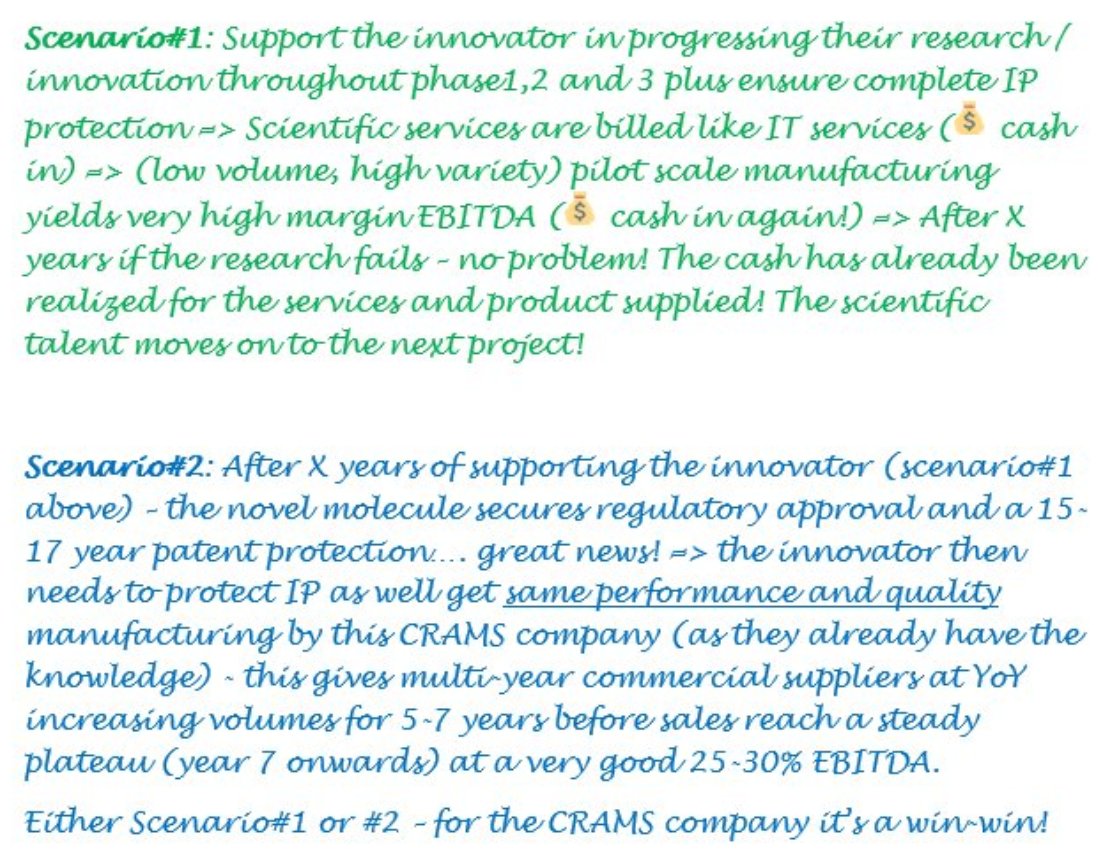

Research in CDMO/APIs is never a slam dunk. It may take ages to yield results. CEP filings can be lumpy as a result. As I wrote last year (link below), Hikal has been consistently sacrificing operating profits for a sustainable future. Best is ahead 🎥 🍿

https://t.co/hItmOud8Pm

#Hikal has stepped up R&D in recent years. Next few years (capex & launches) should yield superior earnings. Wish them all the luck \U0001f44d

— Sajal Kapoor (@unseenvalue) September 26, 2020

D: invested and biased view for sure, but it was below 1x price to sales vs 12x price to sales for many chemicals and generic players. No reco!! pic.twitter.com/aqPUKbziHK

More from Sajal Kapoor

Tail-events generate the biggest panic and upside. If you survive the panic w/o jumping off the train, you deserve the 100x in few stocks.

Temperament + Business Analysis = ⤴️

@unseenvalue Hats off Sir. I compared an equal weighted portfolio of your stocks above to the 2 Coffee Can stocks Abbott & Divis and your portfolio has delivered significant upside since then

— ML4TradingDoctor (@DrKRIndia) May 16, 2021

Key has to be conviction and equal weighting pic.twitter.com/6dJ1LDMSYr

Those who exited at 1500 needed money. They can always come back near 969. Those who exited at 230 also needed money. They can come back near 95.

Those who sold L @ 660 can always come back at 360. Those who sold S last week can be back @ 301

Sir, Log yahan.. 13 days patience nhi rakh sakte aur aap 2013 ki baat kar rahe ho. Even Aap Ready made portfolio banakar bhi de do to bhi wo 1 month me hi EXIT kar denge \U0001f602

— BhavinKhengarSuratGujarat (@IntradayWithBRK) September 19, 2021

Neuland 2700 se 1500 & Sequent 330 to 230 kya huwa.. 99% retailers/investors twitter par charcha n EXIT\U0001f602

2. Put your neck on the line (invest your hard earned capital - experience comes by paying tuition fee)

3. Read non-investing books as well (Psychology, history, biographies or whatever non-fiction you like)

4. Read this :

https://t.co/6z3HvtKakL

How to augment your Sector knowledge? Follow these 5 points \U0001f447

— Conviction | Patience (@unseenvalue) May 18, 2019

1. The Five Rules For Successful Stock Investing by Pat Dorsey

2. Con Calls - as many as you can in that sector

3. Annual Reports - as many as you can in that sector

4. Interact with trade/channel partners

5. AGMs pic.twitter.com/2ZOx3nkC4i

Never Knowingly Misguide.

Money making and fake advisory/PMS propaganda has never been my agenda

In just 15 years, #LaurusLabs has scaled up like no other..!

— Conviction | Patience (@unseenvalue) July 5, 2020

Numbers v Narrative: Well balanced 2800 Cr sales + huge competitive advantage in terms of IP/patents/synthesis capability!

Comparing Laurus with others - 1 hrs 28 mins\U0001f447https://t.co/Zzx6AwHZLH

Conviction | Patience pic.twitter.com/I6bImfjDCW

More from Uvlearnings

In an example of how deeply ingrained misogyny is in the Indian system, billionaire investor Rakesh Jhunjhunwala asked the management of Jubilant Pharmova: \u201cHow can we be lower than the lady? We have to beat her,\u201d in a slighting reference to @kiranshaw.

— Dr. Kailashnath Koppikar (@koppik) June 26, 2021

https://t.co/1dkZ9JMLLr