Lets First start from knowing the cause of this "FEAR" of pulling the trigger.

A traders goes through many phases before becoming Profitable.

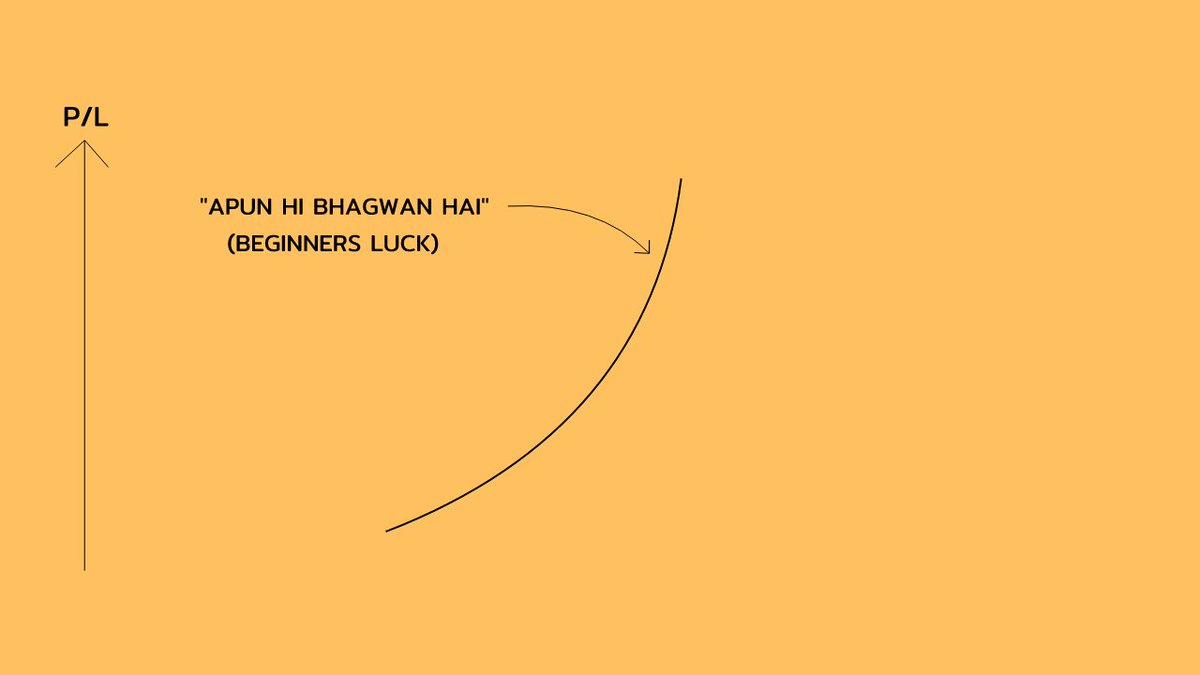

The first phase is the " APUN HI BHAGWAN HAI" phase-

When we first begin Trading, we don’t know any concepts, we don’t know about the risks , the dangers.

So we start trading, and like most guys by beginners luck we start making good, we start to calculate how much money we will make in next 1yr, 5 yrs, Greed start to Hop in.

We get introduced to Various instruments, F&O, LEVERAGE.

We take big positions as we don’t have any FEAR cause we haven't seen those bad phases yet.

Now we get the Big blow, account down -50%, or in many cases wiped out.

The first phase ends here.

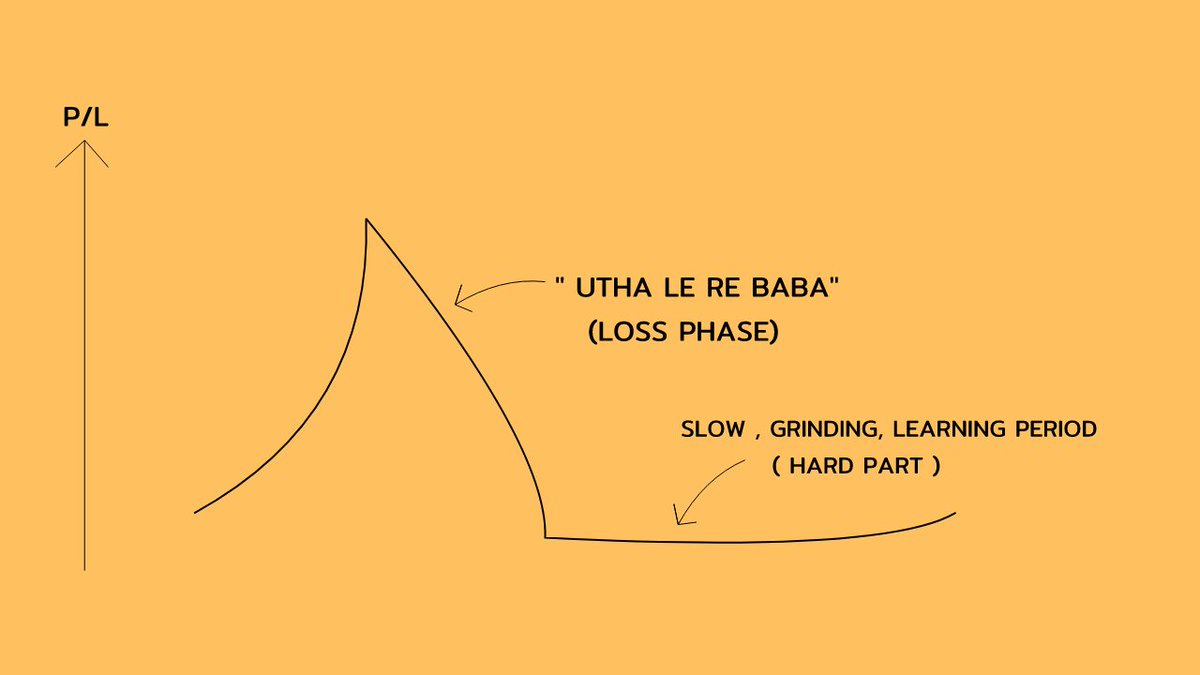

Now we know How the market can kick our ass, we now know the risk that comes with those big positions.

"THE LEARNING PHASE"-

Now we know that we were just lucky initially and now we have to learn why we get those losses, so we start learning concepts , fundamental, Technicals.

This phase is very long, slow grinding phase,this is the hard part

Because we are not making profits and neither big losses,but we are loosing a lot of time

Now the biggest problem we get is We fear of pulling the trigger, and this is going to be the biggest problem for us now.

Cause every time we Find an opportunity , we think about the previous losses and the fear Takes over, and the opportunity is missed.

So now we know How we reached at this point, where we fear taking the trade.

HOW TO MINIMIZE THE FEAR OF PULLING THE TRIGGER -

1. DON’T TRADE THE P/L ,TRADE THE MARKETS-

Traders are obsessed with the P/L , and that is why they behave irrationally while taking decisions in trading.

Start to think in Terms of R , it will change your trading your trading for good,just this small tweak will have a tremendous effect in your trading

Track your trade results in terms of R and not in P/L terms

This seems a small thing but will make a big difference trust me.

2. FIX THE RISK -

One of the reason traders are uncomfortable in taking a trade is that they are not comfortable in taking the risk they are taking currently.

So, the solution is to start for the LEVEL 0, fix your R , Say if you have a 1 lakh account , fix your R at say 500 Rs, or 1000 Rs, just fix the risk you take on every trade.

And trade with that R till you are comfortable with loosing 10 times in a row with that R and still be profitable over a 100 trade period.

Then increase the risk over time.

3. You cant win all the time -

Okay I get it, it feels good when you have a winning trade, but my friend in trading you cant win all the time.

Even the High accuracy traders have 60-70% accuracy, and many have 30-40% accuracy and still make more than you may think of.

So, be comfortable losing on a trade, know that if you have an edge you will make gains over a big sample of trades.

4. "Yaar 12k par to Nifty liya nahi, 14k par lekar phas gaye to"

This is why most of the people are not able to take trades, because they think that ,

they have lost the opportunity and now its not a good time to take the trade.

As they think trend will change when they enter, and it keeps to go up and up and up.

So you have to change this mindset, If you loose on a trade even if you take at the market top, how much you will lose 1R right, but in fearing of this 1 loss , you don’t take those 100 trades which would have or will give profit too.

5. Go through historical charts-

One aspect that may have stopping you from taking the trade is that you don’t have much confidence in your edge.

As a discretionary trader its important to go through historical charts as much as you can, and then screen time play a big role.

This way you will have confidence in your edge, and you will be able to put on the next trade.

6. Don’t rely on others for your trading decisions -

Even if you are going to fail or succeed,you should be the reason for that and not your broker, not your twitter friend, not anyone else

Just take trades on what you know and improve over time,

many times you miss your trades because you want to confirm about it form others, it’s the worst thing you can do.

I also did it, but I learned very early that its only me who can help to improve my trading results.

7. WHAT MAKES THE DIFFERENCE -

The beginner only have the CONFIDENCE,

The experienced only have the KNOWLEDGE,

The PRO have both " KNOWLEDGE + CONFIDENCE "

Thanks for reading till here.

These are only my opinions and not necessarily be yours

Cheers,

Trader knight.