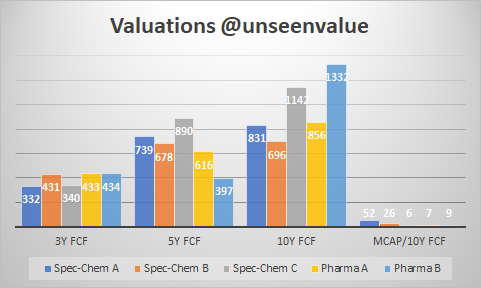

FCF = Free Cash Flow (Operating Cash after adjusting for working capital - total Capex)

MCap is based on last Friday's closing.

Q :: What stocks?

A :: “Bhaiya Ji Smile ... Kamaal karte ho Pandey jee ...” 😅

Disc: invested in the 3 businesses at single digit MCap/10Y FCF 😉

More from Sajal Kapoor

Long story short :: If you follow someone - make sure you do actually 'follow' ...

When the focus is on capability, terminal value and ESOPs - reported earnings recovery would have to wait. No science. No commerce. Pure basics 😏

Stock traded at 336.50 on 29 June. #Oversmart money was looking at limit-up closing followed by a next day gap up opening to make an annualized CAGR of 5000%

— Conviction | Patience (@unseenvalue) June 30, 2021

Animal spirits! - Lag Gaye \U0001f606 https://t.co/Cew044YHmK

Playing real estate and home improvement structural story in \U0001f1ee\U0001f1f3 via a focused proxy consumption \U0001f9fa

— Conviction | Patience (@unseenvalue) January 10, 2020

1. Asian Paints

2. Pidilite

3. SHIL (Hindware portfolio)

4. Fragrance SpecChem (Kelkar & Fairchem)

Consumption | Proxy Consumption

More from Uvlearnings

#Bicara presented clinical data from the lead immunotherapy program, BCA101, at ASCO 2021 - June 2021

— Punit (@punitbansal14) June 17, 2021

Title: First-in-human phase I study of the bifunctional EGFR/TGF\u03b2 fusion protein BCA101 in patients with EGFR-driven advanced solid cancers

Unseen Bicara Pipeline\U0001f9ec https://t.co/bMhtUEnw0C pic.twitter.com/cz6V5BLeuc

My 15 small and mid sized pharma for 15Y

— Sajal Kapoor (@unseenvalue) December 20, 2019

\u26a0\ufe0f~5 can go bust (0)

No trading. No questions. Your money. Your conviction. Your due diligence!

Albert David

DCAL

FDC

Indoco

JB Pharma

Jubilant Life

Laurus

Natco

Neuland

RPG Life

SeQuent

SMS Pharma

Solara

Strides

Syngene

| Pharma \U0001f489\U0001f48a

You May Also Like

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0