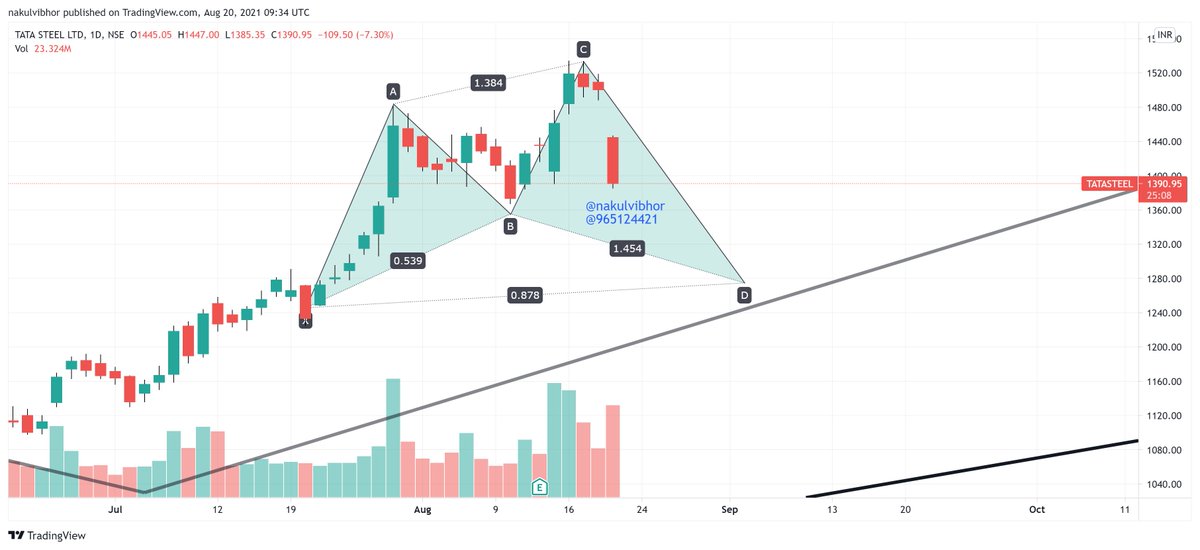

#TataSteel 1st target is done, 1481 is the high posted till now. Marching well towards 1600 now.

#TataSteel #NiftyMetal #StockToWatch

— Team MD&ABN (@team_md_abn) July 7, 2021

CMP - 1224.80

Buy range - 1190-1200

Upside Possible Levels

Conservative - 1395

Aggressive - 1600

The view will be invalid if closes below 1129 pic.twitter.com/e6MabwG9YI

More from Team MD&ABN

#Radico reached our 1st target and is trading at 870 now.

@MD_ABNSTOCKS

@MD_ABNSTOCKS

#Radico #StockToWatch #Stock #Equity #StockMarket

— Team MD&ABN (@team_md_abn) July 10, 2021

CMP - 779

Entry - once price closes above 783 in the hourly chart

Pattern invalid below - 736.50

Possible upside Levels

Conservative - 866

Aggressive - 944@caniravkaria pic.twitter.com/6xD7oywkNC

#DeepakNtr From 1875 to 2076 till now.. Marching well towards 2355.

@MD_ABNSTOCKS

@MD_ABNSTOCKS

#DeepakNtr #StockToWatch

— Team MD&ABN (@team_md_abn) July 5, 2021

Entry - any dip towards 1875 is a buy

A counter will become weak if it closes below 1710 in a daily time frame.

A possible upside level is 2355 pic.twitter.com/IPlHPvBXFI