Mark Zuckerberg on NYT story: "To suggest we weren't interested in knowing the truth or wanted to hide what we knew or wanted to prevent investigations is simply untrue."

The entire discussion around Facebook\u2019s disclosures of what happened in 2016 is very frustrating. No exec stopped any investigations, but there were a lot of heated discussions about what to publish and when. https://t.co/dSOpKy767l

— Alex Stamos (@alexstamos) November 15, 2018

Why isn\u2019t Sheryl Sandberg on this call?

— Dylan Byers (@DylanByers) November 15, 2018

Zuckerberg: Blah blah. I generally don't talk about specific cases of that in public. Blah blah.

Zuckerberg: I learned about this yesterday. In general, I think you're right. This might be normal in Washington but it's not the kind of thing we want Facebook associated with.

Facebook: ... We are bringing the world closer together.

Zuckerberg: We have made personnel changes. Hey, we just hired a new global policy and comms chief. Let's focus on that.

"I am quite focused on finding ways to get more independence into our systems in other ways."

Zuckerberg: Transparency is one of the bigger areas where we have to continue to do more.

Zuckerberg: "I think someone on our comms team must have hired them."

Comms team, meet the bus that just ran you over.

Worthwhile to read through this whole thread of Stamos replying to our report: https://t.co/0QXNjU0waB

— Sheera Frenkel (@sheeraf) November 15, 2018

Zuckerberg: Sheryl learned about this at the same time that I did. Overall Sheryl is doing great work for the company. She has been a very important partner to me and will continue to be.

Mark Zuckerberg: I have no idea what's happening inside my own company and neither does Sheryl.

Zuckerberg: We are doing the right things to fix the issues. I am fully committed to getting this right.

More from Tech

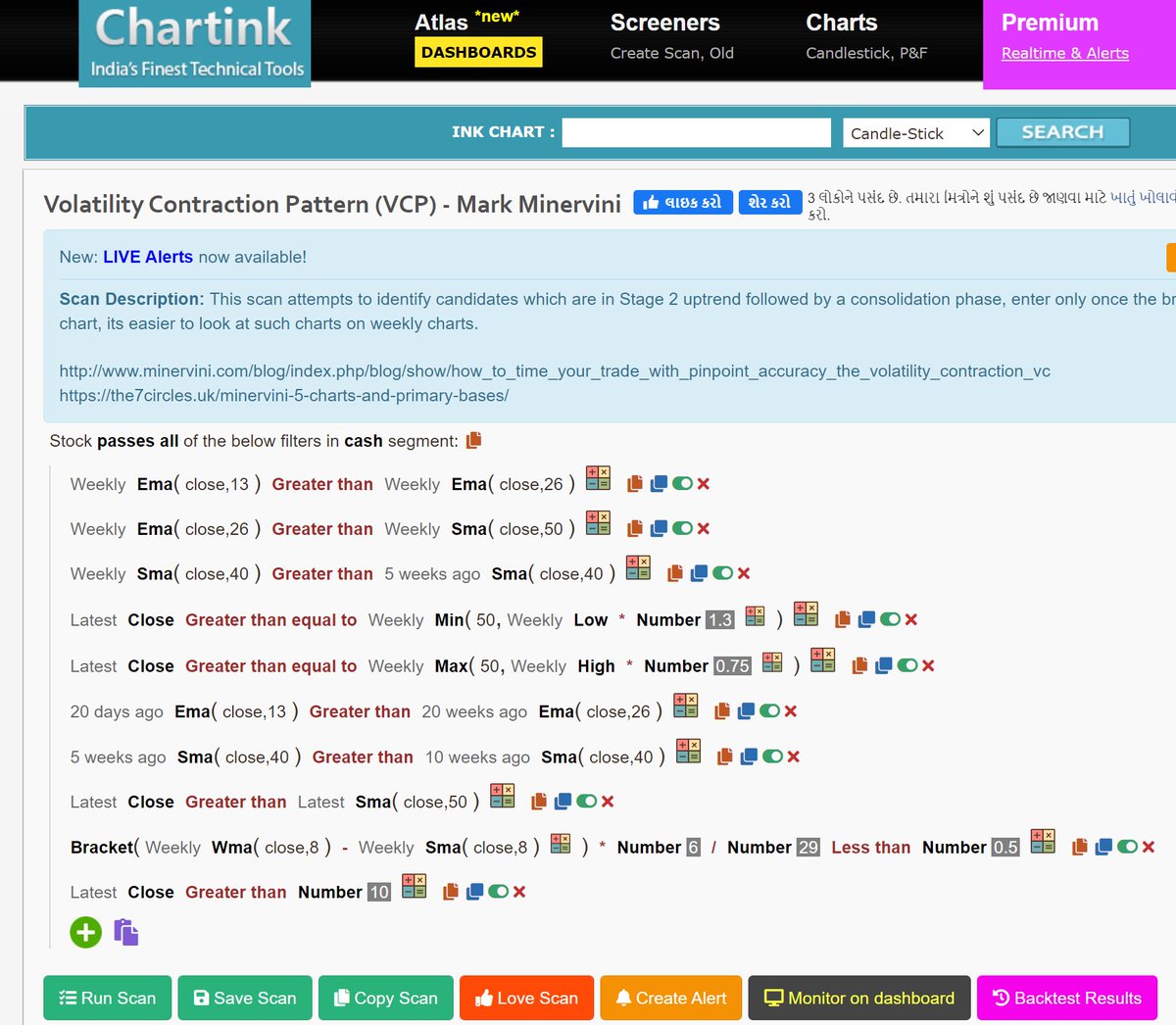

@MadhusudanKela @VQIndia @sameervq

My key learnings: ⬇️⬇️⬇️

Bubble or Bull Market? Join us for a short presentation and candid one on one on 27th Jan, 4pm with Shri \u2066@MadhusudanKela\u2069. \u2066@VQIndia\u2069 \u2066@sameervq\u2069 #bubbleorbullmarket pic.twitter.com/LBvlBrz6mS

— Ravi Dharamshi (@ravidharamshi77) January 24, 2021

First, the BEAR case:

1. Bitcoin has surpassed all the bubbles of the last 45 years in extent that includes Gold, Nikkei, dotcom bubble.

2. Cyclically adjusted PE ratio for S&P 500 almost at 1929 (The Great Depression) peaks, at highest levels except the dotcom crisis in 2000.

3. World market cap to GDP ratio presently at 124% vs last 5 years average of 92% & last 10 years average of 85%.

US market cap to GDP nearing 200%.

4. Bitcoin (as an asset class) has moved to the 3rd place in terms of price gains in preceding 3 years before peak (900%); 1st was Tulip bubble in 17th century (rising 2200%).

You May Also Like

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.