Then I use options to maximize my capital. I mitigate the risk with diversification.

How I Trade

Easy. I trade with the trend. Buy low sell high for up trends. Sell high, buy low during down trends. I don’t care about fundamentals. Often I don’t even know what sector the stock is in. Half my trades, don’t even know the name of the company.

Then I use options to maximize my capital. I mitigate the risk with diversification.

Let’s take a look at this chart. Now. Let’s trade it.

I have no idea how. There are no landmarks. It could be going up, or down, maybe sideways. If I have no clue where it’s going. How do I make a plan? Where do I enter? Where is the exit?

Now this one. A simple fact. If you see a 1-2 setup. 3 is next. 3 runs fast and hard. Usually between 100% to 161.8% of 1. However if price break down below 2. This trade is invalid. We have to consider an alternative.

Can you manage a trade like this?

Months probably years to be an expert in it.

Not that is not going to do you any good eh? Years to master something before making any money.

https://t.co/hXiDAcRCeg

If you can set aside a couple of thousand. Not your entire savings. The goal will be playing with house money ASAP. If all you have is a few thousand. Keeping it in the bank is not going to make you any richer. Neither will consuming it.

More from Trading

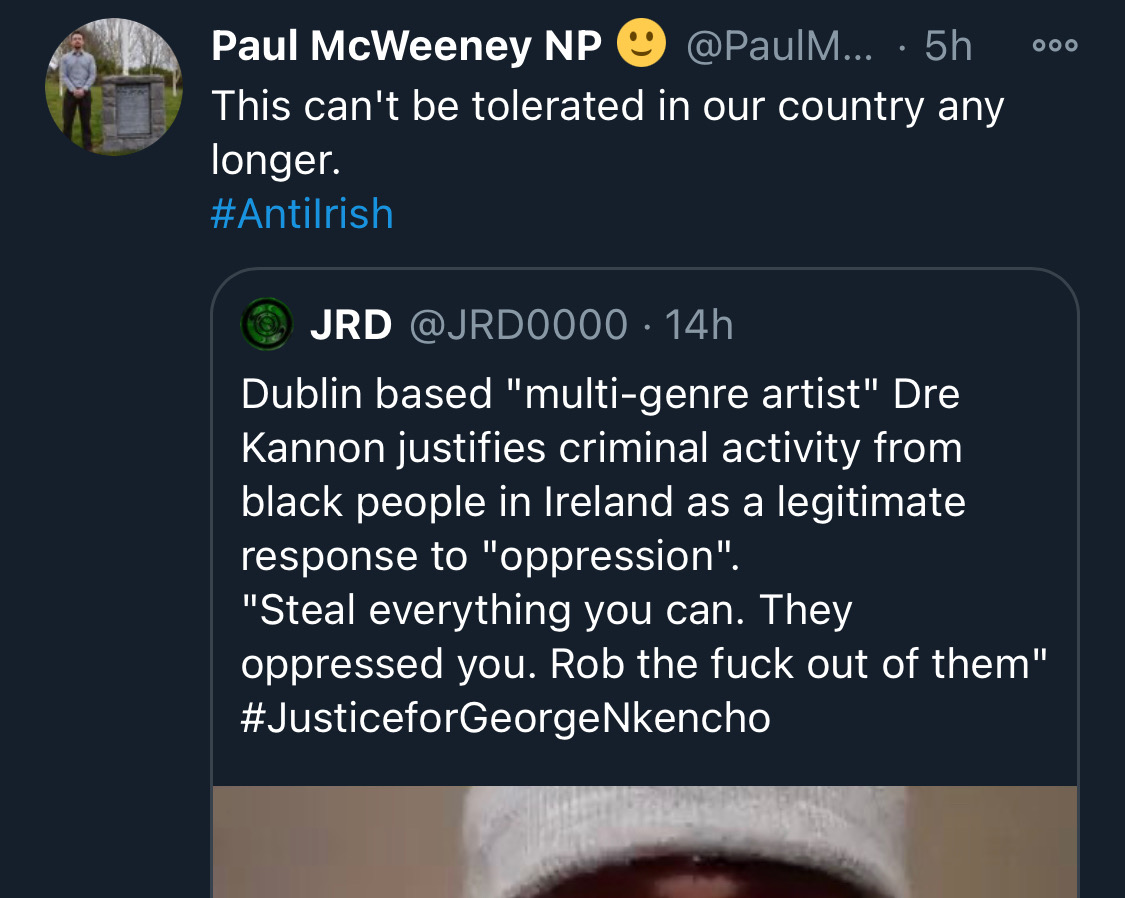

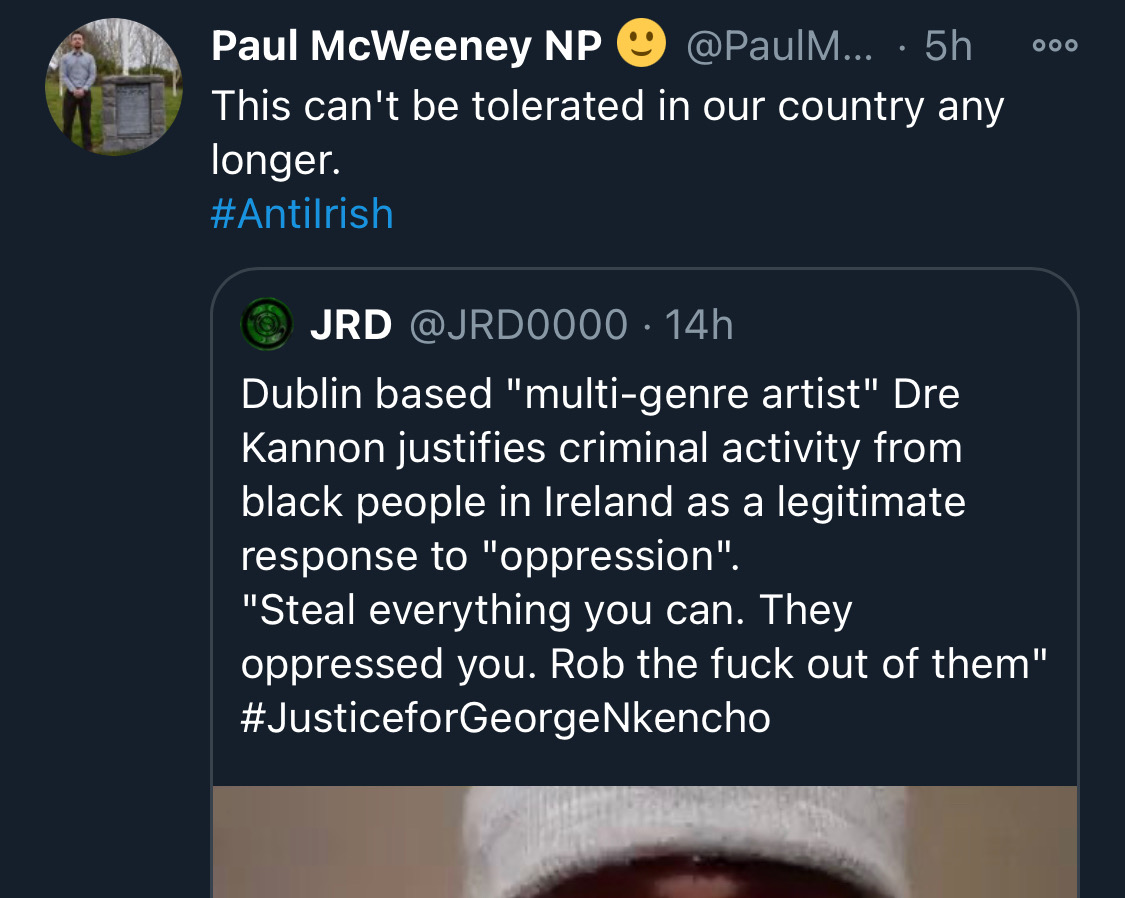

Fake chats claiming to be from the Irish African community are being disseminated by the far right in order to suggest that violence is imminent from #BLM supporters. This is straight out of the QAnon and Proud Boys playbook. Spread the word. Protest safely. #georgenkencho

There is co-ordination across the far right in Ireland now to stir both left and right in the hopes of creating a race war. Think critically! Fascists see the tragic killing of #georgenkencho, the grief of his community and pending investigation as a flashpoint for action.

Across Telegram, Twitter and Facebook disinformation is being peddled on the back of these tragic events. From false photographs to the tactics ofwhite supremacy, the far right is clumsily trying to drive hate against minority groups and figureheads.

Declan Ganley’s Burkean group and the incel wing of National Party (Gearóid Murphy, Mick O’Keeffe & Co.) as well as all the usuals are concerted in their efforts to demonstrate their white supremacist cred. The quiet parts are today being said out loud.

The best thing you can do is challenge disinformation and report posts where engagement isn’t appropriate. Many of these are blatantly racist posts designed to drive recruitment to NP and other Nationalist groups. By all means protest but stay safe.

There is co-ordination across the far right in Ireland now to stir both left and right in the hopes of creating a race war. Think critically! Fascists see the tragic killing of #georgenkencho, the grief of his community and pending investigation as a flashpoint for action.

Across Telegram, Twitter and Facebook disinformation is being peddled on the back of these tragic events. From false photographs to the tactics ofwhite supremacy, the far right is clumsily trying to drive hate against minority groups and figureheads.

Be aware, the images the #farright are sharing in the hopes of starting a race war, are not of the SPAR employee that was punched. They\u2019re older photos of a Everton fan. Be aware of the information you\u2019re sharing and that it may be false. Always #factcheck #GeorgeNkencho pic.twitter.com/4c9w4CMk5h

— antifa.drone (@antifa_drone) December 31, 2020

Declan Ganley’s Burkean group and the incel wing of National Party (Gearóid Murphy, Mick O’Keeffe & Co.) as well as all the usuals are concerted in their efforts to demonstrate their white supremacist cred. The quiet parts are today being said out loud.

There is a concerted effort in far-right Telegram groups to try and incite violence on street by targetting people for racist online abuse following the killing of George Nkencho

— Mark Malone (@soundmigration) January 1, 2021

This follows on and is part of a misinformation campaign to polarise communities at this time.

The best thing you can do is challenge disinformation and report posts where engagement isn’t appropriate. Many of these are blatantly racist posts designed to drive recruitment to NP and other Nationalist groups. By all means protest but stay safe.