One segment I have been absolutely upbeat is IT/Tech. Tech has always been the hidden moat for many companies - AP/BFL to name a few. Tech is no longer a vertical in market. It has become horizontal that cuts across every single vertical.

More from Ameya

Time to update reading on #tataelxsi. Note where the last fall was supported. Perfectly near the previous arc BO level. We will make some retracements here & there but now seems to be going for 10391. 3rd arc formation in process & looks very similar to the previous one https://t.co/KwBFN6fkKk

This is line chart based arc I plotted a few days ago to see where does the target of 2nd arc completes. We got ~9200(+/- 100/-) Switch to candles. See rejection area. Arc on candles is not really ideal but on line it is. No view above 9200! MAs need to catch up. #TATAELXSI pic.twitter.com/WNJRZZedrj

— Ameya (@Finstor85) March 30, 2022

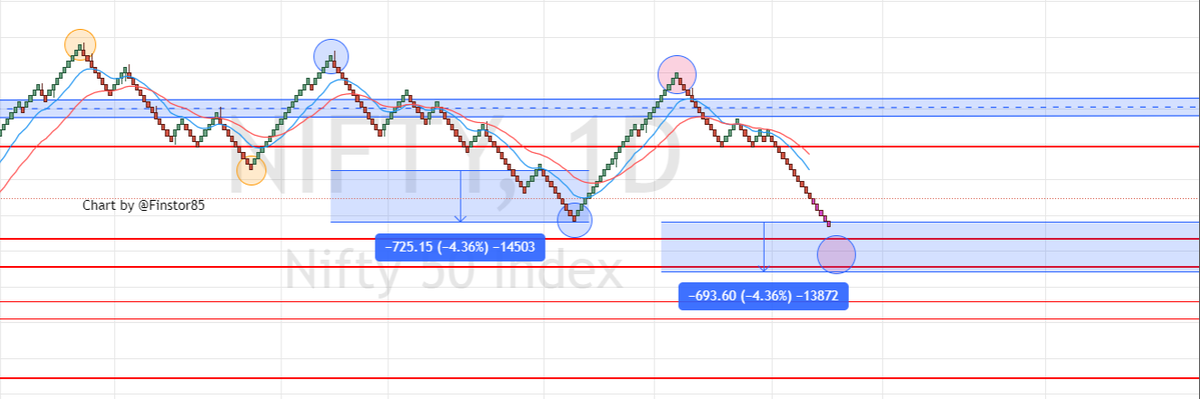

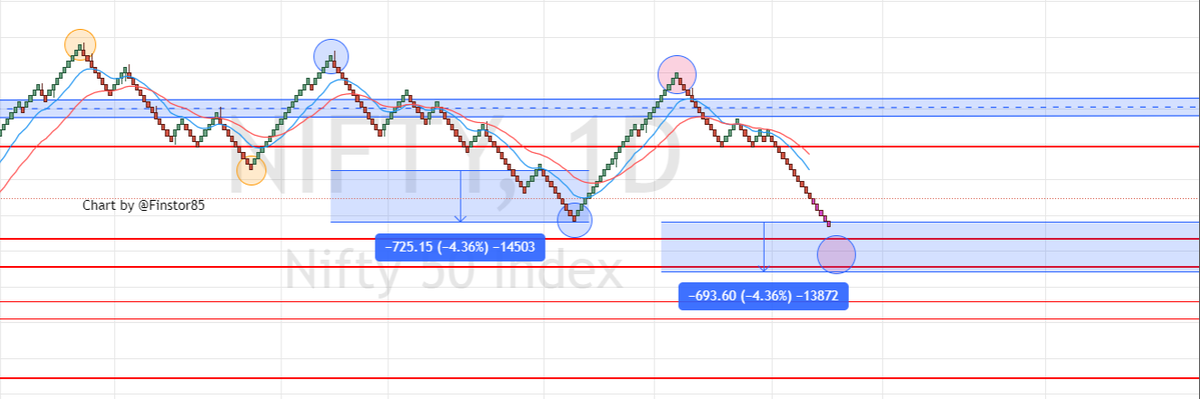

and we are in the range now! 15282 is the low of the range. I start buying between 15666-15282. Big Q is, will we stop in the range & reverse? Honestly, I don't know. All I know is range is here, deserves some allocation in core conviction ideas. #niftymasterchart https://t.co/RXuJb0dTWi

If we are to continue LH-LL setup & break 16666 on daily we will finally complete this drag near 15214. I am not bearish. In fact, this should give amazing opportunity to buy. Until then 16666-17300 continue to provide L-H range for traders. pic.twitter.com/tfIq00VJmZ

— Ameya (@Finstor85) May 2, 2022

More from Tech

The entire discussion around Facebook’s disclosures of what happened in 2016 is very frustrating. No exec stopped any investigations, but there were a lot of heated discussions about what to publish and when.

In the spring and summer of 2016, as reported by the Times, activity we traced to GRU was reported to the FBI. This was the standard model of interaction companies used for nation-state attacks against likely US targeted.

In the Spring of 2017, after a deep dive into the Fake News phenomena, the security team wanted to publish an update that covered what we had learned. At this point, we didn’t have any advertising content or the big IRA cluster, but we did know about the GRU model.

This report when through dozens of edits as different equities were represented. I did not have any meetings with Sheryl on the paper, but I can’t speak to whether she was in the loop with my higher-ups.

In the end, the difficult question of attribution was settled by us pointing to the DNI report instead of saying Russia or GRU directly. In my pre-briefs with members of Congress, I made it clear that we believed this action was GRU.

The story doesn\u2019t say you were told not to... it says you did so without approval and they tried to obfuscate what you found. Is that true?

— Sarah Frier (@sarahfrier) November 15, 2018

In the spring and summer of 2016, as reported by the Times, activity we traced to GRU was reported to the FBI. This was the standard model of interaction companies used for nation-state attacks against likely US targeted.

In the Spring of 2017, after a deep dive into the Fake News phenomena, the security team wanted to publish an update that covered what we had learned. At this point, we didn’t have any advertising content or the big IRA cluster, but we did know about the GRU model.

This report when through dozens of edits as different equities were represented. I did not have any meetings with Sheryl on the paper, but I can’t speak to whether she was in the loop with my higher-ups.

In the end, the difficult question of attribution was settled by us pointing to the DNI report instead of saying Russia or GRU directly. In my pre-briefs with members of Congress, I made it clear that we believed this action was GRU.

BREAKING: @CommonsCMS @DamianCollins just released previously sealed #Six4Three @Facebook documents:

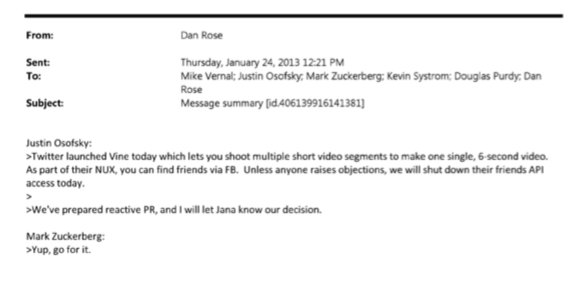

Some random interesting tidbits:

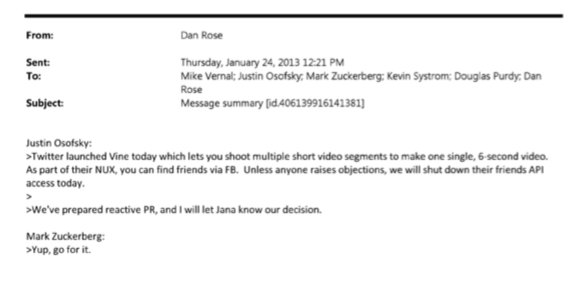

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

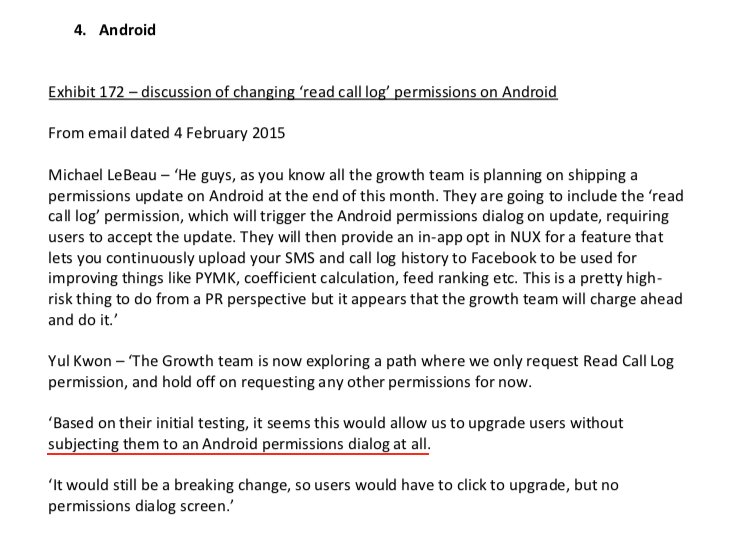

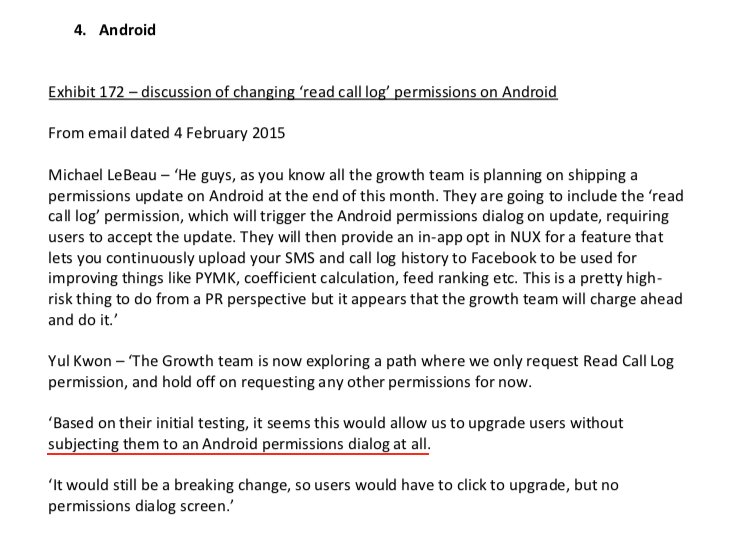

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

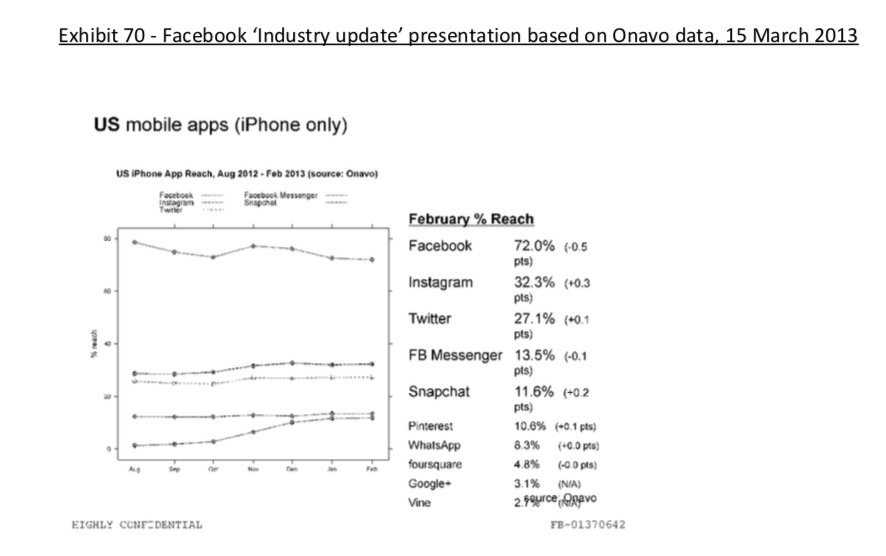

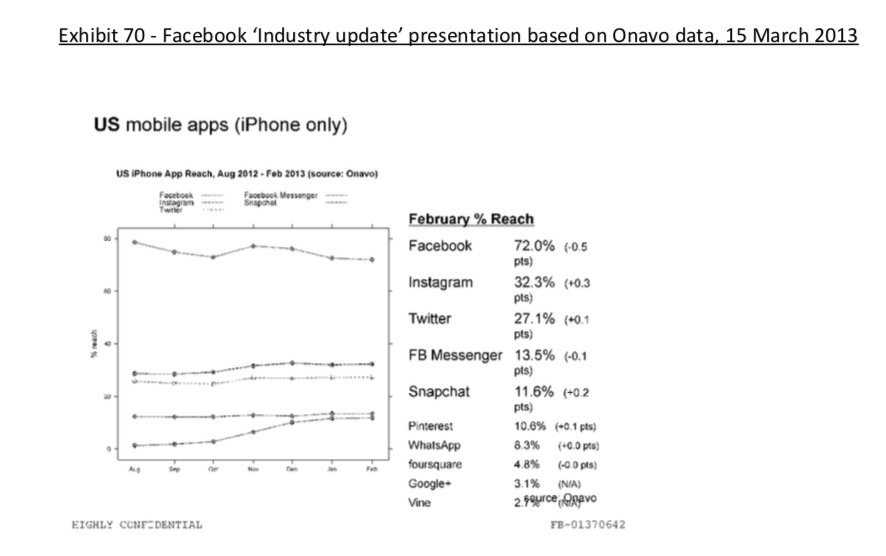

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x

Some random interesting tidbits:

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x