https://t.co/pdkK0QheoT

— Harsh (@HarshAsserts) September 11, 2020

— Harsh (@HarshAsserts) September 11, 2020

When trading,moods will want to influence ur decisions

— Banknifty Addict (Gaurav) (@BankniftyA) December 29, 2019

How to minimize:

-Have a backtested plan/system

-Know yourself(emotion and panic levels)

So trade size is important to keep ur emotions in check

-dont focus too much on pnl

-have a back up plan ready

& last stay positive!!

Backtest the complete expiry and practice again and again till u develop conviction

— Banknifty Addict (Gaurav) (@BankniftyA) November 5, 2020

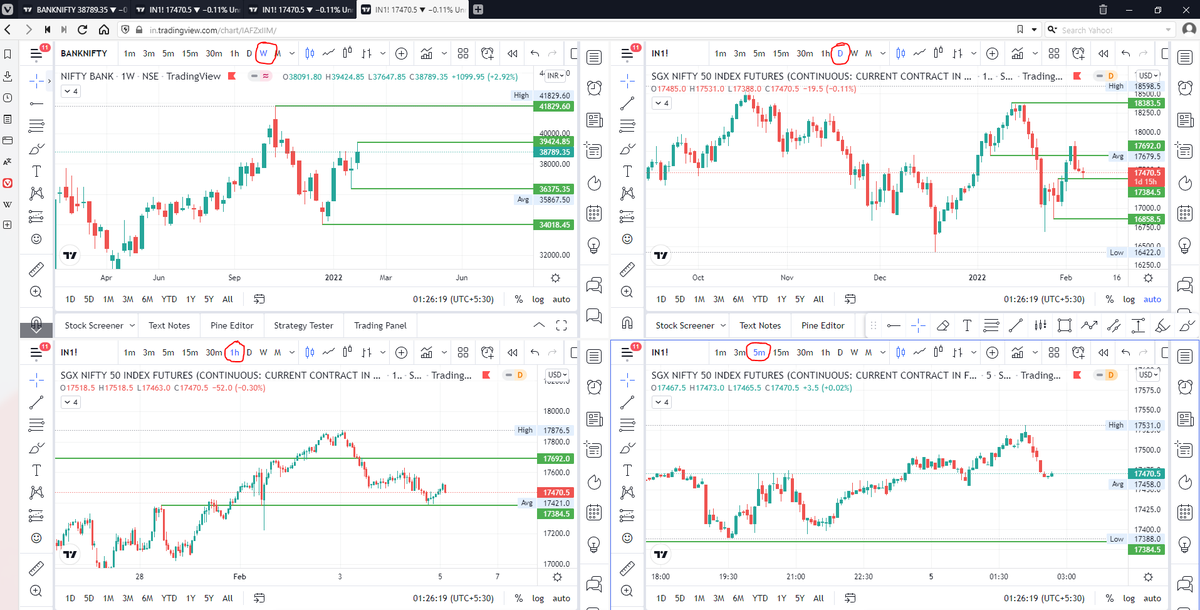

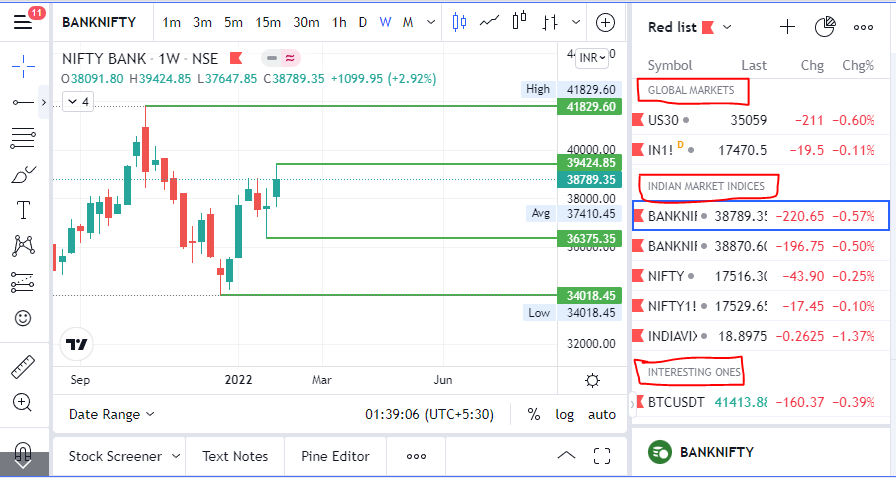

Support and resistance levels based on technical charts on various time frames.

— Banknifty Addict (Gaurav) (@BankniftyA) December 19, 2019

Breaking any of the above, leads to a direction

and then only directional play.

Premium is not fixed. Depends upon conviction on that strike.

— Banknifty Addict (Gaurav) (@BankniftyA) April 1, 2020

Quantity again as per my conviction.

Suppose premium at 50,and I can sell total 5k qty, so here I will sell 1500 qty and keep on pyramiding once it started going down with volume.

Bcz these days banknifty has become highly volatile and moves of 300-400 points comes within 5-10 mins

— Banknifty Addict (Gaurav) (@BankniftyA) September 24, 2019

So sl of 20 points in option is too less

For selling : U need to play OTM options with less than 50 points premium and in the direction of trend.

Very true... Only focus is which all strikes will be zero.

— Banknifty Addict (Gaurav) (@BankniftyA) October 17, 2019

Those who thinks OI data is the key to write options will be killed eventually.

— Banknifty Addict (Gaurav) (@BankniftyA) June 26, 2019

Only experience will be the key to all the locks.

If u trade expiry as per the trend with proper risk reward then i expect u to earn some xyz amount.

— Banknifty Addict (Gaurav) (@BankniftyA) August 1, 2019

Out of that earned amount atleast 10% can be risked (where loss is limited) to get a returns like 5x-10x

I agree that risk reward is not good when it comes to selling options.

— Banknifty Addict (Gaurav) (@BankniftyA) October 10, 2019

But chances of winning is more in selling bcz of theta decay if u know the direction.

Importantly u also need to know how to manage your position when market goes in other direction.

I do that.... Since day 1

— Banknifty Addict (Gaurav) (@BankniftyA) November 14, 2019

Also we must re-analyze our loss making trades that what went wrong...and try not to repeat our mistakes

This improves accuracy

Stocks to keep in radar for tomorrow

— Banknifty Addict (Gaurav) (@BankniftyA) December 18, 2019

-Indusind Bank

-Muthoot

-Manapuram

-Maruti

-Ibulhsgfin

-Titan

-LT

-Kotak

-justdial

If u see any surge in Volume, then go in the direction of trend. Expecting ba trending movement in them within 1-2 days max.

Dow theory. HH-HL

— Banknifty Addict (Gaurav) (@BankniftyA) August 1, 2020

LH and LL

Yesterday there were only call writers

— Banknifty Addict (Gaurav) (@BankniftyA) January 2, 2020

And today in morning there were huge volume in buying side.

That was a clear indication of trap day and on trap day market usually don't give chance to trappers to exit(call sellers in our case)

So OI Data don't work in such cases

These are called trap days. The moment bnf sustained the gap today ...meant it will trap call sellers who sold aggressively calls yesterday.

— Banknifty Addict (Gaurav) (@BankniftyA) January 9, 2020

Generally it goes down for few minutes and immediately goes up and keep going up....

Also sometimes closes around days high.

1)Never buy a put when market close around day high.Infact cut Ur position even in loss when u see market closing around day high

— Banknifty Addict (Gaurav) (@BankniftyA) June 6, 2020

2) if market sustains the gap tomorrow morning & keep going higher exit.

When it gets rejection from higher level then hold til it don't take support

If market sustains the gap and keep moving up, to trap shorters further. Exit loss making side. Hold only if u see rejections. And gap not sustaining.

— Banknifty Addict (Gaurav) (@BankniftyA) June 6, 2020

Suggestion: whenever market closing around day high/low. Avoid short straddle/strangle bcz chance of gap up/down is there.

At around 10.30 am when market made higher high and start going up. Got clear idea that it won't be a bearish day. And it kept on making higher high.

— Banknifty Addict (Gaurav) (@BankniftyA) June 12, 2020

So was sure that market would end around day high.

There's no rocket science behind it.

— Banknifty Addict (Gaurav) (@BankniftyA) August 17, 2020

When OI start going down and price start going up where the whole day trend is negative, then shorters will run to cover their positions, which will ultimately move the price up and thus causing short covering. pic.twitter.com/dnTbb8vIFu

Today's charts and graphical explaination pic.twitter.com/n7b2tTqIGn

— Banknifty Addict (Gaurav) (@BankniftyA) August 28, 2020

Correct

— Banknifty Addict (Gaurav) (@BankniftyA) September 16, 2020

Add more.Once price move up sharply, and consolidate in a narrow range, means it is preparing for next up move (12:50-1:30 pm)

Also, the downmove was rejected(1pm around)with volume, now shorters will be trapped and market will close around high bcz of short covering. https://t.co/DfHicd5KNx

Girana vala OI. Samjh ke bahar h...

— Banknifty Addict (Gaurav) (@BankniftyA) September 10, 2020

U must avoid and follow price action pic.twitter.com/NeRtqiaT91

Strong charts intraday, high volume compared to last 5 days, closing around high....

— Banknifty Addict (Gaurav) (@BankniftyA) September 11, 2020

Reliance

— Banknifty Addict (Gaurav) (@BankniftyA) September 13, 2020

TCS

HUL

Hdfcbank

Airtel

HDFCAMC

3M

Sanofi

Abbott india

And many more which I am not able to remember.

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

https://t.co/Ngoc5bh906 Thank Mahek bhai for making this video basis my set up which i have been following since past 2 yr I\u2019m not promoting this software, neither I 'll gain any referral if anyone subscribes for this software ,Purpose is to share help fellow traders!\U0001f60a

— itrade(DJ) (@ITRADE191) September 5, 2021

5. A THREAD on . . . .

— Aditya Todmal (@AdityaTodmal) July 11, 2021

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.https://t.co/YiYYaIReNS

6. Thread on how @ITRADE191 made 3 lakhs in 2 days.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

You will need:

1. Pivots

2. Vwap

3. PDL/PDH (Previous day high/low)

4. Advance/Decline Ratio.https://t.co/o9tLOaLpEh

7. DJ @ITRADE191 multiple chart analysis for INTRADAY TRADING.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm biashttps://t.co/qZQCWOSisa

For three years I have wanted to write an article on moral panics. I have collected anecdotes and similarities between today\u2019s moral panic and those of the past - particularly the Satanic Panic of the 80s.

— Ashe Schow (@AsheSchow) September 29, 2018

This is my finished product: https://t.co/otcM1uuUDk

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."