🚨Here is the link to the DETAILED Step by Step Guide for Swing Trading

1 - Building a watchlist

2 - Drilling Down for entries

I show a REAL EXAMPLE with MY BROKER STATEMENTS

$EBAY

1500 Profit on Shares 🚀

Oct 29 77C 1.31 to 4.92 +275% (Holding)

More from Trading Warz

Friends here we go 🗝️

12 solid videos each 1 HR long teaching you all I know on #Options and day trading 🚀

This is my gift to the world ❤️

All of your questions have been answered here 👇👇👇

Help me with a❤️so we can share the TRUTH with the

TradingWarz FREE Indicators TOS

Holy Grail by Rich

https://t.co/yi7xeIsSTX

Inside Power by Rich

https://t.co/J6J8wOMRj6

Doubles by Rich

https://t.co/Tb6RyFjBTd

Outside Power by Rich

https://t.co/Wpr9OlCjid

Leave a ❤️ to help me out

12 solid videos each 1 HR long teaching you all I know on #Options and day trading 🚀

This is my gift to the world ❤️

All of your questions have been answered here 👇👇👇

Help me with a❤️so we can share the TRUTH with the

TradingWarz FREE Indicators TOS

Holy Grail by Rich

https://t.co/yi7xeIsSTX

Inside Power by Rich

https://t.co/J6J8wOMRj6

Doubles by Rich

https://t.co/Tb6RyFjBTd

Outside Power by Rich

https://t.co/Wpr9OlCjid

Leave a ❤️ to help me out

More from Watchlist

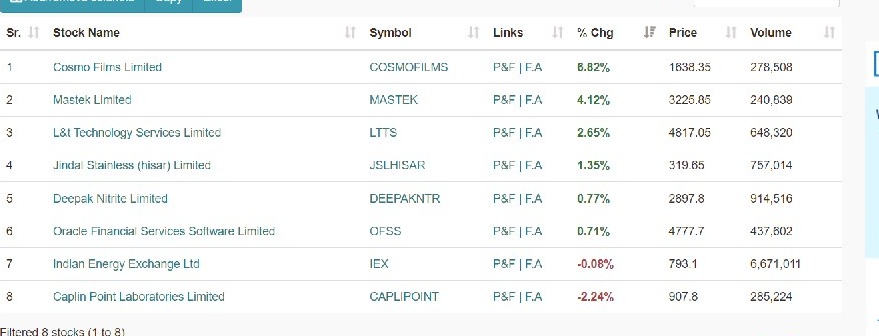

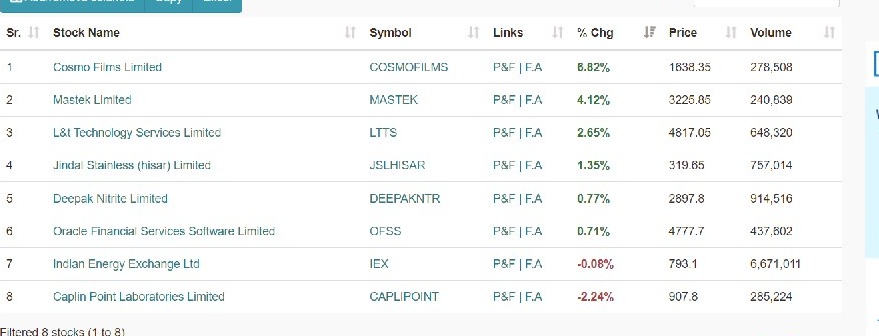

Im sharing A stock Screener+Swing Strategy

Criteria

Screener to Find Swing Stocks.

1. 15% Range of Near 52 week high

2. Avg Volume > 1 lakh

3. Market Cap > 2000 Cr

4. Roe Roce > 20%

5. Eps Increasing Qtr on Qtr

6. Above 50 ema

1/

How to use This Screener

1. Basically we are screening Fundamentally strong stock

2. These are Technically Strong also as stocks are near 52 week high and above 50 ema

3. Below is the list For the screened Stocks.

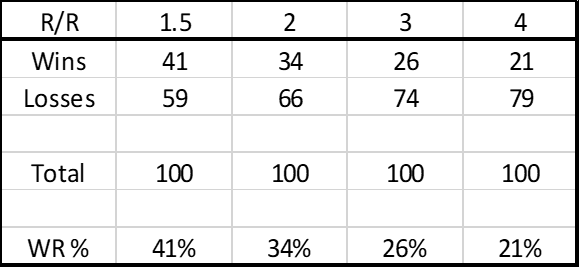

4. Target should be on RR

@StocksNerd @MarketScientist

2/

When to Enter

1. When 52 week High is Broken

2. Filter Stocks Select Stock With High Relative Strength

Example : #CosmoFilms , #Mastek

3. Keep Sl Below 21 ema

4. Keep Trailing Using 21 ema

5. Enter stocks on high volume breakout

6.Look for Price Range Contraction

3.

Your Most work is done by the screener

The most important task is filtering out manually and that's where your Returns will differ

As we are screening TechnoFunda stocks these can used for momentum investing

Join telegram https://t.co/b4N4oPAto9

@AmitabhJha3 @chartians

Criteria

Screener to Find Swing Stocks.

1. 15% Range of Near 52 week high

2. Avg Volume > 1 lakh

3. Market Cap > 2000 Cr

4. Roe Roce > 20%

5. Eps Increasing Qtr on Qtr

6. Above 50 ema

1/

How to use This Screener

1. Basically we are screening Fundamentally strong stock

2. These are Technically Strong also as stocks are near 52 week high and above 50 ema

3. Below is the list For the screened Stocks.

4. Target should be on RR

@StocksNerd @MarketScientist

2/

When to Enter

1. When 52 week High is Broken

2. Filter Stocks Select Stock With High Relative Strength

Example : #CosmoFilms , #Mastek

3. Keep Sl Below 21 ema

4. Keep Trailing Using 21 ema

5. Enter stocks on high volume breakout

6.Look for Price Range Contraction

3.

Your Most work is done by the screener

The most important task is filtering out manually and that's where your Returns will differ

As we are screening TechnoFunda stocks these can used for momentum investing

Join telegram https://t.co/b4N4oPAto9

@AmitabhJha3 @chartians

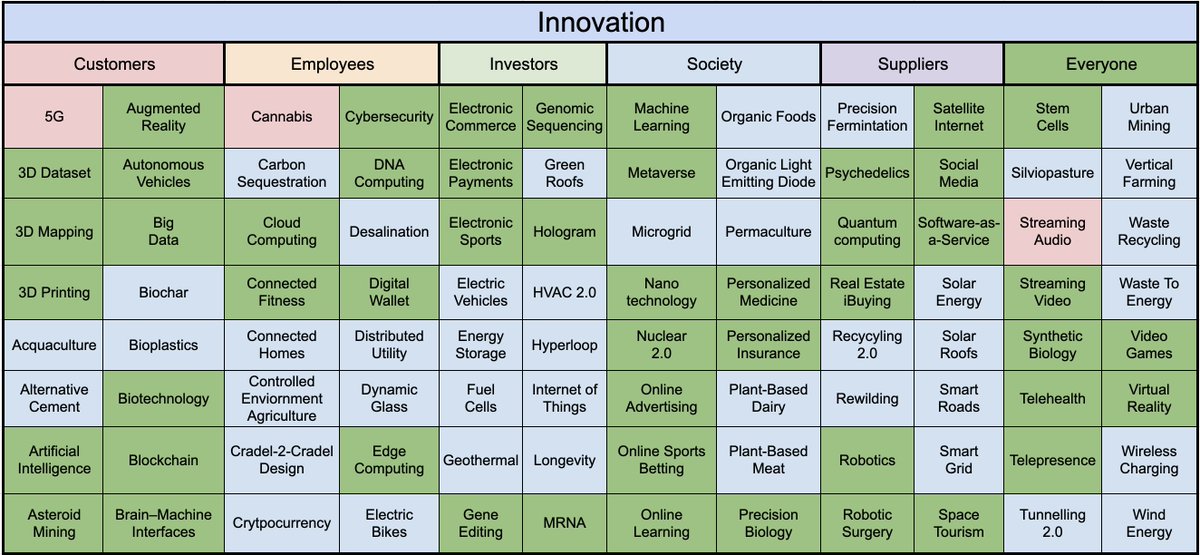

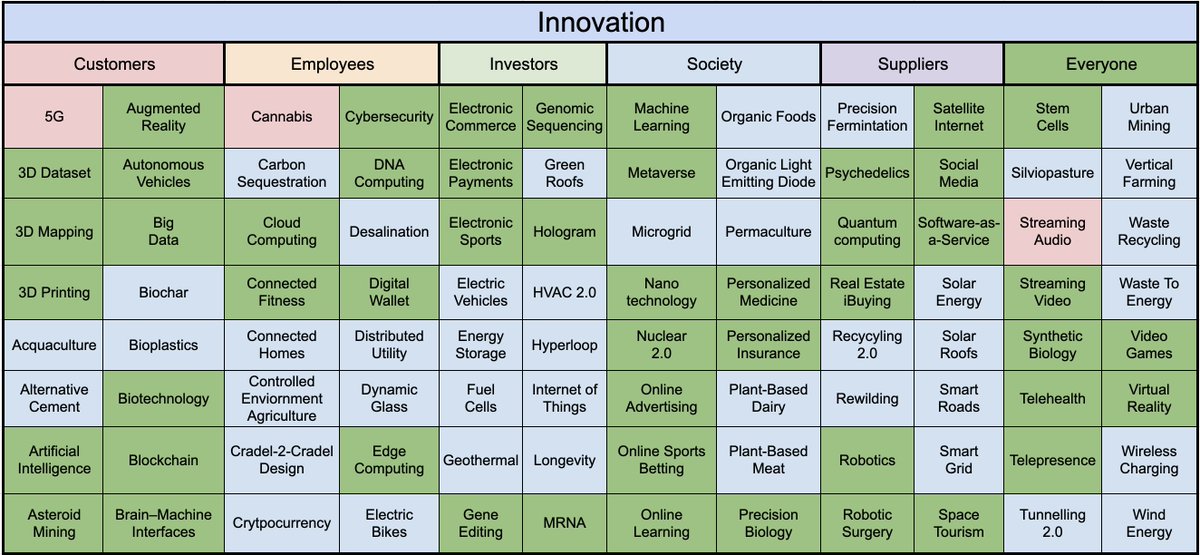

Everyone knows Apple, Amazon, Microsoft...

But how do you find the next $AFRM, $PLTR, or $USPT early?

Here are 9 GREAT resources for finding stock ideas (8 of them are FREE):

1: ETFs

Look through the holdings of high-growth ETFs

Google the ETF symbol and “holdings”

These are worth cracking open:

▪️ $ARKF / $ARKG / $ARKK / $ARKW

▪️ $FFTY

▪️ $HACK

▪️ $IZRL

▪️ $TMFC

2: Fund Managers

Type a fund you respect into @Whalewisdom

You can see all their holding and get emails of any changes

These funds are worth tracking:

▪️AKre Capital

▪️AKO Capital

▪️Dorsey Asset

▪️Fundsmith

▪️Polen Capital

More

3: Newly Public Companies

▪️Direct Listings

▪️IPOs

▪️SPACs

Are a great idea source

Helpful resources:

▪️ https://t.co/jJW01WpJQh

▪️

4. Screeners

@Finviz is great for screening by sector/industry

@Stockcard is great for screening by themes (like the mega-trends listed below)

But how do you find the next $AFRM, $PLTR, or $USPT early?

Here are 9 GREAT resources for finding stock ideas (8 of them are FREE):

1: ETFs

Look through the holdings of high-growth ETFs

Google the ETF symbol and “holdings”

These are worth cracking open:

▪️ $ARKF / $ARKG / $ARKK / $ARKW

▪️ $FFTY

▪️ $HACK

▪️ $IZRL

▪️ $TMFC

2: Fund Managers

Type a fund you respect into @Whalewisdom

You can see all their holding and get emails of any changes

These funds are worth tracking:

▪️AKre Capital

▪️AKO Capital

▪️Dorsey Asset

▪️Fundsmith

▪️Polen Capital

More

Here are some of the big investors that track:

— Brian Feroldi (@BrianFeroldi) February 17, 2021

Altarock Partners

AKO Capital

Appaloosa

Akre Capital

Broad Run

Dorsey Asset

Duquense

Ensemble

Fundsmith

Polen Capital

Third Point

Here are their current top 10 holdings (in order) and links to their latest buys/sells \u2b07\ufe0f

3: Newly Public Companies

▪️Direct Listings

▪️IPOs

▪️SPACs

Are a great idea source

Helpful resources:

▪️ https://t.co/jJW01WpJQh

▪️

4. Screeners

@Finviz is great for screening by sector/industry

@Stockcard is great for screening by themes (like the mega-trends listed below)

You May Also Like

1/ 👋 Excited to share what we’ve been building at https://t.co/GOQJ7LjQ2t + we are going to tweetstorm our progress every week!

Week 1 highlights: getting shortlisted for YC W2019🤞, acquiring a premium domain💰, meeting Substack's @hamishmckenzie and Stripe CEO @patrickc 🤩

2/ So what is Brew?

brew / bru : / to make (beer, coffee etc.) / verb: begin to develop 🌱

A place for you to enjoy premium content while supporting your favorite creators. Sort of like a ‘Consumer-facing Patreon’ cc @jackconte

(we’re still working on the pitch)

3/ So, why be so transparent? Two words: launch strategy.

jk 😅 a) I loooove doing something consistently for a long period of time b) limited downside and infinite upside (feedback, accountability, reach).

cc @altimor, @pmarca

4/ https://t.co/GOQJ7LjQ2t domain 🍻

It started with a cold email. Guess what? He was using BuyMeACoffee on his blog, and was excited to hear about what we're building next. Within 2w, we signed the deal at @Escrowcom's SF office. You’re a pleasure to work with @MichaelCyger!

5/ @ycombinator's invite for the in-person interview arrived that evening. Quite a day!

Thanks @patio11 for the thoughtful feedback on our YC application, and @gabhubert for your directions on positioning the product — set the tone for our pitch!

Week 1 highlights: getting shortlisted for YC W2019🤞, acquiring a premium domain💰, meeting Substack's @hamishmckenzie and Stripe CEO @patrickc 🤩

2/ So what is Brew?

brew / bru : / to make (beer, coffee etc.) / verb: begin to develop 🌱

A place for you to enjoy premium content while supporting your favorite creators. Sort of like a ‘Consumer-facing Patreon’ cc @jackconte

(we’re still working on the pitch)

3/ So, why be so transparent? Two words: launch strategy.

jk 😅 a) I loooove doing something consistently for a long period of time b) limited downside and infinite upside (feedback, accountability, reach).

cc @altimor, @pmarca

4/ https://t.co/GOQJ7LjQ2t domain 🍻

It started with a cold email. Guess what? He was using BuyMeACoffee on his blog, and was excited to hear about what we're building next. Within 2w, we signed the deal at @Escrowcom's SF office. You’re a pleasure to work with @MichaelCyger!

5/ @ycombinator's invite for the in-person interview arrived that evening. Quite a day!

Thanks @patio11 for the thoughtful feedback on our YC application, and @gabhubert for your directions on positioning the product — set the tone for our pitch!