I wasn’t planning to do the year-end collection of writings thread, but I would like to bury all the rather unpleasant notifications coming in from my critique of Stock, so...

I did not *write* much this year, but I was lucky to have a few things published anyway:

4. On Adorno and exploitation https://t.co/cejOfqx4Hs

Thoughts on Adorno, exploitation, the bounds of agency, and control vs. domination.

— William Clare Roberts (@MarxinHell) May 19, 2020

I think this bit in Adorno is of a peice with the Frankfurt School's anti-positivism, even if it is an extreme pole within the school. 1/ https://t.co/T02vqKLFDd

Been meaning to get back to this \u2014 here is a thread on the value of Althusser\u2019s reading of Marx: 1/15 https://t.co/j8vLXMP3hc

— William Clare Roberts (@MarxinHell) September 4, 2020

In defense of cancel culture, a thread:

— William Clare Roberts (@MarxinHell) July 8, 2020

One of the markers of canceling is that it is crowd action. Being canceled is not being fired, being jailed, being excommunicated. It can lead to these things, but they are separate acts, carried out by agents with official power. 1/10

Last week I gave a qualified defense of canceling on democratic grounds. Today I want to say something about this thread by Teresa Bejan.

— William Clare Roberts (@MarxinHell) July 17, 2020

(Prof. Bejan is going to be a colleague for a while this next year, so, COVID permitting, we\u2019ll be able to discuss this IRL.) 1/20 https://t.co/lHFbJIVUPa

I just had a very fruitful discussion (with some of the McGill poli sci grad students and my colleague @KrzPelc ) of @owasow's much discussed APSR paper, "Agenda Seeding: How 1960s Black Protest Moved Elites, Public Opinion, and Voting."

— William Clare Roberts (@MarxinHell) July 2, 2020

And I have questions!

1/20

1. An essay on Lissagaray and the Commune, forthcoming in @NCFS_journal

2. An essay on CLR James in The CLR James Journal

3. A small provocation on Rawls

I wish everyone a better year in 2021. See you on the flipside!

More from Trading

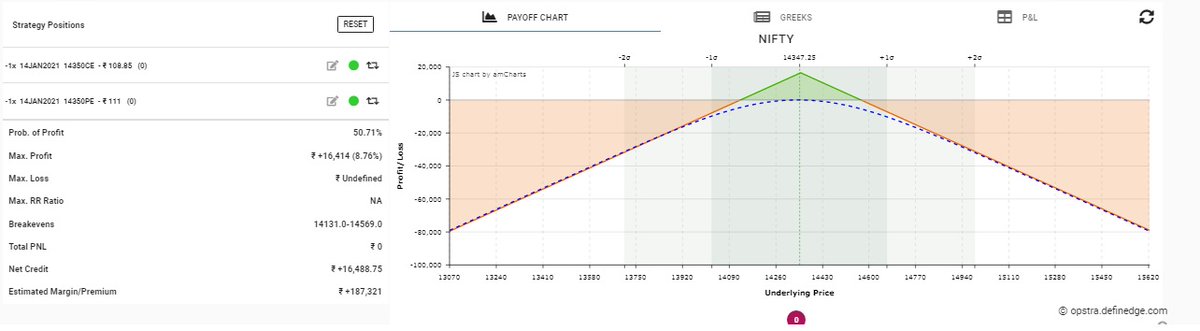

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

Here is a master thread related that will help a beginner to understand about Options Trading.

A complete course worth Rs 50K for free.

1/ A detailed thread on basics of Option Greeks and how it impacts Options

There are various Options Greeks like: Delta, Gamma, Vega, Rho, Theta.

— Yash Mehta (@YMehta_) September 4, 2022

A complete guide on how these #Option Greeks impact option price.

2/ Basic Option Trading Strategies:

There are many option strategies to trade. But keeping your strategy simple is the key.

In this thread, all the basic option trading strategies are being

Option trading is tough but here\u2019s what can make it easier for you

— The Chartians (@chartians) September 17, 2022

8 option strategies that you can use in any market (sold as a \u20b9 50,000 course !)

3/ What are the things that you should look at before taking any Option

They say options trading can make YOU BANKRUPT - is it true ?

— The Chartians (@chartians) September 23, 2022

If yes then why ?

A thread on Risk management and Position sizing in options trading (worth 50k\u20b9 course)\U0001f9f5

4/ Is Option Selling Possible with Rs 1 Lakh Capital?

Even a beginner can start trading in option selling with capital as low as Rs 1 Lakh.

What are the techniques one can use and how to mitigate the infinite loss risk is shared in this

101 guide on how you can start option selling to generate active returns with less capital (Rs 1 Lakh) \U0001f9f5:

— Yash Mehta (@YMehta_) August 19, 2022

A course on option selling available for free.