Risk is felt, it’s not something that can be quantified despite the failed attempts of many. 2/9

Short thread on emotions in trading

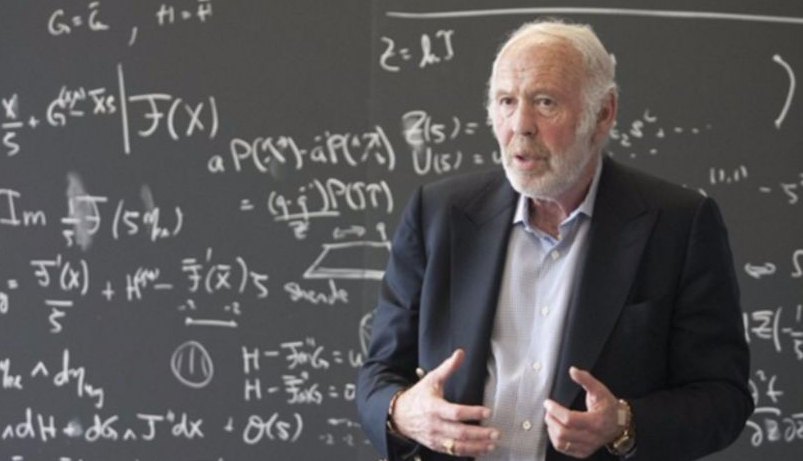

A common meme is that the best traders are the least emotional. I’m calling BS on this.

I’ve analysed the Psychological make-up of many brilliant traders over many years using psychometrics. And whilst this isn’t scientific research.

1/9

Risk is felt, it’s not something that can be quantified despite the failed attempts of many. 2/9

The fact that they don’t suppress their emotions aids this process.

They use their emotions as

3/9

Feeling their emotions & being aware of them enables them to identify opportunities & threats with great haste, giving them an edge over ‘less emotional’ types who are not able to

4/9

By contracts the less emotional types can tend to be overconfident & don’t always see (because they don’t feel) the degree of risk or threat in situations.

I am not saying emotional or unemotional is superior. Both types can and do succeed.

5/9

What matters is congruence: There are certain 6/9

For emotional types, I ‘tend’ to find that the shorter-term/faster the style or signal, the better it is.

7/9

Again this creative ‘edge’, which isn’t necessarily unique to, but seems to tend towards, emotional types, can be highly valuable to designing systems or new methods.

8/9

More from Trading

You May Also Like

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0