Stan Weinstein's Stage Analysis offers traders a powerful methodology to identify trends in the markets while following strict risk management principles.

1/

First, let's review who Stan Weinstein is and his contributions to the market.

Weinstein is a veteran technical trader who has over 50 years of experience and now works as an advisor for institutional investors.

2/

Stan is well known for authoring "Secrets for Profiting in Bull & Bear Markets" which you can find at the link below.

This book is incredibly well written and gets into the nitty-gritty of his processes in the markets.

https://t.co/VQB2EbDUOU 3/

So, what is Stage Analysis?

Stage Analysis is used to identify the longer-term trend of a stock or index. There are 4 different stages 👇

The Basing Area, Advancing Phase, The Top Area, and Declining Phase.

4/

Stage 1: The Basing Area

This stage occurs at the bottom of a longer term base or during the first primary base a stock forms after it’s IPO.

During this stage the stock is oscillating under a declining 30 week moving average.

5/

🔑 Traits in Stage 1 👇

✅ Buyers and sellers start to balance each other out

✅ There is a volume dry up, signaling major selling has subsided

✅ Volume will start to increase towards the end of the period without significant price concession

6/

Below is an example of $TSLA going from Stage 1 to Stage 2. Note how price was unable to break above the declining 30 week MA, and then did so in a big way on volume. Price would then progress into a sustained Stage 2: Advancing Phase.

7/

Stage 2: Advancing Phase

This is the stage where we should be looking to take long positions in a stock or index. Buyers are now in control and the balance of power is now in line with demand.

8a/

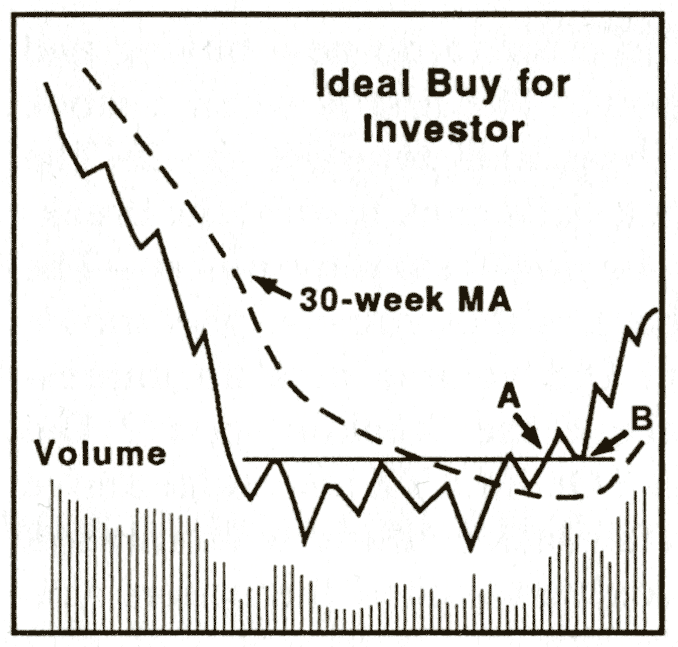

Stage 2: The Ideal Buy Point for Investors

Investors should watch for the first breakout on volume just as the stock begins a new Stage 2 uptrend.

Investors can buy the breakout or the retest of the pivot point.

8b/

Stage 2: The Ideal Buy Point for Traders

Traders should look for bases within an existing Stage 2 uptrend and focus on breakouts on volume.

Intermediate term traders can also use investor buy points.

8c/

🔑 Traits in Stage 2 👇

✅ Breakout above the resistance zone & 30 week MA on big volume

✅ Post initial breakout, there is usually a retest of the breakout point

✅ 30 week MA starts turning up shortly after the breakout

9/

Here is an example of $PTON below 👇

Note how $PTON exhibited all of the key traits we are looking for to start a Stage 2: Advancing Phase.

10/

Here is another example of Stage 2 using $NVDA.

Note how massive volume came into the stock and solidified itself above the 30 week moving average, followed by a retest of the 30 week moving average and subsequent move higher.

11/

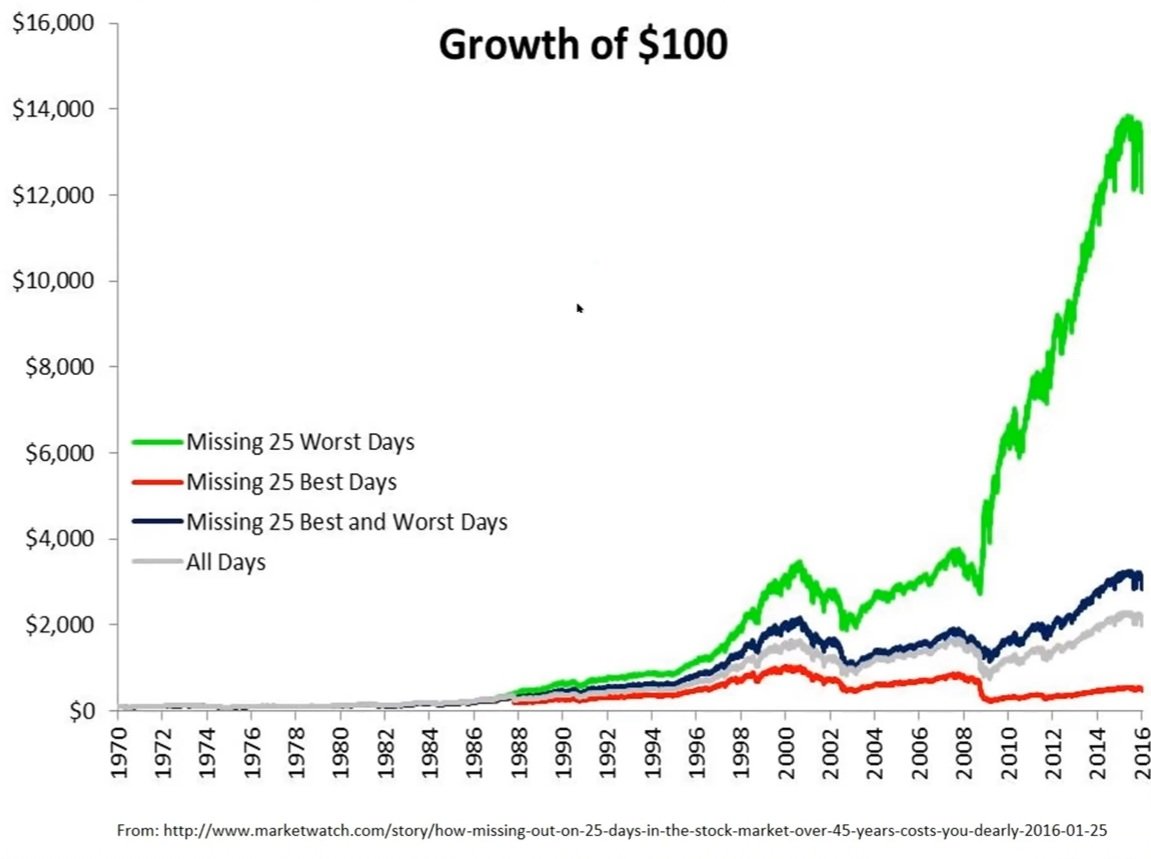

While we want to be focused on stocks moving into Srage 2 uptrends, we want to make sure we are still managing risk along the way. This means we have to ensure we are buying right. and using stop losses.

12/

Stage 3: The Top Area

This stage occurs during longer-term bases in a stock’s lifecycle after a Stage 2 Uptrend. The stock is oscillating up and down around the 30-week moving average, showing there is no clear uptrend but also no clear downtrend.

13/

🔑 Traits in Stage 3 👇

✅ 30 week MA starts flattening out w/ price chopping above & below this line

✅ Balance has returned between buyers & sellers, leading to sideways action

✅ News/earnings are exciting, but we have to wait for a trend

14/

$AMZN is a good example of a chart that had a clear Stage 2 Advance, followed by a Stage 3: The Top Area.

Clearly, buyers were met with equal force from sellers and price oscillated above and below the 30 week moving average.

15/

It is important to understand that not all stocks that go into a Stage 3 rollover and go into a Stage 4: Declining phase.

It is very normal to see many Stage 2's and Stage 3's in a row in a winning stock.

$SHOP is a great example of this ⬇️

16/

Stage 4: The Declining Phase

This stage occurs when sellers take control and outlast the buyers. Price will begin to trend below a declining 30 week moving average.

The big money is lost going/staying long in a Stage 4 decline.

17/

🔑 Traits in Stage 4 👇

✅ Price breaks below the bottom of the support zone

✅ Don't need overwhelming volume to the downside to enter a Stage 4

✅ No matter how the fundamentals appear, the price trend is all that matters

18/

Here is an example of $SPX from 2008.

19/

Here is another example of $CSCO making a Stage 4 decline as well.

20/

Major 🔑

The active trader/investor must take note of the slope of the 30 week moving average. Every time the 30 week moving average flattens itself out, the stock is set to make a trend decision.

Be ready to act if it enters either a Stage 2 or Stage 4.

21/

The trend of the weekly chart and the Stage a stock is in reveal the net accumulation/distribution by institutions. This price trend is looking at the future expectations of earnings and regardless of the current fundamentals must be respected.

22/

For more information on Stage Analysis learn from our interview with Stan himself!

👇

https://t.co/9BvJpXJ52m

Also be sure to check out our video featuring

@richardmoglen covered the concept and going through examples.

👇

https://t.co/itFdReYCRE

@RichardMoglen If you enjoyed this thread make sure to retweet and check out our FREE weekly newsletter.

⬇️⬇️⬇️

https://t.co/Q9MjxVAAgL