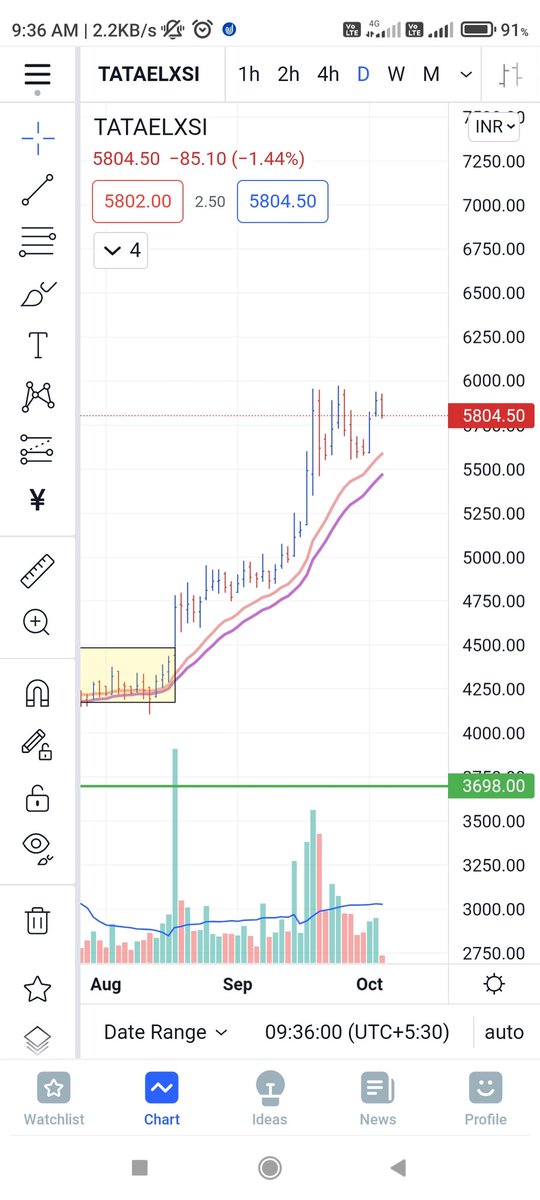

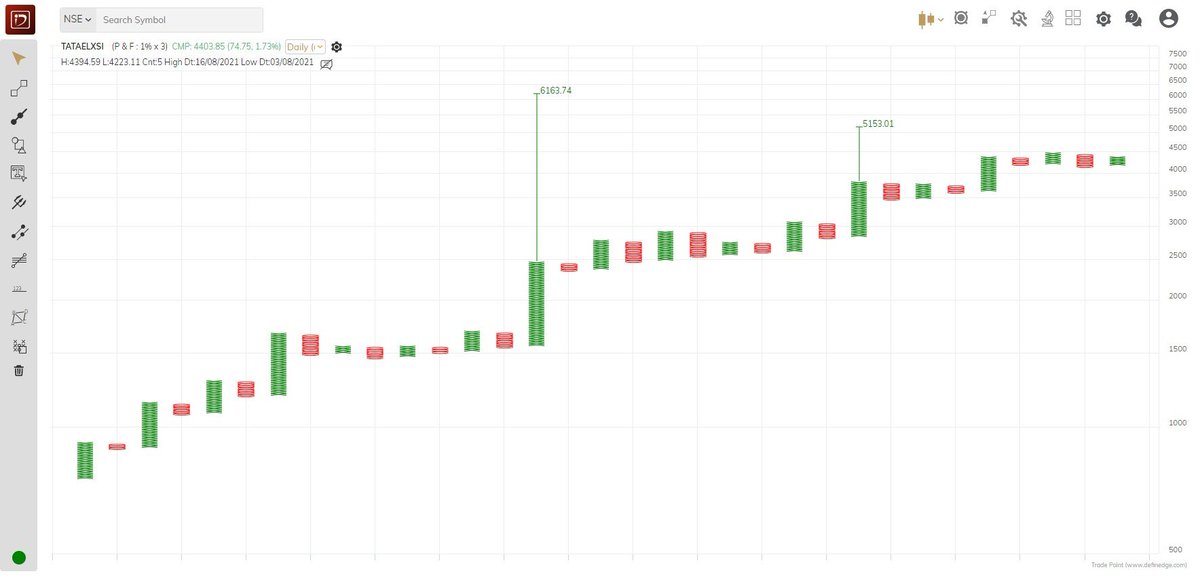

Tata Elxsi - DTB active after close above 4527.75 https://t.co/rO4f8hkPFF

Tata Elxsi - Daily I track this chart and waiting for a big kill in this. You have to act like a cheetah sometimes waiting for the weakest hit.

— The_Chartist \U0001f4c8 (@nison_steve) August 10, 2021

There are times when you must sit patiently to catch your prey. pic.twitter.com/CRoBHIetHE

More from The_Chartist 📈

Tata Elxsi (W) - near to the resistance zone again 5th time. @nishkumar1977 @suru27 @rohanshah619 @indian_stockss @sanstocktrader @BissaGauravB @RajarshitaS @PAVLeader @Rishikesh_ADX @VijayThk @Investor_Mohit @TrendTrader85 @jitendra_stock pic.twitter.com/aIC5kO8XqA

— Steve Nison (@nison_steve) December 18, 2020

It is important to analyse the strength of the breakout. If the price does not continues the move in 1 or 2 sessions and candles show long upper wicks, it is better to bring the SL closer. Distribution sign.

Will be helpful in next breakouts. https://t.co/AtZOj4bKeT

Learning: Strong breakout

— The_Chartist \U0001f4c8 (@nison_steve) July 2, 2021

1. Breakout candle will have no upper shadow or extremely less compared to the body

2. Volumes will be high (to avoid retailers to enter & also big hand absorbing all the selling)

3. Pullbacks will be rare/very less

4. Happens after a long consolidation pic.twitter.com/YTHDOnEdxo

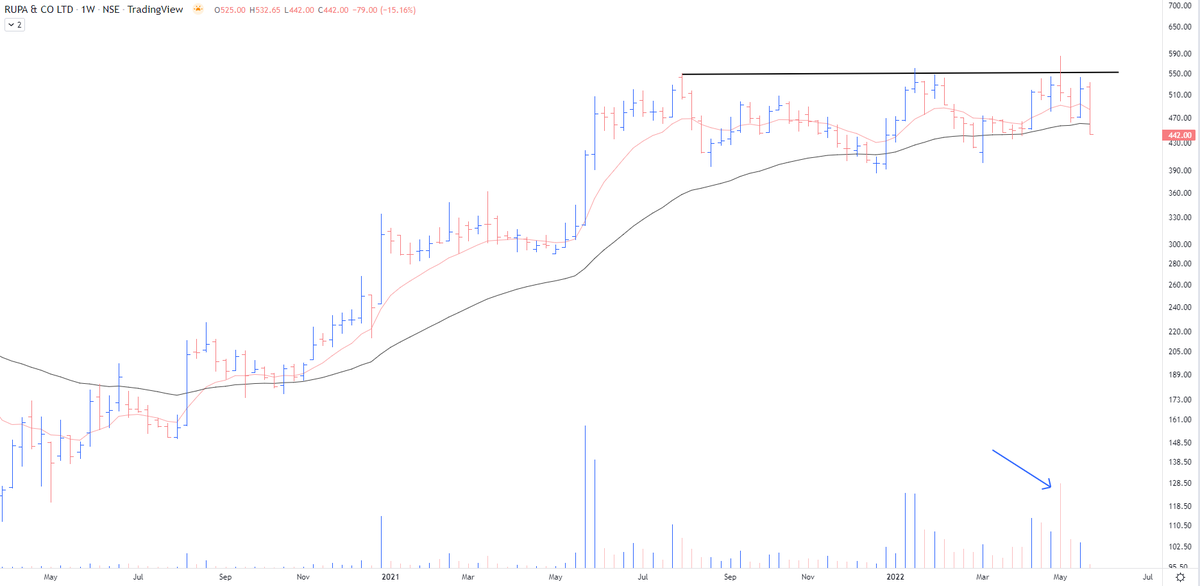

Fresh case - RUPA https://t.co/nqq5nI1wLU

Respect your stop losses in the stocks that have gone down today with heavy volumes even on a strong day.

— The_Chartist \U0001f4c8 (@charts_zone) March 17, 2022

VTL pic.twitter.com/3pJ9XngCDL

USDINR - a breakout that will not bode well for the equities

78+ https://t.co/AWqZxF5B1L

Can you anticipate a breakout? Yes

— The_Chartist \U0001f4c8 (@charts_zone) June 10, 2022

the attached tweet.

now the chart is for USDINR https://t.co/Vb2wKaCvTB pic.twitter.com/INo0GC4fGY

More from Tataelxsi

Sir tata elxsi??

— NITISH KUMAR OJHA (@nkoiiiiiii) October 1, 2021