Canadian media has acted like the messenger for the devil's architects. Conservative supporters bought out the Toronto Star and Post Media"s foreign owned hedge fund are calling the shots.

https://t.co/fec9GIBDpj

https://t.co/uhUbqtgwQE

More from Louisette Lanteigne 🌎✌️⚖️♥️

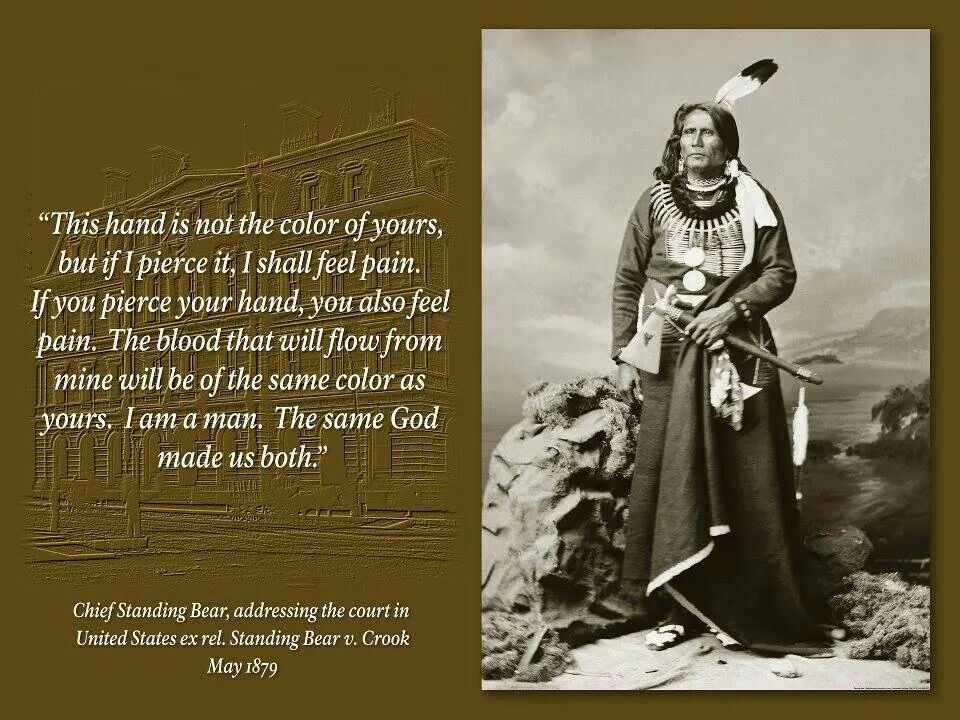

UN CERD letter to government of #Canada \U0001f1e8\U0001f1e6 re: Secwepemc Wet\u2019suwet\u2019en pipeline resistance and the international #indigenous human rights violations by Canada #shutdowntmx #stopcgl pic.twitter.com/E4LZE8culv

— Kanahus Manuel (@KanahusFreedom) January 12, 2021

53 organizations representing over 2 million people, we call on the Government of Canada to immediately order EDC to align its business with Canada’s climate commitments. Coastal Gaslink Pipeline mentioned.

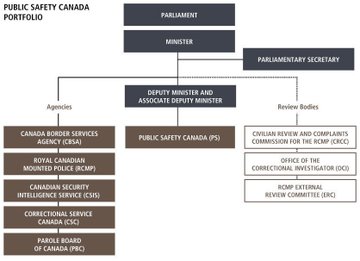

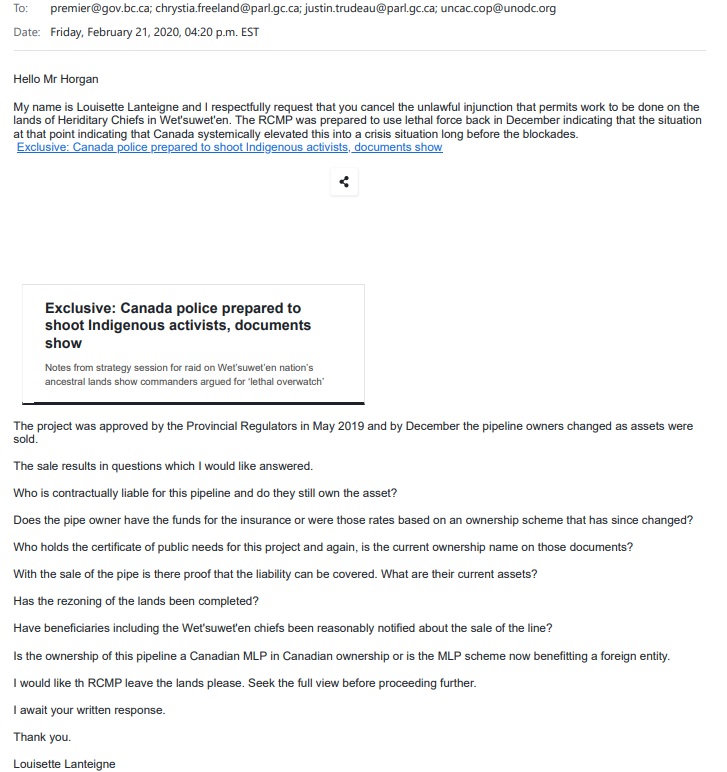

In Canada the pattern repeated with multiple pipelines. After approvals they flip the ownership of pipes with asset sales to negate contractual obligations re: terms of approval, insurance, liability etc. This happened to TransMountain, Coastal Gas Link, Enbridge Line 10 etc.

My email to the Prime Minister from Feb. 2020. I am still waiting for the answers.

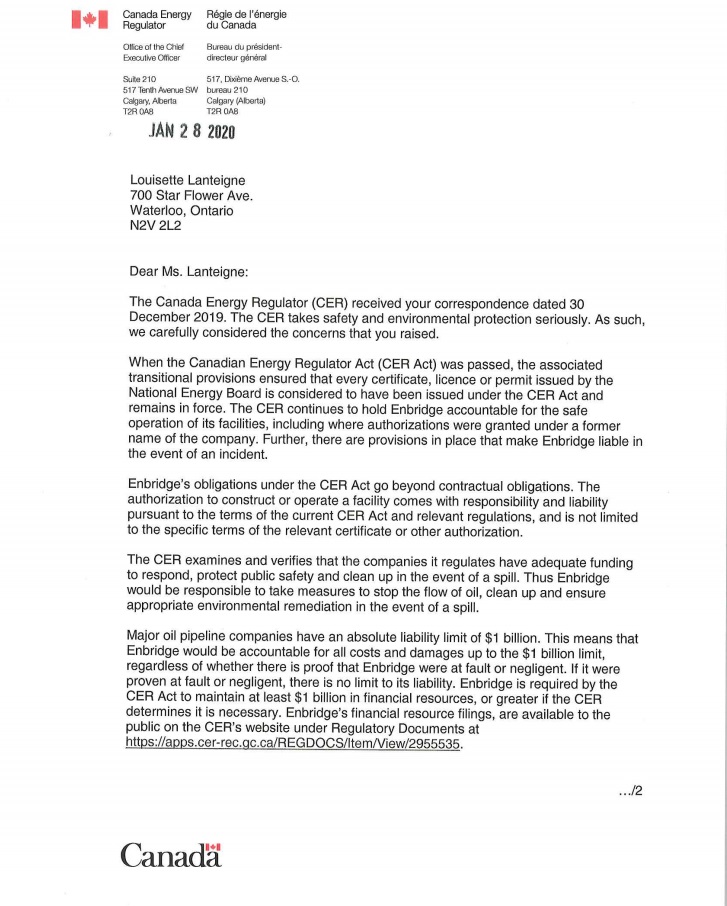

Canada Energy Regulator (CER) is formerly the National Energy Board. I asked for proof of the insurance of Enbridge's pipelines. The CER Chair sent me data based on assets owned in 2016 most of which has been sold off since. The website give in the response held that info.

More from Trading

Collaborated with @niki_poojary

Here's what you'll learn in this thread:

1. Capture Overnight Theta Decay

2. Trading Opening Range Breakouts

3. Reversal Trading Setups

4. Selling strangles and straddles in Bank Nifty

6. NR4 + IB

7. NR 21-Vwap Strategy

Let's dive in ↓

1/ STBT option Selling (Positional Setup):

The setup uses price action to sell options for overnight theta decay.

Check Bank Nifty at 3:15 everyday.

Sell directional credit spreads with capped

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

@jigspatel1988 2/ Selling Strangles in Bank Nifty based on Open Interest Data

Don't trade till 9:45 Am.

Identify the highest OI on puts and calls.

Check combined premium and put a stop on individual

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

@jigspatel1988 3/ Open Drive (Intraday)

This is an opening range breakout setup with a few conditions.

To be used when the market opens above yesterday's day high

or Below yesterday's day's

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)