#CandleTrading : #Bullish

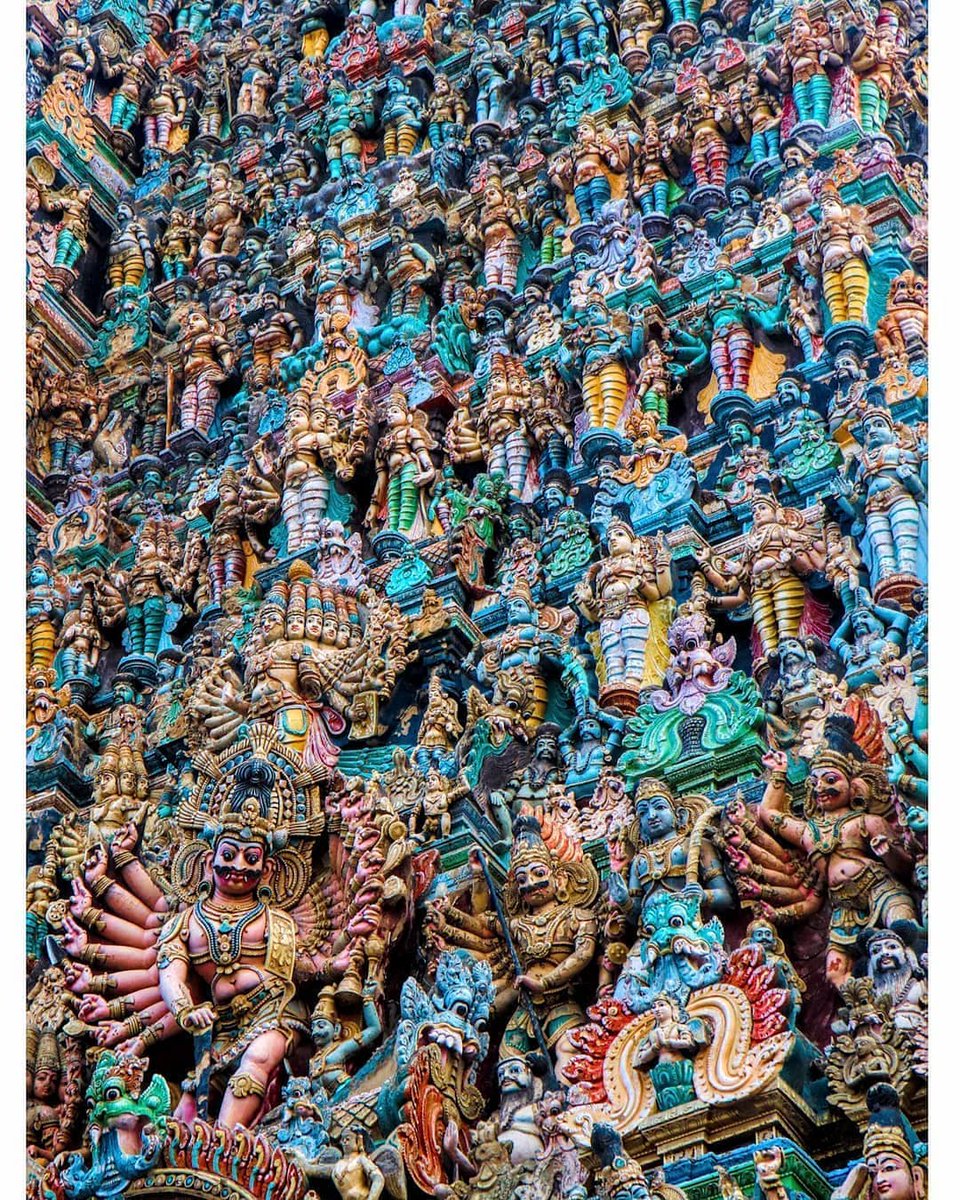

Attached below are some of the latest observations on the recently discussed 'Lord #NarsimhaPattern' for your #learning.

For detailed information on characteristics do go through my previous post related to the same.

Charts attached below (1/9)👇👇

More from Sacchitanand Uttekar

#Adaniports #ESCORTS #IOC were some of its recent spots

Latest occurrence getting confirmed #BHEL #BOSCH #CANBK #MGL & #BANKNIFTY ☺️

Watch out for these 🎁

#CandleTrading : #Bullish

— Sacchitanand Uttekar (@USacchitanand) August 24, 2021

'Lord #NarsimhaPattern' in #M&MFinancial \U0001f64f\U0001f64f .Check properties \U0001f60a#Pattern #Psychology :

First long bar depicts the long pillar from which the lord emerges & kills the negativity pic.twitter.com/gF0mu4qHLR https://t.co/Fb2WUq1fJZ

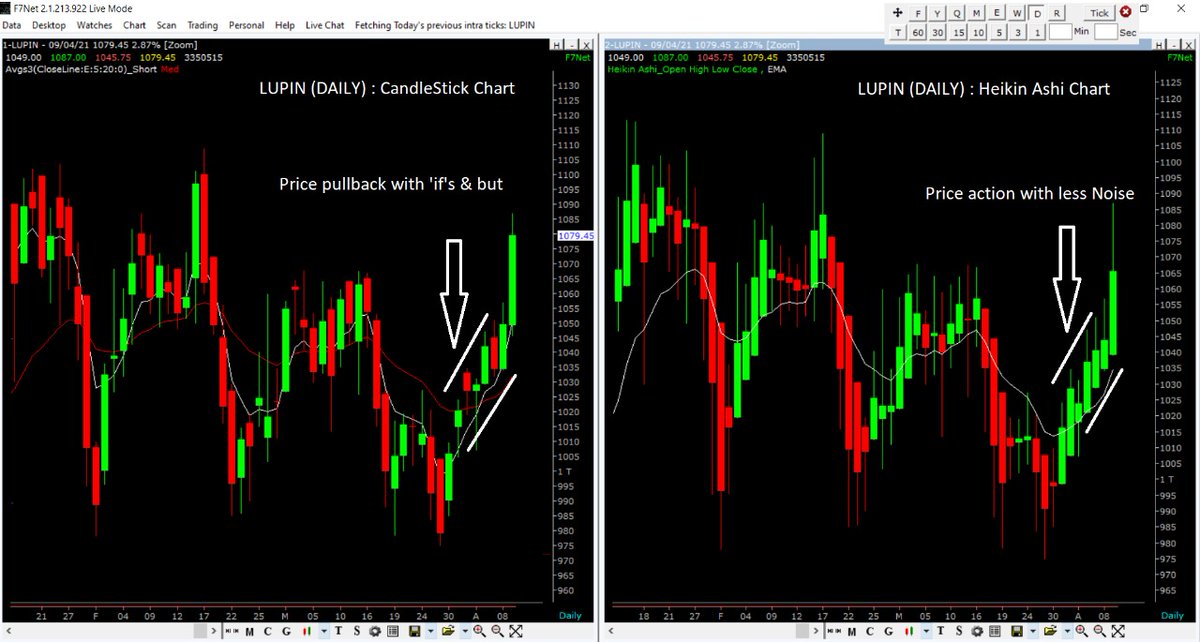

✅ #Candlesticks to spot reversal

+

☑️ #HeikinAshi to capture/ride the trend

Why ? Coz, Heikin dependence on previous candle data delays its signal.

Ideal combination for #Traders; By keeping both the time scales constant.

Do try it 🤗 https://t.co/VSv8lhkAAq

#CandleTrading Mega move

— Sacchitanand Uttekar (@USacchitanand) April 10, 2021

\u2705 #Candlesticks to spot reversal

+

\u2611\ufe0f #HeikinAshi to capture/ride the trend

Why ? Coz, Heikin dependence on previous candle data delays its signal.

Ideal combination for #Traders; By keeping both the time scales constant.

Do try it \U0001f917

More from Stocklearnings

Kindly RETWEET and LIKE if you feel our efforts adding to your knowledge.

🩸Types of

There are 4\u20e3 type of #BREAKOUTS

— The Chartians (@chartians) January 22, 2021

1\u20e3 Breakout with no retest

2\u20e3 Breakout with a re-test

3\u20e3 Breakout with a hard re-test

4\u20e3 Failed breakout.

We Will Explain it one by one with examples. Kindly Retweet it if you find it useful. #Nifty

🩸 Detailed guide on TX, a free trading tool by

A detailed guide on #TX3 by @EdelweissFin

— The Chartians (@chartians) August 8, 2021

Software worth 50,000/- for F R E E \U0001f3c6

Scroll down \U0001f447 for detailed analysis

(Using for 2+years)

User guide PDF \U0001f4d9 https://t.co/Ke7Bn2jRO8 #chartians #momentum #StockMarketindia #trading #tx3 #edelweiss pic.twitter.com/6M7TCYpPLc

🩸 Fibonacci retracement and golder ratio - Part

\U0001fa78FIBONACCI retracement and GOLDEN RATIO - PART 2

— The Chartians (@chartians) August 8, 2021

Before we move forward, kindly like and retweet if you find our content is adding something to your knowledge. pic.twitter.com/HDlcOa5ZPP

🩸 Fibonacci retracement and golden ratio - Part

\U0001fa78FIBONACCI retracement and GOLDEN RATIO

— The Chartians (@chartians) August 7, 2021

Before we move forward, kindly like and retweet if you find our content is adding something to your knowledge. pic.twitter.com/iVC6W3pqks