It was a very heady experience, and while preparing to interview him, I was startled to discover how much work he's done in healthcare, aviation, spaceflight, but also innovation.

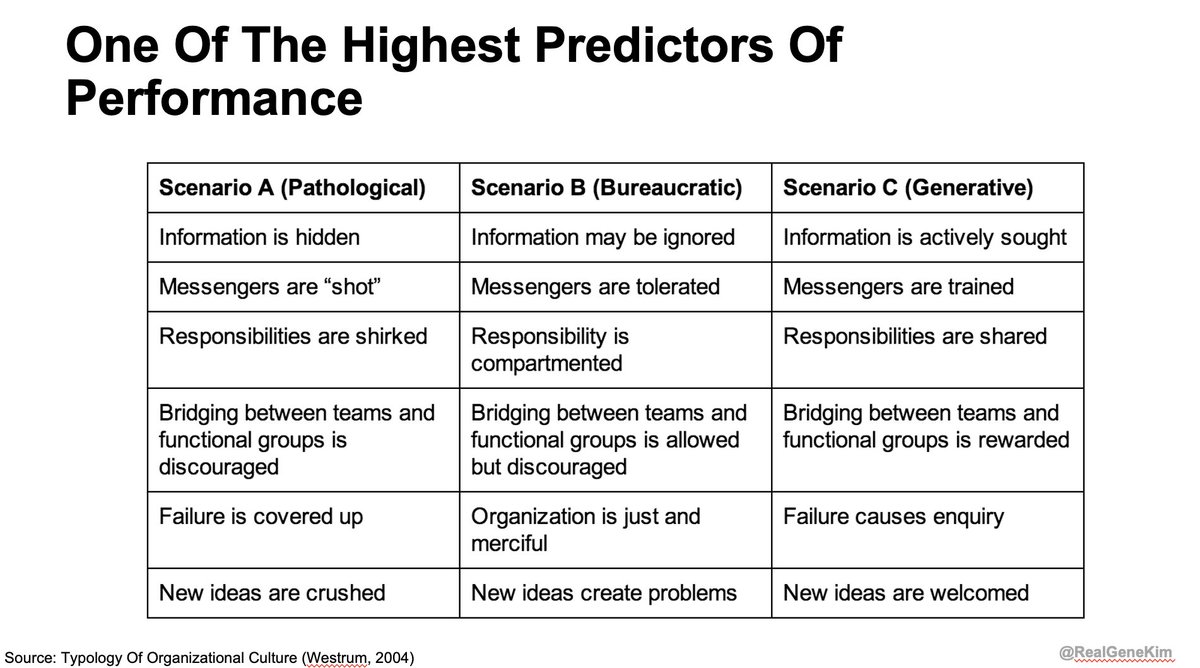

Many of you have seen the famous Westrum Organizational Typology model, so prominently featured in State of DevOps Research, Accelerate, DevOps Handbook, etc.

This model was created Dr. Ron Westrum, a widely-cited sociologist who studied the impact of culture on safety

It was a very heady experience, and while preparing to interview him, I was startled to discover how much work he's done in healthcare, aviation, spaceflight, but also innovation.

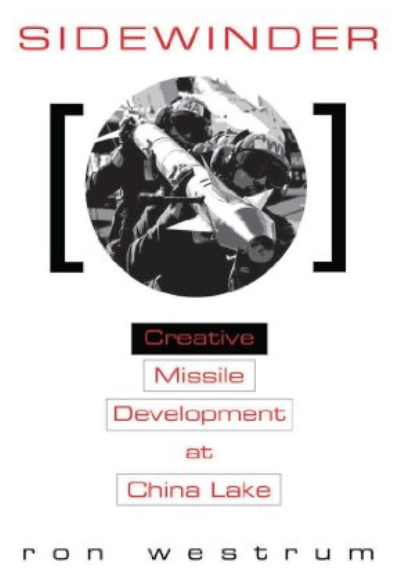

I was startled to learn he has also studied in depth what enables innovation. He wrote a wonderful book "Sidewinder: Creative Missile Development at China Lake"

https://t.co/OjY5KSDbNK

"What is the underlying science [and theory]?

"Today Rabinow, professional inventor w/230+ US patents, an advisor to NIST: 'all inventors come up w/many idea; you must know that most are trash."

This prevented expansions in budget, oversight, meddling

Dr. Bill McLean is the center of the narrative, Ph.D. from Caltech, who led the program, and eventually China Lake

That could be answering a question, dictating what the work should be, or doing the work.

"Lockheed Skunk Works shared many similar traits... Director "Kelly" Johnson promised P-80 Shooting star in

(Also resonates w/me. As @chawlady wrote: we stopped optimizing for cost, and optimized for speed)

Dr. Westrum says that the literature calls this the "technical maestro"

(other missile programs burdened with lots of premature requirements)

More to come later...

More from Trading

𝗡𝗶𝗳𝘁𝘆-𝗕𝗮𝗻𝗸𝗻𝗶𝗳𝘁𝘆 𝗢𝗽𝘁𝗶𝗼𝗻 𝗕𝘂𝘆𝗶𝗻𝗴 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]