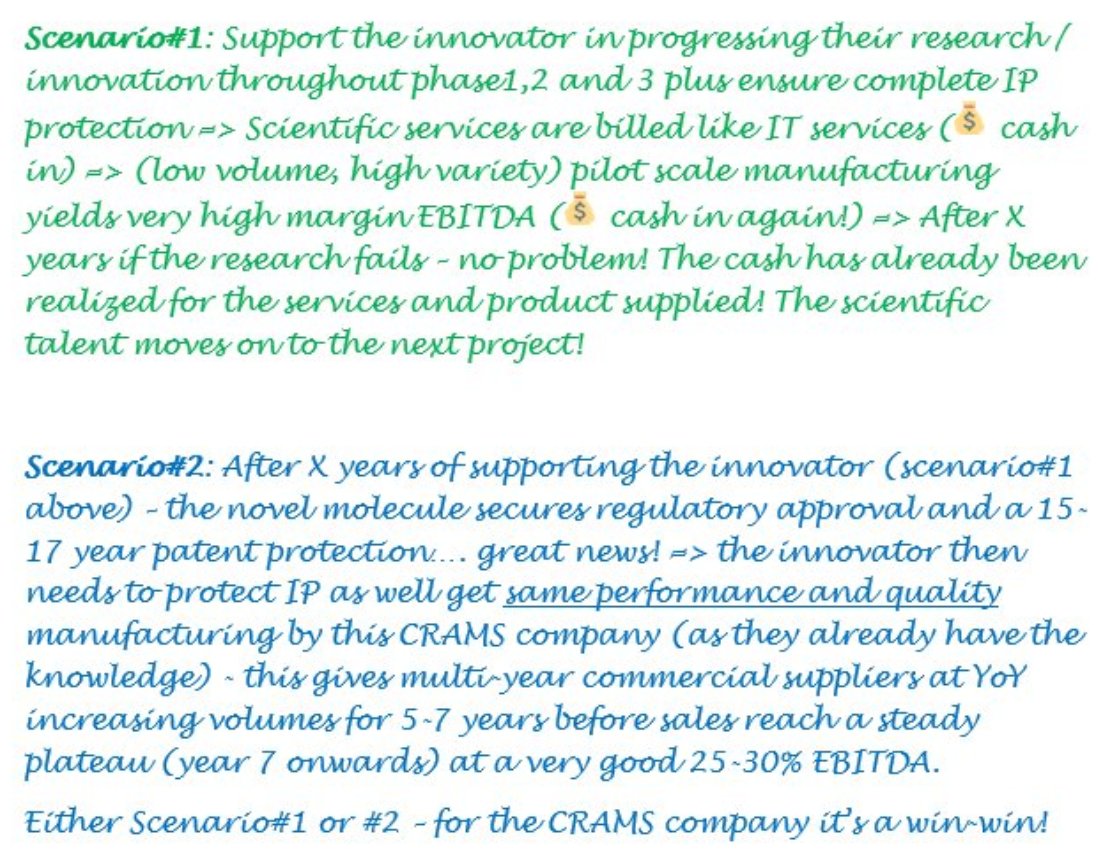

S1 : Majority NBE/NCE R&D projects fail. CDMO partner to that innovator "makes money in all failed" cases.

S2 : CDMO "may make larger money" in those lucky, successful (thin minority) cases, if the same #CDMO is retained as the manufacturing partner.

Extract from 2018 tweet 👇

More from Sajal Kapoor

@shuchi_nahar @AnyBodyCanFly Created this thread in 2018, as saw this coming. Covid actually accelerated the trend … next disruption will be lead by biosciences. Unseen today be seen few years out

Technology is enabling new ways of credibly accessing medical knowledge via smart phones / tablets.

— Conviction | Patience (@unseenvalue) November 8, 2018

Android, iOS have > 5k health / fitness apps like @Medscape, pointing to a future where the Tech. drives a part of medical knowledge and therapeutic guidance instead of a Doctor!

More from Uvlearnings

Only 1 hospital chain has these all packed in to 1 entity, IMHO. That chain also is the only chain in the world that trades near 1x replacement cost. But how can we buy it? It makes losses! -ve RoE!! Doesn't appear in quant filters, ignored due to RoE = Moat rhetoric. PAT is God.

How many hospitals in India have globally comparable healthcare quality and high end molecular diagnostics, genomics diagnostics, AI/ML, Robotics for timely, accurate diagnosis and best possible prognosis, treatment at affordable cost?

— Sajal Kapoor (@unseenvalue) June 21, 2021

Any thoughts @tusharbohra @AdityaKhemka5 https://t.co/6Mhpu5Dru1

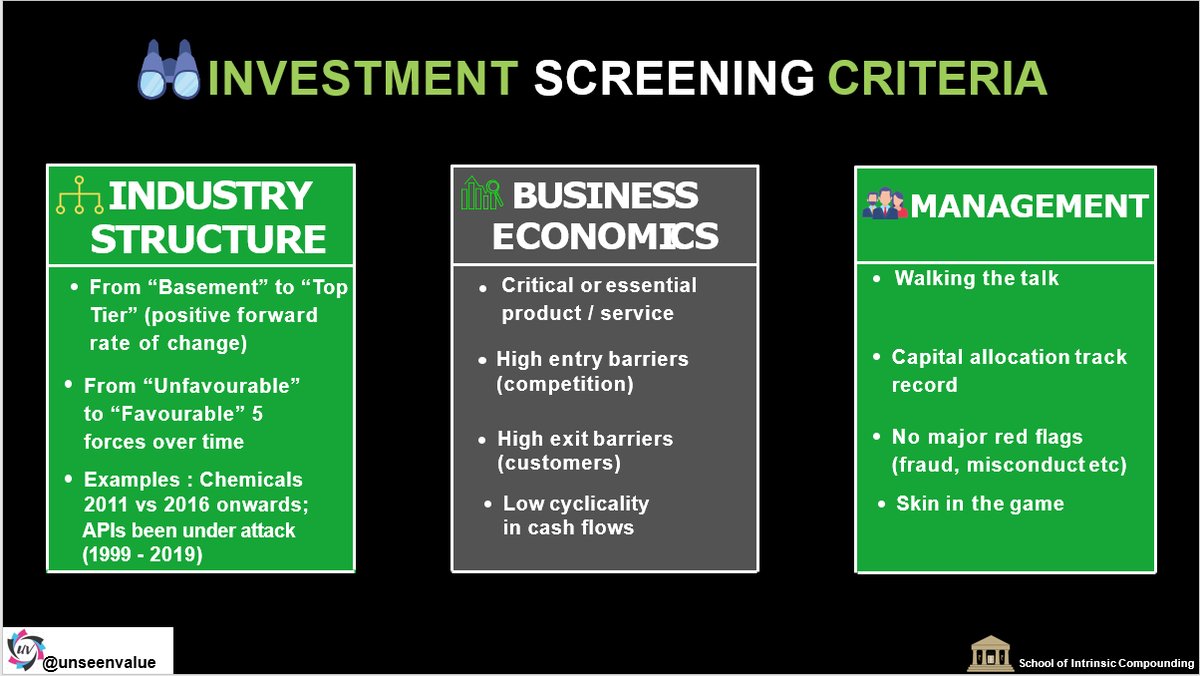

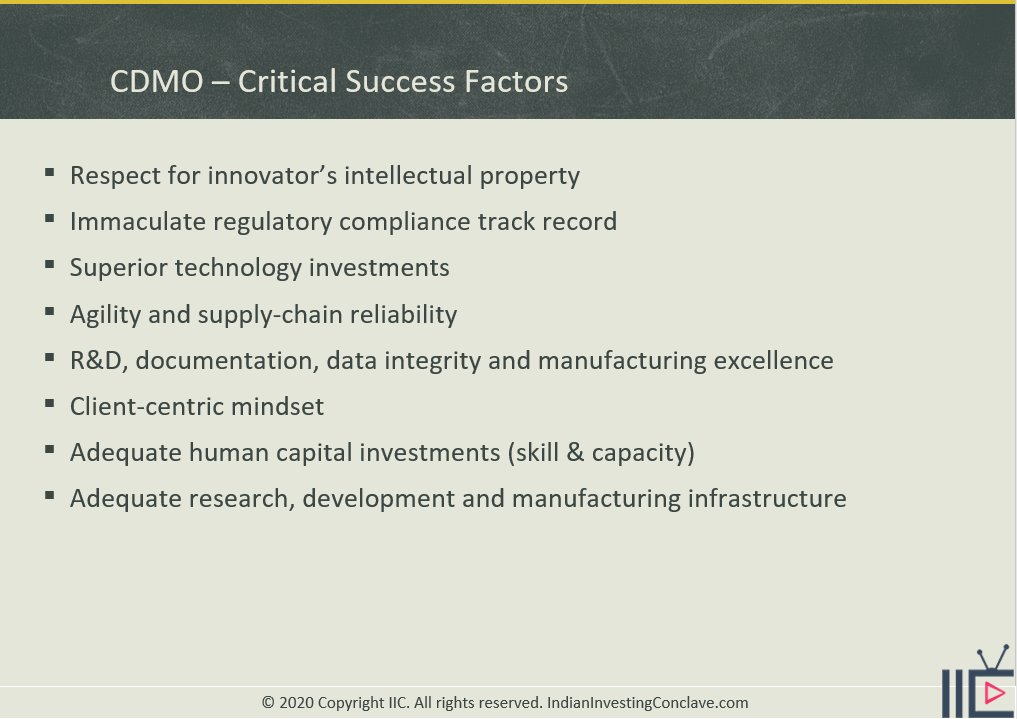

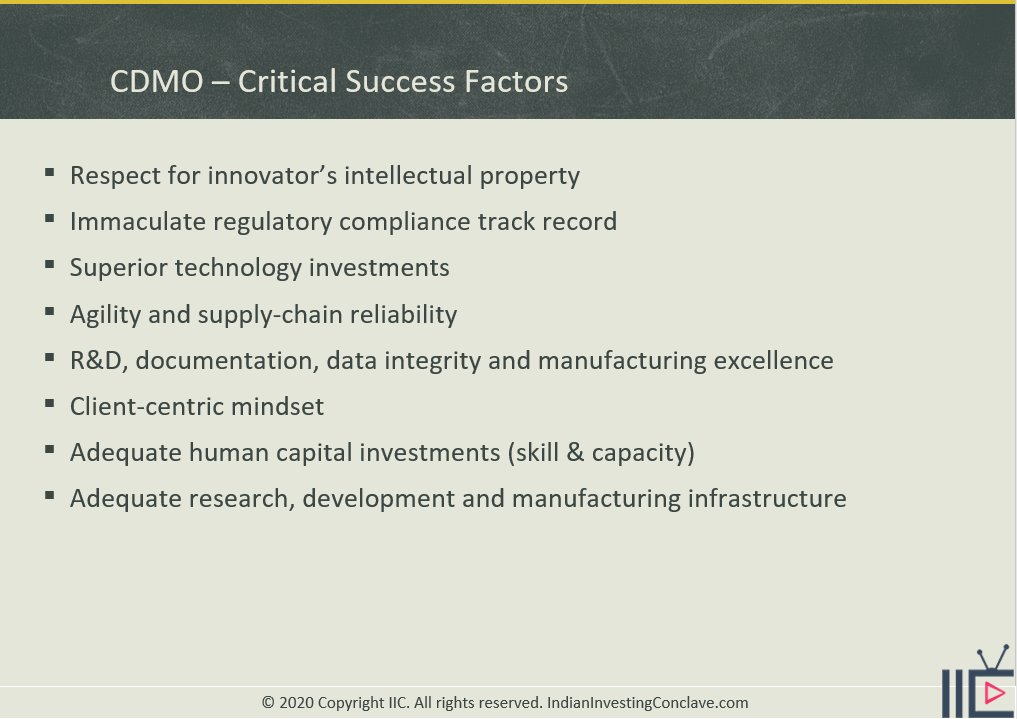

You offer me 80% cost arbitrage (discount relative to Japan/EU/US) along with low confidence / assurance on Critical Success Factors and I won't give you a single NCE/NBE to discover, develop or manufacture. Capex/opex arbitrage is too low in the disruptive-science-pecking-order! https://t.co/O2l8dK4BUv

@unseenvalue Given high capex/opex cost structures of US/Japan/EU, how will they be able to compete with Indian API companies? https://t.co/OYhC2PUZpL

— Hiren (@hiren_investing) August 11, 2021