Most stocks are fit for short term trading. Not every business will compound wealth over the long term. Some commonly used proxies for long term compounding 'potential' (in alphabetic order) ::

Cash flow per share

Earnings per share

Scientists per share

Tweets per share

More from Sajal Kapoor

Twitter should be like that airport shuttle service, the moment you walk out (start following someone) - there should be a chauffeur (new stock idea) ready to drive you to your destination!

[Free CDMO Masterclass #18] https://t.co/208eQbYKEF

[Free Art of Investing] https://t.co/bHvUqnpiTE

[Paid IIC Dec 2020 on SeQuent] https://t.co/3iDO438Et9

[Charity fund raise on Unseen Trends in Biotechnology] https://t.co/eNi1x1qwhH

[Q&A on APIs]

Those who exited at 1500 needed money. They can always come back near 969. Those who exited at 230 also needed money. They can come back near 95.

Those who sold L @ 660 can always come back at 360. Those who sold S last week can be back @ 301

Sir, Log yahan.. 13 days patience nhi rakh sakte aur aap 2013 ki baat kar rahe ho. Even Aap Ready made portfolio banakar bhi de do to bhi wo 1 month me hi EXIT kar denge \U0001f602

— BhavinKhengarSuratGujarat (@IntradayWithBRK) September 19, 2021

Neuland 2700 se 1500 & Sequent 330 to 230 kya huwa.. 99% retailers/investors twitter par charcha n EXIT\U0001f602

More from Uvlearnings

Technology is enabling new ways of credibly accessing medical knowledge via smart phones / tablets.

— Conviction | Patience (@unseenvalue) November 8, 2018

Android, iOS have > 5k health / fitness apps like @Medscape, pointing to a future where the Tech. drives a part of medical knowledge and therapeutic guidance instead of a Doctor!

https://t.co/hItmOud8Pm

#Hikal has stepped up R&D in recent years. Next few years (capex & launches) should yield superior earnings. Wish them all the luck \U0001f44d

— Sajal Kapoor (@unseenvalue) September 26, 2020

D: invested and biased view for sure, but it was below 1x price to sales vs 12x price to sales for many chemicals and generic players. No reco!! pic.twitter.com/aqPUKbziHK

Those who exited at 1500 needed money. They can always come back near 969. Those who exited at 230 also needed money. They can come back near 95.

Those who sold L @ 660 can always come back at 360. Those who sold S last week can be back @ 301

Sir, Log yahan.. 13 days patience nhi rakh sakte aur aap 2013 ki baat kar rahe ho. Even Aap Ready made portfolio banakar bhi de do to bhi wo 1 month me hi EXIT kar denge \U0001f602

— BhavinKhengarSuratGujarat (@IntradayWithBRK) September 19, 2021

Neuland 2700 se 1500 & Sequent 330 to 230 kya huwa.. 99% retailers/investors twitter par charcha n EXIT\U0001f602

You May Also Like

As someone\u2019s who\u2019s read the book, this review strikes me as tremendously unfair. It mostly faults Adler for not writing the book the reviewer wishes he had! https://t.co/pqpt5Ziivj

— Teresa M. Bejan (@tmbejan) January 12, 2021

The meat of the criticism is that the history Adler gives is insufficiently critical. Adler describes a few figures who had a great influence on how the modern US university was formed. It's certainly critical: it focuses on the social Darwinism of these figures. 2/x

Other insinuations and suggestions in the review seem wildly off the mark, distorted, or inappropriate-- for example, that the book is clickbaity (it is scholarly) or conservative (hardly) or connected to the events at the Capitol (give me a break). 3/x

The core question: in what sense is classics inherently racist? Classics is old. On Adler's account, it begins in ancient Rome and is revived in the Renaissance. Slavery (Christiansen's primary concern) is also very old. Let's say classics is an education for slaveowners. 4/x

It's worth remembering that literacy itself is elite throughout most of this history. Literacy is, then, also the education of slaveowners. We can honor oral and musical traditions without denying that literacy is, generally, good. 5/x

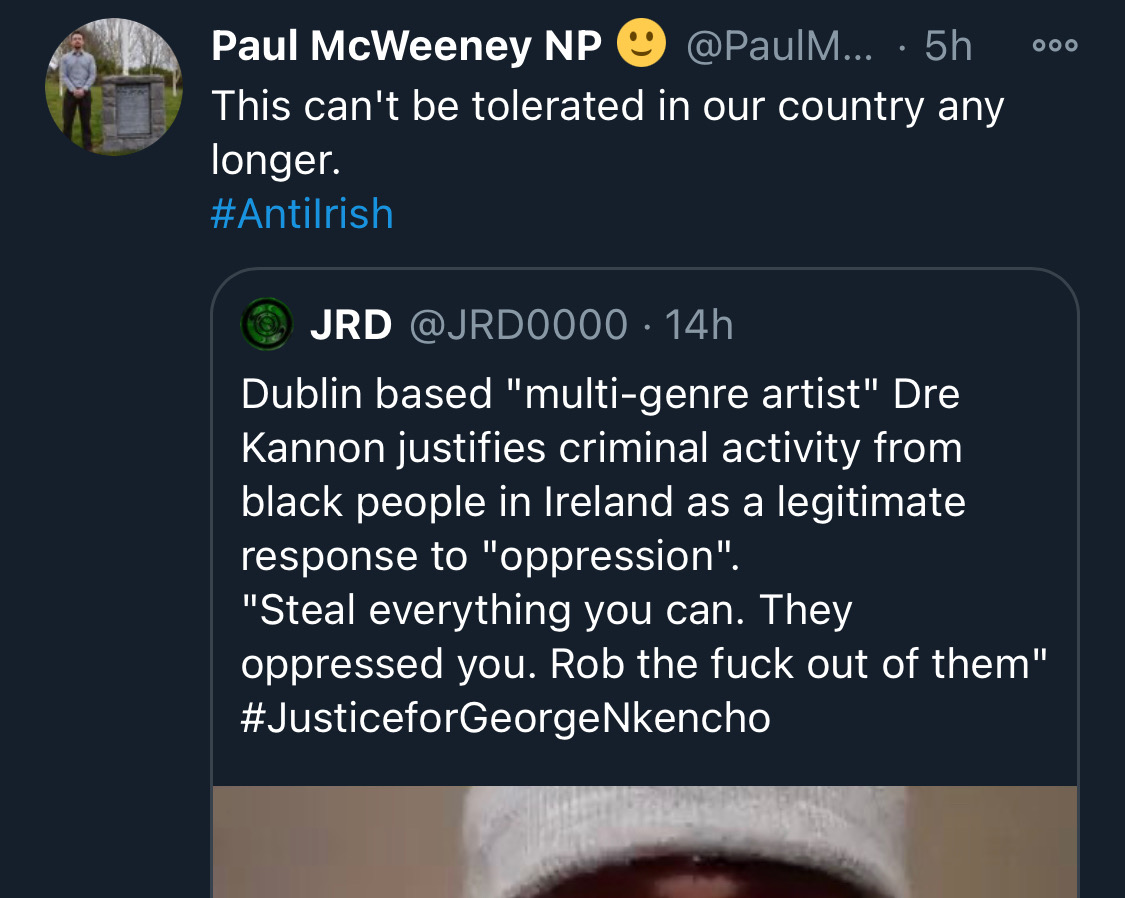

There is co-ordination across the far right in Ireland now to stir both left and right in the hopes of creating a race war. Think critically! Fascists see the tragic killing of #georgenkencho, the grief of his community and pending investigation as a flashpoint for action.

Across Telegram, Twitter and Facebook disinformation is being peddled on the back of these tragic events. From false photographs to the tactics ofwhite supremacy, the far right is clumsily trying to drive hate against minority groups and figureheads.

Be aware, the images the #farright are sharing in the hopes of starting a race war, are not of the SPAR employee that was punched. They\u2019re older photos of a Everton fan. Be aware of the information you\u2019re sharing and that it may be false. Always #factcheck #GeorgeNkencho pic.twitter.com/4c9w4CMk5h

— antifa.drone (@antifa_drone) December 31, 2020

Declan Ganley’s Burkean group and the incel wing of National Party (Gearóid Murphy, Mick O’Keeffe & Co.) as well as all the usuals are concerted in their efforts to demonstrate their white supremacist cred. The quiet parts are today being said out loud.

There is a concerted effort in far-right Telegram groups to try and incite violence on street by targetting people for racist online abuse following the killing of George Nkencho

— Mark Malone (@soundmigration) January 1, 2021

This follows on and is part of a misinformation campaign to polarise communities at this time.

The best thing you can do is challenge disinformation and report posts where engagement isn’t appropriate. Many of these are blatantly racist posts designed to drive recruitment to NP and other Nationalist groups. By all means protest but stay safe.