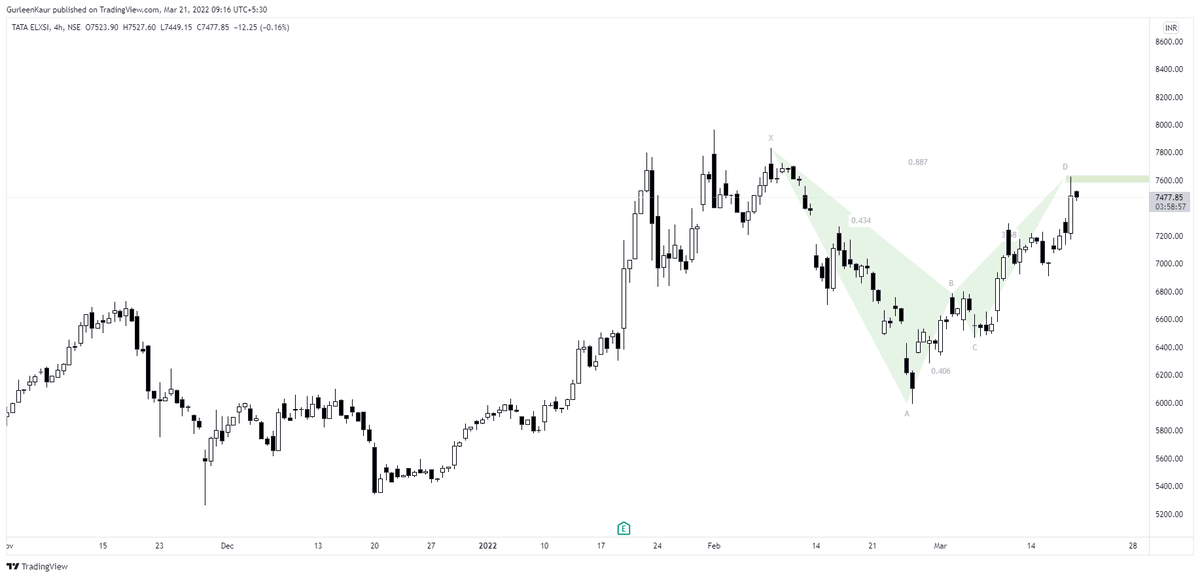

#TATAELXSI Weekly

A simple setup set towards breaking out in to the uncharted territory above 4373.20

#StockMarket #StocksInFocus

More from Gurleen

Midway resistances held up strong.

Once these are breached, It is poised for more towards 1950 followed by 2000.

#StockMarket #StocksInFocus https://t.co/kswtnvjQM8

#KOTAKBANK

— Gurleen (@GurleenKaur_19) August 8, 2021

In daily; Trendline breakout along with price volume action.

Resistances midway at 1812.70 and 1856.75.

Once these are breached, It is poised for more towards 1950 followed by 2000.

In weekly as well; Setup looks quite bullish. #StockMarket #StocksToTrade pic.twitter.com/vfIjR7MuCE

Into a narrow consolidation band post breakout.

Sustained above the zone, Target's intact.

#StockMarket #StocksInFocus https://t.co/lhfemwd4iQ

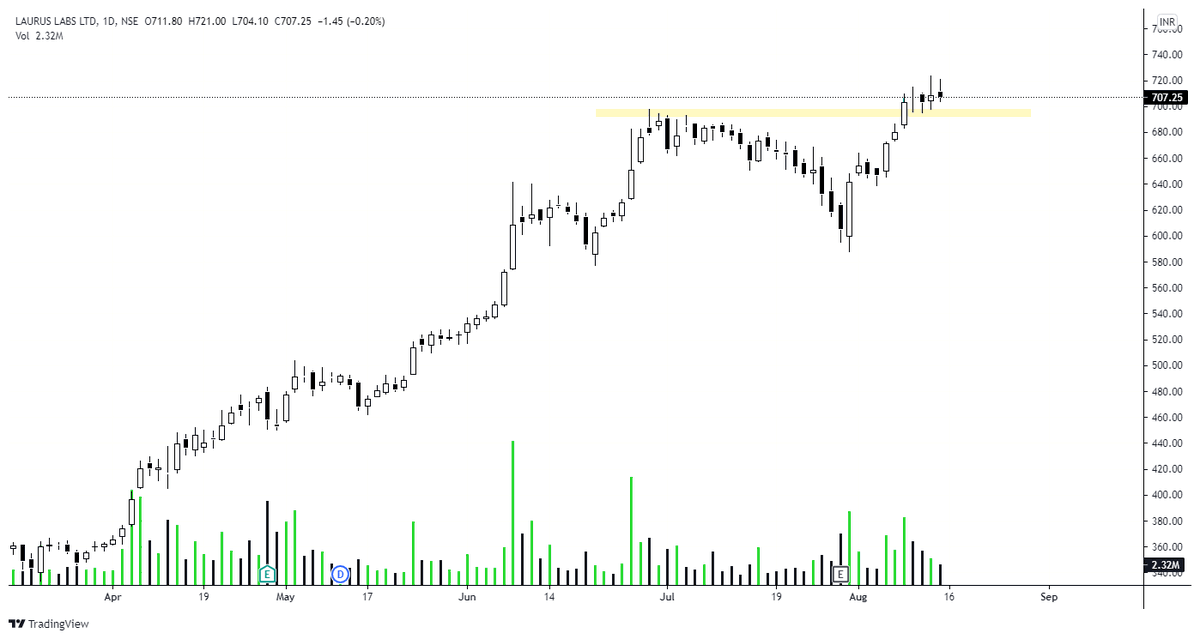

#LAURUSLABS Multiple TF Analysis

— Gurleen (@GurleenKaur_19) August 9, 2021

A break-through at ATH.

Sustenance above 698 and a breakout at 705.85 would bring in higher targets of 733 followed by 800 in short term. #StockMarket #StocksToWatch pic.twitter.com/2aaY3BG99D

More from Tataelxsi

#stockmarket #investing

Invest in companies where you have conviction to stay invested due to your own reasons. No use trying to investing in everything and anything. #TataElxsi #investors https://t.co/KM2W83OI51 pic.twitter.com/pUElD6Mdb3

— Gopal Kavalireddi (@gvkreddi) December 28, 2020

You May Also Like

As a dean of a major academic institution, I could not have said this. But I will now. Requiring such statements in applications for appointments and promotions is an affront to academic freedom, and diminishes the true value of diversity, equity of inclusion by trivializing it. https://t.co/NfcI5VLODi

— Jeffrey Flier (@jflier) November 10, 2018

We know that elite institutions like the one Flier was in (partial) charge of rely on irrelevant status markers like private school education, whiteness, legacy, and ability to charm an old white guy at an interview.

Harvard's discriminatory policies are becoming increasingly well known, across the political spectrum (see, e.g., the recent lawsuit on discrimination against East Asian applications.)

It's refreshing to hear a senior administrator admits to personally opposing policies that attempt to remedy these basic flaws. These are flaws that harm his institution's ability to do cutting-edge research and to serve the public.

Harvard is being eclipsed by institutions that have different ideas about how to run a 21st Century institution. Stanford, for one; the UC system; the "public Ivys".

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0