@profplum99 @hkuppy @Convertbond @contrarian8888 @jam_croissant @pineconemacro @verdadcap @WayneHimelsein @LT3000Lyall @HFI_Research @SahilBloom @coloradotravis @SantiagoAuFund

This year, for the first time, I started sharing my thoughts on various topics in Investing/Economics/Law.

Here’s a ‘Master Thread’ of my main write-ups this year.👇

@profplum99 @hkuppy @Convertbond @contrarian8888 @jam_croissant @pineconemacro @verdadcap @WayneHimelsein @LT3000Lyall @HFI_Research @SahilBloom @coloradotravis @SantiagoAuFund

9/19/2020 https://t.co/1RTLabcJh1

Why Inflation Will Kill the Ponzi Sector (and Catalyze the Long-Awaited Sector Rotation from Growth to Value)...

— BVDDY (@BvddyCorleone) September 19, 2020

A thread.

This topic was a black box to me a few weeks ago. I will try to crystallize what (I think) I now understand.

10/8/2020 https://t.co/LQuw7f3mqY

1- For the record, I\u2019m most convinced that the 2 primary drivers of this sector rotation will be i) fund flows and ii) the shift to fiscal stimulus. https://t.co/TQ2mUwHJhg

— BVDDY (@BvddyCorleone) October 8, 2020

10/10/2020 https://t.co/TmrFKWd2VW

Why the Biggest Risk in Finance is Inflation (and a rising 10Y Treasury Yield).

— BVDDY (@BvddyCorleone) October 10, 2020

A thread.

Hint: it has to do with the ubiquitous Risk Parity framework.

10/10/2020 https://t.co/sYYqVkAMsT

I\u2019m getting this question a lot. Where will inflation come from? What will cause it to rise?

— BVDDY (@BvddyCorleone) October 11, 2020

I know the opinions on inflation are many and varied, but here\u2019s my take.

A thread. https://t.co/0Y5yaqiBH9

10/12/2020 https://t.co/xH6bTTbxgv

1- Great chart. Deflationary downdrafts will not be extinguished, but throughout history, inflation is quite consistent.

— BVDDY (@BvddyCorleone) October 12, 2020

Note also that each low on the chart is higher than the previous, and so is each high. https://t.co/lmzCtWIcBS pic.twitter.com/3fmiEstDXV

10/14/2020 https://t.co/es50d3kTy9

Why We\u2019re on the Precipice of Another Bitcoin Mania...

— BVDDY (@BvddyCorleone) October 14, 2020

A thread.

Note: it has nothing to do with Bitcoin replacing fiat money anytime soon.

10/22/2020 https://t.co/NY60UVpa7P

Time for a thread about US NatGas and why it will surprise to the upside...

— BVDDY (@BvddyCorleone) October 22, 2020

There\u2019s an exceptional opportunity setting up in the energy space, in particular for US NatGas and related equities.

I\u2019ll explain the setup in this thread and also reveal my top pick. \U0001f920

10/24/2020 https://t.co/GFS0NwzCCT

The progression of price inflation can be explained in 3 stages:

— BVDDY (@BvddyCorleone) October 24, 2020

Stage 1: Low Inflation. Low inflation is when prices increase just a little. People don\u2019t much notice. Life goes on. https://t.co/G0G1covcsa

10/30/2020 https://t.co/tKQROIB4CT

This week was... interesting. The election turbulence that some were predicting finally materialized.

— BVDDY (@BvddyCorleone) October 30, 2020

The most notable day of the week, IMO, was Wednesday: stocks sold off by more than 3.5%, while Treasuries offered no protection.

Risk Parity continues to teeter.

A thread.

11/1/2020 https://t.co/xr1Z826pP8

I finally gave this episode a listen. Great and provocative interview as always from @ErikSTownsend.

— BVDDY (@BvddyCorleone) November 1, 2020

Below I\u2019ll share some general comments on MMT along with some thoughts that came to mind while listening to Erik\u2019s conversation with @StephanieKelton.

A thread. https://t.co/ORvjCZJyd8

11/09/2020 https://t.co/4XgQjlLeQt

Mega blowout in $QQQ / $IWN spread this morning.

— BVDDY (@BvddyCorleone) November 9, 2020

Energy complex on fire too. \U0001f525

Tech at incredibly stretched levels, with increasingly negative beta to C19.

Markets teaching us a lesson about fast & violent sector rotations. 1100bps this morning... Keep pushing till it snaps. pic.twitter.com/UHpFEJuZHu

11/10/2020 https://t.co/OON5foFBXd

Fantastic thread. Brief summary:

— BVDDY (@BvddyCorleone) November 10, 2020

-Mkt cap of lower real rate beneficiaries (tech, bonds, etc.) is ~$24T, comprising largest share of $SPX + $RTY mkt cap (69%) in history.

-Equities are positioned for deflation/lower real rates, when higher rates are more likely over next 12mos. https://t.co/yga7ifdUnw

11/13/2020 https://t.co/3wJgEsGt0Z

What a week.

— BVDDY (@BvddyCorleone) November 13, 2020

Tech (QQQ) -1.32%

Small Value (IWN) +8.82%

Energy (XLE) +17.04%

Who\u2019s having fun? pic.twitter.com/tyubwjZmuG

11/16/2020 https://t.co/PU4V0u9Qox

What\u2019s up with bond yields?

— BVDDY (@BvddyCorleone) November 16, 2020

The consensus scenario appears to be that yields stay pegged at zero forever and beyond. I just don\u2019t buy it.

Let\u2019s imagine why long term rates would rise (Part 1), and what would happen if they did, even if just a little (Part 2).

A thread. https://t.co/DfsG81HWbb

11/20/2020 https://t.co/HZdHgU3qae

The Next Bitcoin Mania is Here...

— BVDDY (@BvddyCorleone) November 20, 2020

The main thesis (explained in the thread below) has been that rising institutional demand coupled with an already-tiny float will catapult Bitcoin higher in the short to medium term.

Brief update.\U0001f447 https://t.co/es50d3kTy9

11/20/2020 https://t.co/eDhM1NzeZl

1- $GBTC makes it a lot easier for institutions and retirement accounts to own Bitcoin. So in a sense, it does increase demand, by increasing accessibility.

— BVDDY (@BvddyCorleone) November 20, 2020

Institutions that otherwise would not have been able to buy are now buying thanks to $GBTC (and other similar products). https://t.co/hekHzEVmEN

11/29/2020 https://t.co/gEg6cxZtRR

Why the Growth/Value Rotation is Likely Still in its Early Innings...

— BVDDY (@BvddyCorleone) November 30, 2020

A thread.

Lots of talk about whether this \u201cvalue pop\u201d in Nov will prove to be short-lived or whether it has legs. https://t.co/1RTLabcJh1

12/10/2020 https://t.co/21tvf0JjJc

Brief note on the Growth/Value Rotation.

— BVDDY (@BvddyCorleone) December 10, 2020

I have been using the $QQQ / $IWN ratio to proxy the Large Growth and Small Value factors respectively.

Admittedly, these are imperfect proxies, as they conflate Growth/Value factors with Momentum/Anti-Momentum factors. https://t.co/gEg6cxZtRR

12/20/2020 https://t.co/GPu8lfZay0

The problem with listening to @Jkylebass is that he can convince me of almost anything.

— BVDDY (@BvddyCorleone) December 21, 2020

Great episode nonetheless with many interesting topics covered. Kyle made some points that I think are worth discussing.

Here are some highlights.\U0001f447\U0001f447 https://t.co/oJHQkmOa3q

More from Society

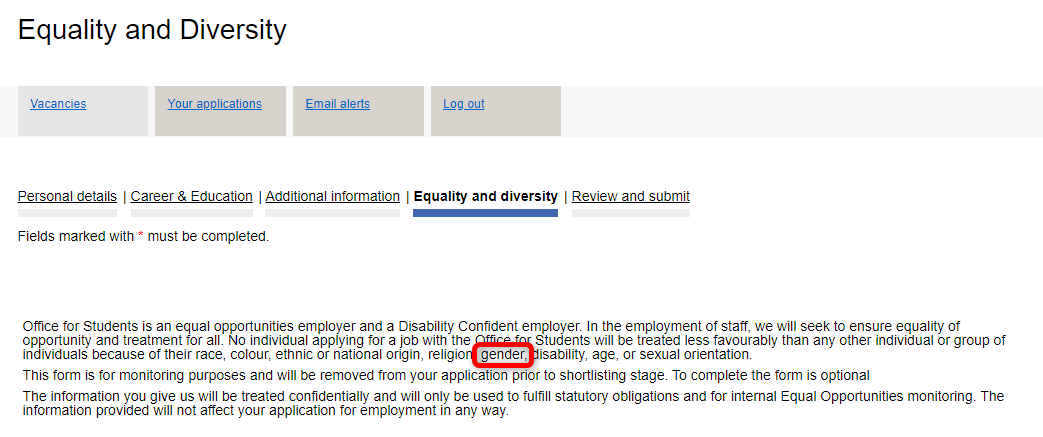

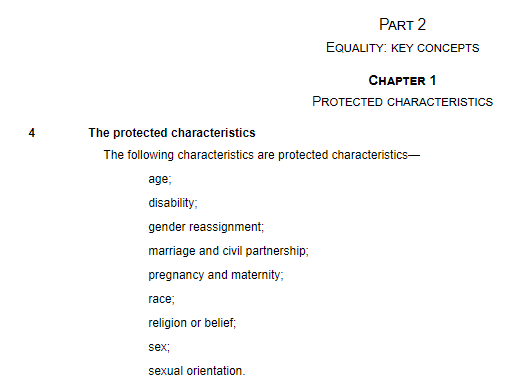

The Equality and Diversity section of your job application has 'gender' in what appears to be a list of the protected characteristics under the Equality Act 2010.

However...

1/15

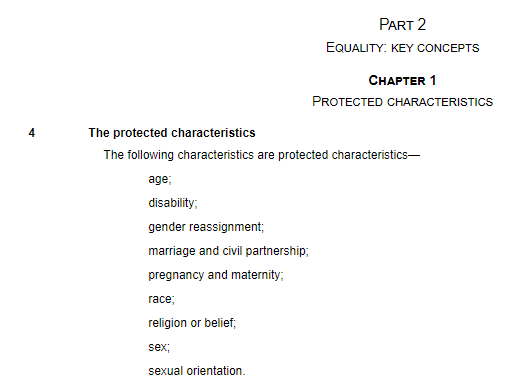

However, 'gender' is not a protected characteristic under the Equality Act 2010 and is not defined in the Act.

https://t.co/qisFhCiV1u

Sex is the protected characteristic under the Act, but that is not on your list.

2/15

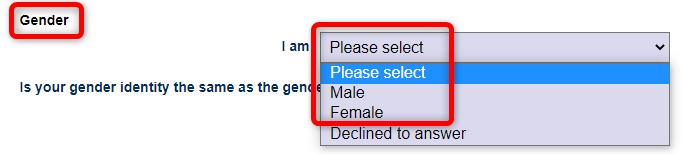

You then ask for the 'gender' of the applicant with options:

Male

Female.

3/15

Again, 'gender' is not a protected characteristic under the Equality Act 2010 and is not defined in the Act.

https://t.co/qisFhCiV1u

4/15

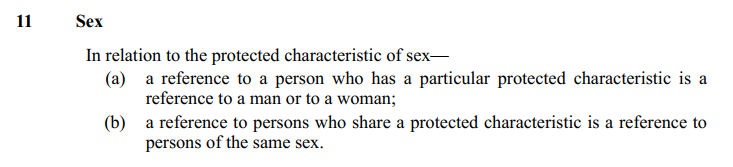

Sex is the protected characteristic and the only two possible options for sex are 'Female' and 'Male' as defined in the Act and consistent with biology, but you don't ask for that.

https://t.co/CEJ0gkr6nF

'Gender' is not a synonym for sex.

5/15

You May Also Like

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The famous \u201cLucy\u201d, an early ancestor of modern humans (Australopithecus) that lived 3.2 million years ago, and was discovered in 1974 in Ethiopia, displayed in the national museum in Addis Ababa \U0001f1ea\U0001f1f9 pic.twitter.com/N3oWqk1SW2

— Patrick Chovanec (@prchovanec) November 9, 2018

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹