2/

This FT piece on deb #cancellation is interesting and poses a few interesting questions.

Let me begin with what I do not like.

The case against cancelling debt at the #ECB https://t.co/o0Vvvf6leU

#monetization 1/

2/

3/

4/

This is what the FT seems to suggest too (this is why the piece is more complex than it seems)

5/

6/

7/

What is interesting is the last sentence of this paragraph:

8/

Interestingly, the strong independence of the ECB in this case could help.

9/

https://t.co/G4XhPZQZup

But the FT acknowledges that the issue is on the table and that sterilization may be part of the equation.

I am ok with this

/end

More from Trading

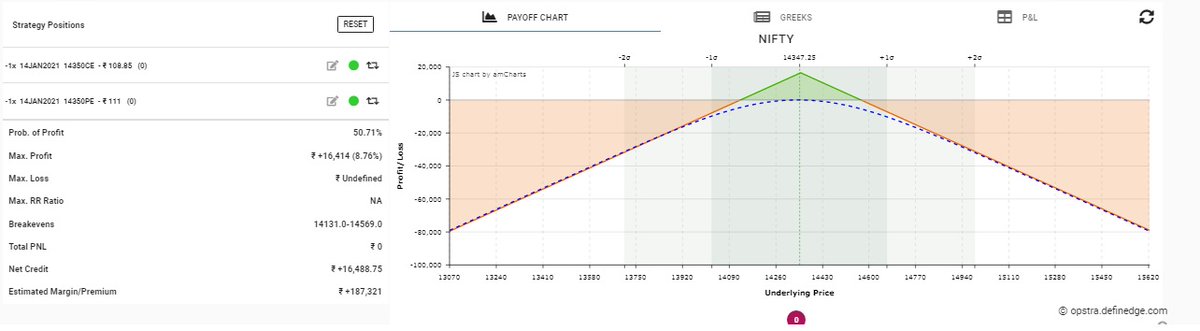

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

If you wish to learn abt trading,psychology,options,business etc

You can go through this thread.

Other than this I do post videos on my YT channel : -Abhishek Kar & Tradiostation

-Intraday views on FREE telegram : Abhishek Kar Official

RT will be appreciated

1. Threads to learn Options

https://t.co/wabkek43I8

2. https://t.co/OIDenHKdWN

3. Some core rules to investing

https://t.co/37d1pygp7P

4.Summing up 2020 Trading lessons

https://t.co/jSUb1lSGbQ

5.Effects of margin change on

\U0001d413\U0001d421\U0001d42b\U0001d41e\U0001d41a\U0001d41d \U0001d41f\U0001d428\U0001d42b \U0001d40e\U0001d429\U0001d42d\U0001d422\U0001d428\U0001d427\U0001d42c

— Abhishek Kar (@Abhishekkar_) December 29, 2020

The entire thread will have some quick pointers on options trading. These bullet points are based on experience and learning and even if you are completely new,will help you to build some perspective. So,lets go :

6. Exciting story about a trader who destroyed a Bank

https://t.co/CsEEhIsD3q

7. Some Thought Provoking facts about stock markets

https://t.co/IjxpX5Wx24

8. A dose on Trading and investing

\U0001d413\U0001d42b\U0001d41a\U0001d41d\U0001d41e\U0001d42b \U0001d430\U0001d421\U0001d428 \U0001d41d\U0001d41e\U0001d42c\U0001d42d\U0001d42b\U0001d428\U0001d432\U0001d41e\U0001d41d \U0001d401\U0001d41a\U0001d42b\U0001d422\U0001d427\U0001d420\U0001d42c \U0001d401\U0001d41a\U0001d427\U0001d424

— Abhishek Kar (@Abhishekkar_) October 11, 2020

This thread is about the trader who with his reckless trading destroyed the entire Barings bank. In case you would like to read more such informative threads,do not forget to retweet and share as acts as encouragement

9. Top 5 resources to learn everything about stocks

https://t.co/6KnIySBGIG

10. Some Pro Tips on Trading

https://t.co/EiSGikt7jv

11. Wisdom on stuffs you should not do

https://t.co/bI2dH0XTSS

12. Reasons why you are losing the

\U0001d5e7\U0001d5db\U0001d5d8 \U0001d5e7\U0001d5e2\U0001d5e3 \U0001d7f1 \U0001d5e7\U0001d5db\U0001d5e5\U0001d5d8\U0001d5d4\U0001d5d7

— Abhishek Kar (@Abhishekkar_) July 21, 2020

The following thread will have top 5 for everything you need in the world of stock market and as learner who wants to REALLY grow. Make sure you #retweet the thread and let it reach the maximum number of people as sharing is caring.

13. The DARK side of stock market

https://t.co/qsteGcbquI

14. Stocks where you should NOT invest

https://t.co/2tD5q0K3UQ

15. Lessons from MILLIONAIRE trader

https://t.co/Pec6LmUtGa

16. Lessons from my

\U0001d5e7\U0001d5db\U0001d5d8 \U0001d5d7\U0001d5d4\U0001d5e5\U0001d5de \U0001d5e6\U0001d5dc\U0001d5d7\U0001d5d8 \U0001d5e2\U0001d5d9 \U0001d5e6\U0001d5e7\U0001d5e2\U0001d5d6\U0001d5de \U0001d5e7\U0001d5e5\U0001d5d4\U0001d5d7\U0001d5dc\U0001d5e1\U0001d5da

— Abhishek Kar (@Abhishekkar_) July 6, 2020

In the following thread you will understand a few dark truths about stock trading as a profession.

Sadly everyone touches the only green side but there has to be a balance. Don't forget to #retweet for wider reach.

Yesterday was brutal for some people...

Losing life-changing money sucks, losing any money sucks...you can chase the market or you can change your strategy.

2/ The original thread is gone but you can read it here.

https://t.co/cLLNs75rB0

tl;dr

- Traded $32k to $1.2m

- Thought I was a genius

- Made poor investments

- Didn't conserve capital

- Peaked at 150 BTC

- Lost nearly all of it

2 weeks from losing my house + no income. Oops.

3/ I am going to assume you are in it for the money rather than the tech. Yeah, you might Tweet about the amazing blockchaining of cross-border payments and oracles yadda yadda...really, you are in it to make money.

If you are really in it for the tech, go and build something.

4/ Okay, so if you want to make money, trading is super hard, you are trading against:

- Better traders than you

- People who can move markets

- Unknown information

And if you are trading with leverage you might blow up your account with the volatility.

5/ If you are not trading, you are investing. Okay, so what are you investing in?

I made the decision that the crypto with the best opportunity of existing in 10 years is #Bitcoin:

- Solves a genuine problem

- The right tech

- A proven track record

You May Also Like

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The famous \u201cLucy\u201d, an early ancestor of modern humans (Australopithecus) that lived 3.2 million years ago, and was discovered in 1974 in Ethiopia, displayed in the national museum in Addis Ababa \U0001f1ea\U0001f1f9 pic.twitter.com/N3oWqk1SW2

— Patrick Chovanec (@prchovanec) November 9, 2018

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹