He was a mathematician, physicist, astronomer, theologian, and author.

Isaac Newton: A brilliant scientist, a terrible investor

How Issac Newton lost $4 million due to the first stock market bubble in history and insider trading

/THREAD/

He was a mathematician, physicist, astronomer, theologian, and author.

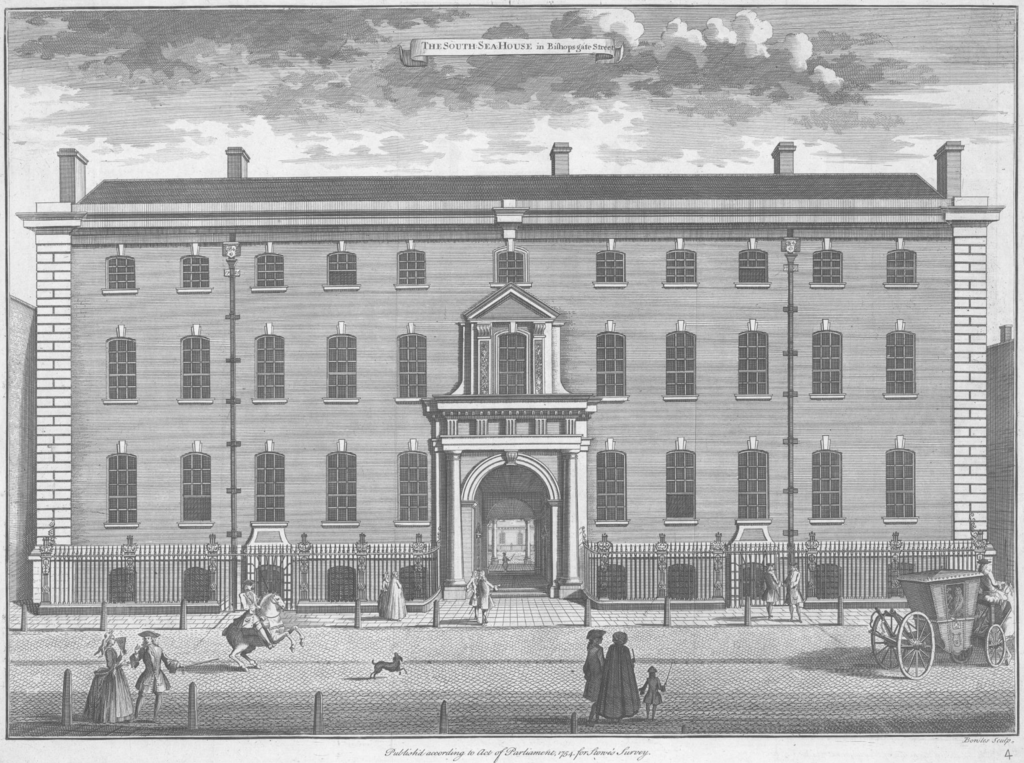

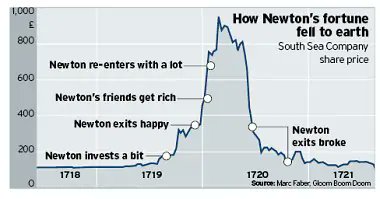

However, his most prominent failure was losing an entire fortune in the first stock market bubble in history, the South Sea Company in 1720.

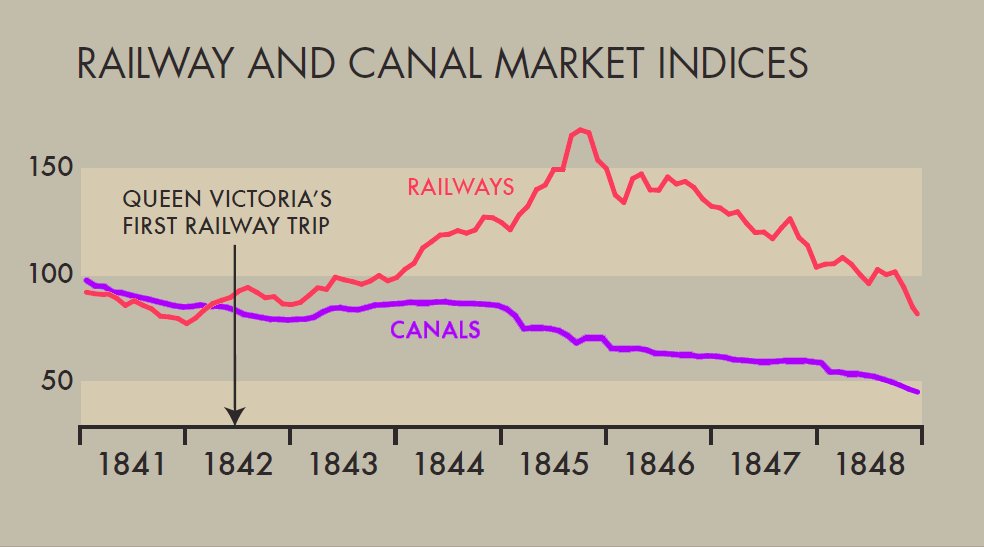

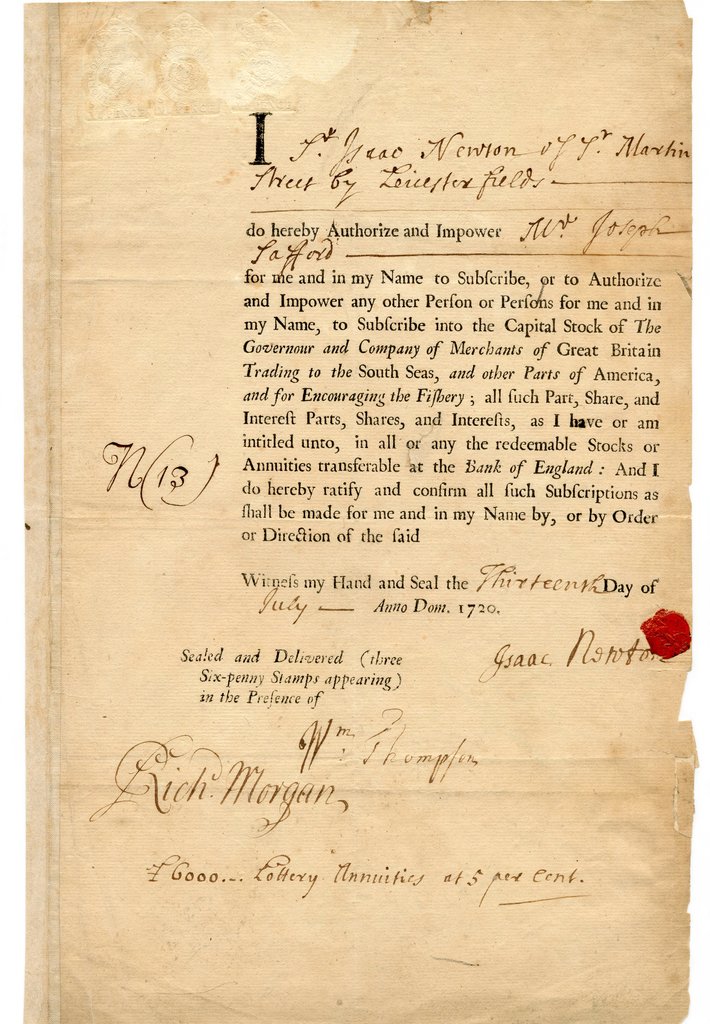

Before 1720 most of his investments were in safe and reliable securities, various government bonds that delivered a regular stream of income, and shares in a few of the larger companies on the exchange, including South Sea Co.

Government bondholders were given the option to exchange their securities into South Sea Co. shares.

However, the potential for dividend increases and sizable capital gains was created when Parliament gave the company a monopoly on trade with Spain’s colonies in South America.

It required all companies that sold stock to the public to hold a royal charter aiming to control rampant speculation.

A well-bribed Parliament and ruling ministry accepted the idea in February, and the deal became official in April.

Over the next eight years, he picked up more shares, using his savings and the proceeds from selling his shares in other companies.

In 1720, he converted his government bonds and annuities into the stock.

At this point, Newton unloaded most of his shares for a profit of more than £20,000 equal to 200 years of his former annual salary as a professor at the University of Cambridge.

This was amplified by the hundreds of newspapers in London posting glowing articles from esteemed authors, along with rumors about South American commodities that would be imported back to Europe.

The stock was also made easier to buy through installment plans with 10% downpayments.

With England in a euphoric mood, watching from the sidelines was hard to do.

By mid-June, Newton could no longer stand the thought of the money he’d “lost” by selling too soon and began to buy back in.

By mid-August, he was paying £700 to £1,000 a share, more than double the price he’d sold in April.

In the summer, news broke that insiders were selling.

The stock began to tumble and within a few weeks, plunged back to the £200 level.

So ended the infamous South Sea Bubble.

Newton’s losses were catastrophic, likely £20,000, the equivalent of $4 million today.

1720 was sometimes referred to as the “Bubble Year”

He allegedly forbade everyone from uttering the words "South Sea" in his presence.

/END/

👇👇👇

https://t.co/ggB2vFv9Ha

Isaac Newton: A brilliant scientist, a terrible investor

— Kostas Kosmidis \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 10, 2021

How Issac Newton lost $4 million due to the first stock market bubble in history and insider trading

/THREAD/ pic.twitter.com/uCU0zDVyw9

More from Kostas Kosmidis 👨💼 📈 💸

How Volkswagen went from being on the brink of bankruptcy to the most valuable company in the world in two days

/THREAD/

1/ At the peak of the 2008 financial crisis, Volkswagen was considered a very likely candidate for bankruptcy.

Heavily indebted and already financially struggling before 2008, with car sales expected to plummet due to the ongoing global crisis.

2/ With GM and Chrysler filing for bankruptcy in 2009, shorting the VW stock would seem a safe bet.

If you are not familiar with stock shorts and short squeezes check my thread

Shorts, Squeezes, and Betting Against Stocks

— Kostas on FIRE \U0001f525 (@itsKostasOnFIRE) January 27, 2021

What is short selling, how is it used and why is it risky?

/THREAD/ pic.twitter.com/PyDd208hFe

3/ On October 26, 2008, Porsche announced it had increased its stake at VW from 30% to 74%.

This was a surprise to many who were led to believe that Porsche wasn't planning a takeover of VW, based on the company's announcements.

4/ Before the announcement, the short interest was approximately 13% of the outstanding shares, a number considered relatively low.

Porsche had a 30% stake, the Lower Saxony government fund held 20% of the shares, and another 5% was held by index funds.

/THREAD/

1. Review your expenses and make a budget

It will help you see where you overspend, make a plan to save, pay down debt and start

Budgeting, the 50-30-20 rule, and the envelope method

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 6, 2021

Your first step towards financial independence

/THREAD/ pic.twitter.com/Tmuc3Itca5

2. Set your investing and retirement goals

How much do you need to support yourself in retirement and when do you want to

The most important number for your retirement: The 4% rule

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 7, 2021

What Is the Four Percent Rule?

/THREAD/ pic.twitter.com/8n1R1UZI5c

3. The earlier you start investing, the better.

Here's why and how time and compounding can become your

The Miracle of Compound Interest and the Rule of 72

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 2, 2021

//THREAD// pic.twitter.com/AOqd3kL6cn

4. Invest in an index fund

It's easy, safe, cheap, and the best choice for a beginner in investing, with not much time for

Jack Bogle, the Father of Indexing

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 8, 2021

How John "Jack" Bogle's creation impacted investors more than Bill Gates, Steve Jobs, and Warren Buffett combined

/THREAD/ pic.twitter.com/4wPi8x3cXn

More from Trading

It's much more powerful than you think

9 things TradingView can do, you'll wish you knew yesterday: 🧵

Collaborated with @niki_poojary

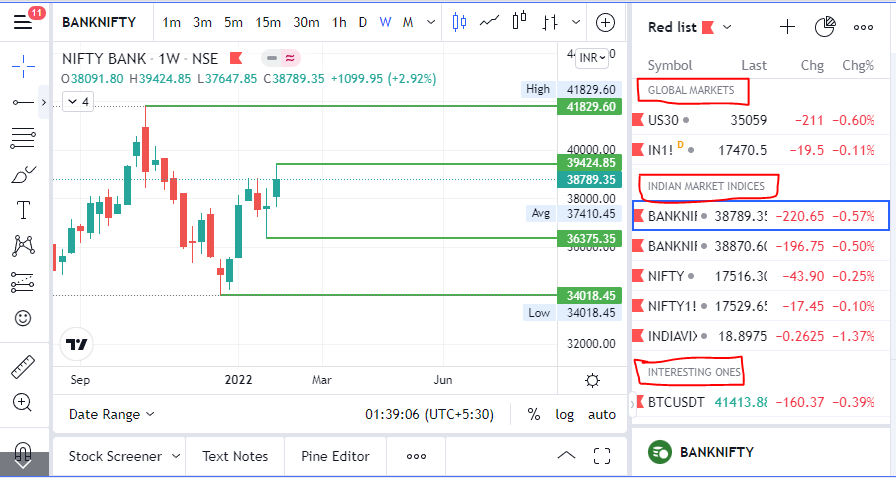

1/ Free Multi Timeframe Analysis

Step 1. Download Vivaldi Browser

Step 2. Login to trading view

Step 3. Open bank nifty chart in 4 separate windows

Step 4. Click on the first tab and shift + click by mouse on the last tab.

Step 5. Select "Tile all 4 tabs"

What happens is you get 4 charts joint on one screen.

Refer to the attached picture.

The best part about this is this is absolutely free to do.

Also, do note:

I do not have the paid version of trading view.

2/ Free Multiple Watchlists

Go through this informative thread where @sarosijghosh teaches you how to create multiple free watchlists in the free

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

3/ Free Segregation into different headers/sectors

You can create multiple sections sector-wise for free.

1. Long tap on any index/stock and click on "Add section above."

2. Secgregate the stocks/indices based on where they belong.

Kinda like how I did in the picture below.