SII started out with 50-60 million doses/mth capacity. Apr 1 it announced efforts to scale up to 100m by May using internal resources, and requested Rs.3000cr funding to scale up. The bulk order came thru mid April, enabling further scale up and deliveries through May/June.

2/

A common mistake made is to extrapolate latest prices to all future orders. Prices are tied to capital costs of scaling up and order size. Early SII orders were Rs.200/dose + GST. The higher initial price Is due to setup and initial investment SII made, described later.

3/

The March order was cheaper per dose but 10x larger. Govt ordered 120 million doses, 100m from SII, 20m from BB, for same 150/dose. This was a tradeoff they agreed to - very large bulk order but low margin. Enough for SII to invest for 100m/month production, but no more.

4/

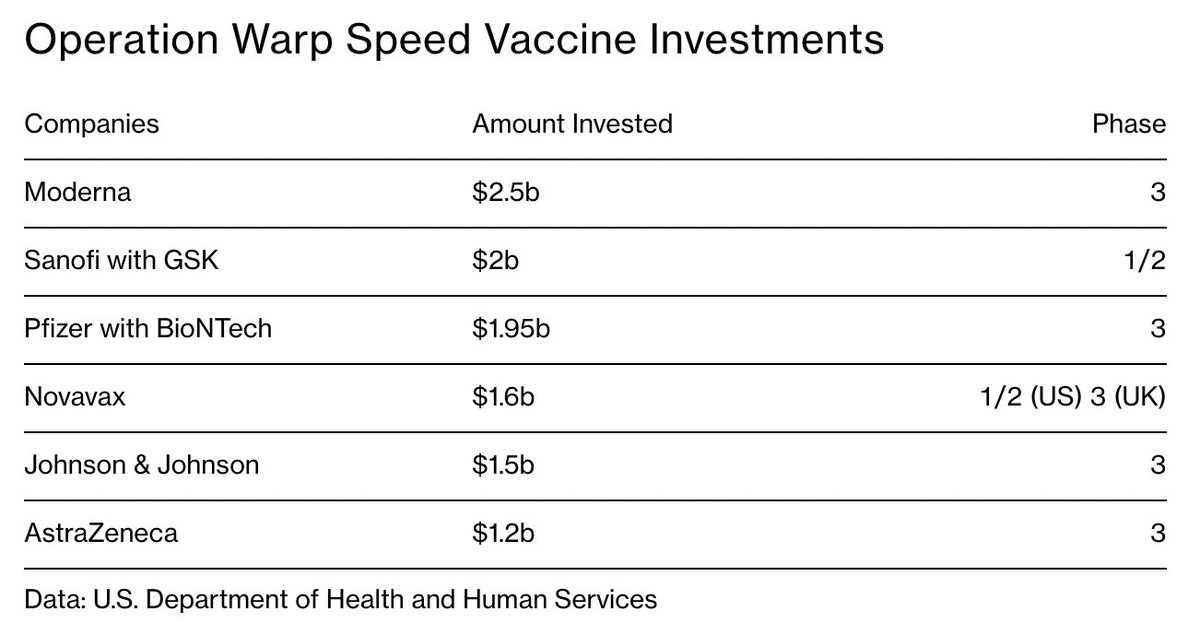

One can either pay intermittently higher per dose costs while demanding more volume, or can pay expansion costs upfront. The US did the latter during Op Warp Speed - $18 billion invested in vaccine research and infrastructure upfront:

5/

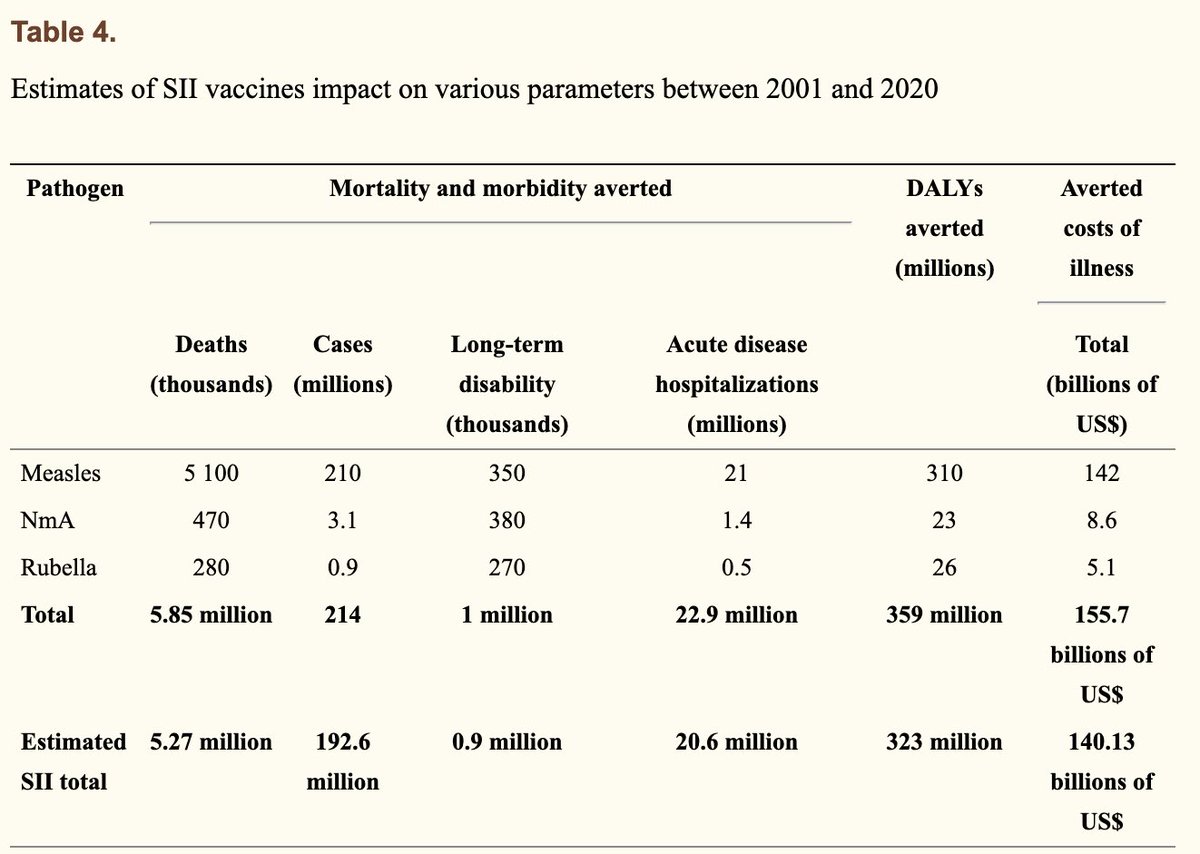

India already has a massive vaccine supply chain infrastructure. In recent years SII alone accounts for over 90% of the savings in vaccine-avertable healthcare costs in the developing world:

https://t.co/5vQVP2ac5u .

6/

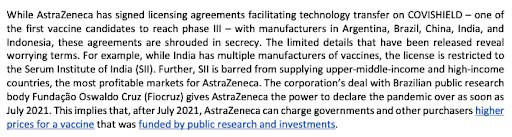

While SII are not an R&D setup and don’t have high overheads, they are restricted by licensing deals. E.g. they cannot subsidize Indian sales by high prices elsewhere. Medecins Sans Frontiers states:

https://t.co/wrHQdYa8E5 7/

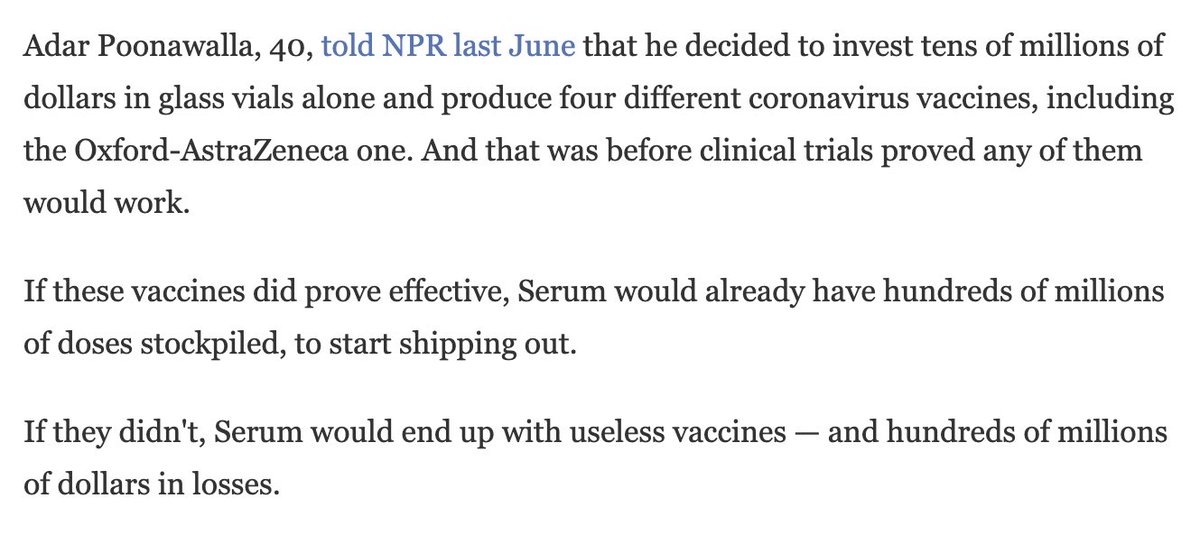

However, SII made an enormous gamble on Covid vaccines, that may have bankrupted them if it didn’t work out:

https://t.co/cb3YvmpvVf 8/

They delivered volume on demand, and need to scale. They invested up front and risked their company to produce vaccines ahead of time. But for their initiative, India would have far fewer vaccine doses. Instead, it will hit 150 million doses today - 90% Covishield.

9/

What’s more, they deferred COVAX/Gavi supplies to prioritize India mid wave, and are facing legal trouble:

https://t.co/gFC8FLe4AW https://t.co/WbRAdLD9aM 10/

@BharatBiotech is its own different story. Covaxin is Indian IP. It was developed from a Covid strain isolated at NIV Indore, India’s most advanced biosafety level 4 lab and one of only the 10 located in Asia:

https://t.co/bT3wyRYfz6 11/

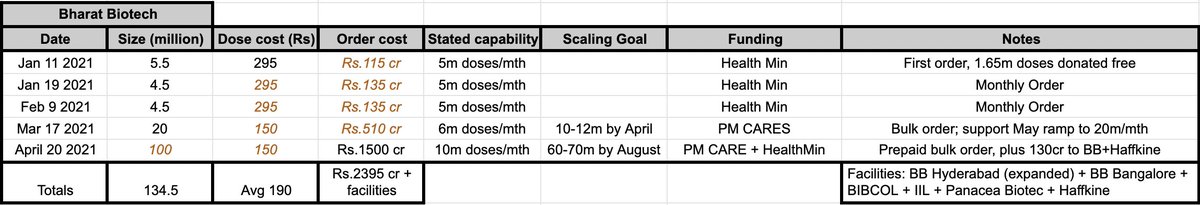

As developer, BB had to spend on R&D and is also responsible for preclinical and clinical trials, SII does not have such overhead, AZ is responsible for it. Thus BB started out priced higher (Rs.295). They also require more to scale.

12/

Covaxin requires the Covid virus culture to be grown in a biosafety level 3 facility, and it is then killed before being sent through manufacturing process. Currently BB and Panacea Biotech are the only BSL-3 private facilities in India.

13/

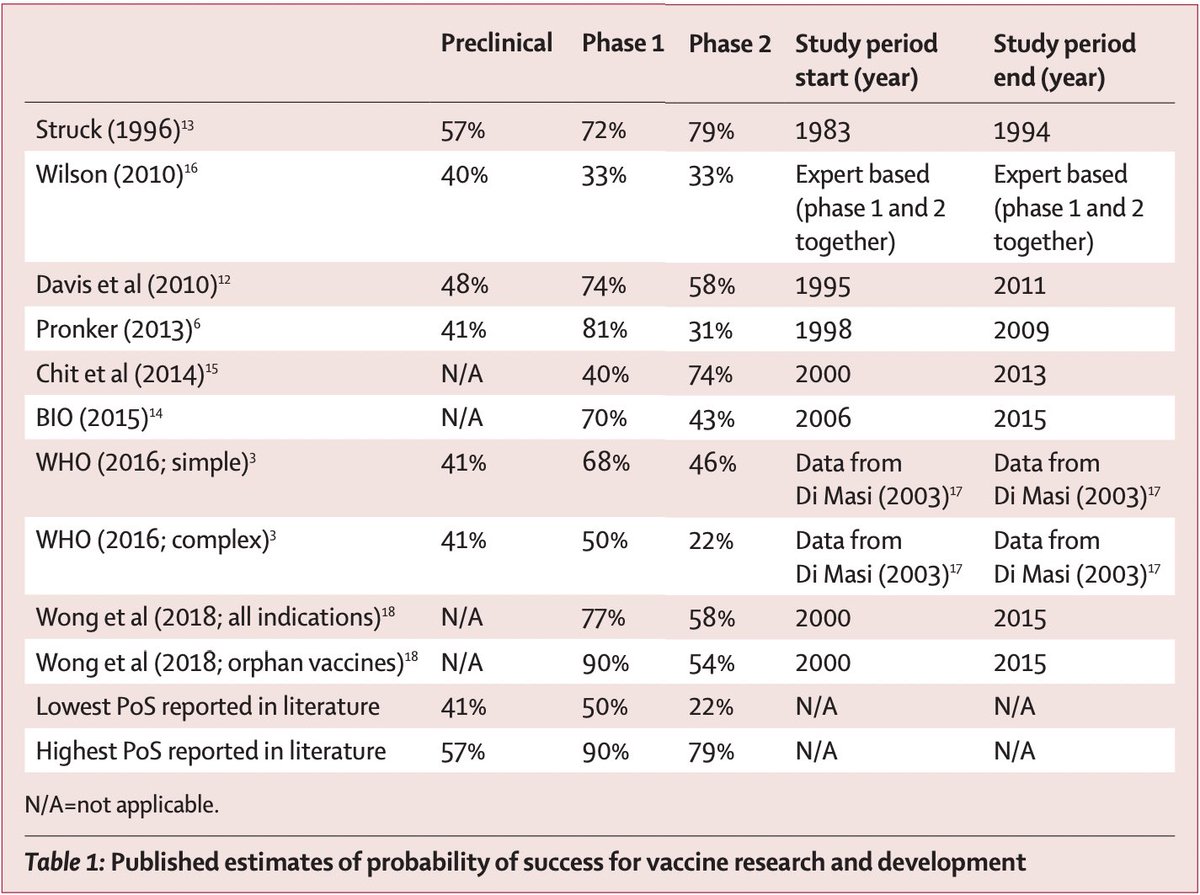

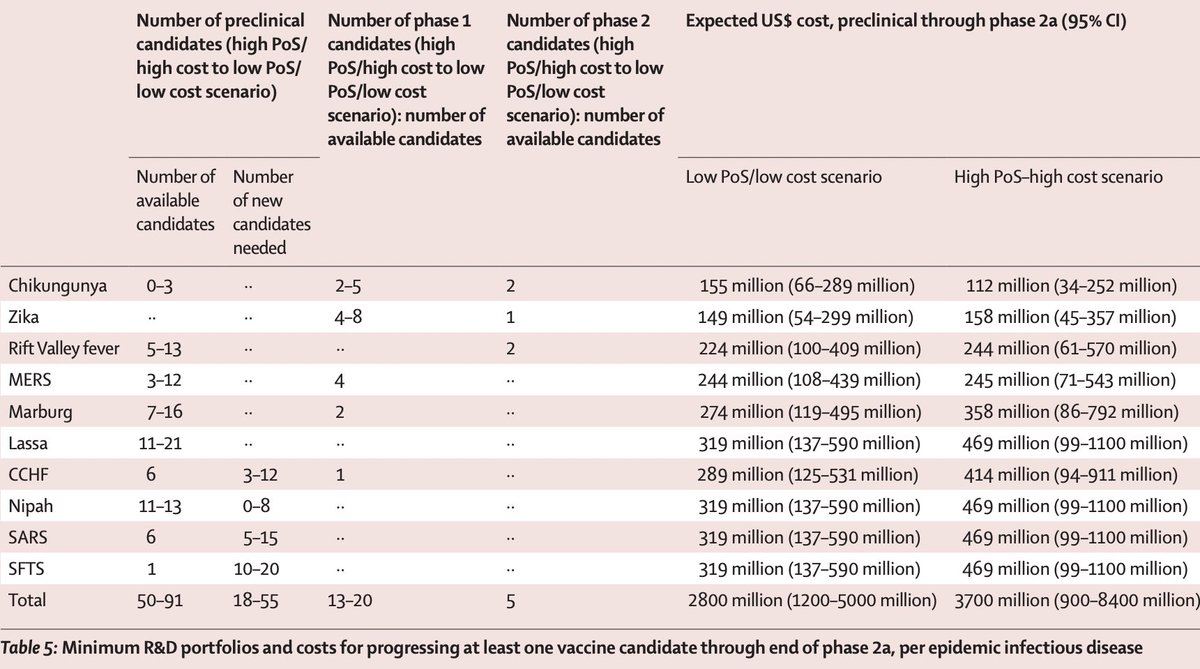

Some argue why didn't we invest in building all these facilities last year. This was done. It must also be remembered that vaccine development isn’t easy. Major entities like Glaxo, Merck all failed, but BB didn’t. Probability of success:

https://t.co/2nrGYB2aQI 14/

In addition to high risk of failure, the cost of vaccine development is not cheap. BB received support from ICMR funds. Even US spent $10 billion across 6 companies but could get only 2 candidates to production by end 2020. India had one bet and BB succeeded.

15/

To scale up Covaxin production, Govt granted BB Rs.65 crore to expand Hyderabad facility and invest in a new one near Bengaluru. They brokered a deal between BB and Panacea for the latter to make Covaxin.

16/

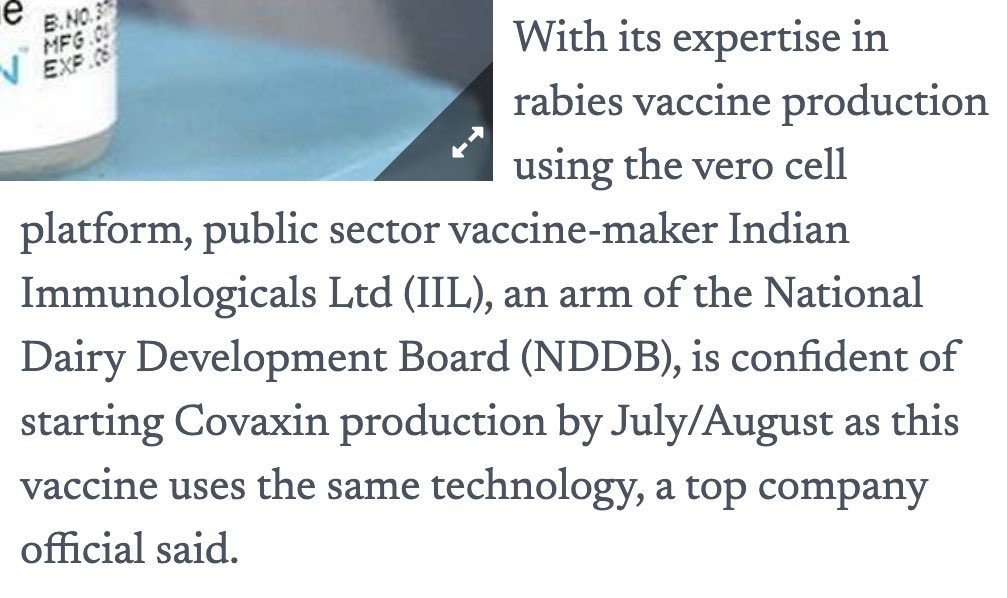

Late last year Govt invested Rs.75cr in Indian Immunologicals PSU to prepare, including BSL-3 capability:

https://t.co/11jIlfgb2k They will start production by August :

https://t.co/LxyyS5tIKW 17/

In addition, Govt invested in BIBCOL and Haffkine to also produce Covaxin:

https://t.co/35o53XEh7b 18/

The combination of all these - brokering agreements between BB and multiple private and PSUs, is intended to dramatically scale up Covaxin from 10m/month now to 70m by August. Ocugen, a US licensee, may get EUA to produce Covaxin there:

https://t.co/cOco64uizu 19/

As of today, total Indian-made vaccine consumption is over 250 million doses. 150m jabs, ~70m exports, few % wasted and rest in pipeline or at mfg. This fits very closely with prior estimates made I made: production to March = consumption to April.

20/

https://t.co/mWVXQHQV9O

After much success with vaccine dev, India was desperately unlucky that a huge wave hit just as vaccinations began. As of today though, 150m doses will be done, 125m people with at least one dose, 25m fully vaccinated.

21/

Data from Maharashtra shows reduction in hospitalization and morality due to vaccination. Each vaccinated person - even after one dose - is one less person who will require hospitalization or extensive oxygenation as we have seen recently.

22/

In April, BB scaled up to 10m, SII is scaling up to 100m, and May/June, both scale up higher thanks to new bulk orders. Sputnik deliveries start early May, production at Dr.Reddys Labs end May/early June. Zycov-D may also become available in May/June.

23/

As India learned, not having supply chain at home means others can block you. SII and Covaxin both faced this:

https://t.co/Lo4hscWNaj However BB collaborated with CSIR to indigenize this:

https://t.co/hNrcvOGtvv 24/

The west tried to guarantee access by placing huge orders, but slow deliveries hurt them. Entire countries were at the mercy of Pfizer:

https://t.co/ZZxYmEgKT0 25/

India must recognize how its own domestic technology & industrial base has helped during this crisis. No country with <$3000 per capita GDP has our ability to do vaccine dev and production.

We are not at the mercy of a Pfizer deciding to send exports elsewhere one week.

26/

The vaccine dev and production concerns must be recognized to understand why they need cash. They’re being pushed to scale up and for that, they set a dose price high enough. They have delivered so far, and for that they deserve to be spared name-calling and criticism.

27/

Further, they have kept up near 100% capacity utilization for months on end while urgently scaling up, and also have managed to avoid catastrophic contamination issues such as what J&J faced:

https://t.co/comCMiq1b8 28/

The best way to ensure later orders can have lower per dose prices is to give the companies early bulk orders, so they can plan, price in the costs of expansion. When equilibrium is achieved they can lower price because capital investments are paid for by prior orders.

29/

It is extremely poor when celebs like

@FarOutAkhtar criticise SII. Due to their influence, they have a role in spreading a positive message. These celebs earned little early on but charge more per film now. Why ? Scaling up a business and personal brand costs money, too.

30/

In the middle of a crisis, it is pointless to dumb down the level of conversation to a point where people make angry twitter posts about Rs.600 dose price of life saving medicine from iPhones that cost 100x. Most states are making it free. Govt already offers it free.

31/

Yes prices have doubled over recent orders. One company is trying to double production, the other trying to increase it by 7x. This costs money. States should recognize this. Govt has paid all the over 7000cr so far. Pool money and negotiate a large order w/ SII or BB.

32/

By late summer with potentially 4 vaccines and over 200m/month production capability, prices will drop as multiple lines can utilize previous sunk investments and price vaccines according to production and operating cost, instead of also adding expansion costs.

33/

Despite the wave hitting at such a bad time, vaccination still continues at pace - 3.3 million Monday, 2.6 million Tuesday this week. Over next 3 months production capacity will increase a lot.

Our vaccine companies need the support to scale up. Let’s give them that.

34/34