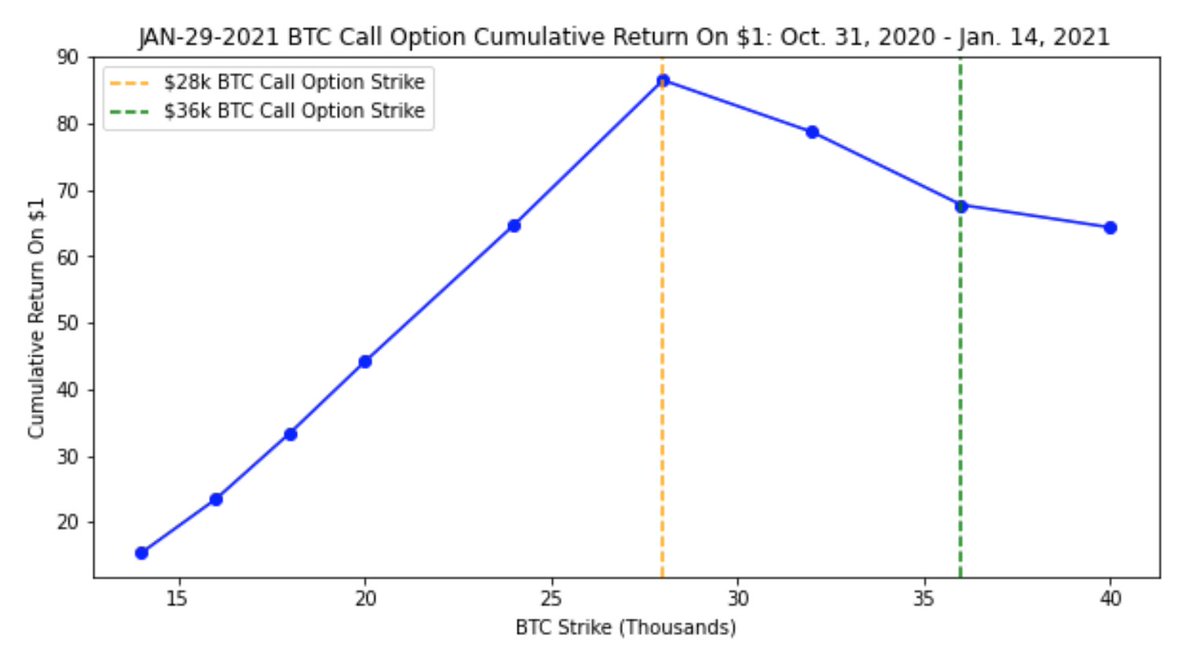

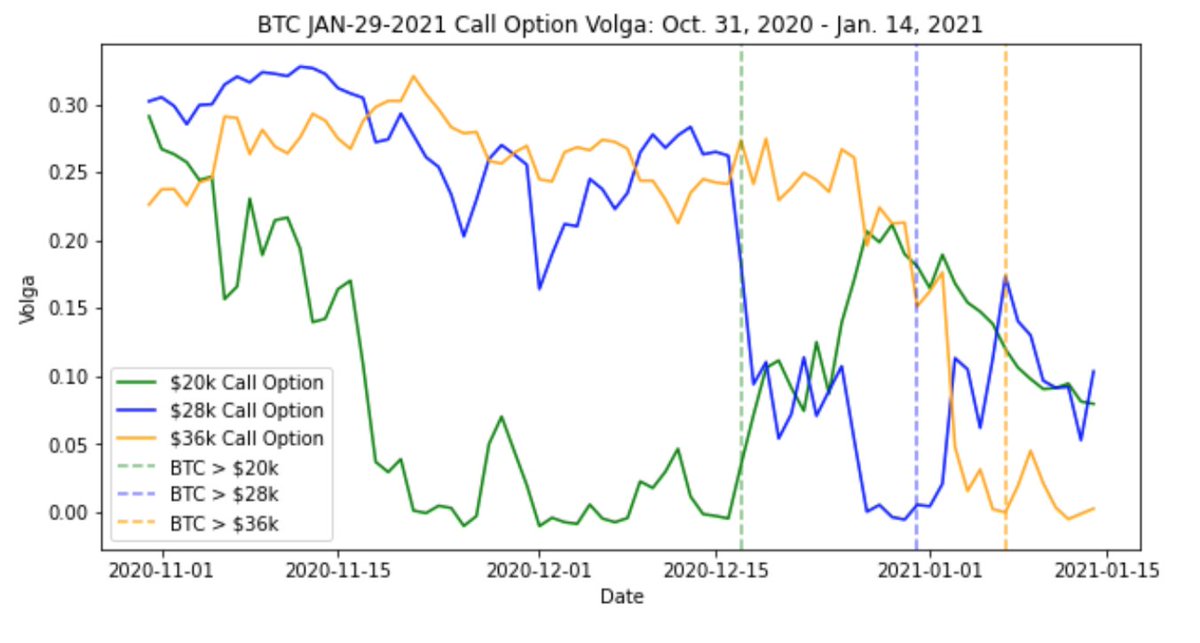

1. This legendary $36k call trade led me down a rabbit hole into the world of higher order option greeks to analyze this trade using past historical data. This was a good learning opportunity and I wanted to share some stuff I've been

#bitcoin $36k calls which saw whale buying at 87% IV are finally seeing a large drop in OI... Sales coming in at 136%@CanteringClark @7ommyZero @samchepal @OptionPit @Options @DeribitExchange pic.twitter.com/HC12MA6V13

— GenesisVolatility (@GenesisVol) January 12, 2021

BIG BTC TRADE!

— Rob Levy (@robbylevy) October 22, 2020

Yesterday there was a buyer of over 5000 BTC $50,000 calls expiring December 31, 2021.

Buyer paid from $1,100 up to $1,200 per call option.

WHAT DOES THIS MEAN??

Time for a thread \U0001f447\U0001f447\U0001f447

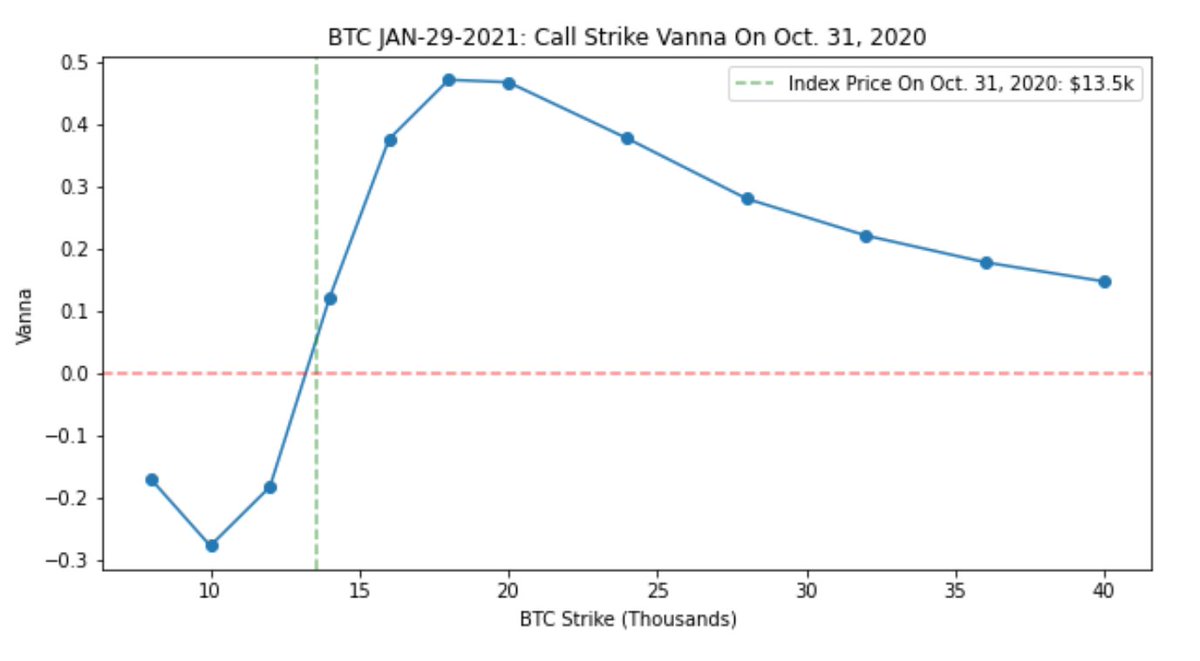

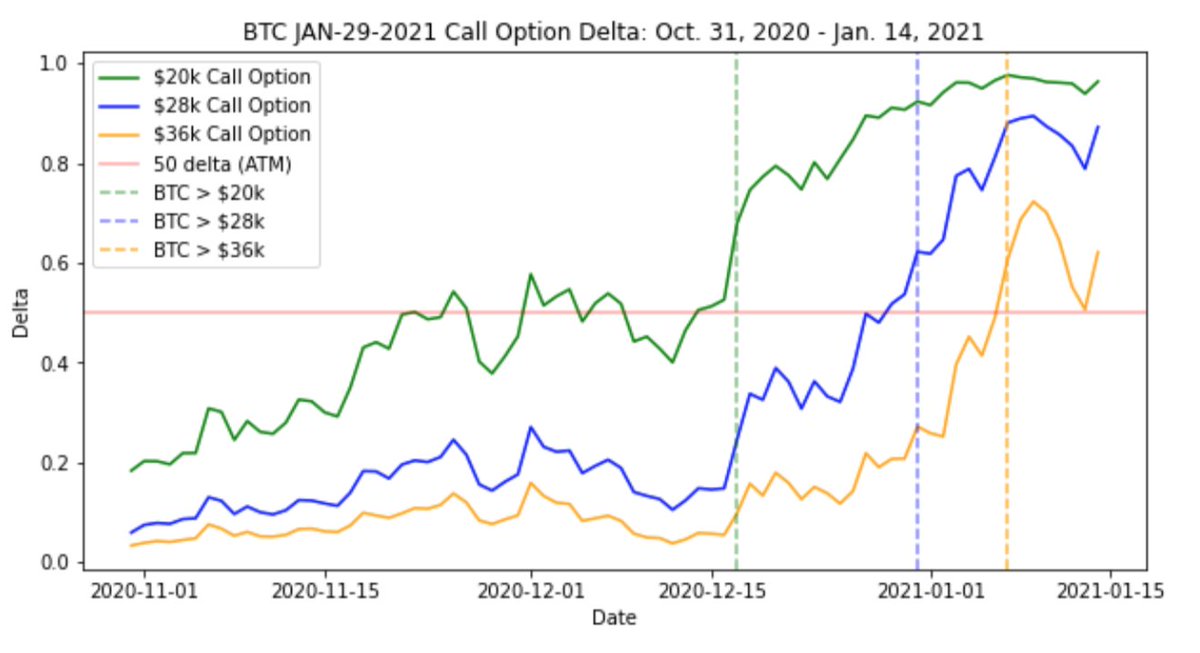

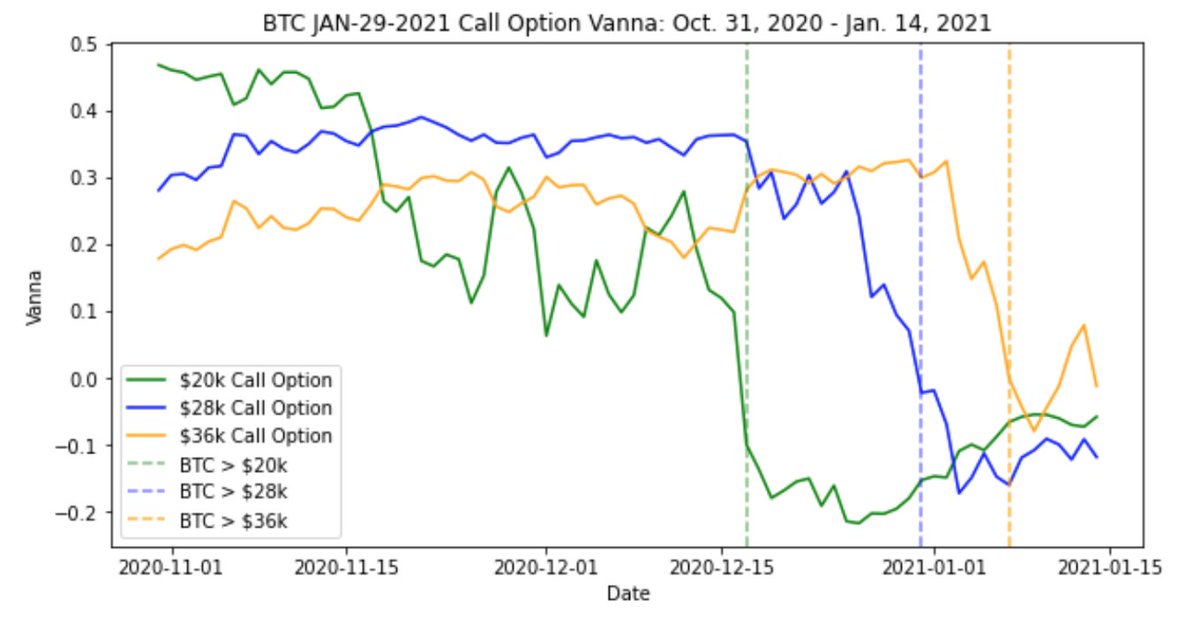

This is the vanna plot for all BTC call strikes as of Oct. 31/2020 for the JAN-29-2021 maturity (~90 days to maturity). Spot is around $13.5k and we can see that vanna peaks around the $20k range.

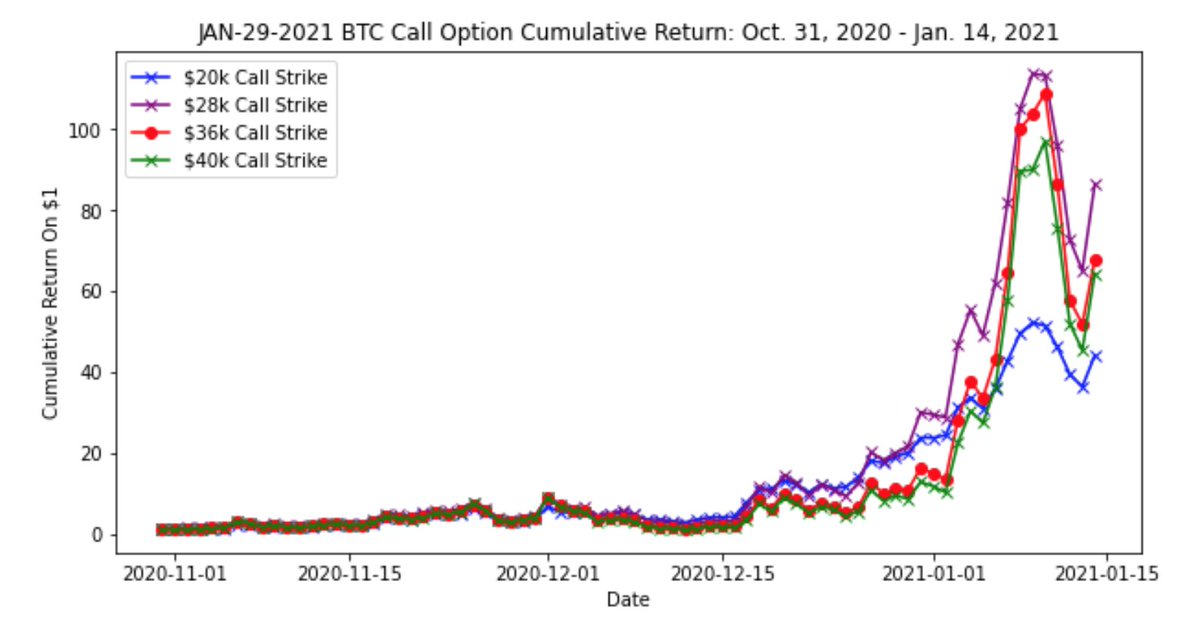

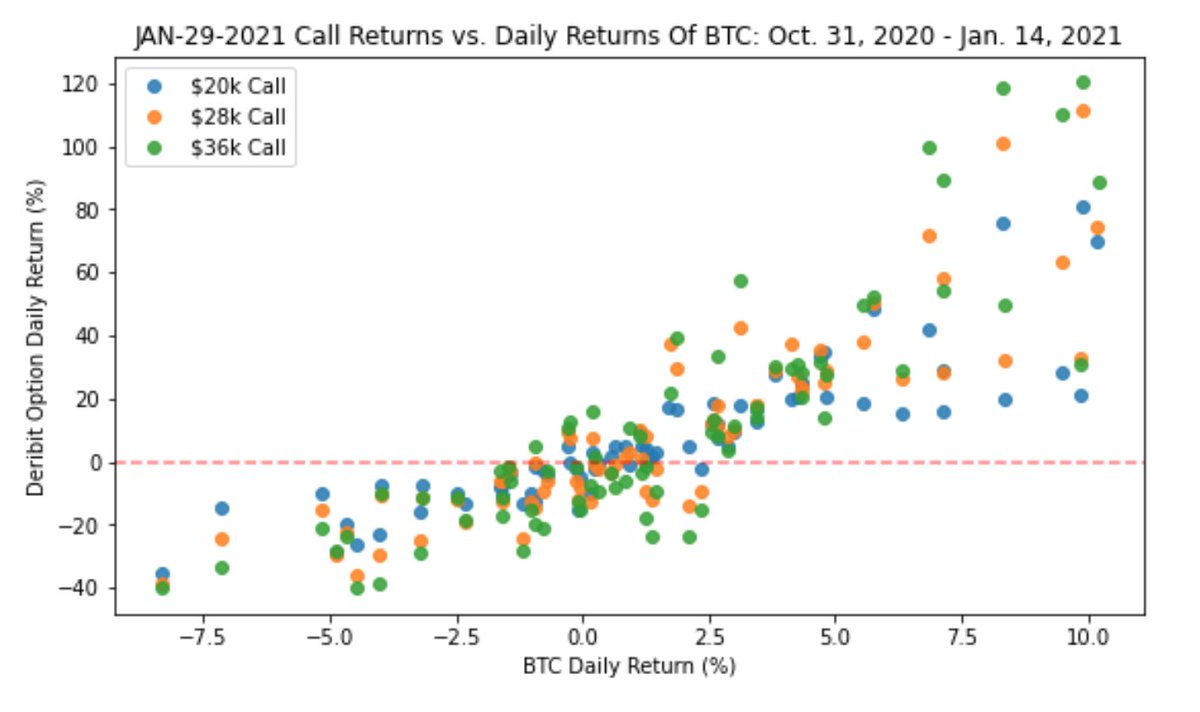

To start, we can see the daily call option returns are fairly similar, however, the 28k/36k are jumpier.

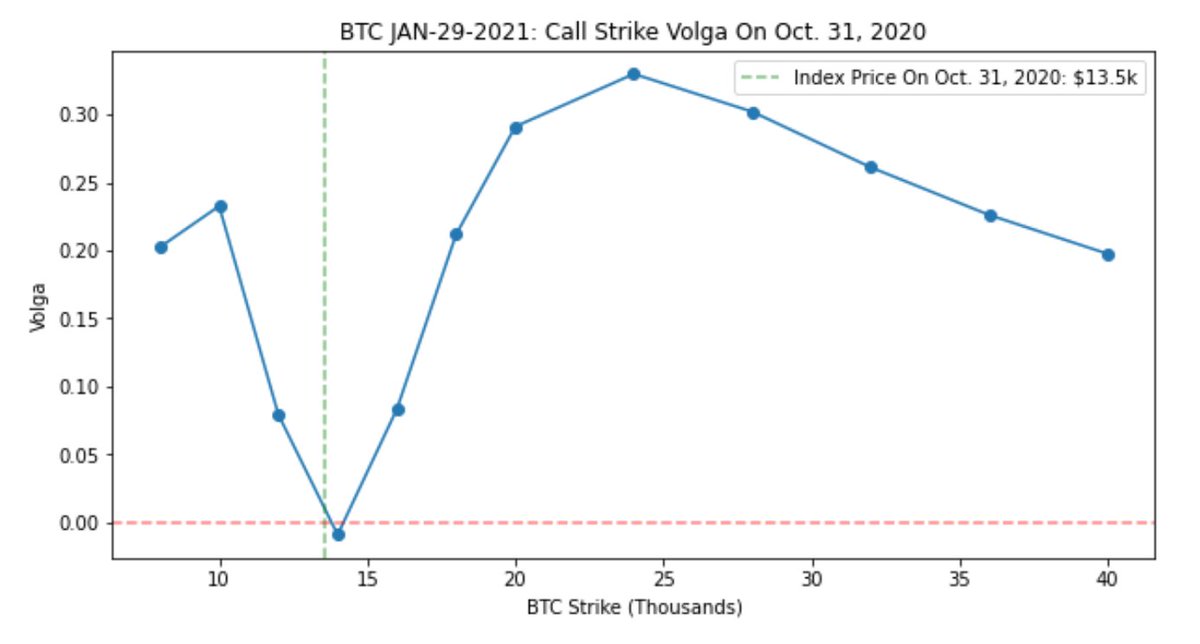

a) What is the expected behaviour for volga when a near-dated option reaches ATM or becomes deep ITM? In this case, what could be a reason for the $20k/$28k volga exposure to rise as the options become ITM?

c) For this trade, which first-order/second-order greek would have the most significant impact on the overall PNL (ie: vanna vs. volga)?

@darshanvaidya @SinclairEuan @GammaHamma22

@mgnr_io @PelionCap @saah1lk @JSterz @OrthoTrading @BitcoinMises @Shamitha_R

More from Trading

Want to master Option Selling for free?

Here are the best resources.

A thread 🧵👇

Collaborated with @niki_poojary

1. Best book of knowledge for a beginner?

Zerodha Varsity from @Nithin0dha's team is the best book for a newcomer to read and increase his basic knowledge about options, especially for the Indian markets.

Link:

2. Best Youtube channel on Options Trading?

The @tastytrade financial network. It's a foreign channel that focuses mostly on selling options.

They teach all strategies for free with their backtests.

Big on Straddle/Strangles selling.

Links:

3. Top Indian YouTube Channel for Options?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

4. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high-probability trades.

Here are the best resources.

A thread 🧵👇

Collaborated with @niki_poojary

1. Best book of knowledge for a beginner?

Zerodha Varsity from @Nithin0dha's team is the best book for a newcomer to read and increase his basic knowledge about options, especially for the Indian markets.

Link:

2. Best Youtube channel on Options Trading?

The @tastytrade financial network. It's a foreign channel that focuses mostly on selling options.

They teach all strategies for free with their backtests.

Big on Straddle/Strangles selling.

Links:

3. Top Indian YouTube Channel for Options?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

15 Learnings from Power of Stocks: \U0001f9f5

— Aditya Todmal (@AdityaTodmal) January 23, 2022

Collaborated with @niki_poojary

4. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high-probability trades.