Eventually the thesis for a good investment boils down to 2-3 simple points. You have to do a lot of work to figure out what those are & why.

2/

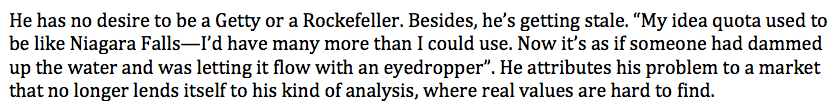

Excellent compilation of Forbes articles on Warren Buffet from 1969 to 2000s. h/t @valuewalk \U0001f44f@dmuthuk @Gautam__Baidhttps://t.co/V7uTYjwSrn pic.twitter.com/GPDyuk7WGB

— Ram Bhupatiraju (@RamBhupatiraju) December 5, 2020

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K