In 2016,Turkey arrested Abdulkadir Yapcan, a prominent Uighur political activist living in the country since 2001 and initiated his extradition. In 2017, Turkey and China signed an agreement allowing extradition even if the purported offense is only illegal in 1of the 2️⃣countries

Erdogan Is Turning Turkey Into a Chinese Client State\U0001f914https://t.co/WZyETQ9mkB

— James Mitchell \u24cb\U0001f42c (@MesMitch) February 13, 2021

More from World

Nuclear energy:

— PragerU (@prageru) February 17, 2021

Safe? \u2705

Clean? \u2705

Efficient? \u2705

Scalable? \u2705

Why is it not receiving more political support?

Polls consistently show conservative support for nuclear energy. It also has high support among elites. The myth that it is unpopular in general isn’t true—although it is unpopular in almost every specific case where they need to site it

Article is old but yeah

This study finds that risk & benefit predict individual opinion the most, followed by the share of nuclear energy already extant, followed by ideology (conservatives support more)

This one finds that journalists attitude affect public perceptions, but that energy consultants, nuclear engineers, bureaucrats, and the military show the highest support for nuclear energy

You May Also Like

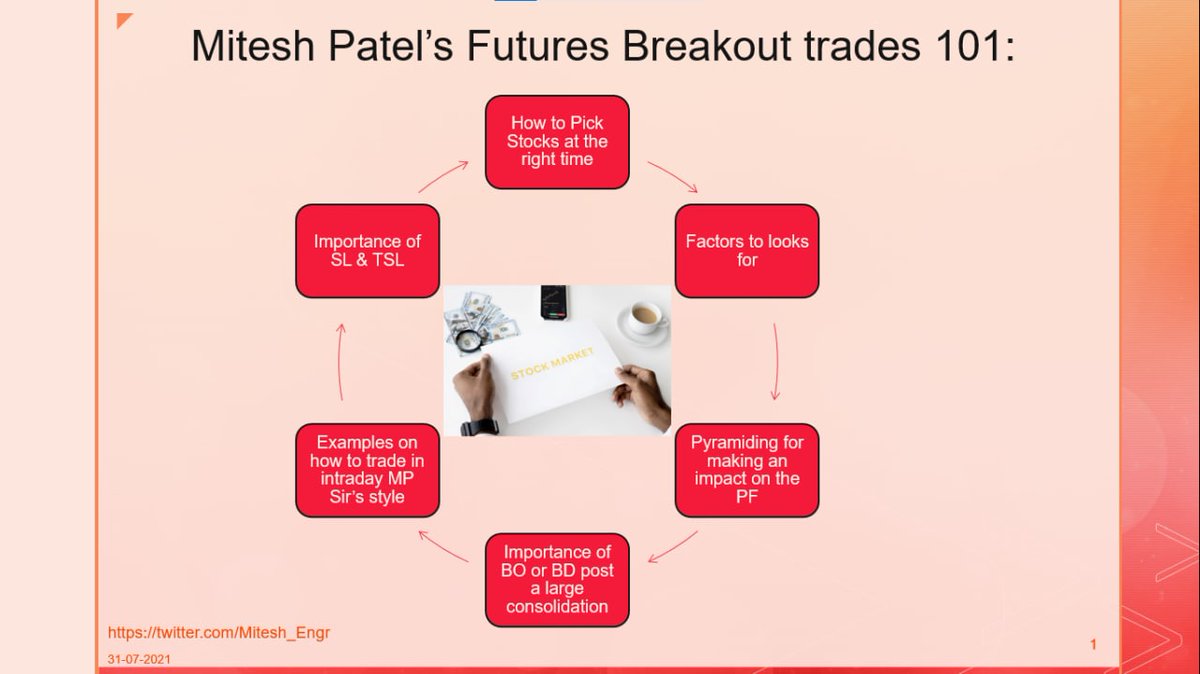

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

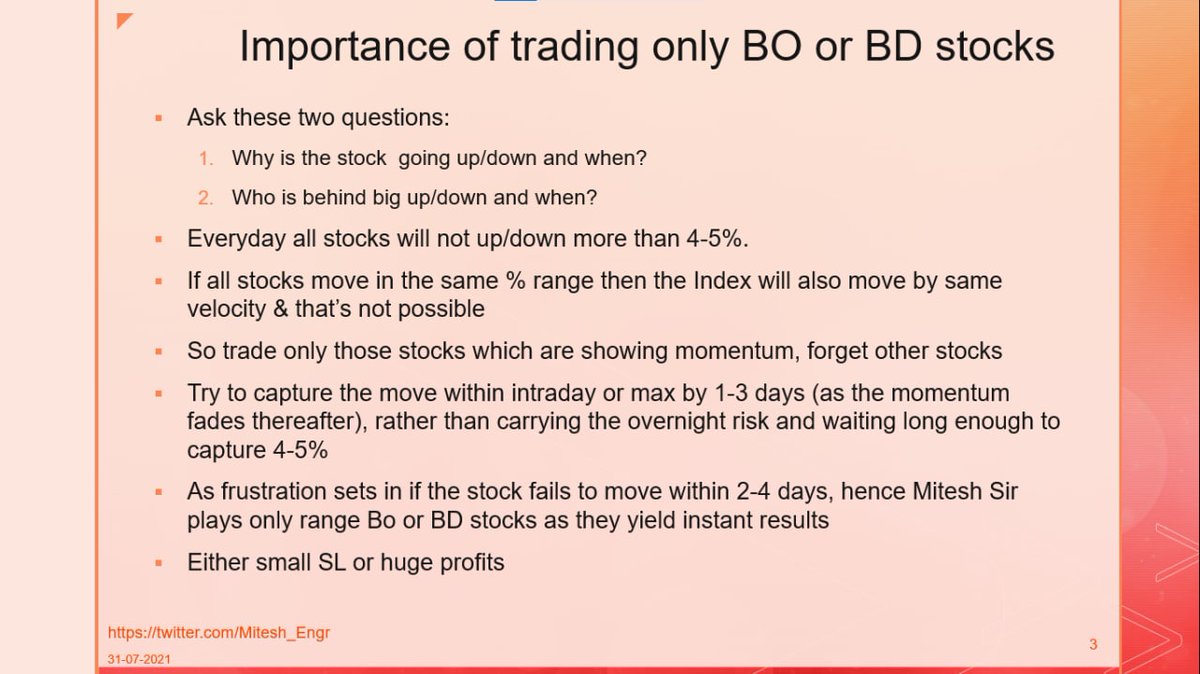

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0