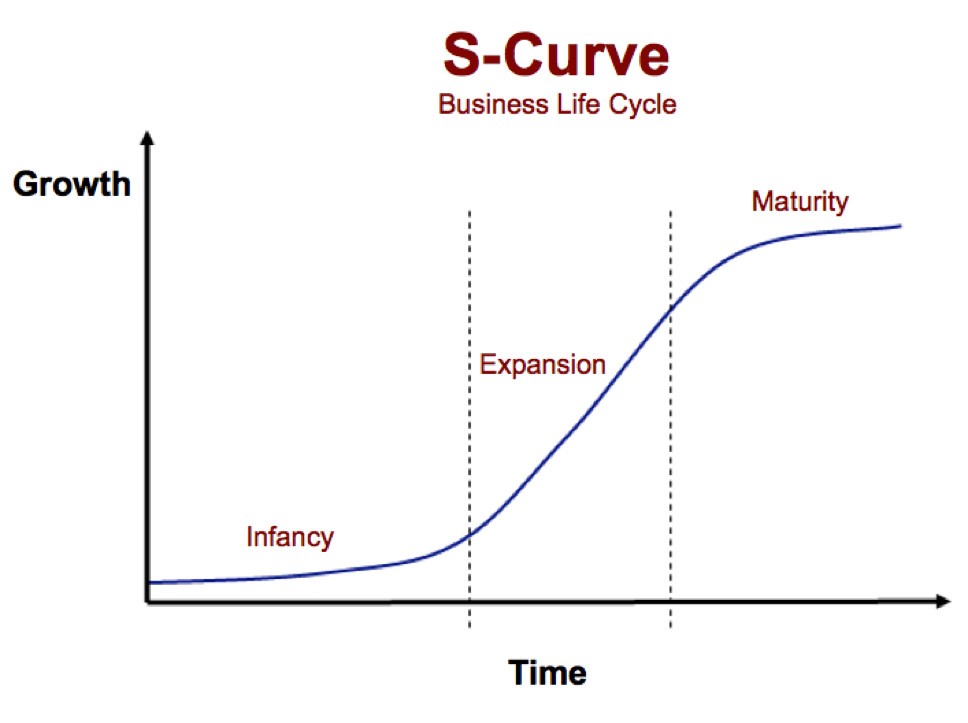

1/ If a business does not grow, its share price will not grow.

In a corporate lifecycle, a company experiences most growth during its expansion phase. That's where most returns are being created.

This is why high growth companies deliver huge returns.

source: Ravi Kumar

2/ The compounding of growth rates is often underestimated.

It can do wonders for your company.

Growing at 30% turns $1 to $13.79 by Y10.

Growing at 10% turns $1 to $2.59 by Y10.

The share price returns a company can generate based on this is significant.

3/ Here's an example: Crowdstrike $CRWD

It grew its ARR from $71 million in 1Q 2018 to $1,731 million in 4Q 2022.

The magic of compounding.

4/ Simple Back Test

I used my Capital IQ to find out what are the stocks that delivered more than 10x returns in the past 5 years and have at least a market cap of $600m USD.

There are 13 companies.

$APPS $XPEL $TSLA

4/ Simple Back Test (continued)

Apart from Ameresco and SolarEdge, others exhibited huge revenue growth.

This tells us future growth is an important ingredient for long term success.

This is echoed by Stanley Drunkmiller too.

5/ Growth stocks seem to be out of favour but have they truly underperformed?

Look at this picture.

Left: Year-til-Date

Right: 5 Yr Results

8/ Growth is the Long-Run Driver of Stock Performance

What we're experiencing now is most well-explained by this graph by Morgan Stanley.

In the short term, multiples are compressing due to interest rate hikes.

But...

In the long term, revenue growth drives returns.

That's a wrap!

If you enjoyed this thread:

1. Follow me

@SlingshotCap for more of these

2. RT the tweet below to share this thread with your audience

https://t.co/yRIDcwkPVJ