More from Colibri Trader

More from Stockslearnings

• Lessons learned from Trading Mistakes

• Moneycontrol article on a pro option seller

• Rakesh Jhunjhunwala investing strategy.

• What do you really need?

• Stocks to invest for long term

A thread 🧵

Best Trading books to read - check the comments section for some great

What's the best trading book you've ever read?

— Steve Burns (@SJosephBurns) September 30, 2021

Lessons learned from some trading

Trading Mistakes & Lessons Learnt \U0001f9f5

— Sourabh Sisodiya, CFA (@sourabhsiso19) September 30, 2021

1) I always keep my mistakes & lessons learnt in front of my screen while trading.

Bcz we as traders tend to commit the same mistakes everytime.

So seeing your learnt lessons everyday ensures that you avoid them.

#trading #mistakes pic.twitter.com/4MYFlCS9Hi

In spite of being rejected in many things, we can still be

I had been rejected many times in my life few are:

— ASAN (@Atulsingh_asan) September 30, 2021

-I was Rejected in a BPO job interview 2006

-I was Rejected in Indian Idol 2011

But Market accepted me as a student since 2013 and journey on

Don\u2019t lose hope when you rejected by someone, keep trying you will succeed.#ASAN

Moneycontrol article on @Pathik_Trader to learn how to trade breakouts with good risk management & position

Small article on my trading journey covered by Shishir in moneycontrol. Thanks a lot shishir.\U0001f942\U0001f942

— Pathik (@Pathik_Trader) September 27, 2021

It's kind of dream come true moment. \U0001f60d\U0001f942

Thank you everyone for inspiration & support. Special thanks to @sanstocktrader@Stockengg @VRtrendfollower\U0001f942\U0001f942https://t.co/0fk2gpd1qv

You May Also Like

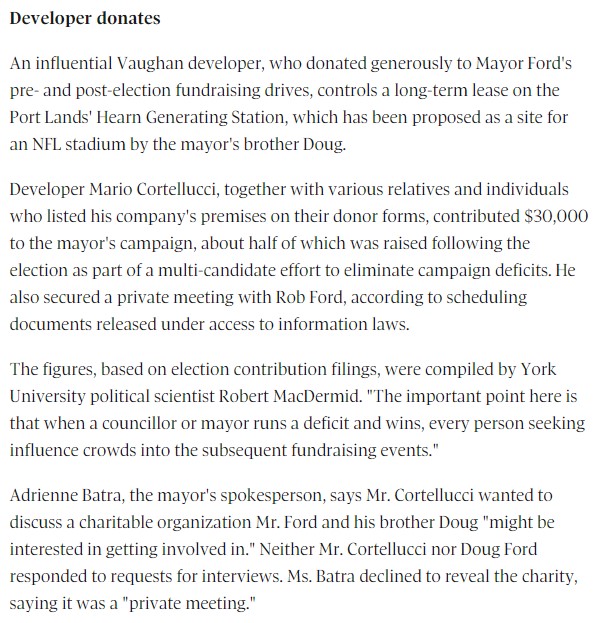

his name might sound familiar because the new cortellucci vaughan hospital at mackenzie health, the one doug ford has been touting lately as a covid-centric facility, is named after him and his family

but his name also pops up in a LOT of other ford projects. for instance - he controls the long term lease on big parts of toronto's portlands... where doug ford once proposed building an nfl stadium and monorail... https://t.co/weOMJ51bVF

cortellucci, who is a developer, also owns a large chunk of the greenbelt. doug ford's desire to develop the greenbelt has been

and late last year he rolled back the mandate of conservation authorities there, prompting the resignations of several members of the greenbelt advisory

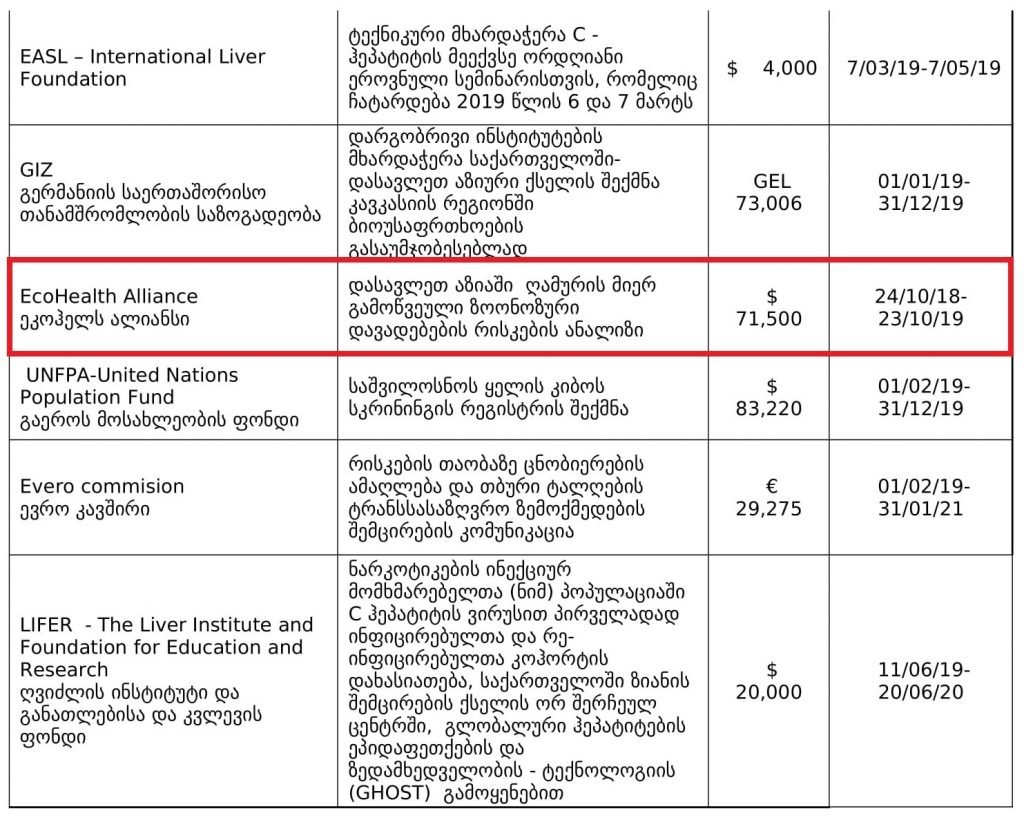

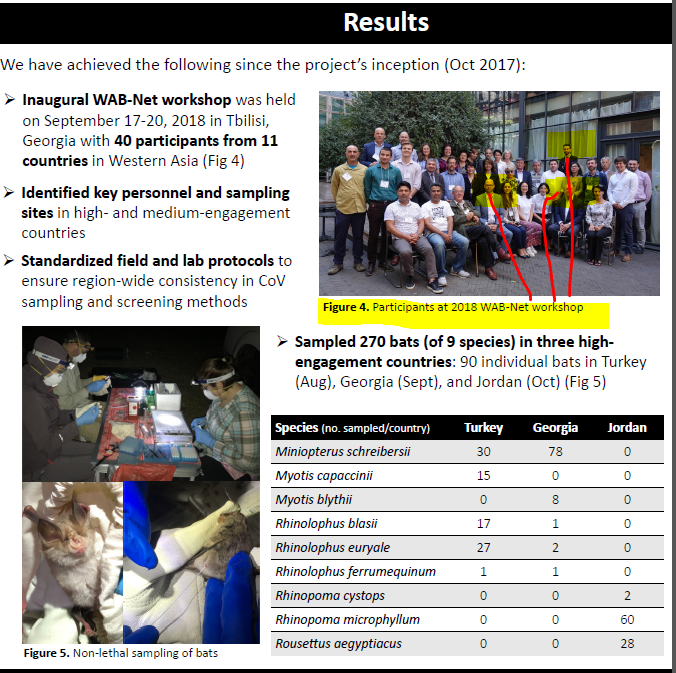

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

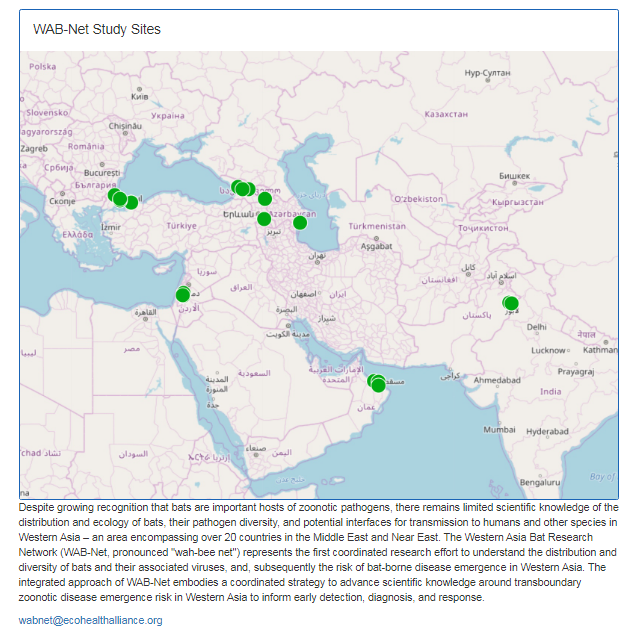

3. EcoHealth Alliance & DTRA Asking for Trouble

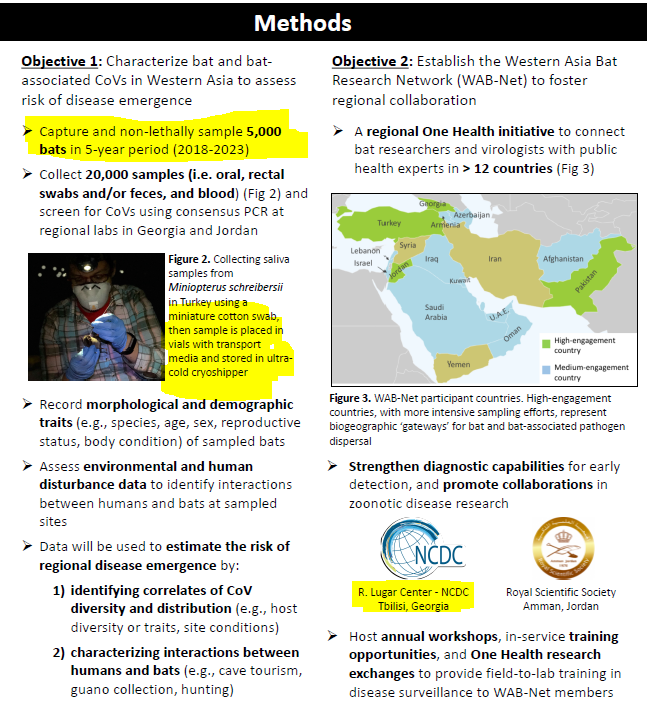

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)