojary

Whether you're a:

• Trader

• Analyst

• Content creator

• or just here to learn

You use Google Chrome daily.

So here are 16 free extensions you didn't know

Google Chrome is the best web browser out there.

— Aditya Todmal (@AdityaTodmal) March 18, 2022

But the right chrome extensions make it even better.

Here is a list of 16 free extensions you'll wish you knew yesterday

: \U0001f9f5

Collaborated with @niki_poojary

If you are on Twitter and reading this thread there's a good chance you want to become a trader.

I curated 12 free courses to start learning options to make

12 FREE Courses to Learn Options Trading:\U0001f9f5

— Aditya Todmal (@AdityaTodmal) April 23, 2022

Collaborated with @niki_poojary

However, 98.8% of users did not see the top content on this site.

Here are the top threads from the past month:🧵

Collaborated with @niki_poojary

Topic: How to understand Volume in more depth.

This is my personal favorite in this

VOLUME is the ultimate Trading cheat code.

— Indrazith Shantharaj (@indraziths) August 6, 2022

But, most people never use it in the right way \u2013 because no one ever taught them how.

Here are 10 psychological triggers to knowing Volume in a better way :

Topic: List of top

Stock Screeners is an integral part of doing homework post market hours.

— Yash Mehta (@YMehta_) August 5, 2022

Most of us use screeners to filter buzzing stocks out of 1000+ stock and it saves lot of times.

Here is the list of top screeners:

Also, last screener is one of my favourite to pick early momentum stocks.

Topic: How to use Debit and Credit

If you are new to F&O, you can start with Vertical Spreads (Debit and Credit spreads) instead of buying options in Stocks and Indices.

— Sheetal Rijhwani (@RijhwaniSheetal) July 3, 2022

Here are some ways how you can do it, when you can do it and the right position sizing for doing it... \U0001f9f5 (1/25)

Topic: What's happening to the

Rupee at a record low of 79/$, what\u2019s happening?

— Kirtan A Shah (@KirtanShahCFP) July 3, 2022

A dummies guide in this \U0001f9f5

Do \u2018re-tweet\u2019 & help us educate more investors (1/13)#Investing #invest #StockMarket #RupeeVsDollar #RupeeSlideDebate

Collaborated with @niki_poojary

1) https://t.co/tSNOa0nEku

Need a fake email address to sign up for a site and don't want to end up in a bunch of spam lists then here's a free website.

Self destructs after 10 minutes.

2) https://t.co/zJVhIwVBIJ

Want to learn for free from an Ivy League school?

MIT OpenCourseWare is a free and open collection of material from thousands of MIT courses, covering the entire MIT curriculum.

3) https://t.co/LsmAfQu2K4

Handpicked movies and shows of every genre.

Use filters to determine your interests and recommends movies/shows to watch for free.

4) https://t.co/agwOP6yz0l

Removes background from any of your pictures for free.