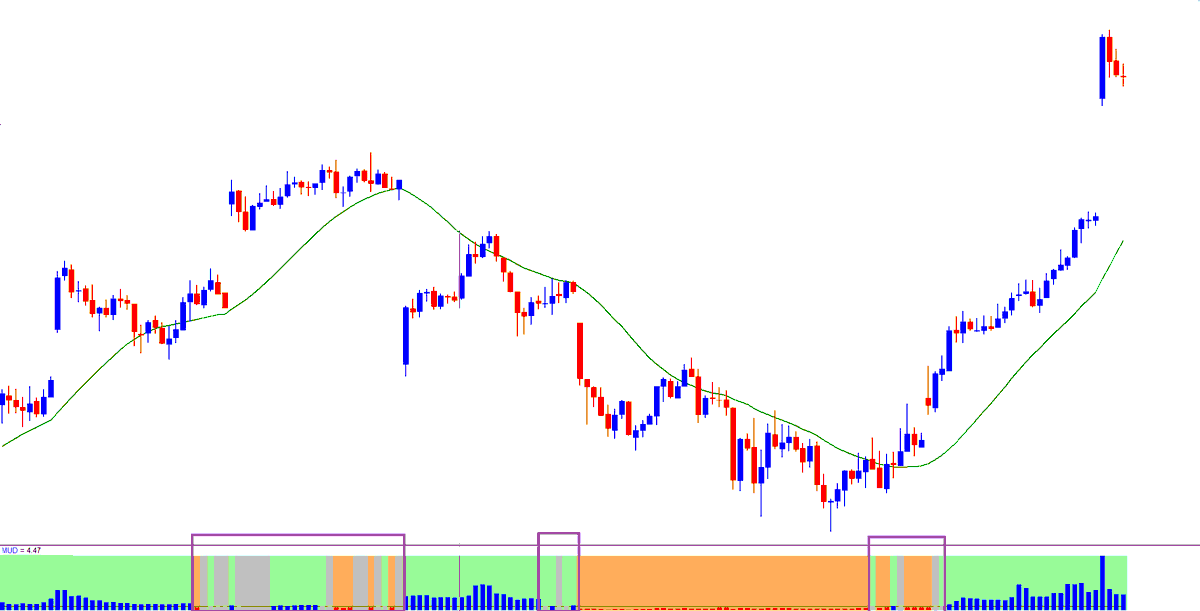

Long setup:

Trading a reversal using 3 bar Price Action

1. Bar 1 closes lower (Red)

2. Bar 2 closes below Bar 1 (Red)

3. Bar 3 closes above the high of both Bar 1 & Bar 2 (Green)

4. Buy at the close of bar 3

5. SL is low of Bar 3 & Trail SL

6. Decide position size as per risk

More from yashstocks

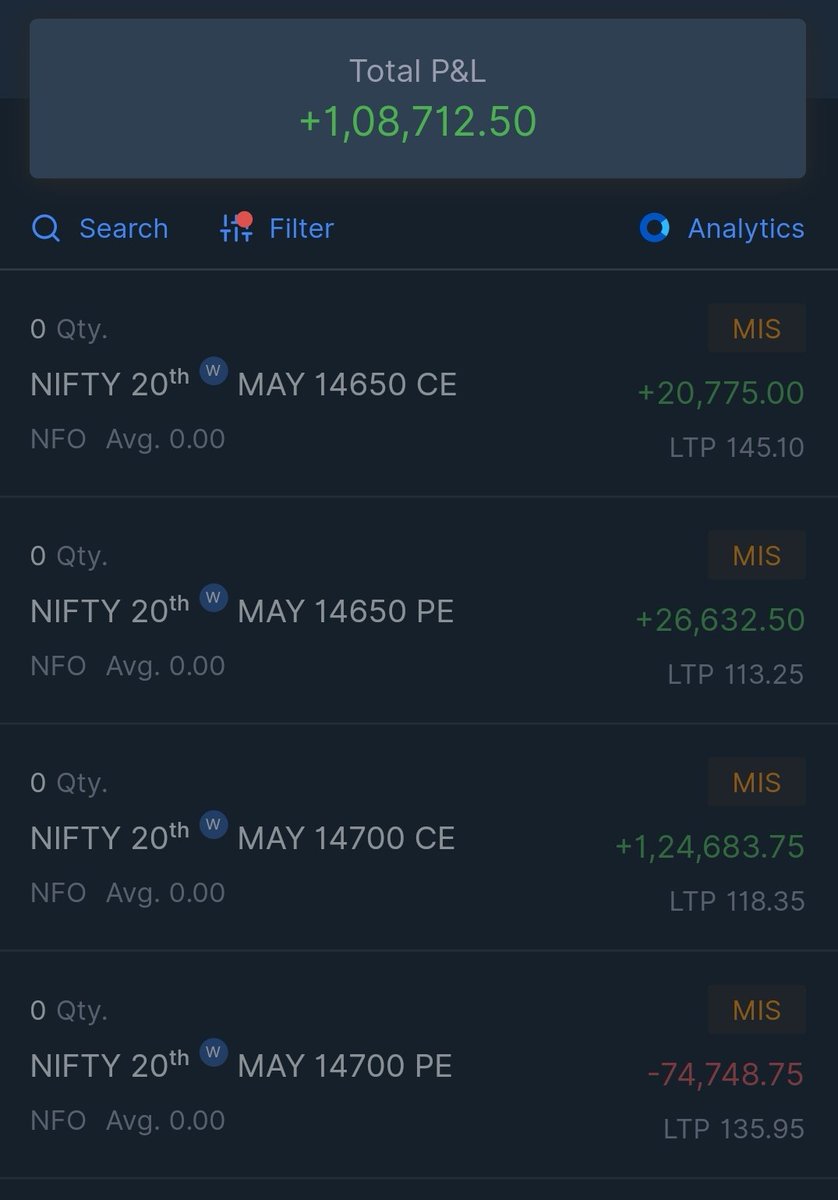

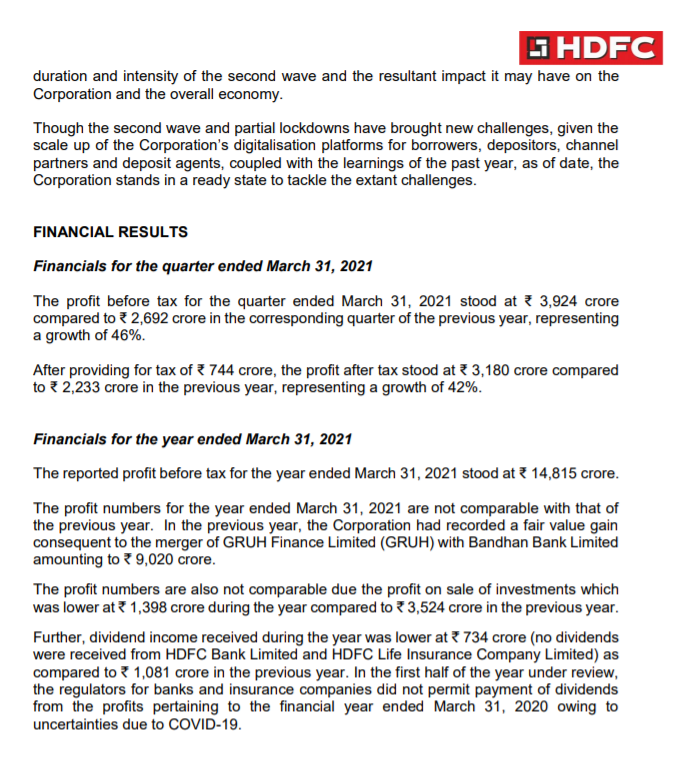

12 to 15% is easily achievable nowadays without taking much risk even though the capital is 10 crores due to leverage :)

Invest 10 crore in liquid, debt, gilt, T-bills, 10-20% equity that will give 6 to 7% average returns every year.

What kind of % return in a year is considered very best with capital more than 10 cr?

— Mitesh Patel (@Mitesh_Engr) October 12, 2021

(2/4)

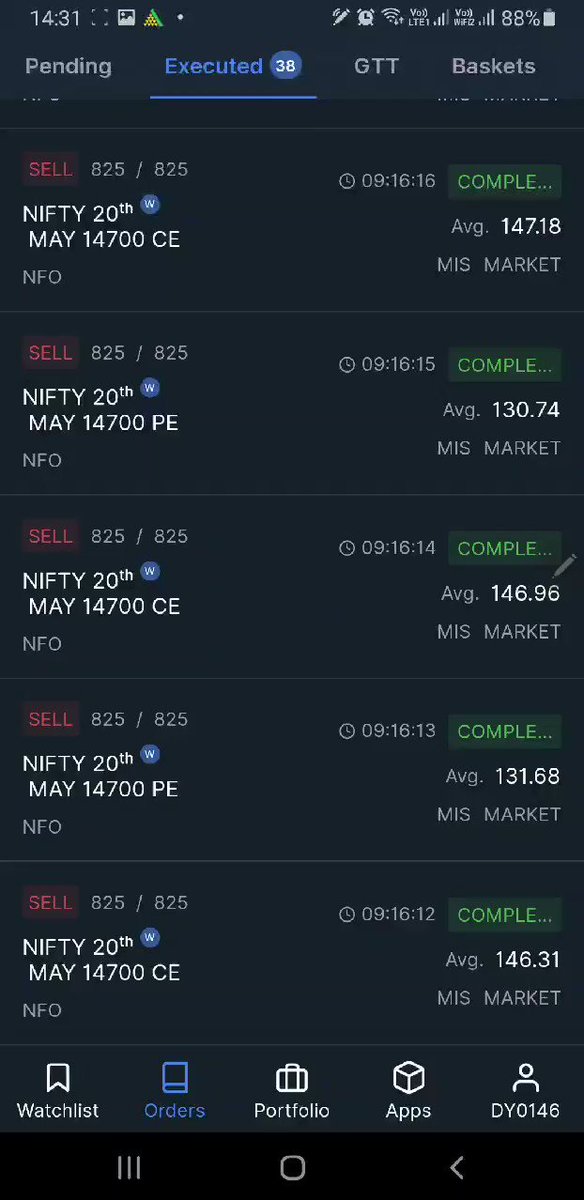

Rest can be made by selling far otm penny options only on expiries. They are trading at good premiums due to leverage and can be easily manageable if goes wrong. Thus targeting only 0.15% returns in a week

0.15% x 52 weeks = 7.8%

6% in MFs + 7.8% in trading = 14% returns

(3/4)

Now comes the hard part, doing this every week without getting bored and without affecting one's psychology is the most difficult part. And since we start making money, we take higher risks which can eventually wipe out profits.

(4/4)

And those who think about blackswan event all the time can do it only call side. And it's purely intraday & only will be done on expiry days, so chance of Black Swan, that too on upper side is mostly impossible. If there is any case as such before, do let know in comments

More from Stockslearnings

Thread's on:

• How to find targets and exit criteria?

• Shanon's Demon (Investing)

• Tradingview scanner- Intraday/BTST

• 90-degree angle inflection point for profit-booking

• Importance of Leverage

Other cool tweets as well.

🧵Shannon's Demon - an investing "thought exercise"

This account writes the best threads, if you like the threads I make, you will surely love this account. Must

1/

— 10-K Diver (@10kdiver) October 23, 2021

Get a cup of coffee.

In this thread, I'll walk you through Shannon's Demon.

This is an investing "thought exercise" -- posed by the great scientist Claude Shannon.

Solving this exercise can teach us a lot about favorable vs unfavorable long-term bets, position sizing, etc.

🧵Finding expected targets and exit criteria to look for to exit the

How to find out the expected targets and what should be the exit criteria when you enter a trade - \U0001f9f5

— Sheetal Rijhwani (@RijhwaniSheetal) October 25, 2021

Possible ways to find out the target:

Check if any patterns forming - it gets quite easy to figure out the targets that way. (1/15)

🧵Trading View Scanner process to trade in momentum stocks.

Trading view scanner process -

— Vikrant (@Trading0secrets) October 23, 2021

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today) https://t.co/GGWSZXYMth

🧵90-degree angle inflection point for

The 90 degree angle inflection point in a stock is a signal to book profit

— Nikita Poojary (@niki_poojary) October 24, 2021

Lets understand with a recent example of a stock #IRCTC \U0001f683\U0001f68b

Time for a thread\U0001f9f5