As 2020 draws to a close, here's a few posts for my 2020 annual review! 👇

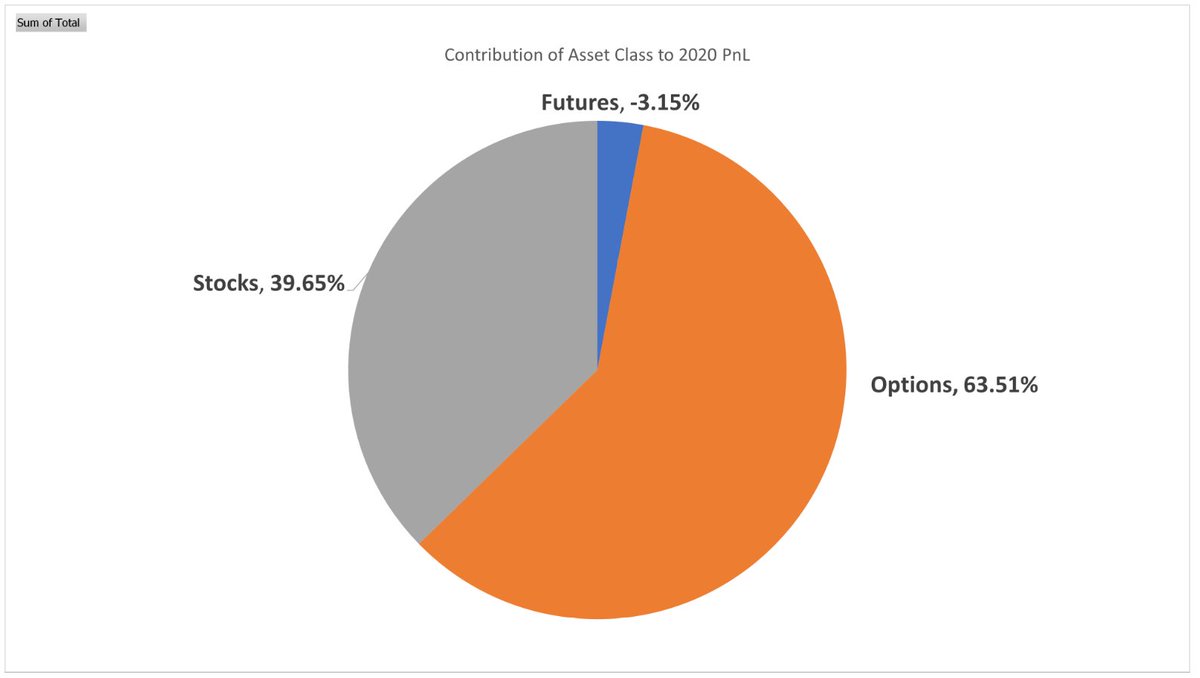

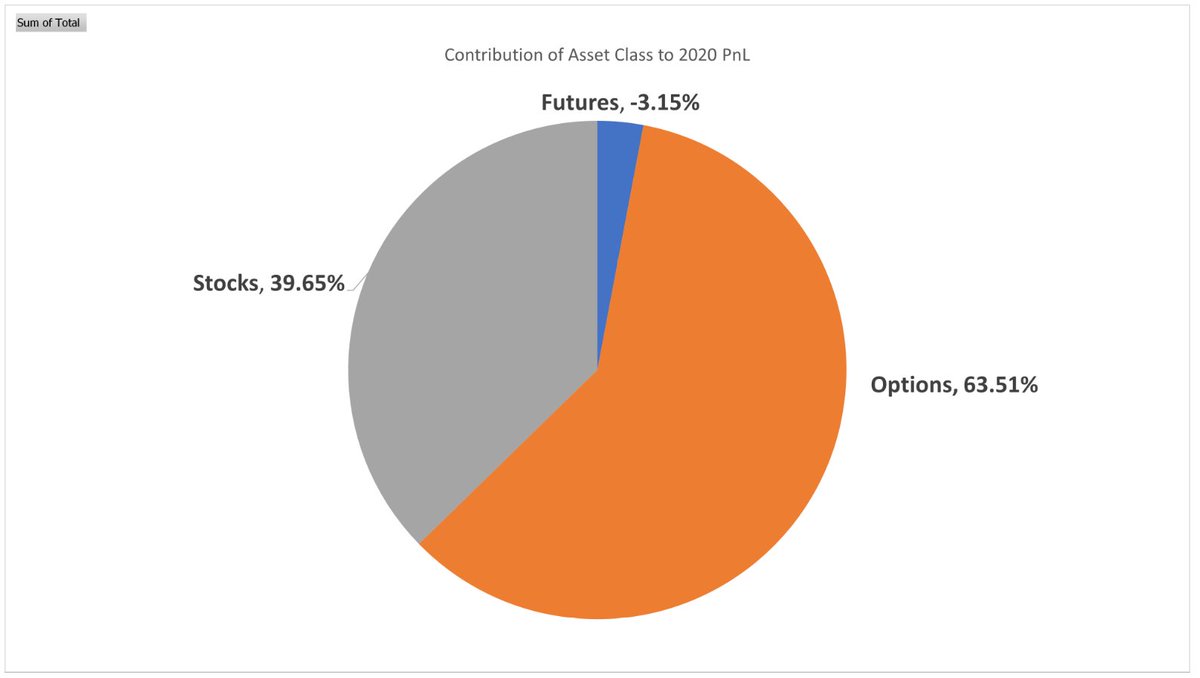

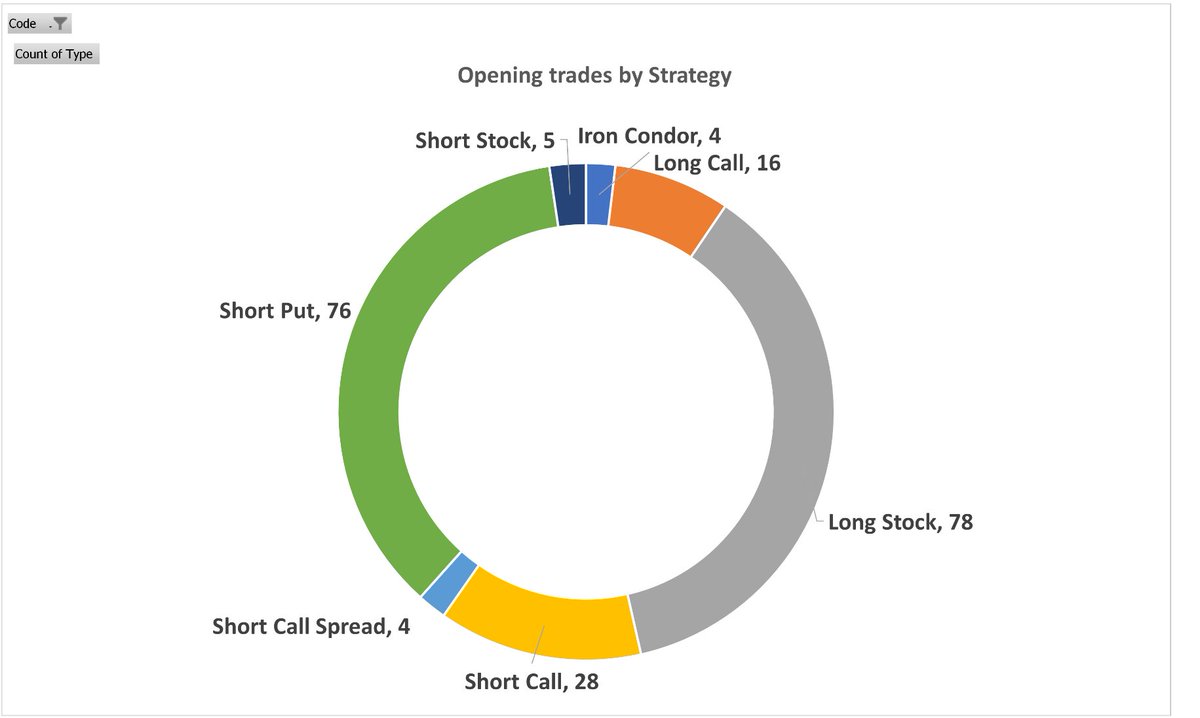

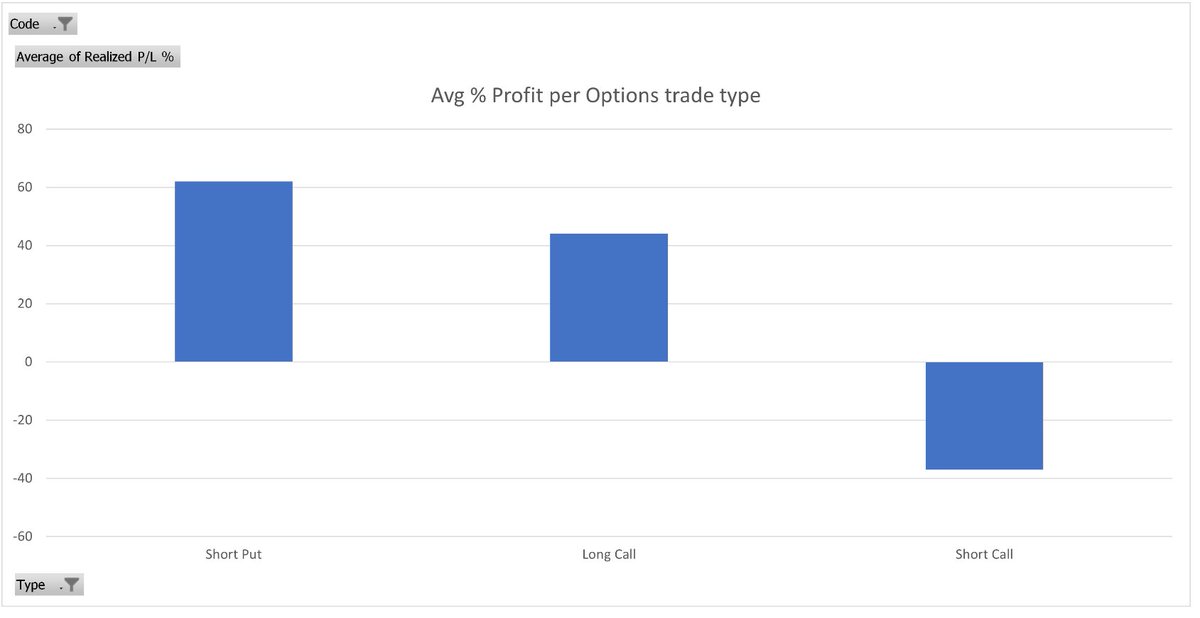

Focus is on the types of trade I made, the underlyings traded, & strategy outcomes, rather than just showing the overall % return

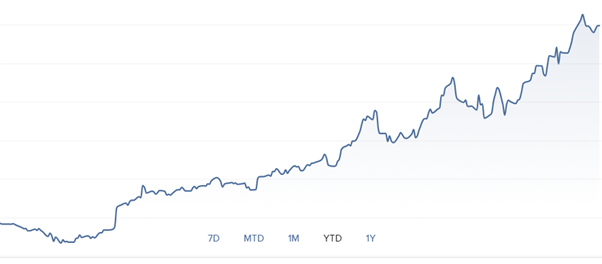

To kick it off, below is the 2020 equity curve of my main account 💰

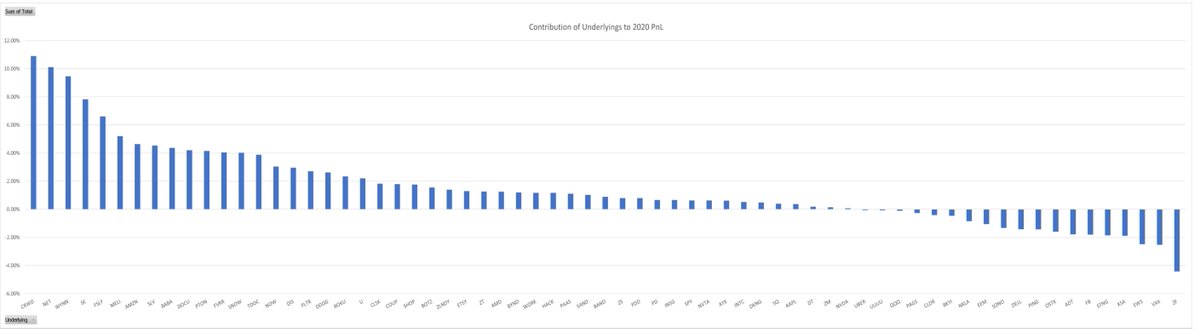

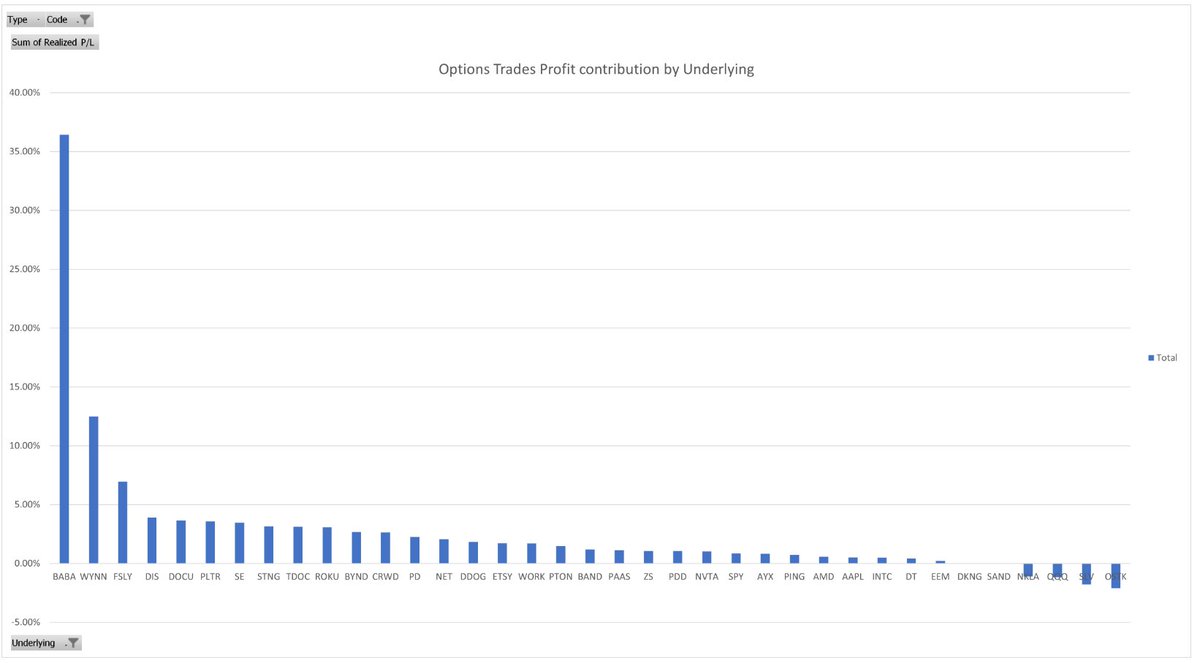

$CRWD, $NET, $WYNN & $FSLY are my top winners! 🚀

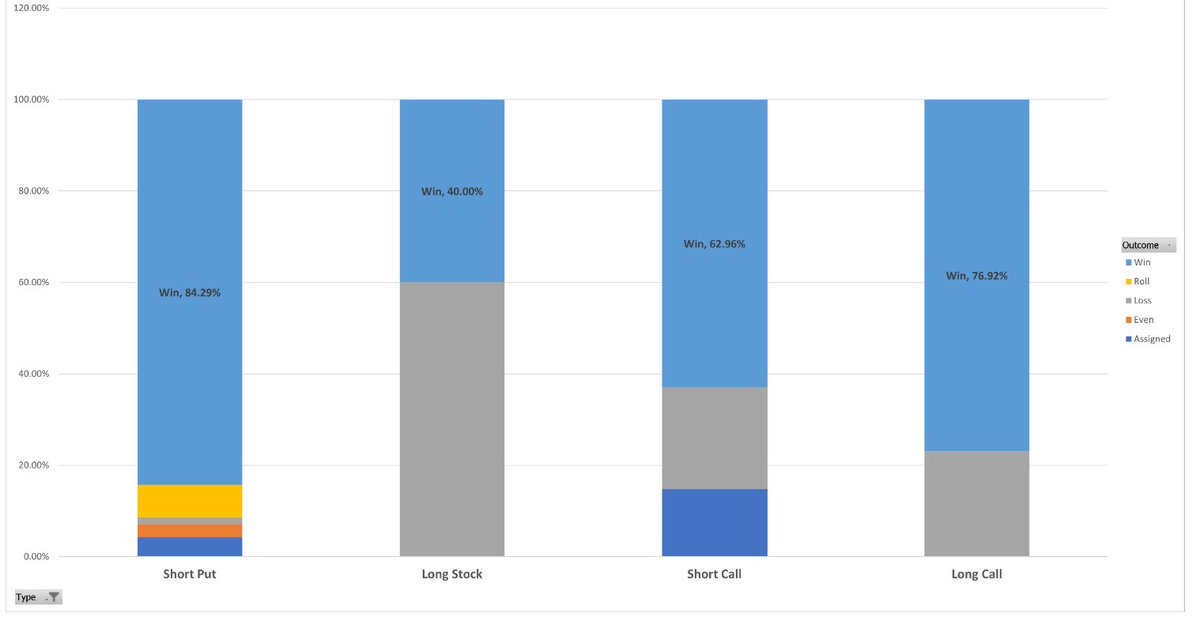

Win rate on long stock is lowest. This is skewed as I’m only using Realized gains, and most of my profitable stock positions are still open

More from Trading

You May Also Like

Hello!! 👋

• I have curated some of the best tweets from the best traders we know of.

• Making one master thread and will keep posting all my threads under this.

• Go through this for super learning/value totally free of cost! 😃

1. 7 FREE OPTION TRADING COURSES FOR

A THREAD:

— Aditya Todmal (@AdityaTodmal) November 28, 2020

7 FREE OPTION TRADING COURSES FOR BEGINNERS.

Been getting lot of dm's from people telling me they want to learn option trading and need some recommendations.

Here I'm listing the resources every beginner should go through to shorten their learning curve.

(1/10)

2. THE ABSOLUTE BEST 15 SCANNERS EXPERTS ARE USING

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

3. 12 TRADING SETUPS which experts are using.

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4.

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

4. Curated tweets on HOW TO SELL STRADDLES.

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.

Funny there are those who think these migrant caravans were a FANTASTIC idea that's going to take the immigration issue away from you.

— Brian Cates (@drawandstrike) November 26, 2018

Like several weeks watching a rampaging horde storm the fences & throw rocks at our border patrol agents & getting gassed = great optics!

This media manipulation effort was inspired by the success of the "kids in cages" freakout, a 100% Stalinist propaganda drive that required people to forget about Obama putting migrant children in cells. It worked, so now they want pics of Trump "gassing children on the border."

There's a heavy air of Pallywood around the whole thing as well. If the Palestinians can stage huge theatrical performances of victimhood with the willing cooperation of Western media, why shouldn't the migrant caravan organizers expect the same?

It's business as usual for Anarchy, Inc. - the worldwide shredding of national sovereignty to increase the power of transnational organizations and left-wing ideology. Many in the media are true believers. Others just cannot resist the narrative of "change" and "social justice."

The product sold by Anarchy, Inc. is victimhood. It always boils down to the same formula: once the existing order can be painted as oppressors and children as their victims, chaos wins and order loses. Look at the lefties shrieking in unison about "Trump gassing children" today.

Imagine for a moment the most obscurantist, jargon-filled, po-mo article the politically correct academy might produce. Pure SJW nonsense. Got it? Chances are you're imagining something like the infamous "Feminist Glaciology" article from a few years back.https://t.co/NRaWNREBvR pic.twitter.com/qtSFBYY80S

— Jeffrey Sachs (@JeffreyASachs) October 13, 2018

The article is, at heart, deeply weird, even essentialist. Here, for example, is the claim that proposing climate engineering is a "man" thing. Also a "man" thing: attempting to get distance from a topic, approaching it in a disinterested fashion.

Also a "man" thing—physical courage. (I guess, not quite: physical courage "co-constitutes" masculinist glaciology along with nationalism and colonialism.)

There's criticism of a New York Times article that talks about glaciology adventures, which makes a similar point.

At the heart of this chunk is the claim that glaciology excludes women because of a narrative of scientific objectivity and physical adventure. This is a strong claim! It's not enough to say, hey, sure, sounds good. Is it true?