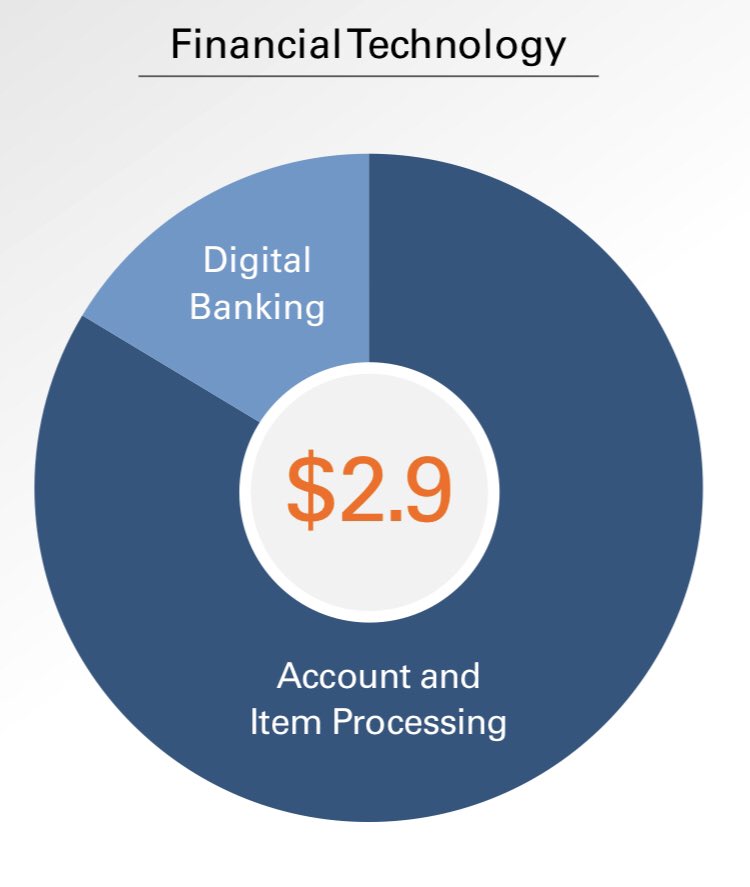

1) $FISV FinTech segment is the #1 provider of core processing and digital banking solutions to the ~11,000 banks and credit unions in the US

Its mission critical systems power 3,700 FIs:

- core processor for 1 out of every 3 banks

- digital offering for 95 out of top 100 banks

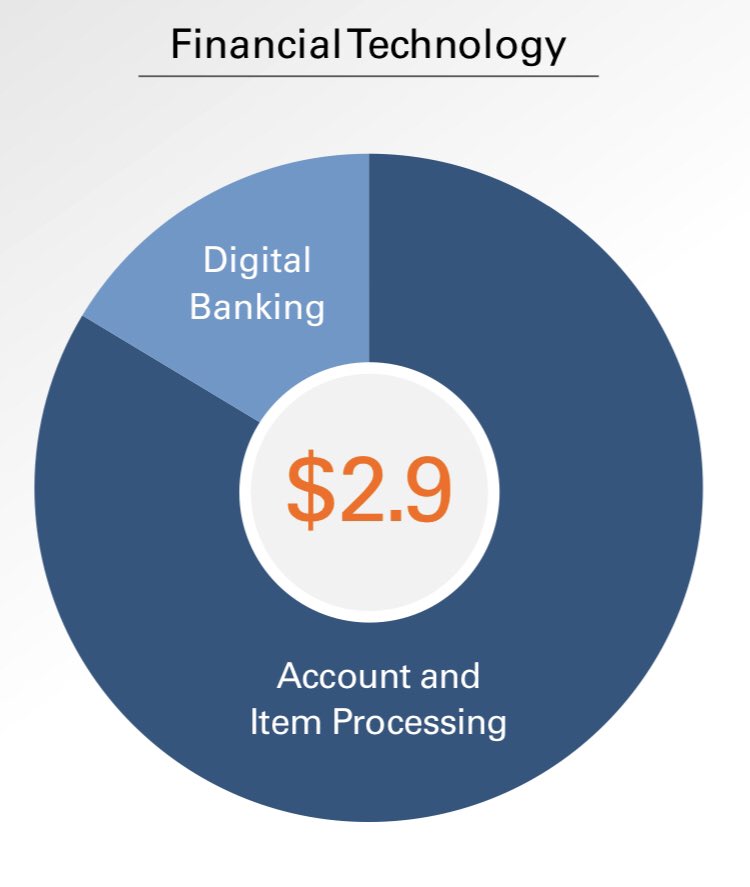

2) This segment dates back to the origins of $FISV, and today it’s the market share leader with nearly 40% of all US banks relying on FISV to power everything from new account opening, items processing, online/mobile banking, regulatory compliance, general ledger/reporting, etc

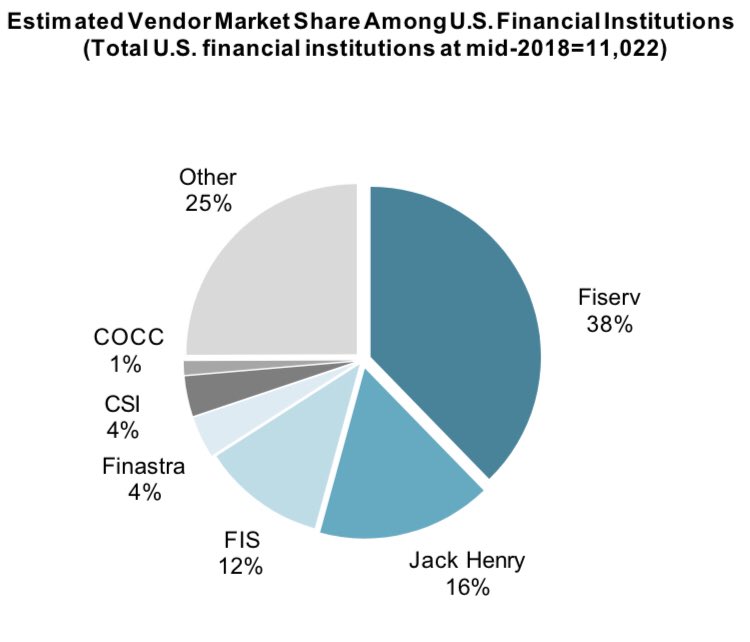

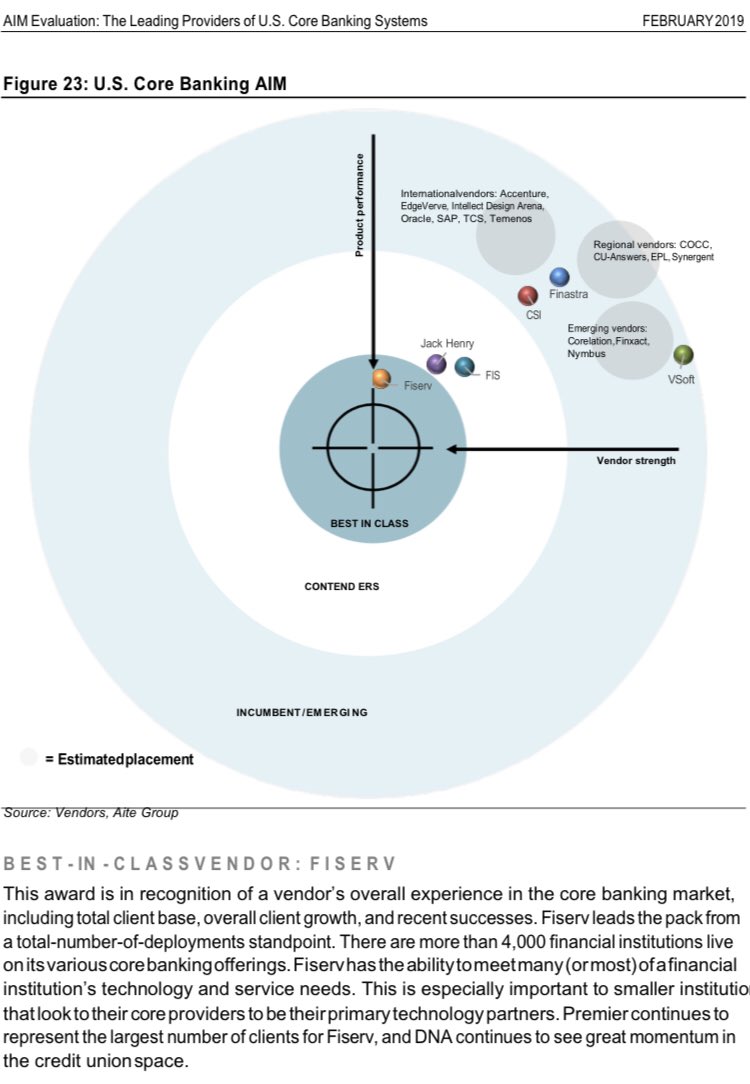

3) Not just the market leader, $FISV is also has a best-in-class offering

Well regarded Aite Group rates it better than nearest competitors $FIS $JKHY

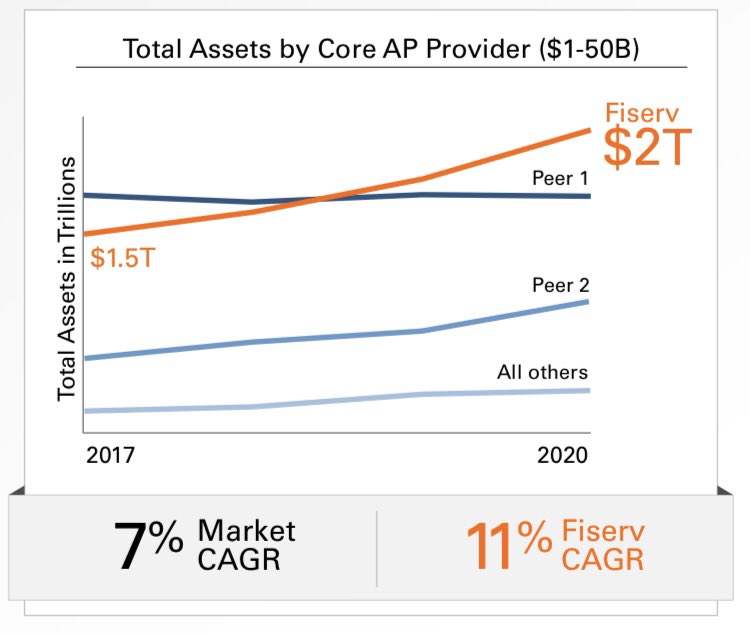

Today, these 3 dominate the market and maintain an oligopoly structure, with various other point solutions pretty far behind

4) $FIS skews larger multinational banks (2x+ as many $10B+ banks as FISV/JKHY combined) and $JKHY is 1,700+ community/credit unions

However, the sweet spot for $FISV is $1-50B banks (now 500+ as clients) while also maintaining a strong base of 3,200+ community/credit unions

5) Why is this important?

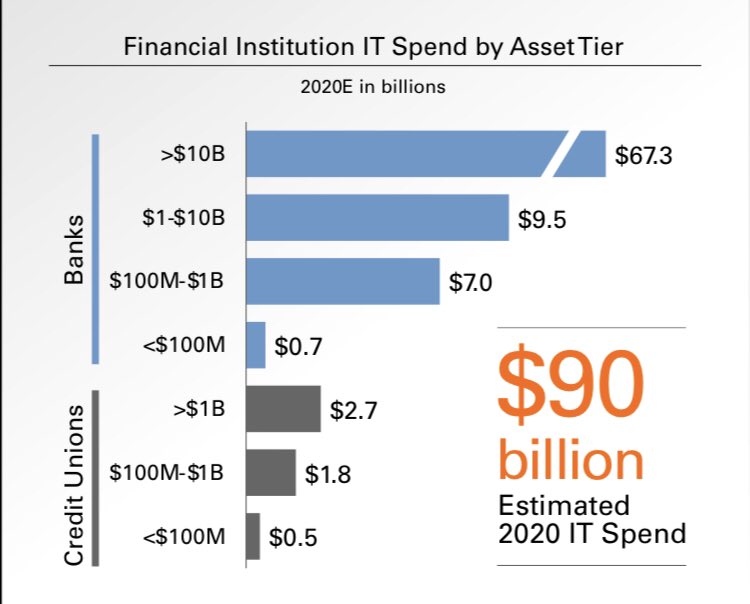

Here’s the US bank IT spend:

~135 Large banks ($10B+) = $67B annually (~$500M budget each)

~1,000 Mid sized banks and large credit unions ($1-10B) = $12B (~$10M budget each)

~10,000+ Small banks and credit unions (<$1B) = $8B (< $1M budget each)

6) Segmentation matters

~135 large banks: a lot of IT spend is in-house. Any 3rd party systems are highly customized

~1,000 mid-sized banks: need to keep up with larger banks but can’t afford to do it themselves

~10,000 smallest banks: entirely reliant on their core processor

7) While $FIS is elephant hunting the largest banks, $FISV focuses on the attractive mid-market ($1-50B banks) and is winning

Large banks often supplement in-house systems with multiple 3rd party vendors

Mid-sized banks look for integrated solutions, enabling FISV to cross sell

8) Even more than mid-sized banks, the ~10,000 small/community banks and credit unions with <$1B in assets just simply don’t have a choice but to rely 100% on the core processor

Many don’t employ more than a handful of IT staff, so they outsource everything to $FISV $FIS $JKHY

https://t.co/p1i7uh7K94

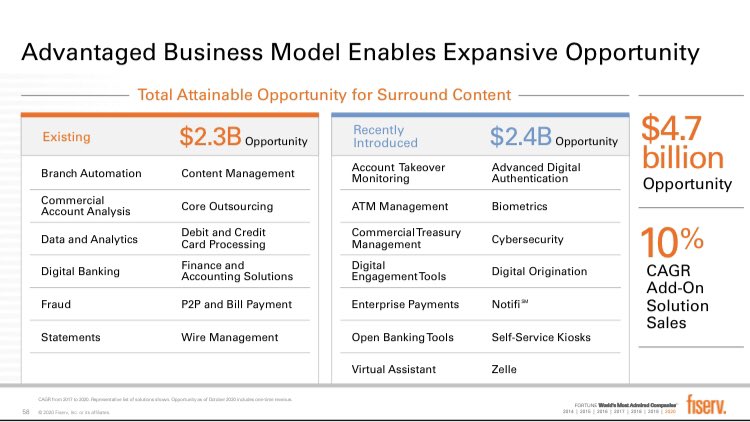

9) $FISV delivering “integrated value” to mid-and-small sized bank clients has been the hallmark of its strategy

With a foot in the door from core account processing, FISV expands its share of wallet with additional “surrounds” such as digital banking, P2P, bill pay, cards, etc

10) Some “surrounds” are internally developed, but many are acquired capabilities that $FISV can immediately cross-selling into its ~4,000 bank core account processing installed base

This is why I view the FinTech segment as “glue” that ties the rest of the portfolio together

11) A good illustration of this is today’s announced acquisition of OnDot to add digital card controls

$FISV was already a partner to OnDot but now owning this capability allows deeper integration and cross-sell, and therefore value capture vs status quo

https://t.co/1rR0BfWhU6

12) The list of $FISV acquired “surrounds” is pretty long:

- CheckFree/BillMatrix (bill pay)

- CashEdge/Dovetail (P2P/RTP)

- M-Com/Monitise (mobile banking)

- Elan (ATM managed services)

- Open Solutions (next gen core)

- PCLender (loan origination)

- OBS (business banking)

13) Today, the average bank client purchases 37 products from $FISV, up from ~20 just 3 years ago

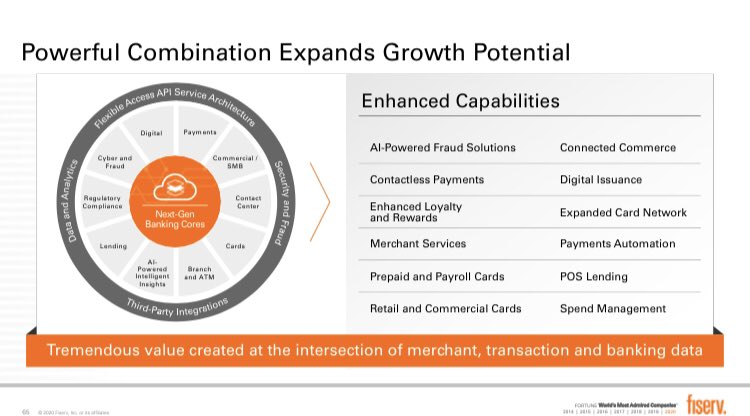

This integrated selling strategy is further enhanced by the FDC merger, with a number of new offerings offering enhanced value by combining merchant, transaction and bank data

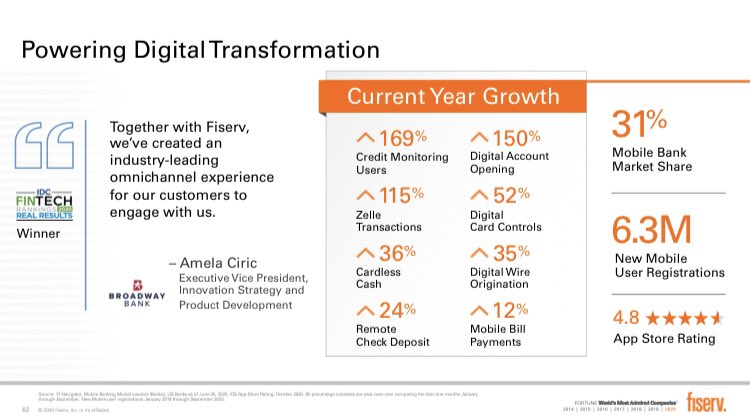

14) With limited internal IT budget to keep pace with the largest banks — and now increasingly digital-first challenger banks — mid-and-small banks effectively look to $FISV for outsourced “innovation” to power their own digital transformations

It’s roadmap is their roadmap ...

15) ... and this roadmap has already helped 1/3 of all US banks evolve from physical branch focused banking to internet delivered to mobile/omni-channel today

Now $FISV seeks to transition its bank clients to the world of open banking: consumption of bank services via open APIs

16) Tying this back to growth

For years, $FISV FinTech has grown low single digits (3% in 2019)

The accelerated 4-6% medium term growth outlook will depend on continued outperformance in the mid-market ($1-50B banks) and cross-sell of its growing portfolio of “surrounds”