....

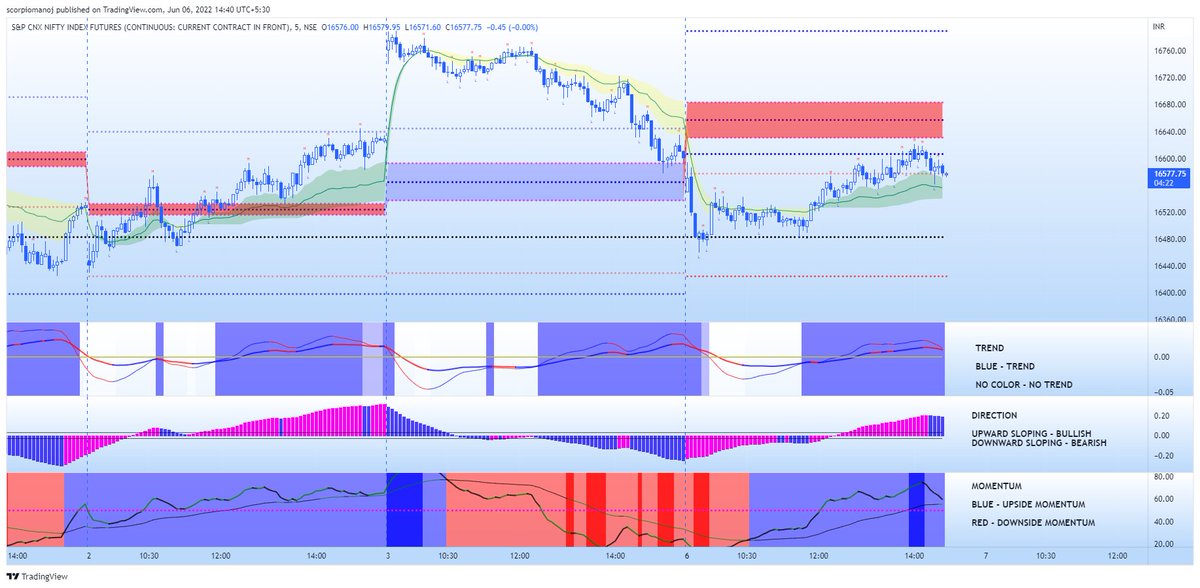

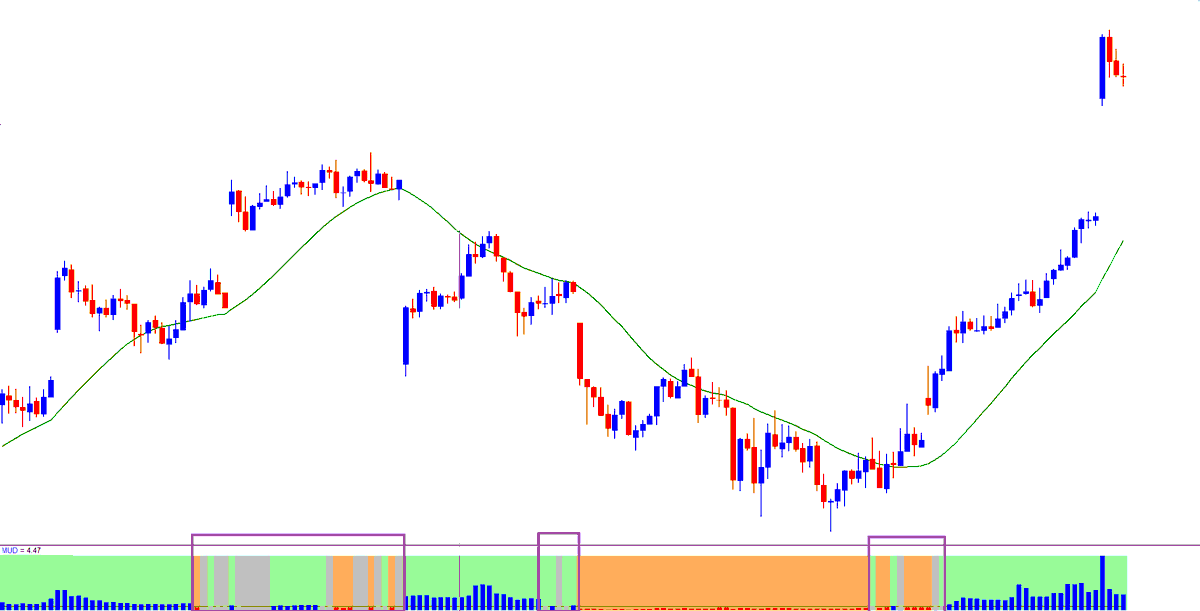

3) Take a note book and right down against each stock, the behaviour of MAs Vis a vis the stock, for eg., 30 week MA / daily 200 ma / 150 ma, 50 ma, etc.); the behaviour of Relative Strength (RS); behaviour in terms of volume; any pattern like rectangular breakout etc.

...

....

4) Might take 3 plus hours for the above exercise. Once you are done, see the common elements against all stocks. That is the edge you have knowing the behaviour of super performance stocks. U need not hold for 400%. U can atleast get 20% out of it.

....

...

5) A eg. is -- few of the stocks had 3 year rectangular breakouts with RS at new high / 52w high. This is just an example. Dont immediately look for only this criteria. I can help you out with a list of triple digit stocks in excess of 400% over last 1 year.

GoodLuck.