and even more importantly, not clothing advice

1) The Ecosystem, Part 1:

Getting Dressed

By now pretty much everyone knows the story:

The meteoric rise, the sudden crash, the dormant period, and the recovery.

This story starts at the lowest point: right after the migration.

But of course there was negative sentiment then! That was expected.

The brutal part for the project was after the fires were put out--the dev funds returned, the migration successful.

But instead, Sushiswap endured a month of the most negative sentiment I've ever seen a project have.

There was a chat, as the major builders and multisig holders got things off their chest.

"desert Sushiswap or I'll pressure your company to fire you".

It was a perfect storm of coordinated attack, disorganized sadness, and all around frustration.

just as some were thinking of quitting, because they didn't want to take it anymore-

there came an outpouring of solidarity.

Sushiswap wasn't perfect, and in some cases it wasn't even good. But it didn't deserve what it was getting.

"Fuck the h8ters"

SUSHI was up 6x from its nadir.

All of a sudden, it's popular again.

Why? What happened?

Partially people got bored of shitting on Sushi.

But more than even of those, right at the lowest point, Sushiswap made a decision.

https://t.co/tcvJXJTrNY

But at its lowest point, Sushiswap found itself naked.

So it did what you do there: it ignored the noise and got dressed.

'Fuck the h8ters. Just build.'

1) Yield Farming, Sushi, and Collective Imagination:

— SBF (@SBF_Alameda) September 2, 2020

The Emperor Has no Clothes

It rolled out more than almost any other project in DeFi did. Frankly, it left most in the dust.

https://t.co/NAqLxTsK6g

-------------

So what does this have to do with @bonfida?

Serum was never in the doghouse the same way Sushiswap was.

But for all its promise, it started with nothing.

What do you do what there's no good Solana wallet?

You build one.

And then you help others build more.

Those six months are nothing on a cosmic scale, but they feel like an eternity. What have they brought to the ecosystem?

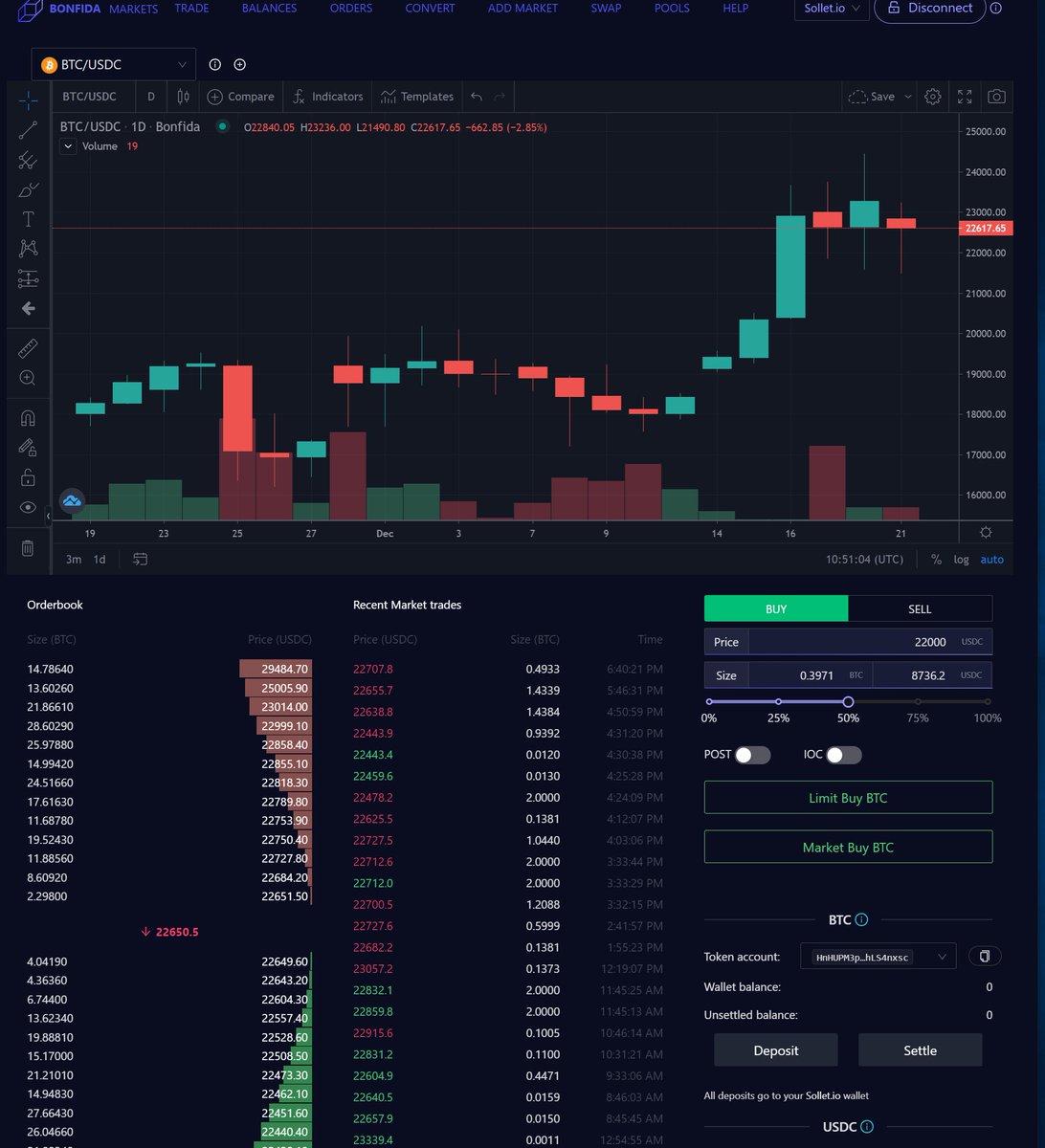

Well, of course, there's the world's only high performance on-chain DEX: https://t.co/16Vp8zPjV4

Because, for a few months, there wasn't a huge marketing barrage or persuasion campaign. In the end actions speak louder than words.

So first you get dressed.

But Bonfida alone as built a shocking amount in less than half a year.

b) Oh, right, also one of the world's only fully on-chain matching engines: https://t.co/VILVwF0IpQ

c) And TradingView Charts!

That's a lot for a few months!

e) Oh also it has on-chain Pools??? https://t.co/xVWs5deto2

g) And an API serving tens of millions of calls per day to CoinGecko, CoinMarketcap, apps, and more! https://t.co/69pje01OMg

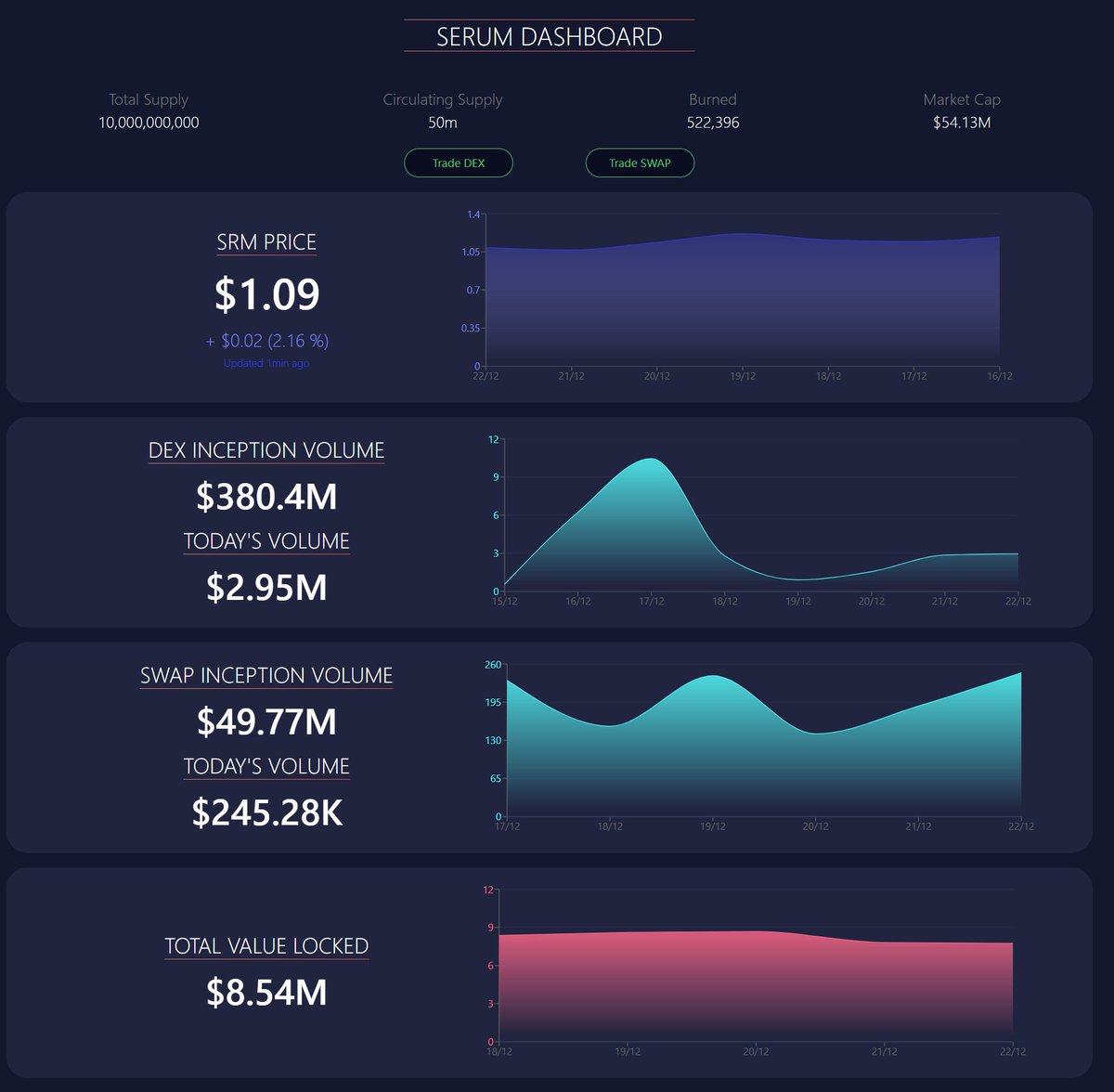

So it's an analytics sweet for Serum.

i) ...and a tool to mint your own brand new token! https://t.co/ZI8GeBWvMW

j) plus a bit of free SOL to get started: https://t.co/QQcrI4AKd7

A token management suite for Solana built in a few months. Not bad!

Now it didn't build all of this from scratch--many of these products are composed with primitives that others have been building out on Serum this year.

And that's totally fine.

And on top of that, it's composed, wrapped, and GUI-ified even more.

None of this takes away from the incredibly intricate work from @blocks_go_brr, @armaniferrante, @seb_alameda, and more.

Bonfida has built a ton. And on top of that, it helps each app be its best self.

It's just getting started.

The action starts in 3 hours:

https://t.co/7rUsDYybK8

https://t.co/16Vp8zPjV4

More from Trading

You May Also Like

Margatha Natarajar murthi - Uthirakosamangai temple near Ramanathapuram,TN

#ArudraDarisanam

Unique Natarajar made of emerlad is abt 6 feet tall.

It is always covered with sandal paste.Only on Thriuvadhirai Star in month Margazhi-Nataraja can be worshipped without sandal paste.

After removing the sandal paste,day long rituals & various abhishekam will be https://t.co/e1Ye8DrNWb day Maragatha Nataraja sannandhi will be closed after anointing the murthi with fresh sandal paste.Maragatha Natarajar is covered with sandal paste throughout the year

as Emerald has scientific property of its molecules getting disturbed when exposed to light/water/sound.This is an ancient Shiva temple considered to be 3000 years old -believed to be where Bhagwan Shiva gave Veda gyaana to Parvati Devi.This temple has some stunning sculptures.

#ArudraDarisanam

Unique Natarajar made of emerlad is abt 6 feet tall.

It is always covered with sandal paste.Only on Thriuvadhirai Star in month Margazhi-Nataraja can be worshipped without sandal paste.

After removing the sandal paste,day long rituals & various abhishekam will be https://t.co/e1Ye8DrNWb day Maragatha Nataraja sannandhi will be closed after anointing the murthi with fresh sandal paste.Maragatha Natarajar is covered with sandal paste throughout the year

as Emerald has scientific property of its molecules getting disturbed when exposed to light/water/sound.This is an ancient Shiva temple considered to be 3000 years old -believed to be where Bhagwan Shiva gave Veda gyaana to Parvati Devi.This temple has some stunning sculptures.