Catch me if you can @Mitesh_Engr

Time for a🧵

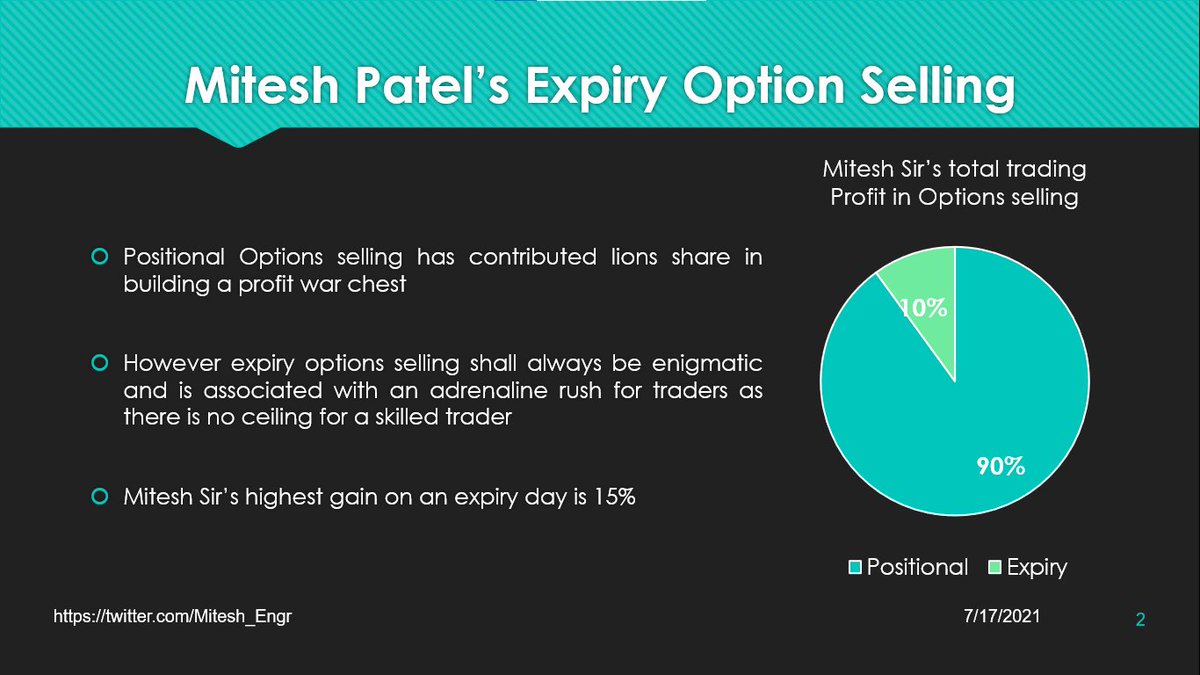

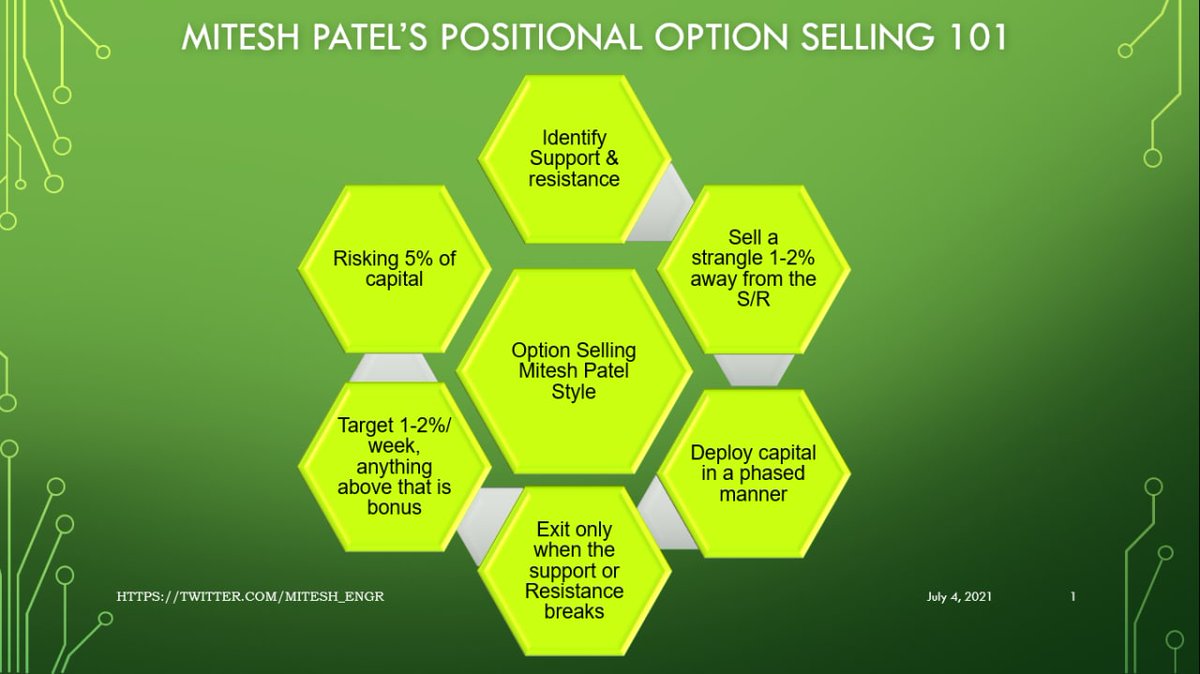

Mitesh Sir's EXPIRY Option Selling 101:

• What to look for?

• Strike Selection & Ratios

• SL mgmt

• Avoiding freezes

• Monthy Expiry

• Event days

• How he would have traded last expiry?

In collaboration with @AdityaTodmal

Edward de Bono says intelligence is like a🚗 Automobile

“A powerful car may be driven badly. A less powerful car may be driven well. The skill of the car driver determines how the power of the car is used.”

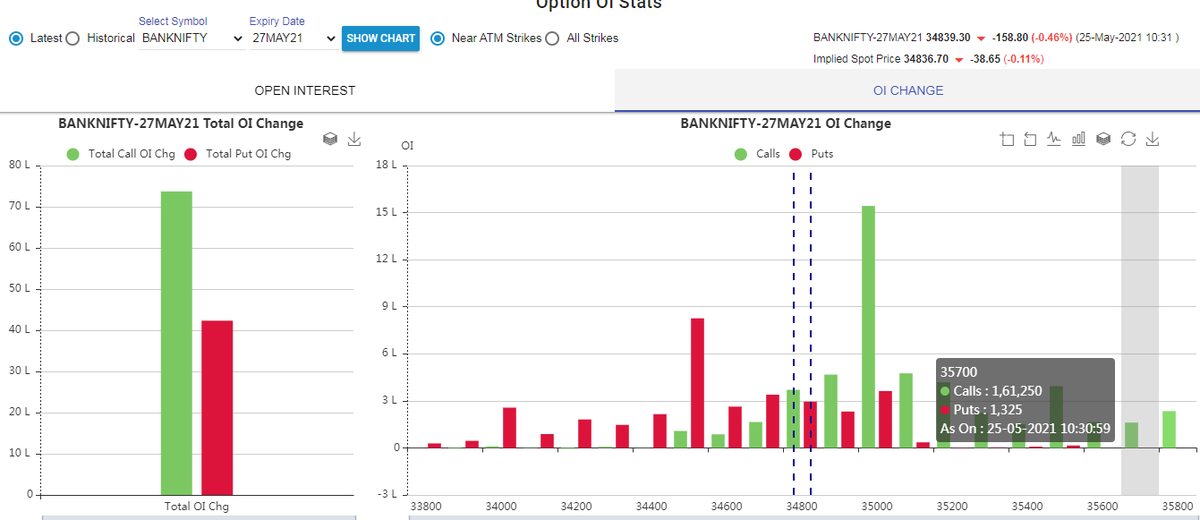

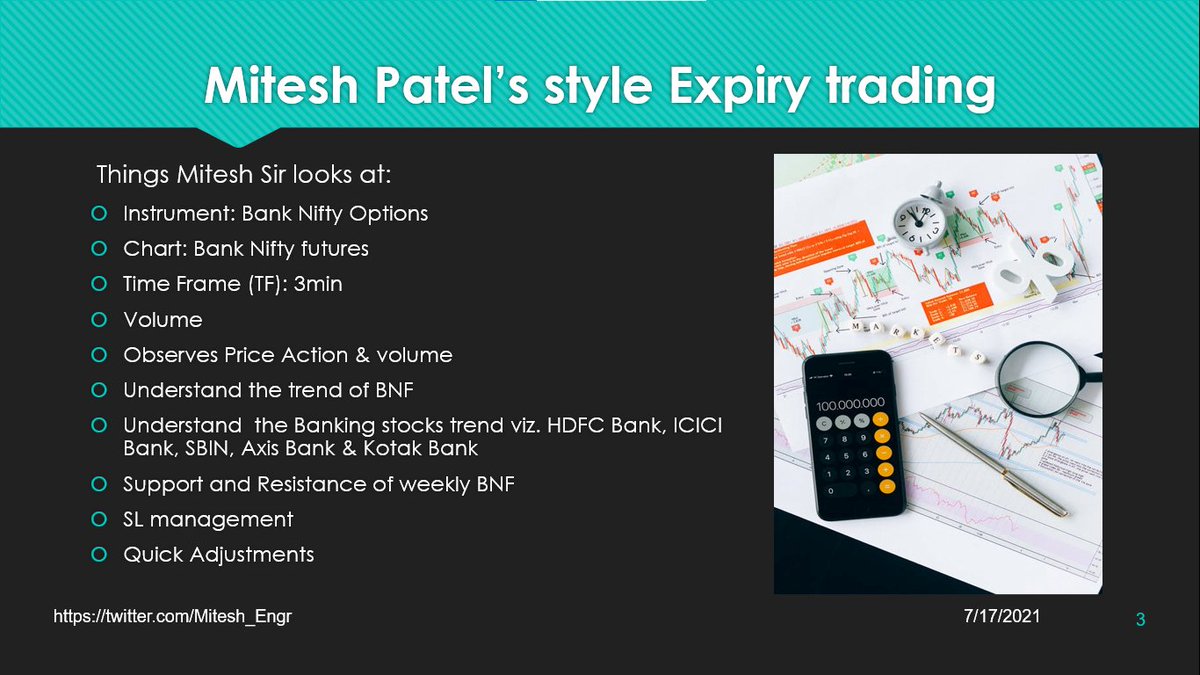

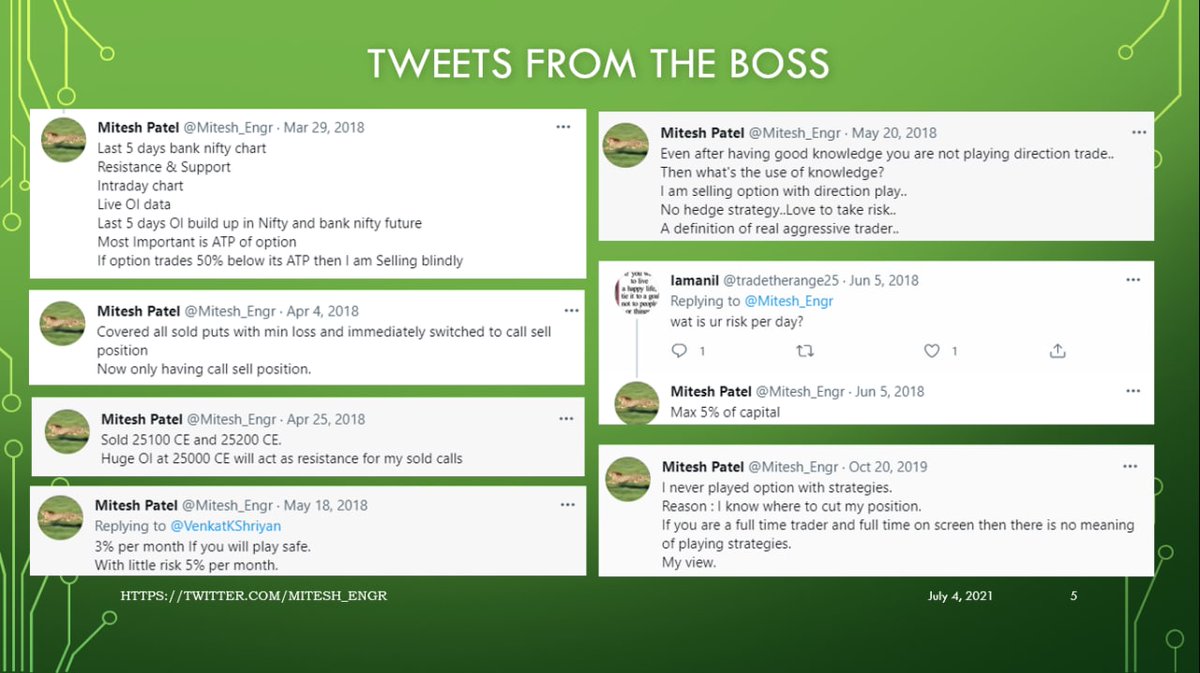

What @Mitesh_Engr Sir looks at for Expiry Trading:

• Technicals of BNF

• Individual Heavyweight stocks of BNF

• Support/Resistance of BNF on weekly TF

• Also has Superb SL management

• When it comes to adjustments, he is always on toes

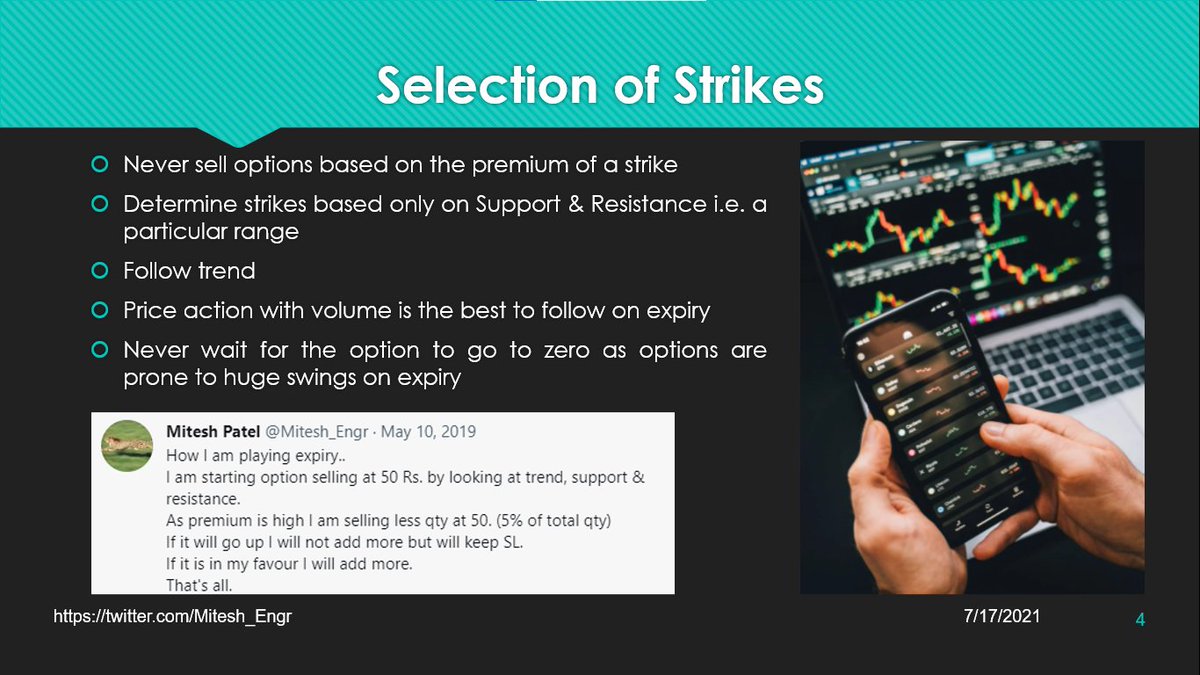

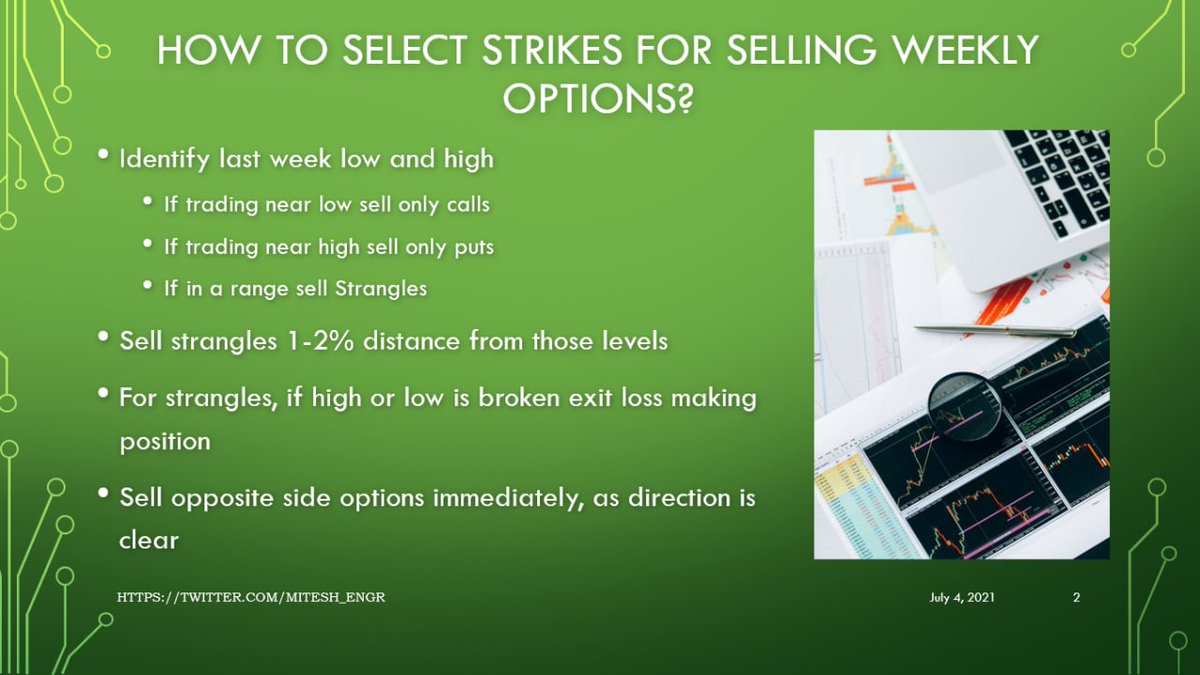

How to Select Strikes to Sell?

• You can't sell based on premium

• Follow only trend

• Price action is best to sell on expiry day

• Never wait for the options to go to zero

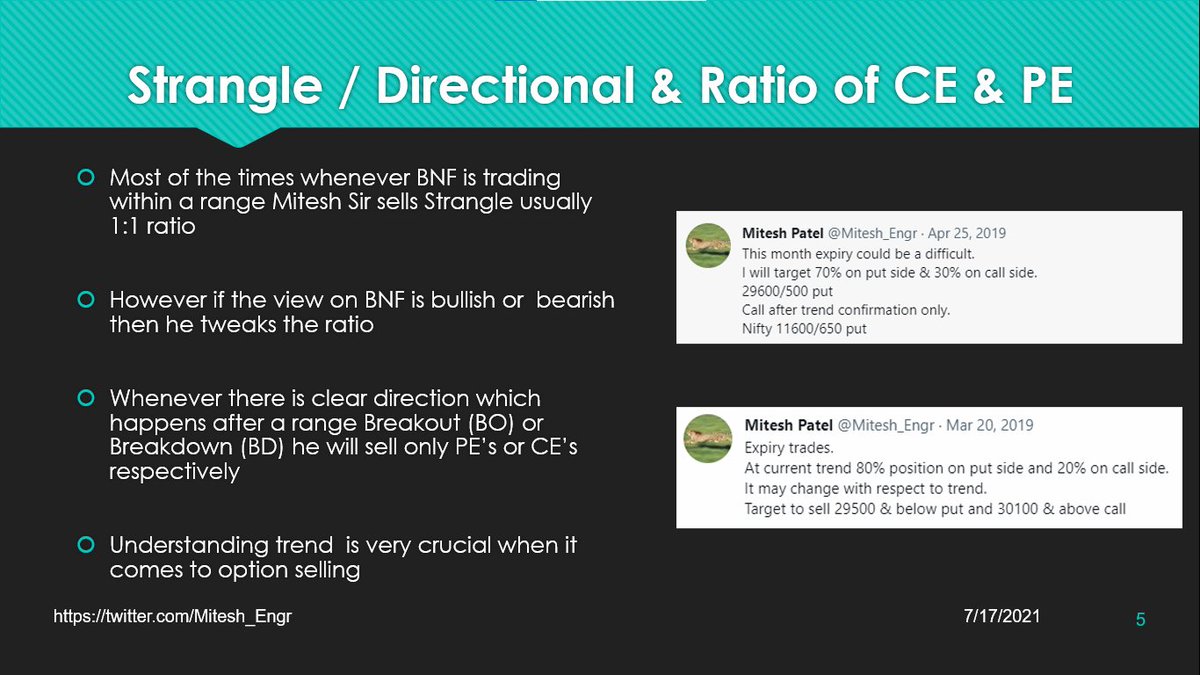

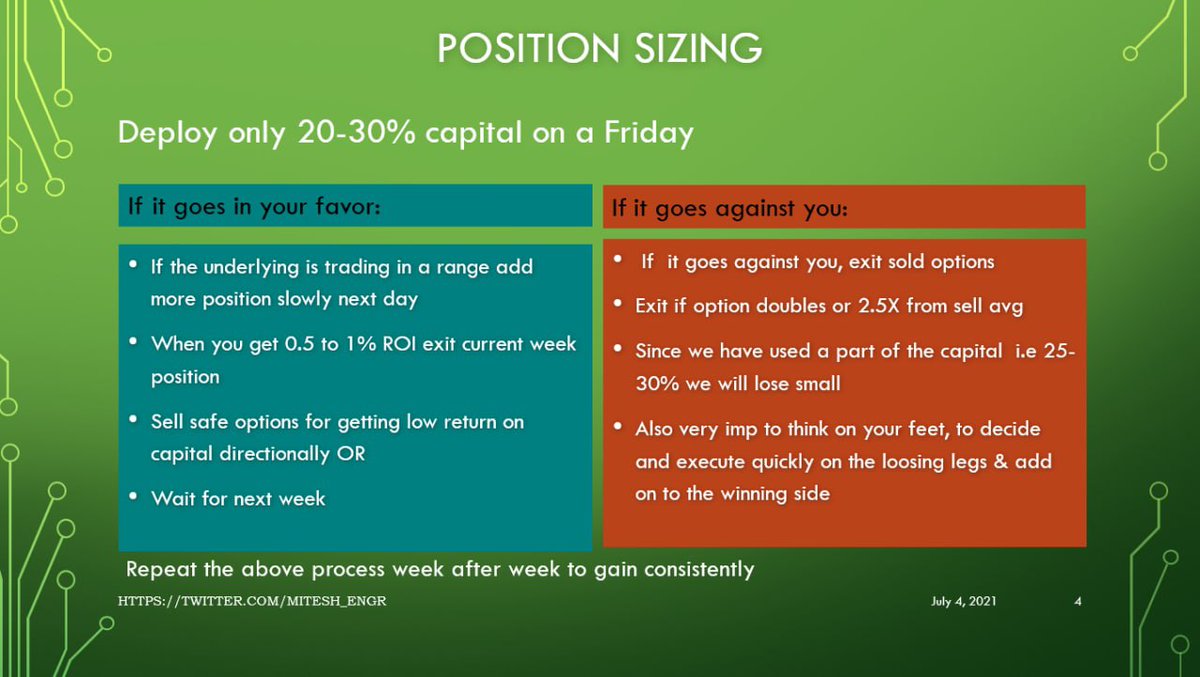

Using Ratios to Sell:

• If BNF is in a range then strangles

• If breakout/ breakdown from a range then directional

• Selling 70/30 or 80/20 ratios

• 2 examples on how he used ratios