Why Patience is so Important as a Trader

🧵👇

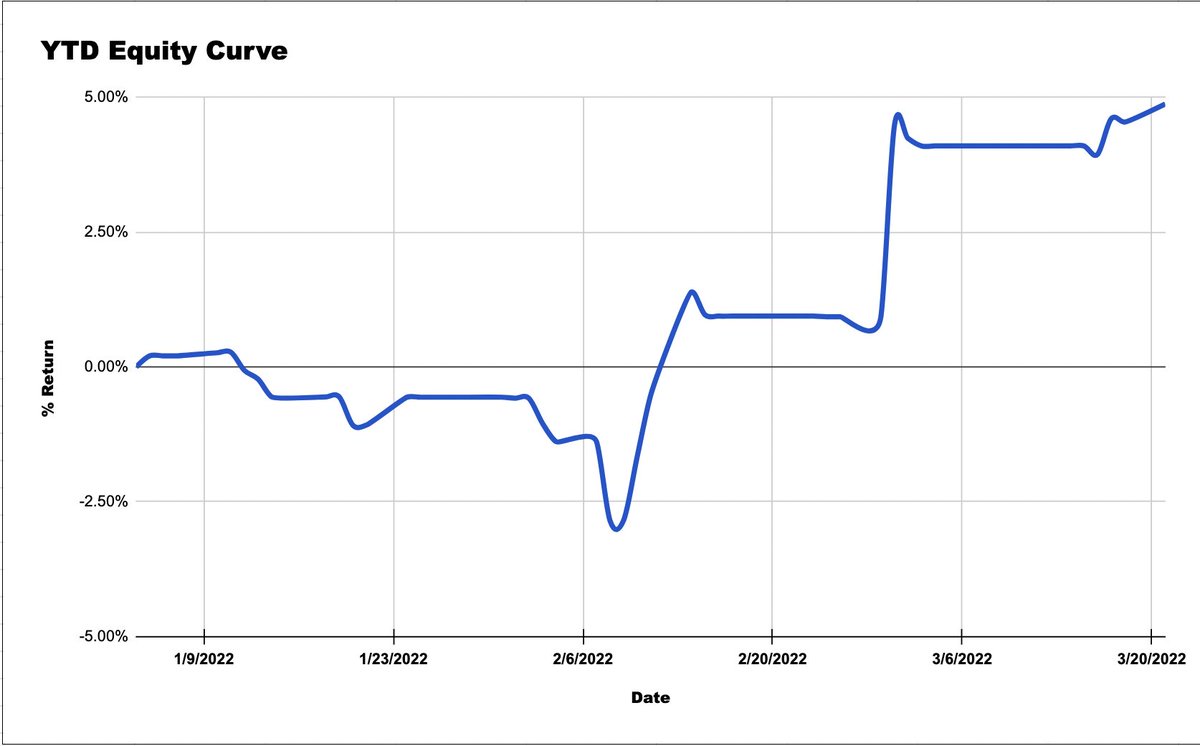

This is exactly what impatience looks like. Just a slow bleed out of money, trying to win on the next trade to make up for losing on the last trade.

A couple of things 👇

❌ my greed got the best of me

❌ didn't trade my best setups

❌ influenced by others making $ short

❌ was red for yr & wanted to get green

I...

✅ realized that impatience was losing me $

✅ decided that I would not care if others made $ w/o me

✅ planned to only trade my best setups for the rest of year

This is only built through $STUDY.

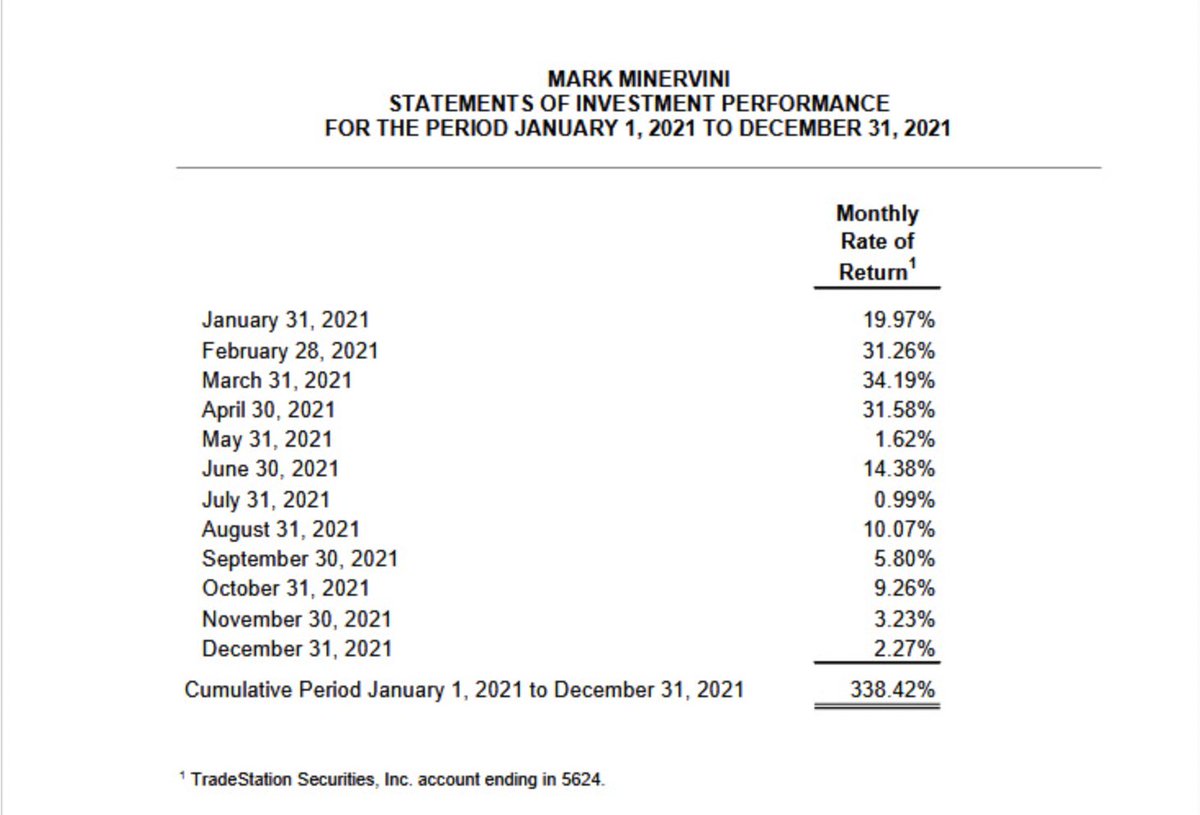

He had FOUR whole months of gains less than 5% and still went on to QUADRUPLE his account.

He knows that when the time is right, he can make a whole lot of money.

When it isn't, he sits out!

This is why Mark is a master.

· $STUDY

· sit while other strategies make $

· control your emotions

If you enjoyed this post:

1. Follow me @GregDuncan_ for more threads like these

2. Retweet the first tweet if you found it helpful or think it can help someone else level up their trading!

3. Check out my thoughts from yesterday https://t.co/tP86MiwUSt

3 Lessons for the Novice Trader (that I wish I knew when I started) \U0001f9f5\U0001f447

— Greg Duncan \U0001f6a2 (@GregDuncan_) March 18, 2022

More from Traderlion

You May Also Like

I’m torn on how to approach the idea of luck. I’m the first to admit that I am one of the luckiest people on the planet. To be born into a prosperous American family in 1960 with smart parents is to start life on third base. The odds against my very existence are astronomical.

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.