#Ultratech rising in a wedge. One fall pending towards 5400.

Wait for the wedge breakdown, if looking for shorts.

A word of caution : Wedges can become channels, so be a little nimble.

#markets #nifty

More from Gunjan Dua, MBA, MFA, CMT, CFTe 🪙⛽️🛢🇦🇺

You May Also Like

So the cryptocurrency industry has basically two products, one which is relatively benign and doesn't have product market fit, and one which is malignant and does. The industry has a weird superposition of understanding this fact and (strategically?) not understanding it.

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.

1/OK, data mystery time.

This New York Times feature shows China with a Gini Index of less than 30, which would make it more equal than Canada, France, or the Netherlands. https://t.co/g3Sv6DZTDE

That's weird. Income inequality in China is legendary.

Let's check this number.

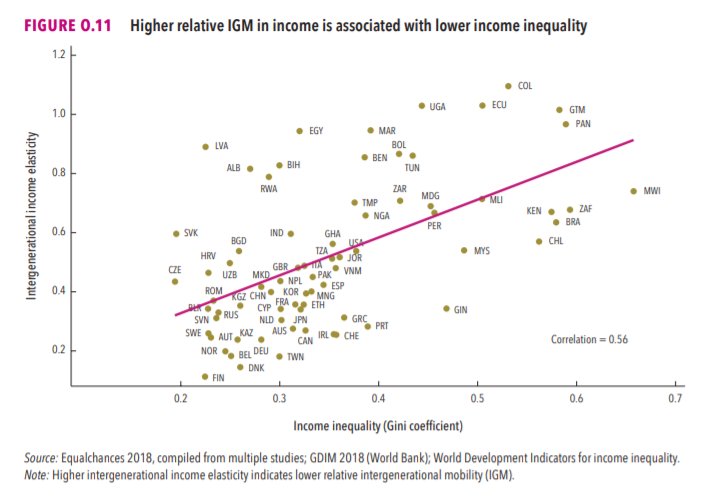

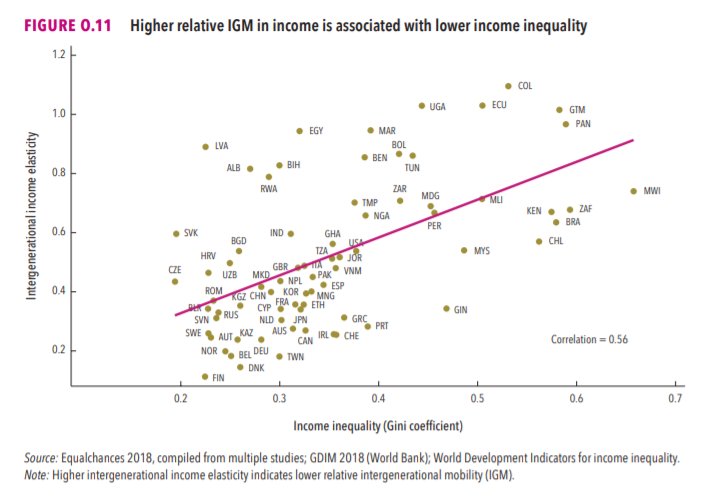

2/The New York Times cites the World Bank's recent report, "Fair Progress? Economic Mobility across Generations Around the World".

The report is available here:

3/The World Bank report has a graph in which it appears to show the same value for China's Gini - under 0.3.

The graph cites the World Development Indicators as its source for the income inequality data.

4/The World Development Indicators are available at the World Bank's website.

Here's the Gini index: https://t.co/MvylQzpX6A

It looks as if the latest estimate for China's Gini is 42.2.

That estimate is from 2012.

5/A Gini of 42.2 would put China in the same neighborhood as the U.S., whose Gini was estimated at 41 in 2013.

I can't find the <30 number anywhere. The only other estimate in the tables for China is from 2008, when it was estimated at 42.8.

This New York Times feature shows China with a Gini Index of less than 30, which would make it more equal than Canada, France, or the Netherlands. https://t.co/g3Sv6DZTDE

That's weird. Income inequality in China is legendary.

Let's check this number.

2/The New York Times cites the World Bank's recent report, "Fair Progress? Economic Mobility across Generations Around the World".

The report is available here:

3/The World Bank report has a graph in which it appears to show the same value for China's Gini - under 0.3.

The graph cites the World Development Indicators as its source for the income inequality data.

4/The World Development Indicators are available at the World Bank's website.

Here's the Gini index: https://t.co/MvylQzpX6A

It looks as if the latest estimate for China's Gini is 42.2.

That estimate is from 2012.

5/A Gini of 42.2 would put China in the same neighborhood as the U.S., whose Gini was estimated at 41 in 2013.

I can't find the <30 number anywhere. The only other estimate in the tables for China is from 2008, when it was estimated at 42.8.

Krugman is, of course, right about this. BUT, note that universities can do a lot to revitalize declining and rural regions.

See this thing that @lymanstoneky wrote:

And see this thing that I wrote:

And see this book that @JamesFallows wrote:

And see this other thing that I wrote:

One thing I've been noticing about responses to today's column is that many people still don't get how strong the forces behind regional divergence are, and how hard to reverse 1/ https://t.co/Ft2aH1NcQt

— Paul Krugman (@paulkrugman) November 20, 2018

See this thing that @lymanstoneky wrote:

And see this thing that I wrote:

And see this book that @JamesFallows wrote:

And see this other thing that I wrote: