.

https://t.co/5d5jgqVDqI

The truth is the deal means the introduction of significant barriers to free trade e.g. customs and regulatory checks (but it is better than no deal and we could certainly do with some good news atm) https://t.co/9MUMkPXvTc

— Gavin Barwell (@GavinBarwell) December 23, 2020

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

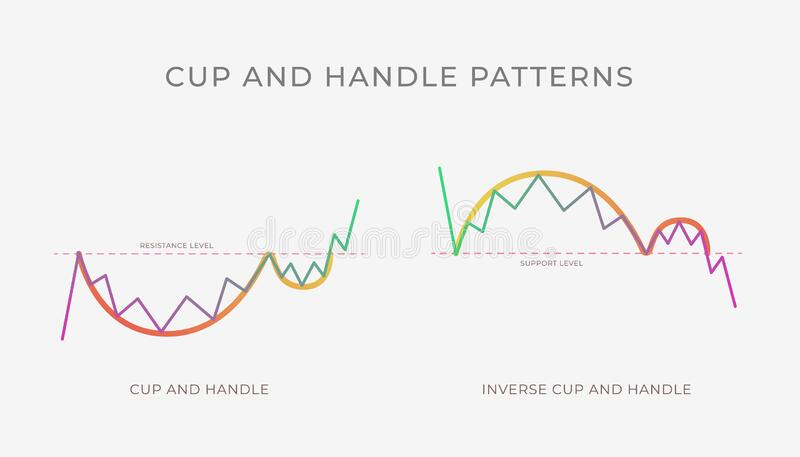

5: When to play directional:

— Nikita Poojary (@niki_poojary) December 18, 2022

Whenever the index is moving in a single direction, its important to go with the trend.

A few weeks ago when BNF broke out of the cup and handle pattern, all we had to do was sell PEs.

Pls note: weekly TF chart is attached to just show the C&H BO pic.twitter.com/z0wgUzJW8t

#VOLTAS Another cup & handle pattern for cash positional pic.twitter.com/Jsc99xJfwY

— Nikita Poojary (@niki_poojary) October 23, 2019