Good time to buy is when a theme or segment is ignored by the market and not when it is popular.

When you buy what is popular when it is popular, need to forego returns for few years.

More from D.Muthukrishnan

More from Valuation

June's research paper: Intangible Value ✨

Can value investing strategies be improved by adding intangible assets?

👾 The Asset-Light Economy

🔮 The Dark Matter of Finance

🏰 Intangible Moats

📉 The Disruption of Value

👨🎓 Fixing the "Value Factor"

(Not investment advice)

🧵

(0/10) Full paper here 📘

Blog

https://t.co/omtrn9kfvt

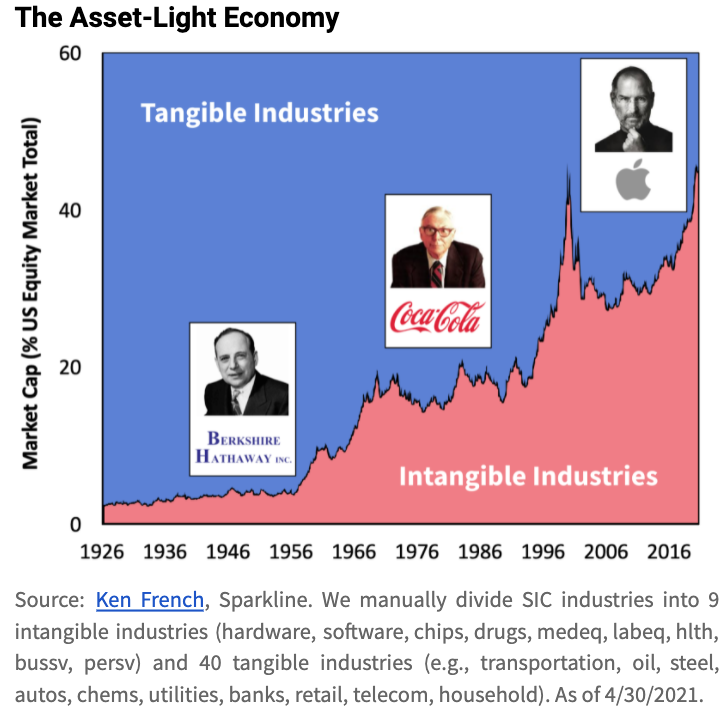

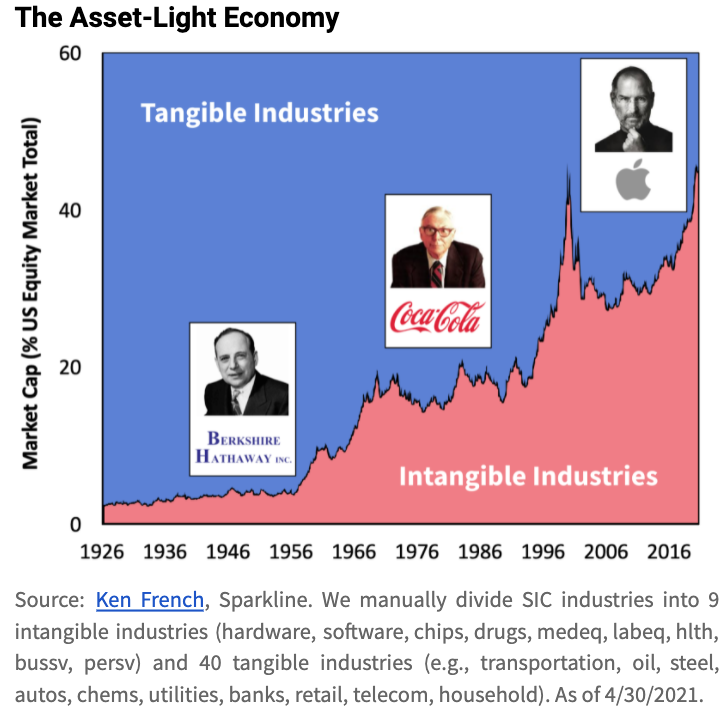

(1/10) The Asset-Light Economy 👾

“The four largest companies today by market value do not need any net tangible assets. They are not like AT&T, GM, or Exxon Mobil, requiring lots of capital to produce earnings. We have become an asset-light economy."

- Warren Buffett

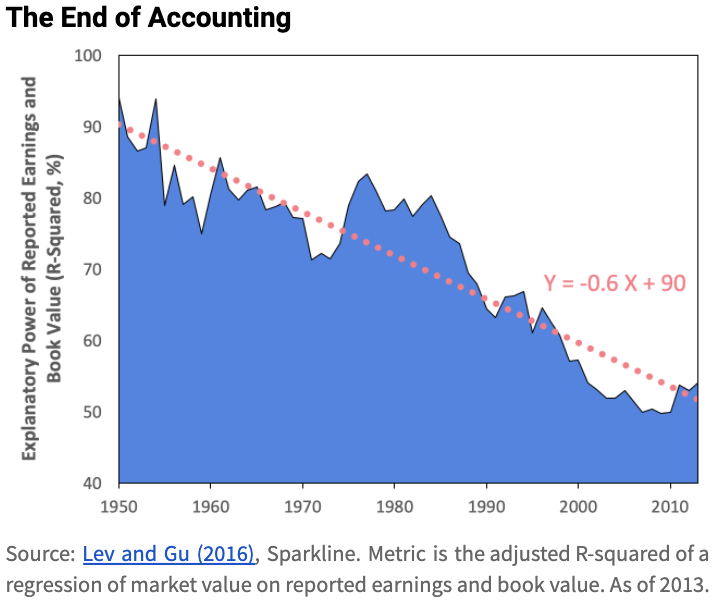

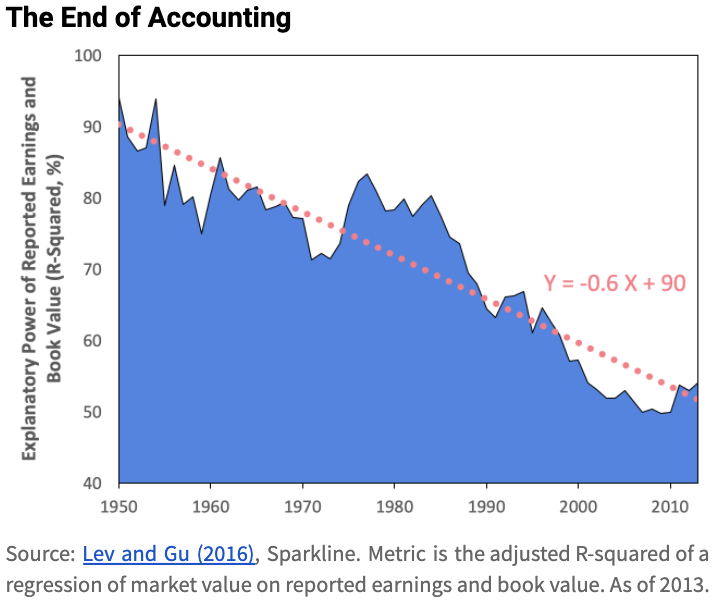

(2/10) The End of Accounting 🧮

“The constant rise in the importance of intangibles in companies’ performance and value creation, yet suppressed by accounting and reporting practices, renders financial information increasingly irrelevant.”

- Baruch Lev and Feng Gu

(3/10) The Dark Matter of Finance 🔮

While intangible matter holds the financial universe together, it is not visible to the naked eye. Unstructured data contains info on intangibles but is large, noisy, and resistant to standard statistical analysis.

Can value investing strategies be improved by adding intangible assets?

👾 The Asset-Light Economy

🔮 The Dark Matter of Finance

🏰 Intangible Moats

📉 The Disruption of Value

👨🎓 Fixing the "Value Factor"

(Not investment advice)

🧵

(0/10) Full paper here 📘

Blog

https://t.co/omtrn9kfvt

(1/10) The Asset-Light Economy 👾

“The four largest companies today by market value do not need any net tangible assets. They are not like AT&T, GM, or Exxon Mobil, requiring lots of capital to produce earnings. We have become an asset-light economy."

- Warren Buffett

(2/10) The End of Accounting 🧮

“The constant rise in the importance of intangibles in companies’ performance and value creation, yet suppressed by accounting and reporting practices, renders financial information increasingly irrelevant.”

- Baruch Lev and Feng Gu

(3/10) The Dark Matter of Finance 🔮

While intangible matter holds the financial universe together, it is not visible to the naked eye. Unstructured data contains info on intangibles but is large, noisy, and resistant to standard statistical analysis.

You May Also Like

So the cryptocurrency industry has basically two products, one which is relatively benign and doesn't have product market fit, and one which is malignant and does. The industry has a weird superposition of understanding this fact and (strategically?) not understanding it.

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.