Categories Stockslearnings

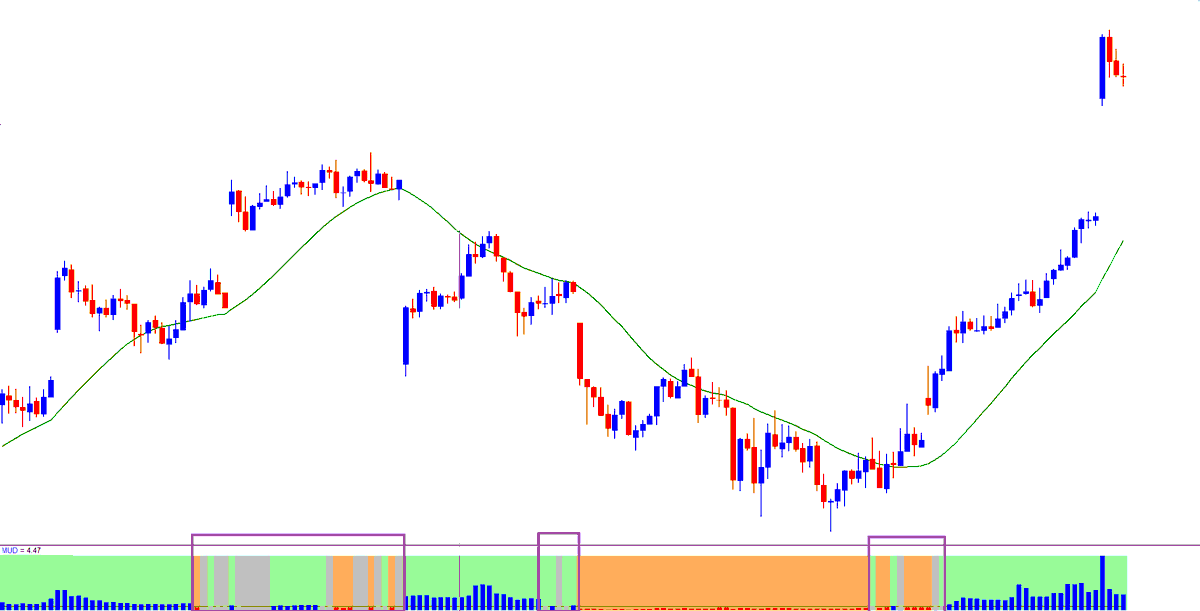

U can guage the strength in the trend once u know how to measure the direction.

This trend strength is infact signals the trend continuity or the potetnial for sustanining the trend.

Thats great assurace to hav https://t.co/HanLvlXkjQ

Before making ur trade entry or even before making a bias of trend as either bullish or bearish, do u use any objective measures to define the trend based on price, volume and momentum?

— Aneesh Philomina Antony (@ProdigalTrader) May 15, 2021

Price will always go back and forth move no matter how strong the trend is.

1/4 pic.twitter.com/qqizh2JO3J

Compelled to take down notes from this very interesting talk by @SamitVartak and share with the Investing community. Was introduced to this gentleman by @ishmohit1 - Thanks !!https://t.co/bCfjfNBWO1

— Mouzam (@mmali09) July 18, 2021

Highly recommended to watch it.

\u267b\ufe0fRetweet to if you find my notes useful https://t.co/3zZ9qCf90z pic.twitter.com/LGjoJDaJsT

• Lessons learned from Trading Mistakes

• Moneycontrol article on a pro option seller

• Rakesh Jhunjhunwala investing strategy.

• What do you really need?

• Stocks to invest for long term

A thread 🧵

Best Trading books to read - check the comments section for some great

What's the best trading book you've ever read?

— Steve Burns (@SJosephBurns) September 30, 2021

Lessons learned from some trading

Trading Mistakes & Lessons Learnt \U0001f9f5

— Sourabh Sisodiya, CFA (@sourabhsiso19) September 30, 2021

1) I always keep my mistakes & lessons learnt in front of my screen while trading.

Bcz we as traders tend to commit the same mistakes everytime.

So seeing your learnt lessons everyday ensures that you avoid them.

#trading #mistakes pic.twitter.com/4MYFlCS9Hi

In spite of being rejected in many things, we can still be

I had been rejected many times in my life few are:

— ASAN (@Atulsingh_asan) September 30, 2021

-I was Rejected in a BPO job interview 2006

-I was Rejected in Indian Idol 2011

But Market accepted me as a student since 2013 and journey on

Don\u2019t lose hope when you rejected by someone, keep trying you will succeed.#ASAN

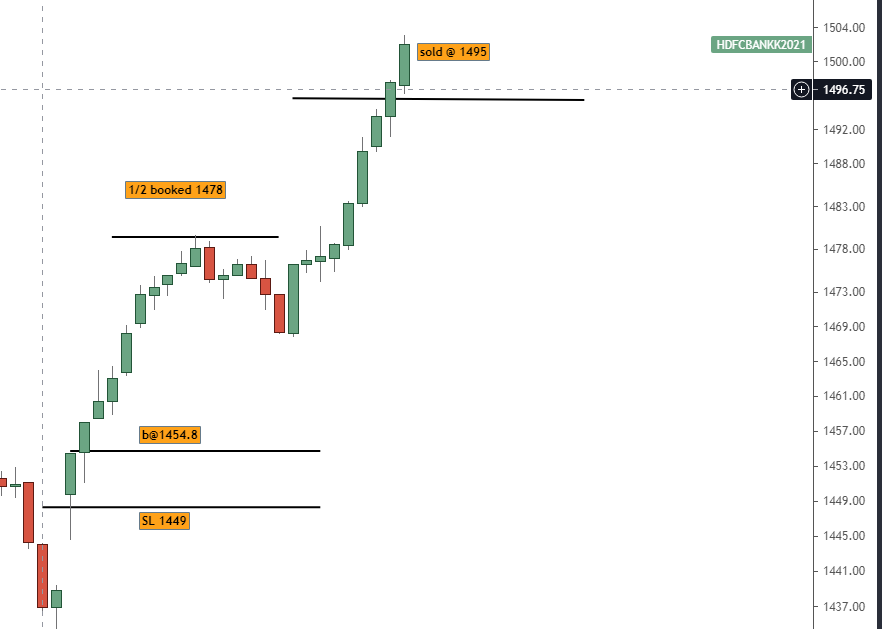

Moneycontrol article on @Pathik_Trader to learn how to trade breakouts with good risk management & position

Small article on my trading journey covered by Shishir in moneycontrol. Thanks a lot shishir.\U0001f942\U0001f942

— Pathik (@Pathik_Trader) September 27, 2021

It's kind of dream come true moment. \U0001f60d\U0001f942

Thank you everyone for inspiration & support. Special thanks to @sanstocktrader@Stockengg @VRtrendfollower\U0001f942\U0001f942https://t.co/0fk2gpd1qv

Market PE at 40 and yet the market is not falling, why? Getting asked this question multiple times. Here's a thread covering \u2018very basic\u2019 premier on valuation for my retail investor friends.

— Kirtan A Shah (@KirtanShahCFP) January 14, 2021

Do hit the \u2018re-tweet\u2019 and help us educate more investors (1/n) pic.twitter.com/8oCkBmmOXY

Friends,

— Pankaj DP (@voPAtrader) May 8, 2021

I am planning to write Stock mkt related thread (/writeup) on..

WHY STUFF WORK?

E.g. Why prior Support acts as Resistance?

If u have such questions related to Data/ TA, DM me. If possible, I shall incorporate reasoning for that as well.....#learning #stocks

On this auspicious day of #GuruPoornima2020

— \u03b1\u043c\u03b9\u0442\u0442 \u0455\u03b1\u03b9\u03b7\u03b9 \U0001f1ee\U0001f1f3 (@heartwon) July 5, 2020

Would like to present a simple yet effective way of understanding and following the TREND of the instrument/stock.

Q: Why I came up with the concept?

A: I wanted to remove noise, keep my chart simple where just a glance, tells the story