2/n

A thread.

Earnings Trades Simplified.

Earnings announcements are public announcements that display a company’s earnings, or lack thereof. As the earnings announcement gets closer, implied volatility tends to increase. After earnings are announced,...

1/n

2/n

Earnings trades are not for everyone, as they involve high amounts of uncertainty and random movements.

3/n

-Increase number of occurrences, many trades available so increases of our probability of profit.

-High IV opportunities

-Short term Binary event leading to drastic volatility crush.

4/n

1. Expected Move

2. When to place trade

3. Historical Moves

4. Strategies based on market conditions

5/n

Normally calculated by IV, stock price, expected move period(as no. of days) by formula

Price * IV * SQRT(days/365)

Market Makers expected move -

ATM Straddle * 0.85* =(both the sides from strike)

Both have some differences.

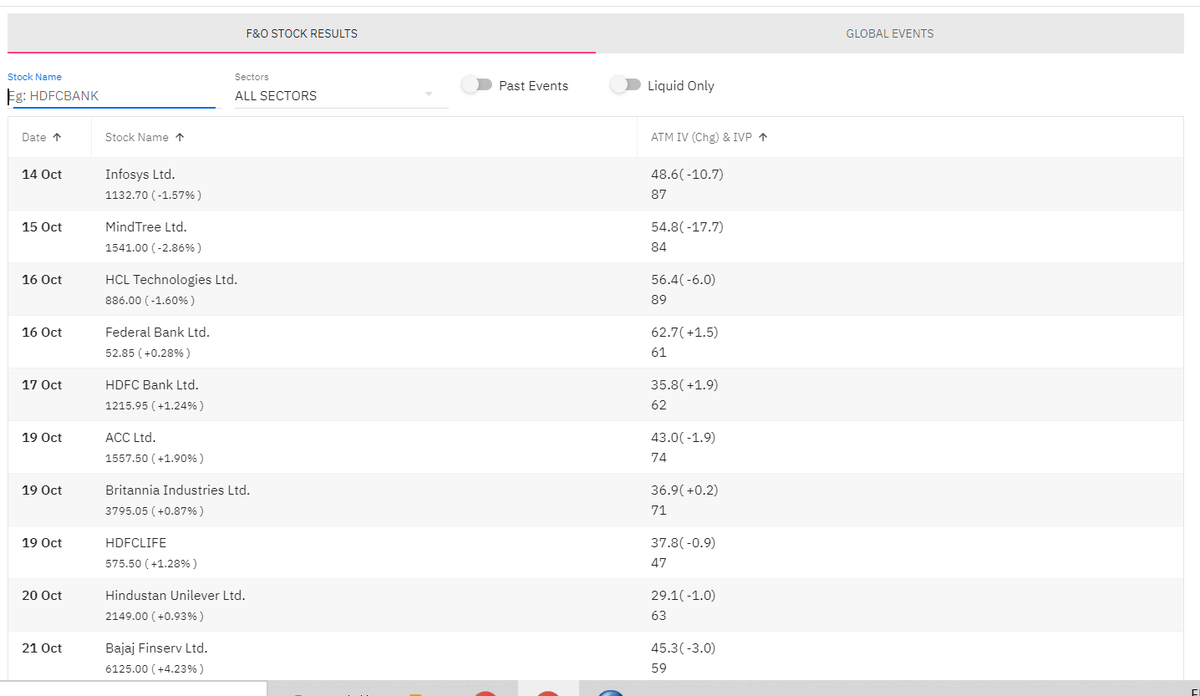

6/n

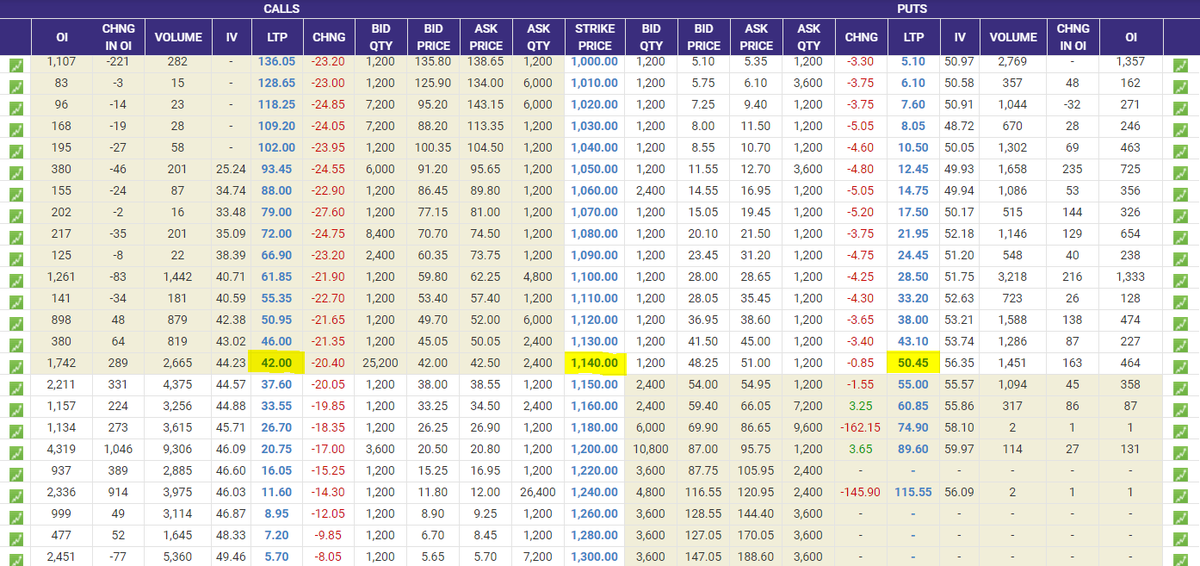

ATM (1140) Straddle = Rs.100 approx.

Days to expiration = 15 (29 October)

Stock Price - 1140

IV = 50%

Expected move till expiry - Rs.115 Either way from spot

Market Maker move - Rs.85 Either way from spot.

7/n

If Earnings is overnight, say tomorrow, place the order at end of the day today for better delta position.

If Earnings is during market hours, at the start of the day as the timing of the earnings can be easily switched during the course of the day.

8/n

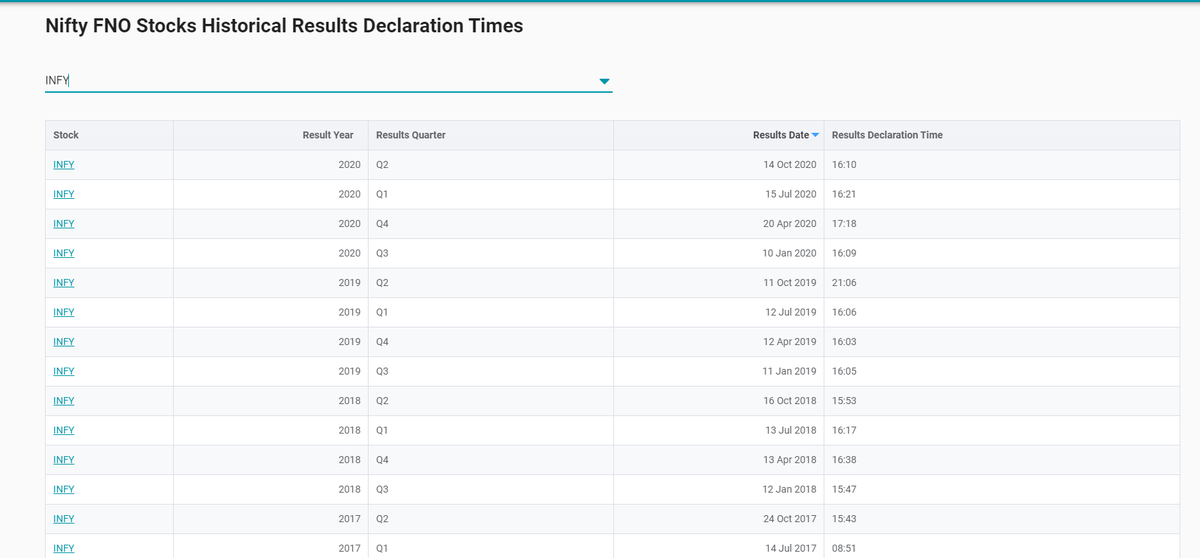

Did the underlying in which the trade is taken historically overstated IVs are understated, in case of INFY case shown below it has understated 5/7 times in last 7 quarters after earnings.

Yellow Dotted lines are earnings days.

9/n

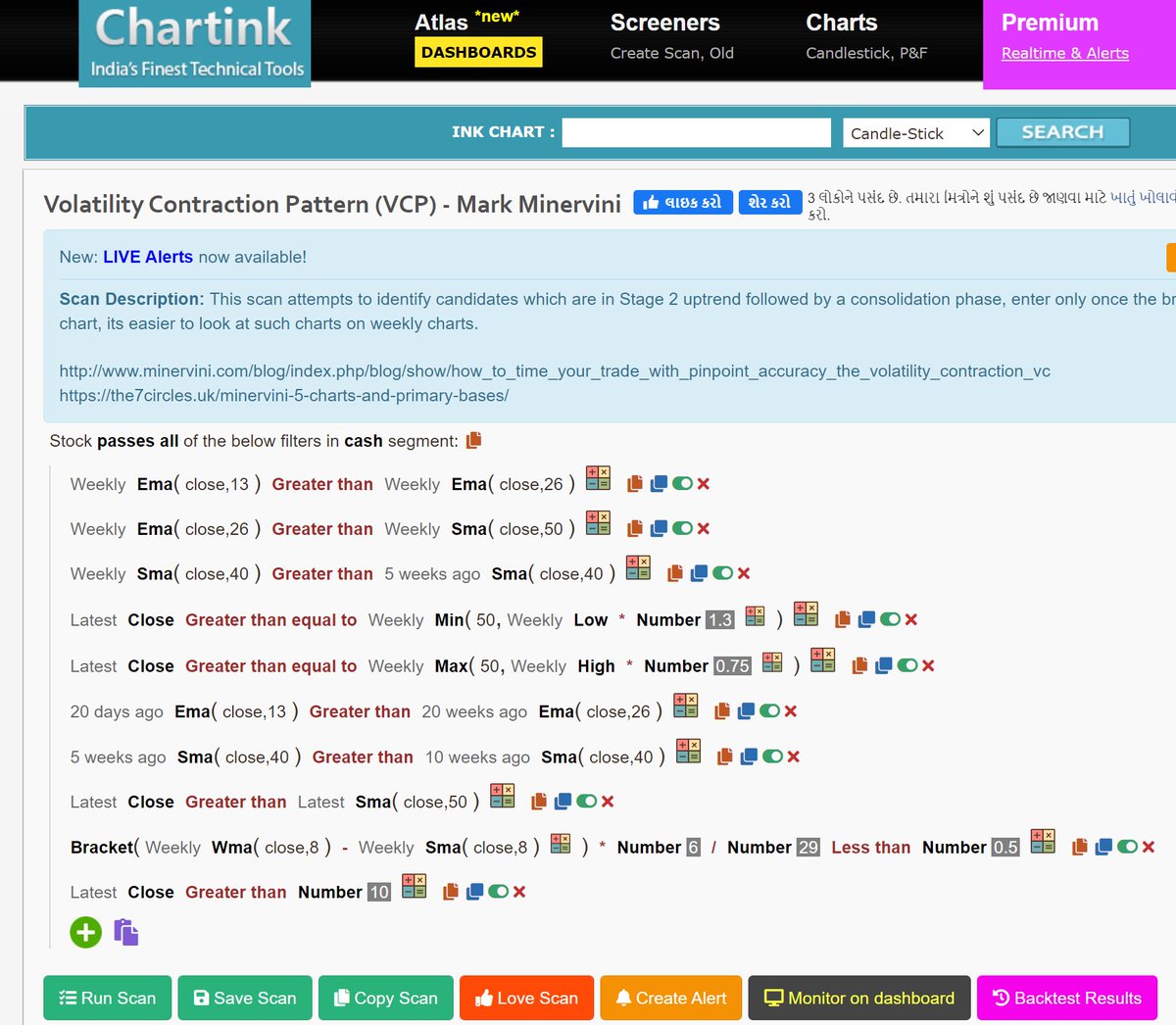

Only basic ones. Will explain three of them here.

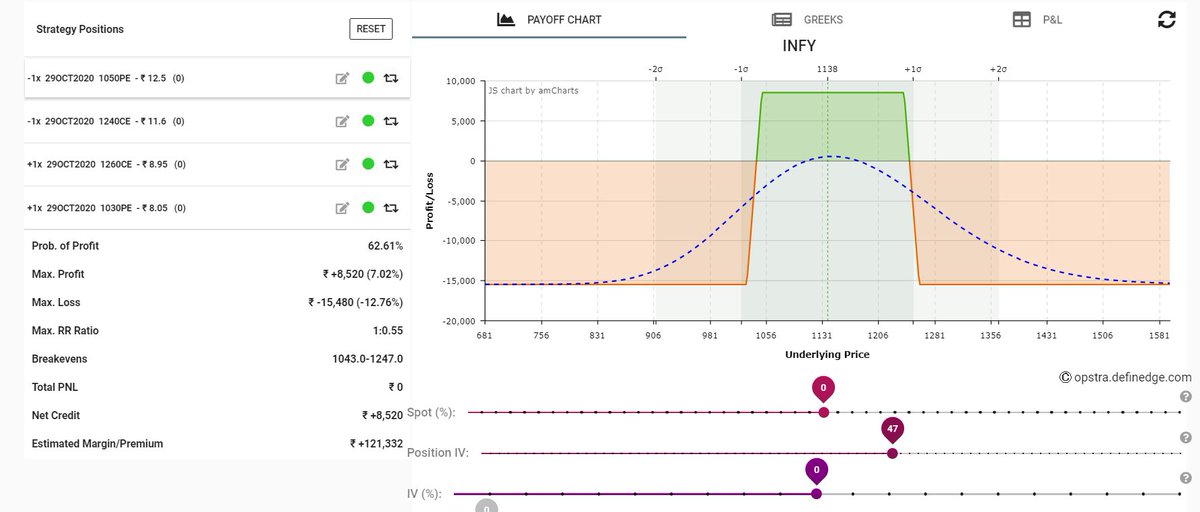

1) Iron Condor - Beginner Strategy, can be used for any underlying. Basic Setup, example on INFY. Explained Iron Condor in y previous threads.

10/n

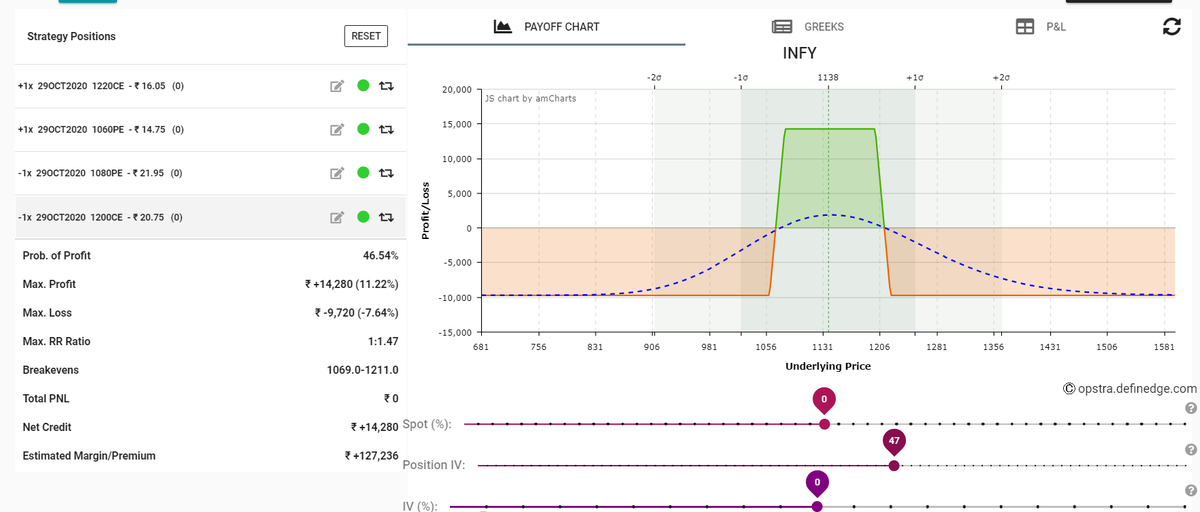

Can be used for large underlying or IV percentile > 90. Better Risk Reward than Iron Condor. Basic Setup as shown below. Sell closer strikes than Iron condor.

11/n

More from Trading

𝗡𝗶𝗳𝘁𝘆-𝗕𝗮𝗻𝗸𝗻𝗶𝗳𝘁𝘆 𝗢𝗽𝘁𝗶𝗼𝗻 𝗕𝘂𝘆𝗶𝗻𝗴 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

Option Trading is very difficult to master as there are so many things to understand.

Here is a master thread related that will help a beginner to understand about Options Trading.

A complete course worth Rs 50K for free.

1/ A detailed thread on basics of Option Greeks and how it impacts Options

2/ Basic Option Trading Strategies:

There are many option strategies to trade. But keeping your strategy simple is the key.

In this thread, all the basic option trading strategies are being

3/ What are the things that you should look at before taking any Option

4/ Is Option Selling Possible with Rs 1 Lakh Capital?

Even a beginner can start trading in option selling with capital as low as Rs 1 Lakh.

What are the techniques one can use and how to mitigate the infinite loss risk is shared in this

Here is a master thread related that will help a beginner to understand about Options Trading.

A complete course worth Rs 50K for free.

1/ A detailed thread on basics of Option Greeks and how it impacts Options

There are various Options Greeks like: Delta, Gamma, Vega, Rho, Theta.

— Yash Mehta (@YMehta_) September 4, 2022

A complete guide on how these #Option Greeks impact option price.

2/ Basic Option Trading Strategies:

There are many option strategies to trade. But keeping your strategy simple is the key.

In this thread, all the basic option trading strategies are being

Option trading is tough but here\u2019s what can make it easier for you

— The Chartians (@chartians) September 17, 2022

8 option strategies that you can use in any market (sold as a \u20b9 50,000 course !)

3/ What are the things that you should look at before taking any Option

They say options trading can make YOU BANKRUPT - is it true ?

— The Chartians (@chartians) September 23, 2022

If yes then why ?

A thread on Risk management and Position sizing in options trading (worth 50k\u20b9 course)\U0001f9f5

4/ Is Option Selling Possible with Rs 1 Lakh Capital?

Even a beginner can start trading in option selling with capital as low as Rs 1 Lakh.

What are the techniques one can use and how to mitigate the infinite loss risk is shared in this

101 guide on how you can start option selling to generate active returns with less capital (Rs 1 Lakh) \U0001f9f5:

— Yash Mehta (@YMehta_) August 19, 2022

A course on option selling available for free.