/2

this methodology is a little complex, so let me explain what i did.

— el gato malo (@boriquagato) May 30, 2020

a few EU countries provide real day of death data. this lets us plot meaningful curves to show rate of disease change.

what struck me is how similar all the curves were.

everyone got the same shape. pic.twitter.com/bN0hILzoSl

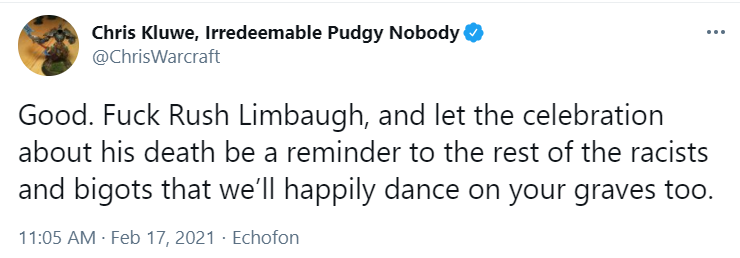

Good. Fuck Rush Limbaugh, and let the celebration about his death be a reminder to the rest of the racists and bigots that we\u2019ll happily dance on your graves too.

— Chris Kluwe, Irredeemable Pudgy Nobody (@ChrisWarcraft) February 17, 2021