A dumb thing I did in 2020:

Saw something that wasn't there on a maiden RE trade and bot late. Should have known bulk tonnage MRE/PEA etc almost all sold news in 2020 but was busy and rushed. Need to be early to best win those types of deposits. -25%ish for my trouble. 1/11

More from Trading

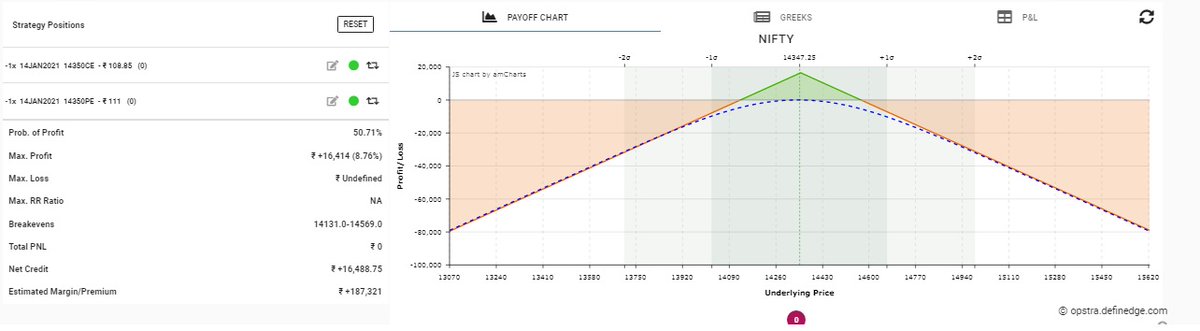

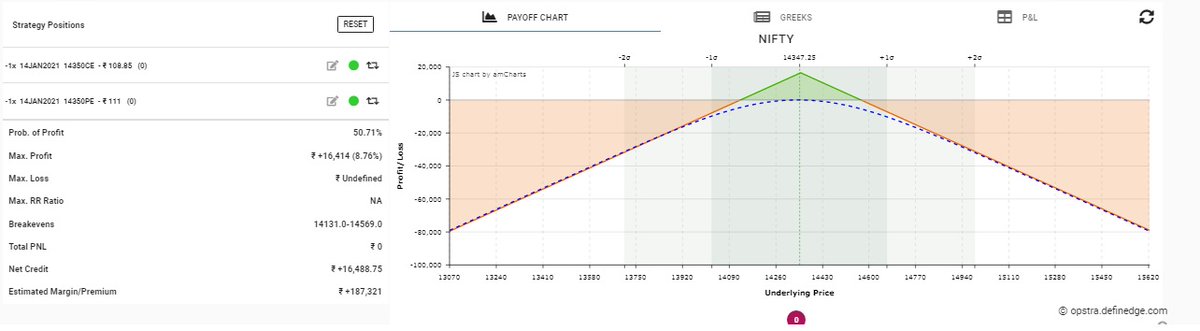

Thread on Short straddle with adjustments:

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

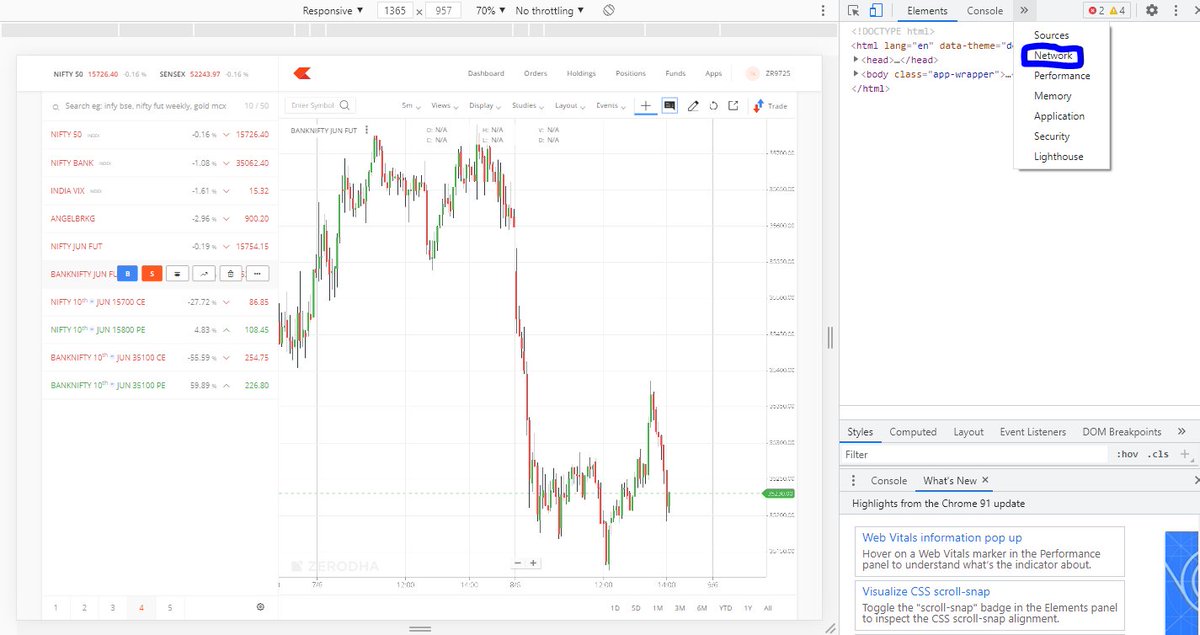

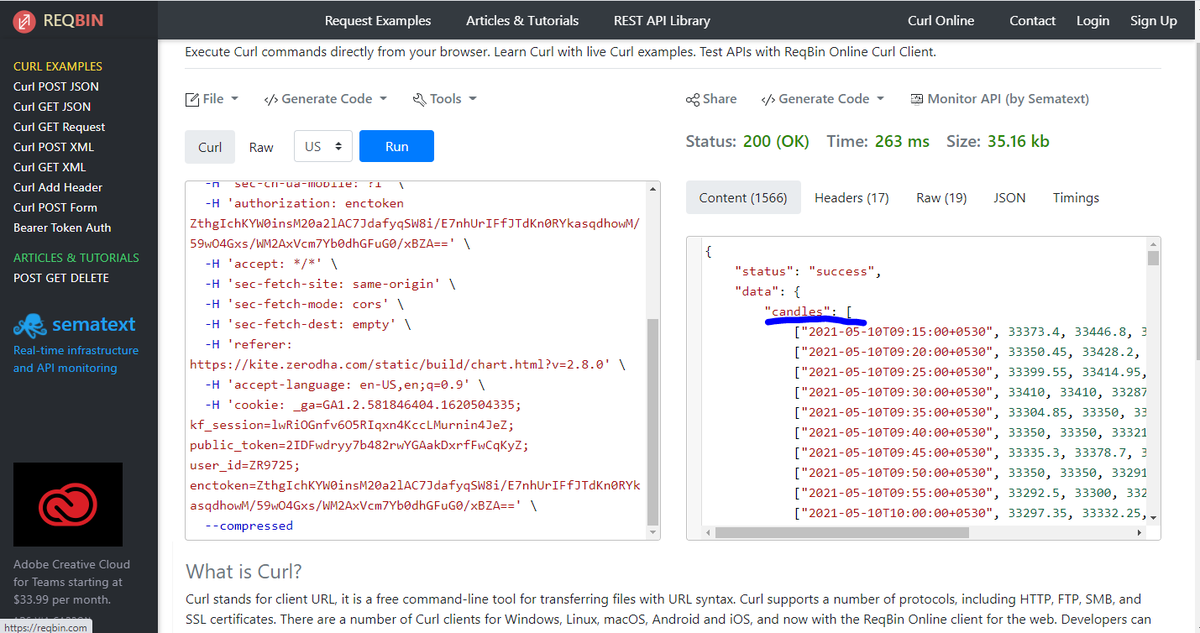

A thread on getting intraday (any timeframe) data to excel without any coding. Limited to only last 60 days. Fetches from zerodha chart.

👇

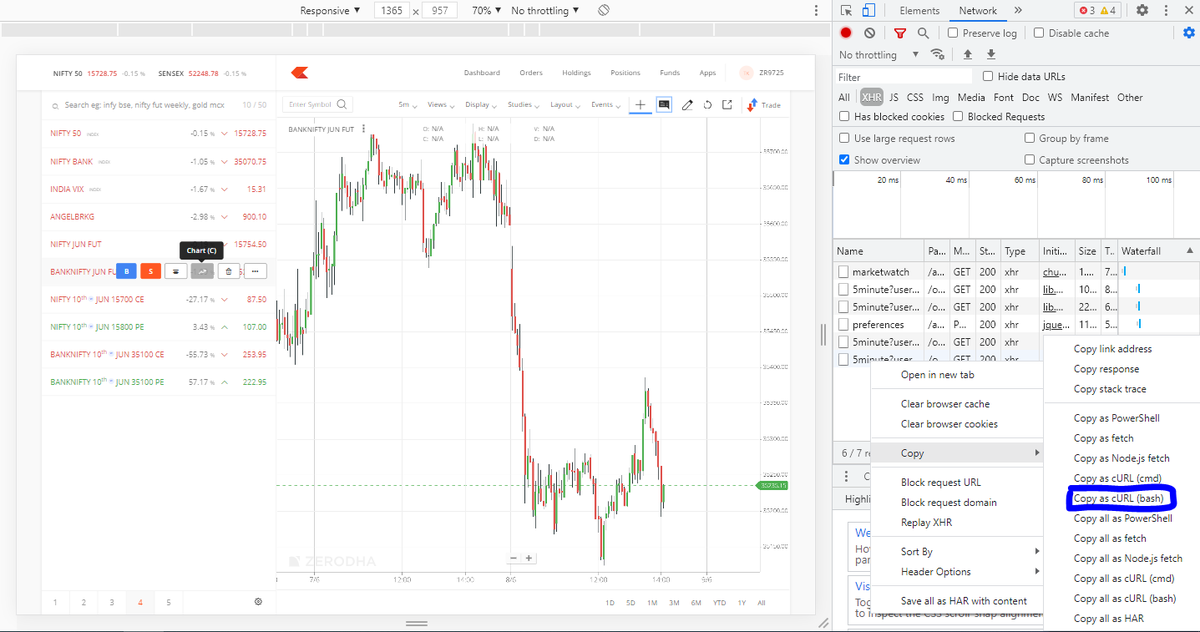

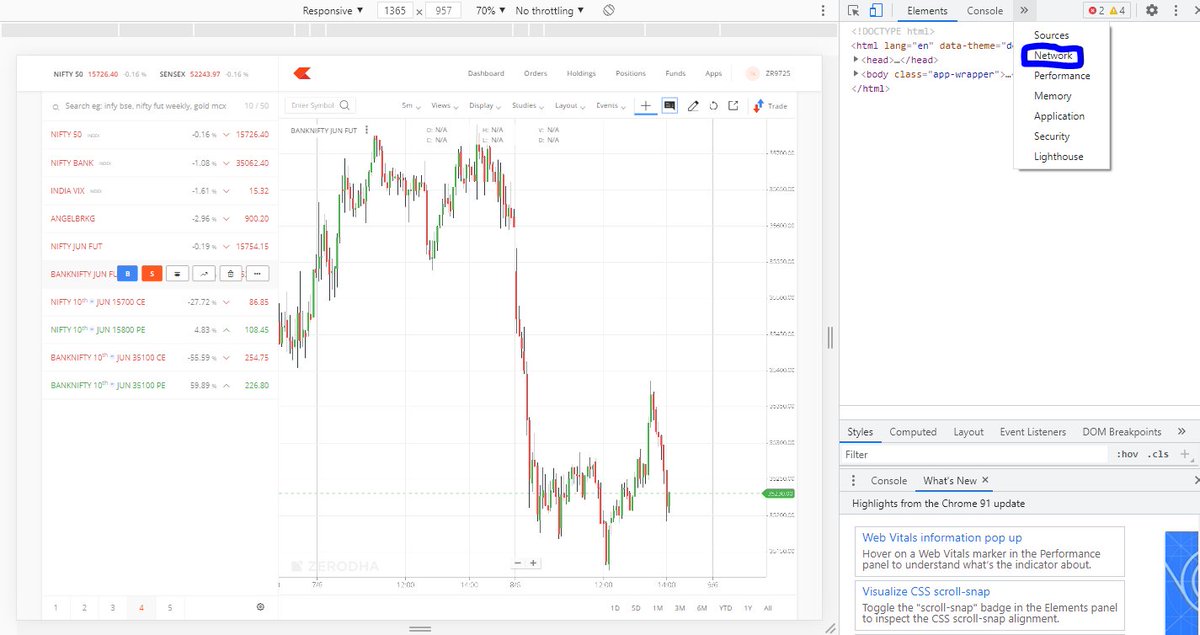

1. Open the chart on zerodha web in chrome. Right click and select 'Inspect'. Click 'Network' as shown in this pic.

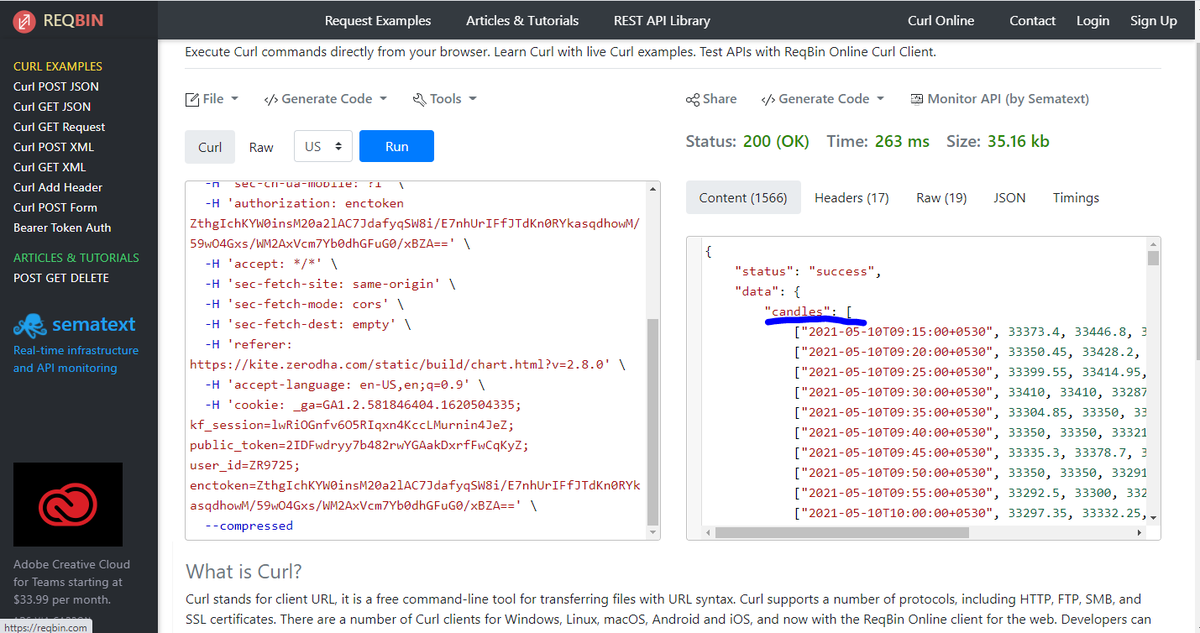

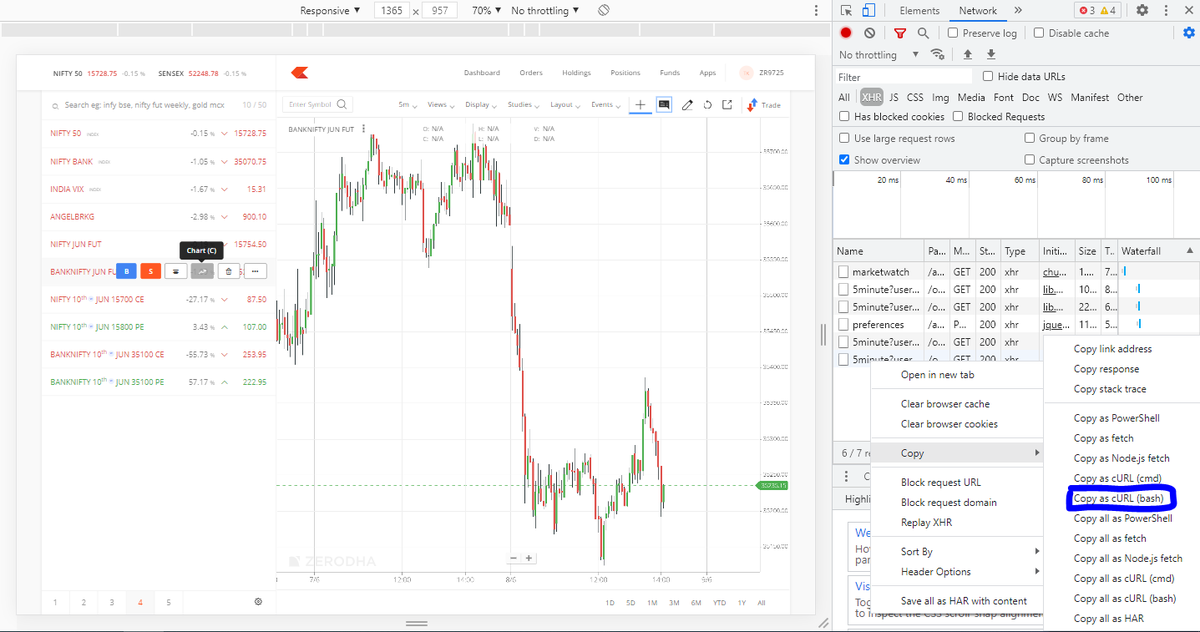

2. Right click on the last entry on the table you see and click 'copy as cURL (bash)'

3. Go to website https://t.co/f8rhwoGLUc and paste on the left box and click 'Run'

4. The output below candles written on right of box is the ohlc, volume and oi data. Copy and paste to excel.

👇

1. Open the chart on zerodha web in chrome. Right click and select 'Inspect'. Click 'Network' as shown in this pic.

2. Right click on the last entry on the table you see and click 'copy as cURL (bash)'

3. Go to website https://t.co/f8rhwoGLUc and paste on the left box and click 'Run'

4. The output below candles written on right of box is the ohlc, volume and oi data. Copy and paste to excel.

You May Also Like

One of the most successful stock trader with special focus on cash stocks and who has a very creative mind to look out for opportunities in dark times

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

Post that the plight of the

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

Another hack to identify extended move in a stock:

Too many green days!

Read

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K

@franciscodeasis https://t.co/OuQaBRFPu7

Unfortunately the "This work includes the identification of viral sequences in bat samples, and has resulted in the isolation of three bat SARS-related coronaviruses that are now used as reagents to test therapeutics and vaccines." were BEFORE the

chimeric infectious clone grants were there.https://t.co/DAArwFkz6v is in 2017, Rs4231.

https://t.co/UgXygDjYbW is in 2016, RsSHC014 and RsWIV16.

https://t.co/krO69CsJ94 is in 2013, RsWIV1. notice that this is before the beginning of the project

starting in 2016. Also remember that they told about only 3 isolates/live viruses. RsSHC014 is a live infectious clone that is just as alive as those other "Isolates".

P.D. somehow is able to use funds that he have yet recieved yet, and send results and sequences from late 2019 back in time into 2015,2013 and 2016!

https://t.co/4wC7k1Lh54 Ref 3: Why ALL your pangolin samples were PCR negative? to avoid deep sequencing and accidentally reveal Paguma Larvata and Oryctolagus Cuniculus?

Unfortunately the "This work includes the identification of viral sequences in bat samples, and has resulted in the isolation of three bat SARS-related coronaviruses that are now used as reagents to test therapeutics and vaccines." were BEFORE the

chimeric infectious clone grants were there.https://t.co/DAArwFkz6v is in 2017, Rs4231.

https://t.co/UgXygDjYbW is in 2016, RsSHC014 and RsWIV16.

https://t.co/krO69CsJ94 is in 2013, RsWIV1. notice that this is before the beginning of the project

starting in 2016. Also remember that they told about only 3 isolates/live viruses. RsSHC014 is a live infectious clone that is just as alive as those other "Isolates".

P.D. somehow is able to use funds that he have yet recieved yet, and send results and sequences from late 2019 back in time into 2015,2013 and 2016!

https://t.co/4wC7k1Lh54 Ref 3: Why ALL your pangolin samples were PCR negative? to avoid deep sequencing and accidentally reveal Paguma Larvata and Oryctolagus Cuniculus?