one thing in Swordfish that bothered me was the scene where Jackman is forced at gunpoint to let a woman give him oral sex while he tries to hack into the defense department. 1

More from Society

1/ One year of destroyed economies, social isolation & deep social splits calls for an anniversary ⬇️thread ⬇️ to celebrate the RT-qPCR manuscript by Christian Drosten (@c_drosten) & Victor Corman (@vmcorman), submitted on 21st Jan 2020 to @Eurosurveillanc. #UnbiasedScience

2/ Before this very publication, virologists were neither treated like superstars, nor were they considered icons or half-gods. In 2009, Drosten almost succeeded in installing the false premise virology could supersede holistic medical sciences as discussed in this thread.

3/ Drosten is a virologist. He neither has any background in epidemiology, nor has he ever worked in the civil service. He also doesn’t have a background in public health. Yet he and his colleagues affect our daily lives to the level of whom to meet up or how to flush the toilet.

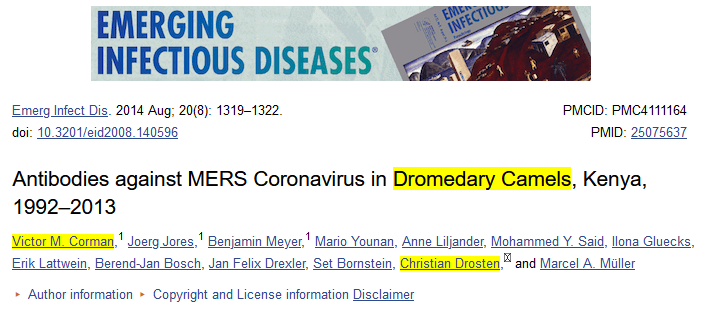

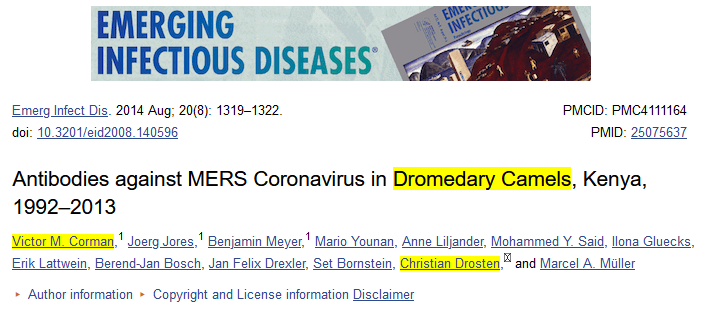

4/ Before January 2020, Drosten and Corman were common virologists at Charité Berlin, whenever they were not involved in economic implications (https://t.co/UTDwG8U7Du). Other than that, they looked at coronaviruses in dromedary calves in the Middle East or Africa. 😍 #cute

5/ Finally in Jan 2020, the published paper laid the theoretical grounds for the current pandemic, the RT-qPCR mass testing-religion, for which he was awarded his second German Federal Cross of Merit (he received the first one in 2005 for developing the SARS-CoV PCR test).

2/ Before this very publication, virologists were neither treated like superstars, nor were they considered icons or half-gods. In 2009, Drosten almost succeeded in installing the false premise virology could supersede holistic medical sciences as discussed in this thread.

3/ Drosten is a virologist. He neither has any background in epidemiology, nor has he ever worked in the civil service. He also doesn’t have a background in public health. Yet he and his colleagues affect our daily lives to the level of whom to meet up or how to flush the toilet.

4/ Before January 2020, Drosten and Corman were common virologists at Charité Berlin, whenever they were not involved in economic implications (https://t.co/UTDwG8U7Du). Other than that, they looked at coronaviruses in dromedary calves in the Middle East or Africa. 😍 #cute

5/ Finally in Jan 2020, the published paper laid the theoretical grounds for the current pandemic, the RT-qPCR mass testing-religion, for which he was awarded his second German Federal Cross of Merit (he received the first one in 2005 for developing the SARS-CoV PCR test).

You May Also Like

And here they are...

THE WINNERS OF THE 24 HOUR STARTUP CHALLENGE

Remember, this money is just fun. If you launched a product (or even attempted a launch) - you did something worth MUCH more than $1,000.

#24hrstartup

The winners 👇

#10

Lattes For Change - Skip a latte and save a life.

https://t.co/M75RAirZzs

@frantzfries built a platform where you can see how skipping your morning latte could do for the world.

A great product for a great cause.

Congrats Chris on winning $250!

#9

Instaland - Create amazing landing pages for your followers.

https://t.co/5KkveJTAsy

A team project! @bpmct and @BaileyPumfleet built a tool for social media influencers to create simple "swipe up" landing pages for followers.

Really impressive for 24 hours. Congrats!

#8

SayHenlo - Chat without distractions

https://t.co/og0B7gmkW6

Built by @DaltonEdwards, it's a platform for combatting conversation overload. This product was also coded exclusively from an iPad 😲

Dalton is a beast. I'm so excited he placed in the top 10.

#7

CoderStory - Learn to code from developers across the globe!

https://t.co/86Ay6nF4AY

Built by @jesswallaceuk, the project is focused on highlighting the experience of developers and people learning to code.

I wish this existed when I learned to code! Congrats on $250!!

THE WINNERS OF THE 24 HOUR STARTUP CHALLENGE

Remember, this money is just fun. If you launched a product (or even attempted a launch) - you did something worth MUCH more than $1,000.

#24hrstartup

The winners 👇

#10

Lattes For Change - Skip a latte and save a life.

https://t.co/M75RAirZzs

@frantzfries built a platform where you can see how skipping your morning latte could do for the world.

A great product for a great cause.

Congrats Chris on winning $250!

#9

Instaland - Create amazing landing pages for your followers.

https://t.co/5KkveJTAsy

A team project! @bpmct and @BaileyPumfleet built a tool for social media influencers to create simple "swipe up" landing pages for followers.

Really impressive for 24 hours. Congrats!

#8

SayHenlo - Chat without distractions

https://t.co/og0B7gmkW6

Built by @DaltonEdwards, it's a platform for combatting conversation overload. This product was also coded exclusively from an iPad 😲

Dalton is a beast. I'm so excited he placed in the top 10.

#7

CoderStory - Learn to code from developers across the globe!

https://t.co/86Ay6nF4AY

Built by @jesswallaceuk, the project is focused on highlighting the experience of developers and people learning to code.

I wish this existed when I learned to code! Congrats on $250!!

Nano Course On Python For Trading

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you’re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

... on the go). You will not be required to install python in your PC but you will be using an amazing python editor, Google Colab Visit https://t.co/EZt0agsdlV

This course is for anyone out there who is confused, frustrated, and just wants this python/finance thing to work!

In Module 1 of this Nano course, we will learn about :

# Using Google Colab

# Importing libraries

# Making a Random Time Series of Black Field Research Stock (fictional)

# Using Google Colab

Intro link is here on YT: https://t.co/MqMSDBaQri

Create a new Notebook at https://t.co/EZt0agsdlV and name it AnythingOfYourChoice.ipynb

You got your notebook ready and now the game is on!

You can add code in these cells and add as many cells as you want

# Importing Libraries

Imports are pretty standard, with a few exceptions.

For the most part, you can import your libraries by running the import.

Type this in the first cell you see. You need not worry about what each of these does, we will understand it later.

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you’re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

... on the go). You will not be required to install python in your PC but you will be using an amazing python editor, Google Colab Visit https://t.co/EZt0agsdlV

This course is for anyone out there who is confused, frustrated, and just wants this python/finance thing to work!

In Module 1 of this Nano course, we will learn about :

# Using Google Colab

# Importing libraries

# Making a Random Time Series of Black Field Research Stock (fictional)

# Using Google Colab

Intro link is here on YT: https://t.co/MqMSDBaQri

Create a new Notebook at https://t.co/EZt0agsdlV and name it AnythingOfYourChoice.ipynb

You got your notebook ready and now the game is on!

You can add code in these cells and add as many cells as you want

# Importing Libraries

Imports are pretty standard, with a few exceptions.

For the most part, you can import your libraries by running the import.

Type this in the first cell you see. You need not worry about what each of these does, we will understand it later.