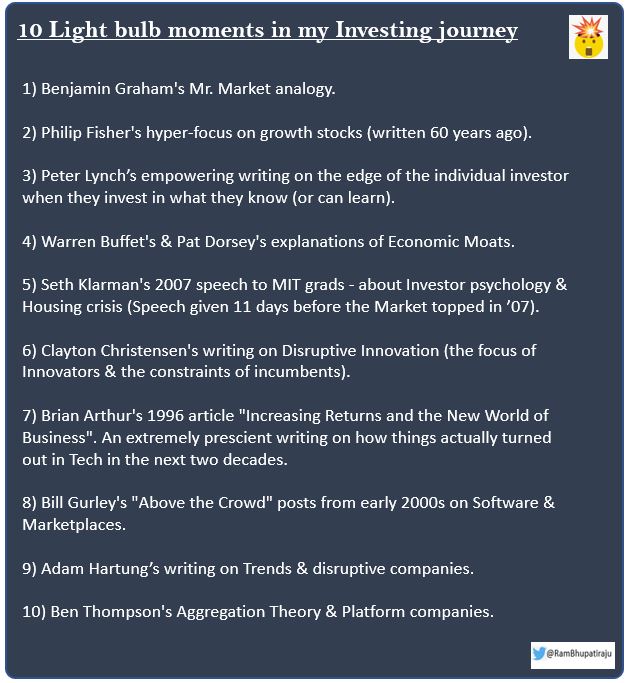

Note : Many of these are my past Tweets related to these topics. Not trying to self promote them. Adding them only because they have the original links, added context and my highlights & fav pts.

Let's dive in. ⬇️⬇️

Excellent compilation of quotes from Benjamin Graham's "The Intelligent Investor". \U0001f44f

— Ram Bhupatiraju (@RamBhupatiraju) May 25, 2020

cc: @dmuthuk @Gautam__Baidhttps://t.co/LNKNVXVj1b

Great summary of Philip Fisher's "Common Stocks and Uncommon Profits". It's no secret that this is one of THE BEST books for Individual investors but it's still enlightening to re-read the book or these summaries.\U0001f44d

— Ram Bhupatiraju (@RamBhupatiraju) June 4, 2020

cc:@saxena_puru @Gautam__Baid @dmuthukhttps://t.co/u16X3CKj8V

Peter Lynch's "Use Your Edge" essay has some great lessons for individual investors. \U0001f44f

— Ram Bhupatiraju (@RamBhupatiraju) November 25, 2020

Solid advice at the end of the article (my fav points highlighted).\U0001f447https://t.co/nkUVDh0NVA pic.twitter.com/aQ1eFr2SGC

For anyone interested on the topic of Moats, the few hours spent on these Docs/Videos/Podcasts by Pat Dorsey will be well worth their time. @dmuthuk @Gautam__Baid @saxena_puru https://t.co/eZMbT309if

— Ram Bhupatiraju (@RamBhupatiraju) February 16, 2020

Just finished reading Brian Arthur's "Increasing Returns and the New World of Business" article in HBR from July 1996 and\U0001f92f.

— Ram Bhupatiraju (@RamBhupatiraju) May 16, 2020

cc: @chetanp @GavinSBaker @patrick_oshag @Gautam__Baid @7Innovator @saxena_puru @BrianFeroldi @IntrinsicInv @BluegrassCap @TMFJMohttps://t.co/izQ952DVpb