Unfortunately, they're not available to the public (even Bernstein's client website cuts off at 2003), but happy to give more details if necessary

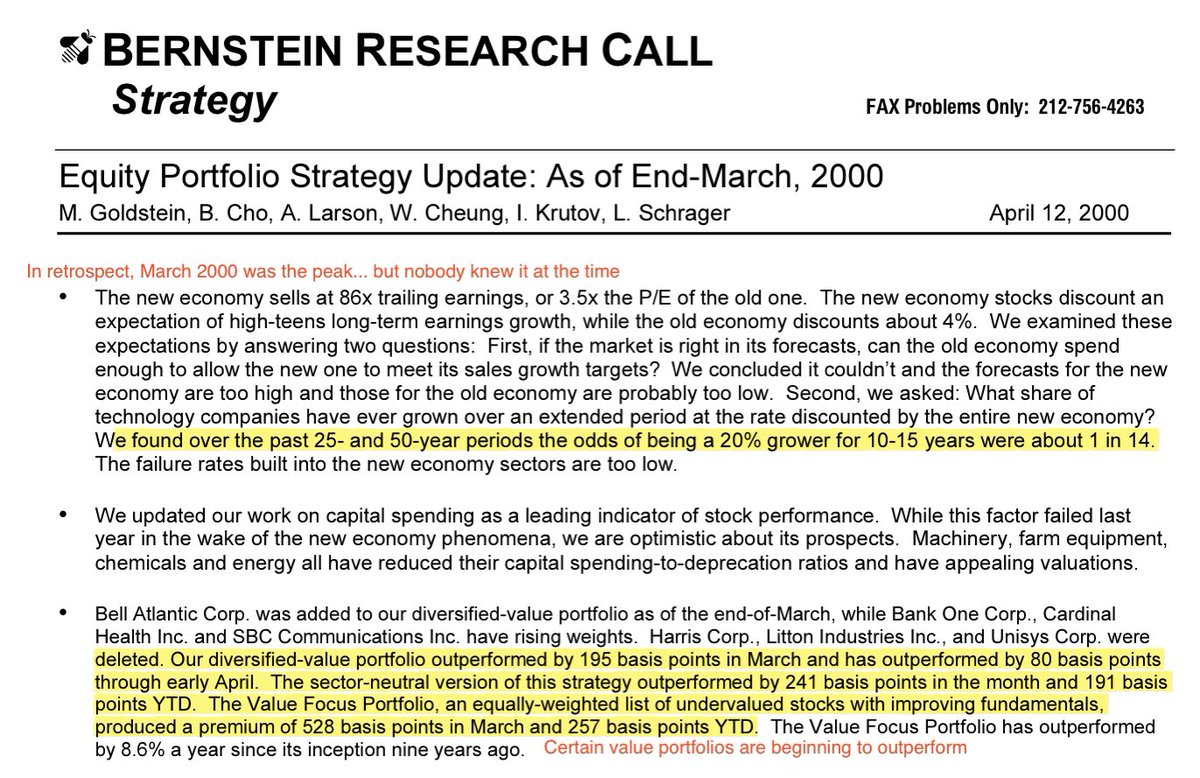

1/ Lessons From The Tech Bubble:

Last year, I spent my winter holiday reading hundreds of pages of equity research from the 1999/2000 era, to try to understand what it was like investing during the bubble

A few people recently asked me for my takeaways. Here they are -

Unfortunately, they're not available to the public (even Bernstein's client website cuts off at 2003), but happy to give more details if necessary

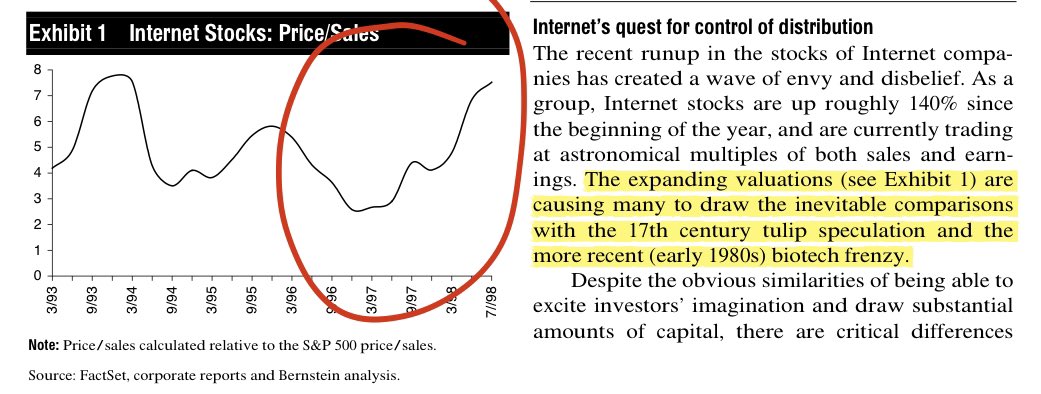

Unfortunately, the quip "it's not a bubble if everyone says it is" just isn't true

Investors were comparing the internet sector to tulip mania as early as mid-98. Bernstein held an entire conference on it in June 99!

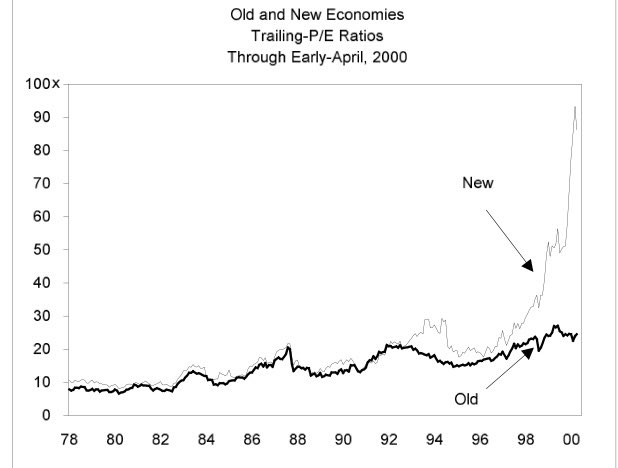

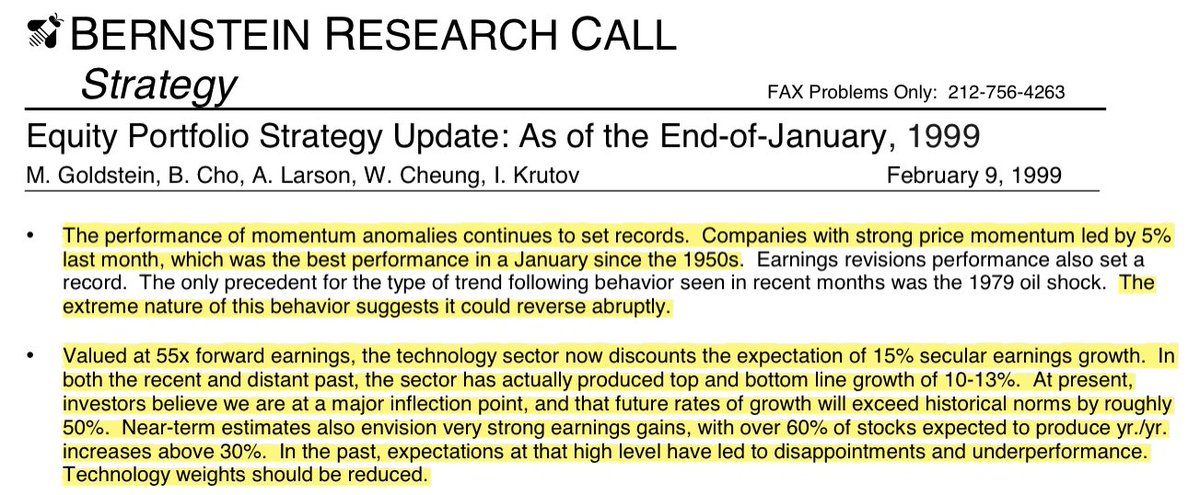

In truth, the hard part about the tech bubble wasn't noticing it. The hard part was timing it

Our equity strategist tried in January 99... he was off by 14 months (and another 30 point gap in value vs growth)

Nobody noticed in March 2000 when it finally popped. Our equity strategist (who bet his career on it!) didn't catch on until June

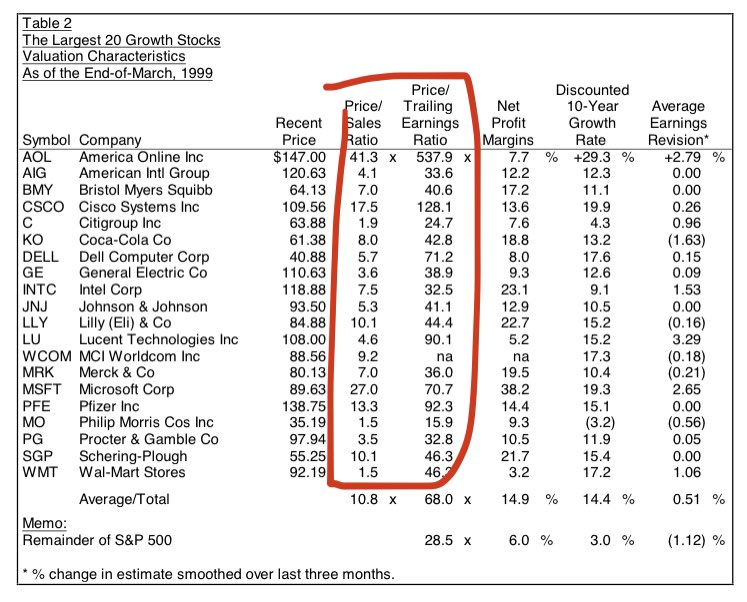

See the valuation table below, 1 year before the top

Yes, Microsoft traded at 70x earnings. But Coca Cola was 43x. Pfizer was 92x. Every stock here was a disaster over the next 10 years...

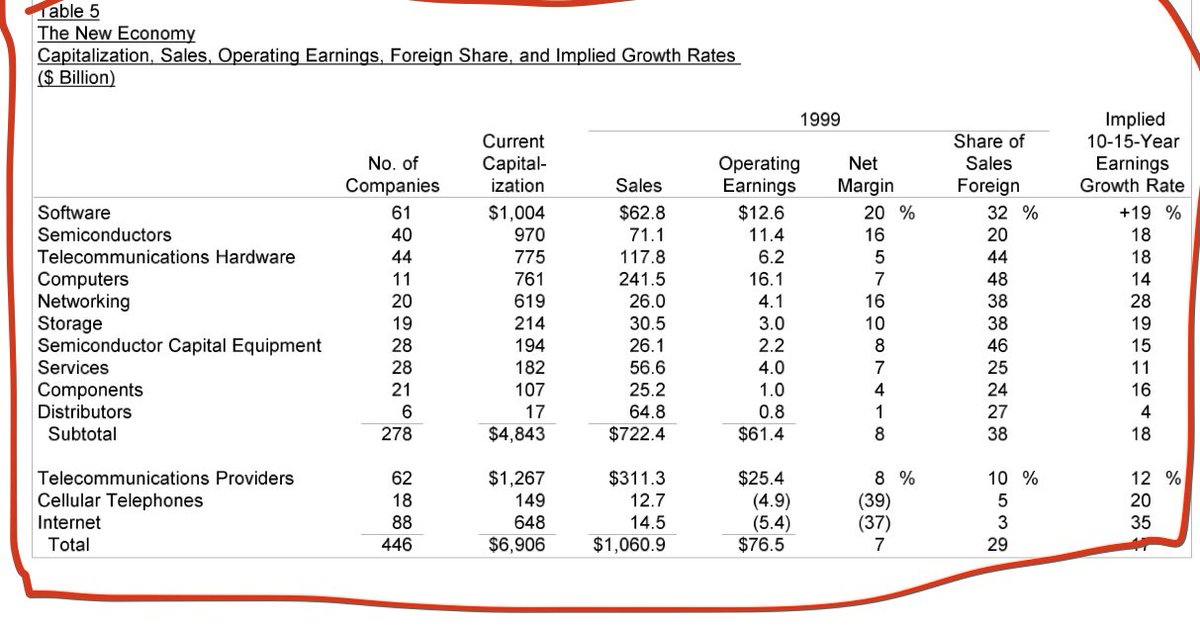

The internet stocks were a sideshow. In 2000, the software sector had a $1 trillion market cap, 20% net margins, 20% annual growth

The problem? It was trading at 16x sales

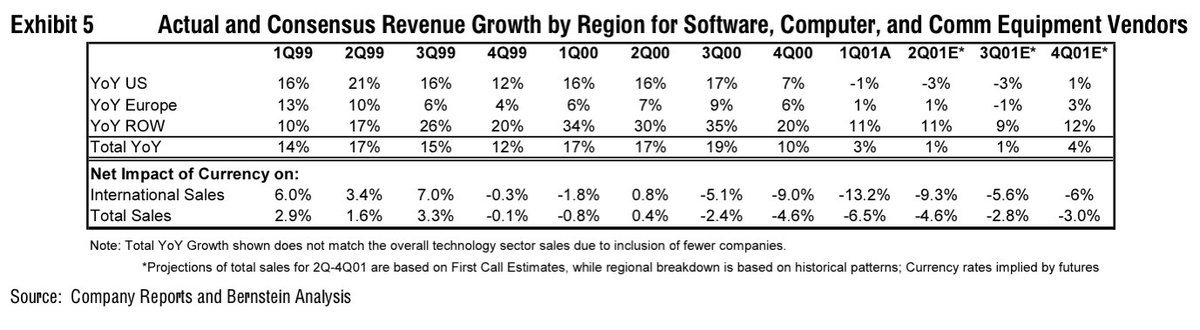

The bubble popped in Q1 2000. Fundamentals didn't decelerate until Q4 2000.

It was reflexivity at work. Lower stock prices = less capex spend = less revenue growth = lower stock prices. A vicious cycle

More from Trading

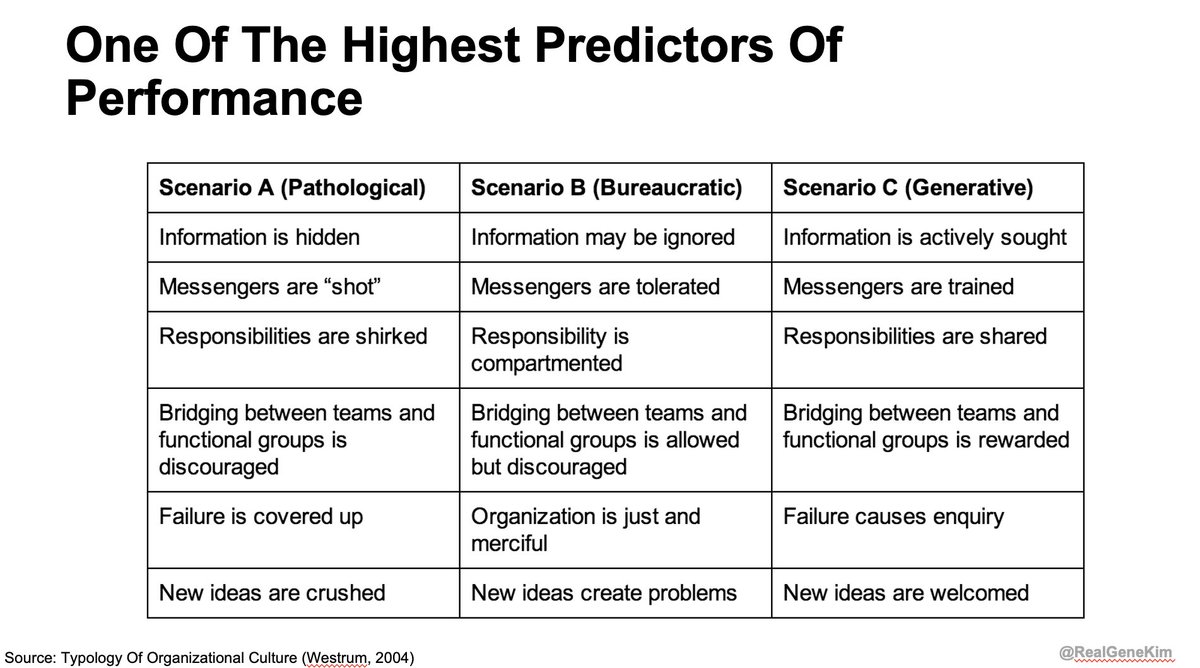

This model was created Dr. Ron Westrum, a widely-cited sociologist who studied the impact of culture on safety

Thanks to Dr. @nicolefv, I was able to interview him for an upcoming episode of the Idealcast! 🤯

It was a very heady experience, and while preparing to interview him, I was startled to discover how much work he's done in healthcare, aviation, spaceflight, but also innovation.

I've read 4+ of his papers, so I thought I was familiar with his work. (Here's one paper: https://t.co/7X00O67VgS)

I was startled to learn he has also studied in depth what enables innovation. He wrote a wonderful book "Sidewinder: Creative Missile Development at China Lake"

Dr. Westrum writes about China Lake Research Labs: "its design and structure had one purpose: to foster technical creativity. It did; China Lake operated far outside the normal envelope... Sidewinder & others were "impossible" accomplishments,

I love this book because it describes traits of organizations that routinely create and maintain greatness: US space program (Mercury, Gemini, Apollo), US Naval Reactors, Toyota, Team of Teams, Tesla, the tech giants (Amazon, Google, Netflix, Google)

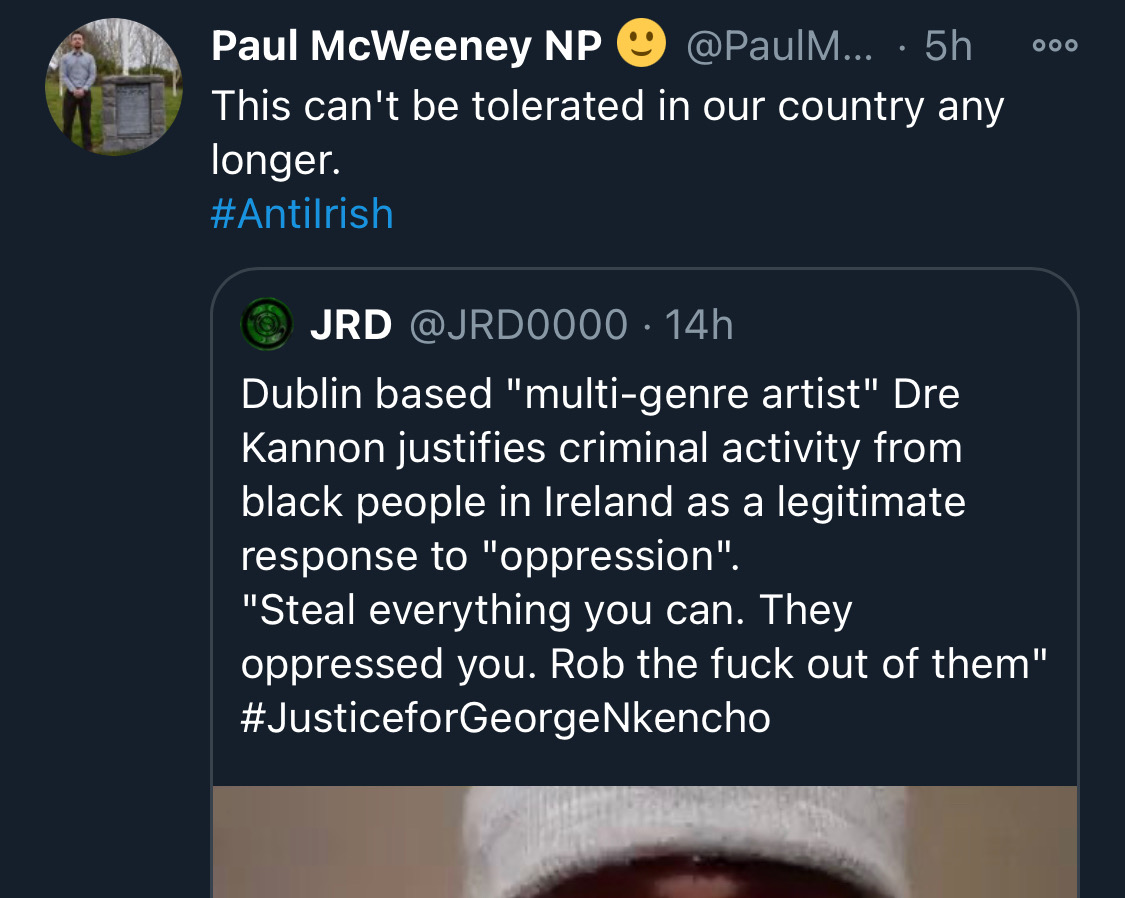

There is co-ordination across the far right in Ireland now to stir both left and right in the hopes of creating a race war. Think critically! Fascists see the tragic killing of #georgenkencho, the grief of his community and pending investigation as a flashpoint for action.

Across Telegram, Twitter and Facebook disinformation is being peddled on the back of these tragic events. From false photographs to the tactics ofwhite supremacy, the far right is clumsily trying to drive hate against minority groups and figureheads.

Be aware, the images the #farright are sharing in the hopes of starting a race war, are not of the SPAR employee that was punched. They\u2019re older photos of a Everton fan. Be aware of the information you\u2019re sharing and that it may be false. Always #factcheck #GeorgeNkencho pic.twitter.com/4c9w4CMk5h

— antifa.drone (@antifa_drone) December 31, 2020

Declan Ganley’s Burkean group and the incel wing of National Party (Gearóid Murphy, Mick O’Keeffe & Co.) as well as all the usuals are concerted in their efforts to demonstrate their white supremacist cred. The quiet parts are today being said out loud.

There is a concerted effort in far-right Telegram groups to try and incite violence on street by targetting people for racist online abuse following the killing of George Nkencho

— Mark Malone (@soundmigration) January 1, 2021

This follows on and is part of a misinformation campaign to polarise communities at this time.

The best thing you can do is challenge disinformation and report posts where engagement isn’t appropriate. Many of these are blatantly racist posts designed to drive recruitment to NP and other Nationalist groups. By all means protest but stay safe.

You May Also Like

A thread 👇

https://t.co/xj4js6shhy

Entrepreneur\u2019s mind.

— James Clear (@JamesClear) August 22, 2020

Athlete\u2019s body.

Artist\u2019s soul.

https://t.co/b81zoW6u1d

When you choose who to follow on Twitter, you are choosing your future thoughts.

— James Clear (@JamesClear) October 3, 2020

https://t.co/1147it02zs

Working on a problem reduces the fear of it.

— James Clear (@JamesClear) August 30, 2020

It\u2019s hard to fear a problem when you are making progress on it\u2014even if progress is imperfect and slow.

Action relieves anxiety.

https://t.co/A7XCU5fC2m

We often avoid taking action because we think "I need to learn more," but the best way to learn is often by taking action.

— James Clear (@JamesClear) September 23, 2020