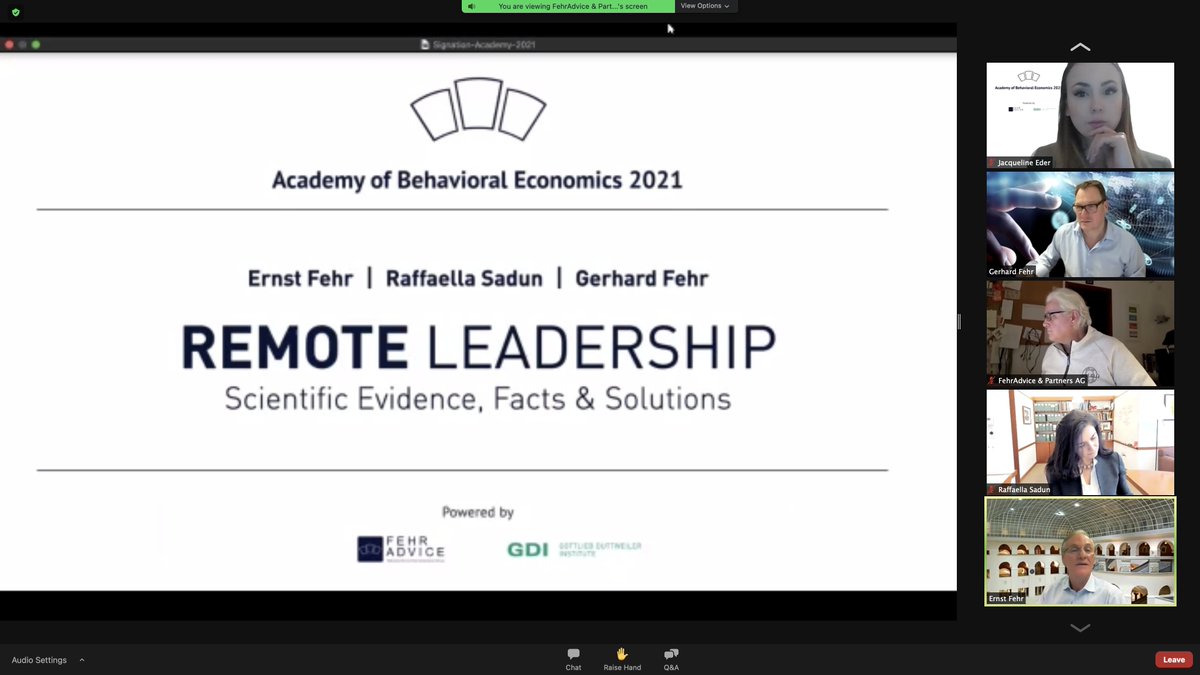

🧵 We're riding shotgun tonight. Here's a little thread on remote leadership with your's truly Ernst Fehr (@econ_uzh), @raffasadun and @Gerhard_Fehr. https://t.co/FcO1CFyRZk

What does good leadership look like when everyone works from home?\u2013Top scientists @raffasadun and Ernst Fehr will provide you with some answers on 27 January \u2013 online and for free in our Academy of Behavioral Economics https://t.co/Di6hRqPvAA

— G. Duttweiler Inst' (@GDInstitute) January 15, 2021

Ernst Fehr @econ_uzh #EconomicsForSociety

Ernst Fehr @econ_uzh #EconomicsForSociety

Ernst Fehr @econ_uzh #EconomicsForSociety

Ernst Fehr @econ_uzh #EconomicsForSociety

Ernst Fehr @econ_uzh #EconomicsForSociety

Ernst Fehr @econ_uzh #EconomicsForSociety

1. Think systematically

2. Set up a learning process

3. Structured delegation

@raffasadun @HarvardHBS

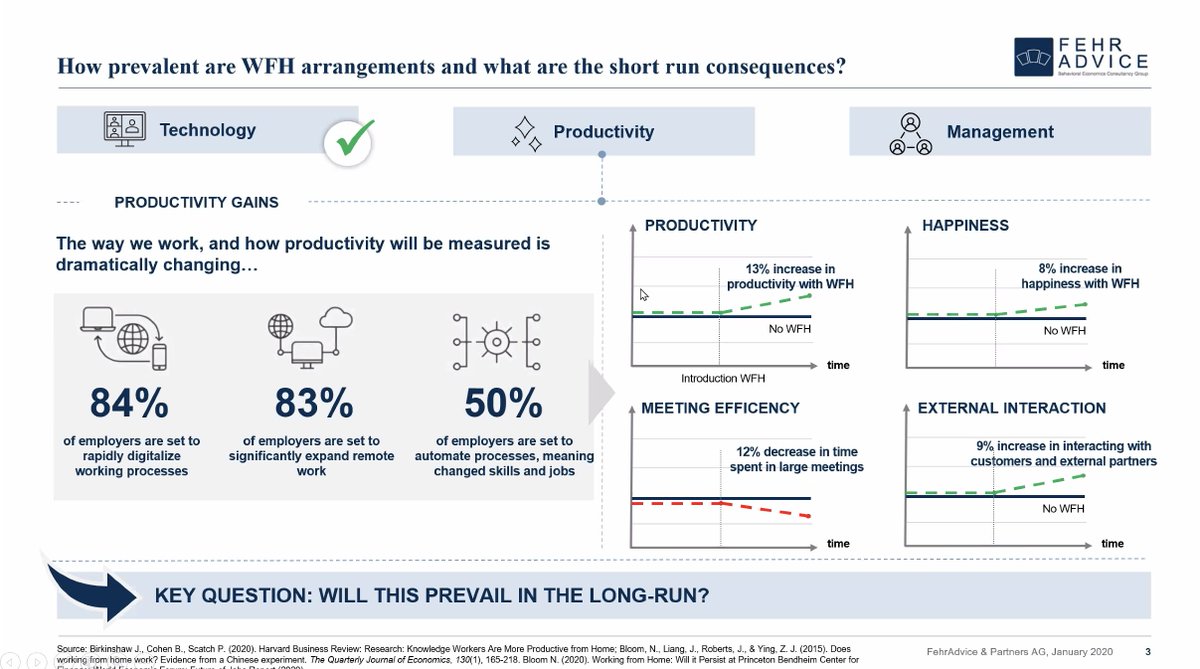

@Gerhard_Fehr @FehrAdvice

@Gerhard_Fehr @FehrAdvice

@Gerhard_Fehr @FehrAdvice

@Gerhard_Fehr @FehrAdvice

Ernst Fehr @econ_uzh

More from Society

Ready?

Create a private foundation and give it all away. 1/

Let's stipulate first that lottery winners often have a hard time. Being publicly identified makes you a target for "friends" and "family" who want your money, as well as for non-family grifters and con men. 2/

The stress can be damaging, even deadly, and Uncle Sam takes his huge cut. Plus, having a big pool of disposable income can be irresistible to people not accustomed to managing wealth. https://t.co/fiHsuJyZwz 3/

Meanwhile, the private foundation is as close as we come to Downton Abbey and the landed aristocracy in this country. It's a largely untaxed pot of money that grows significantly over time, and those who control them tend to entrench their own privileges and those of their kin. 4

Here's how it works for a big lotto winner:

1. Win the prize.

2. Announce that you are donating it to the YOUR NAME HERE Family Foundation.

3. Receive massive plaudits in the press. You will be a folk hero for this decision.

4. Appoint only trusted friends/family to board. 5/

You May Also Like

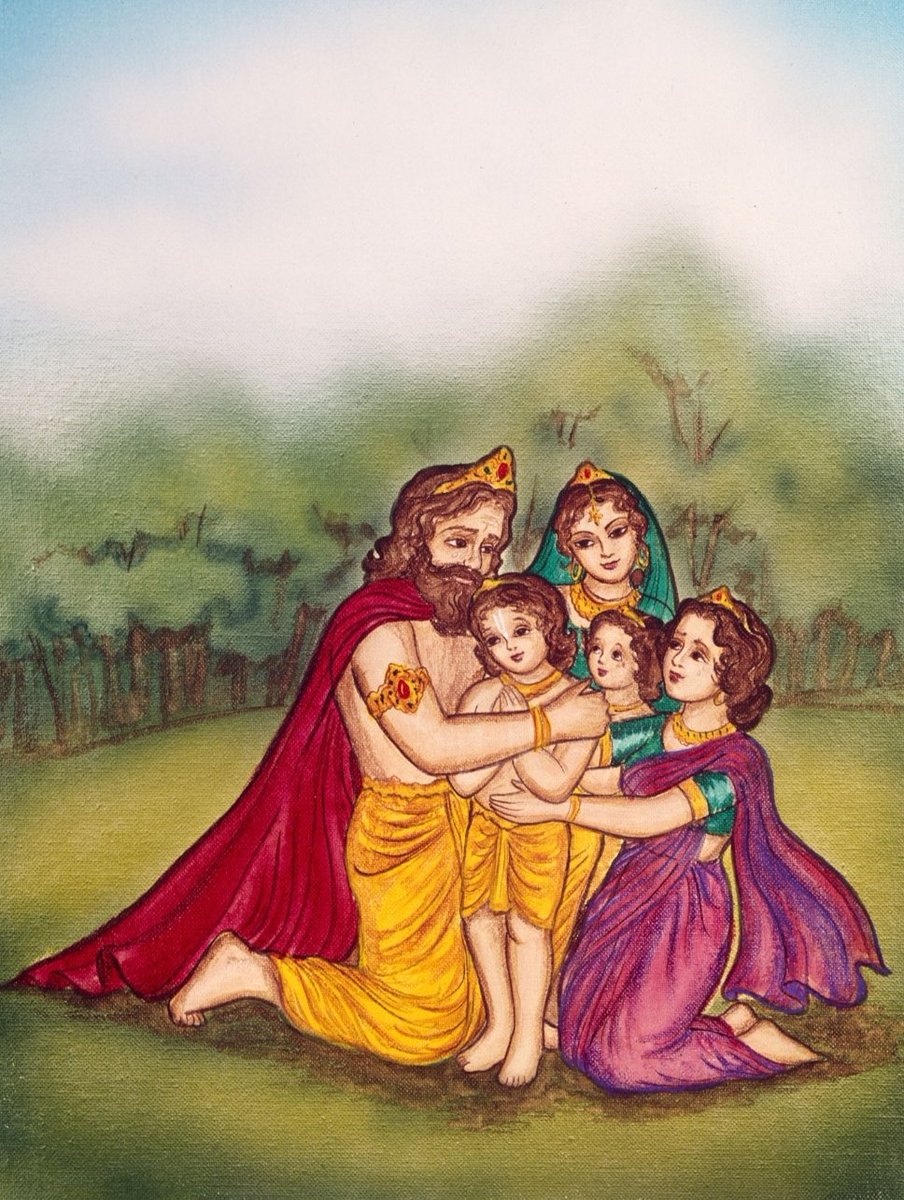

Once upon a time there was a Raja named Uttānapāda born of Svayambhuva Manu,1st man on earth.He had 2 beautiful wives - Suniti & Suruchi & two sons were born of them Dhruva & Uttama respectively.

#talesofkrishna https://t.co/E85MTPkF9W

Prabhu says i reside in the heart of my bhakt.

— Right Singh (@rightwingchora) December 21, 2020

Guess the event. pic.twitter.com/yFUmbfe5KL

Now Suniti was the daughter of a tribal chief while Suruchi was the daughter of a rich king. Hence Suruchi was always favored the most by Raja while Suniti was ignored. But while Suniti was gentle & kind hearted by nature Suruchi was venomous inside.

#KrishnaLeela

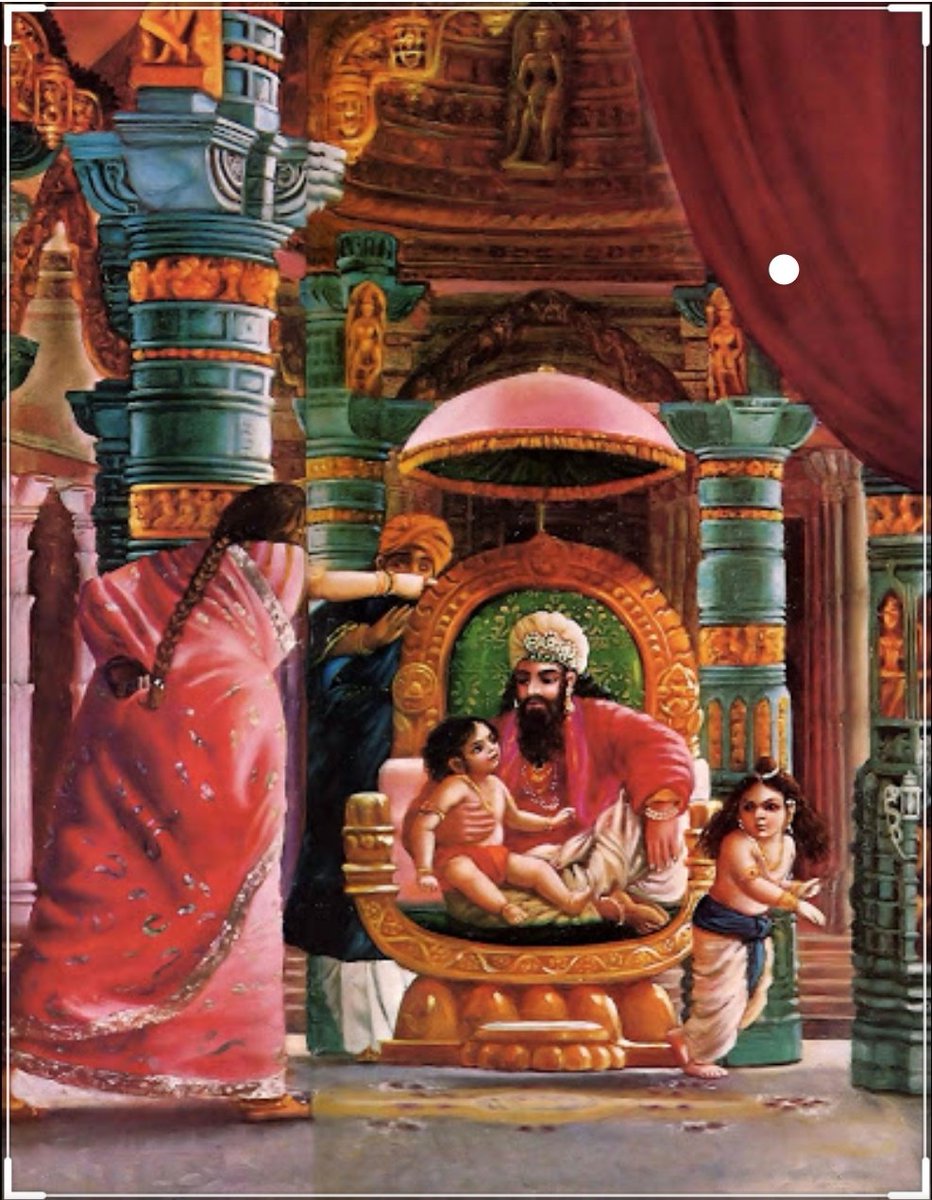

The story is of a time when ideally the eldest son of the king becomes the heir to the throne. Hence the sinhasan of the Raja belonged to Dhruva.This is why Suruchi who was the 2nd wife nourished poison in her heart for Dhruva as she knew her son will never get the throne.

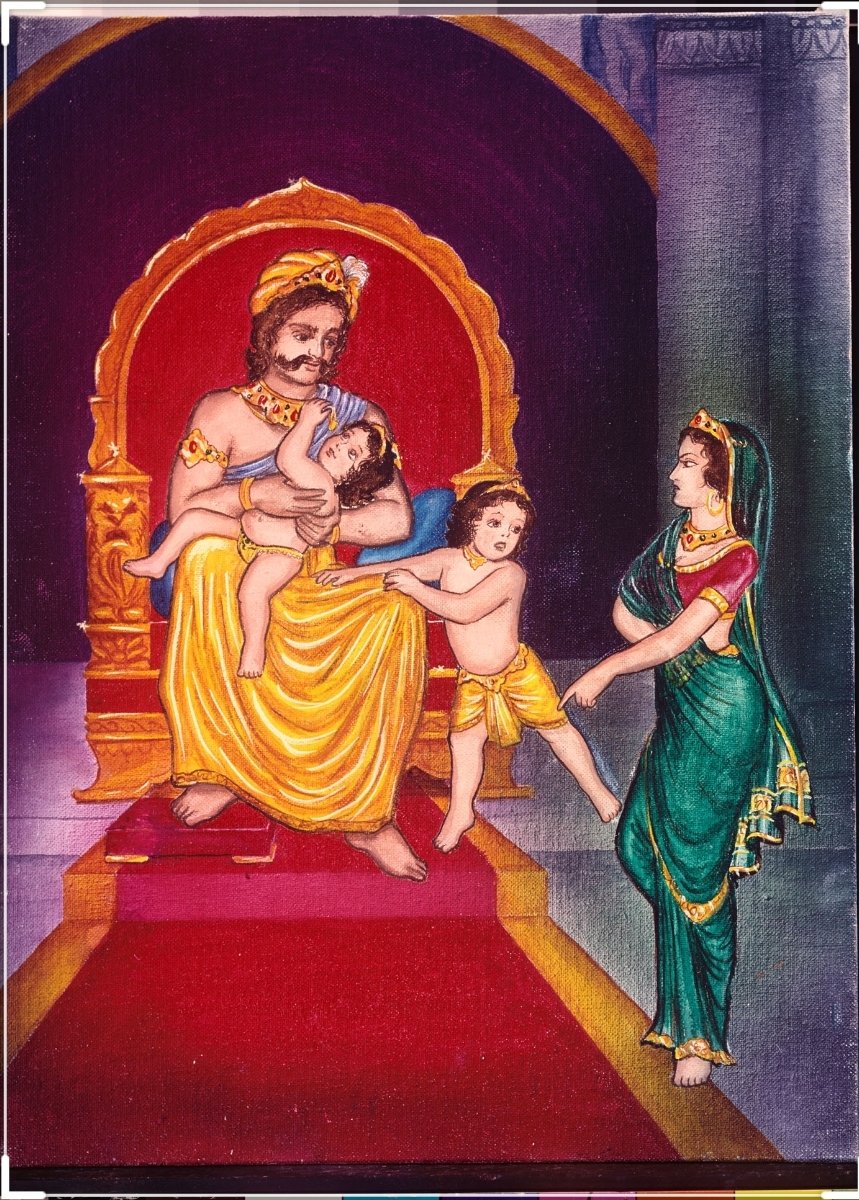

One day when Dhruva was just 5 years old he went on to sit on his father's lap. Suruchi, the jealous queen, got enraged and shoved him away from Raja as she never wanted Raja to shower Dhruva with his fatherly affection.

Dhruva protested questioning his step mother "why can't i sit on my own father's lap?" A furious Suruchi berated him saying "only God can allow him that privilege. Go ask him"

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5

As a dean of a major academic institution, I could not have said this. But I will now. Requiring such statements in applications for appointments and promotions is an affront to academic freedom, and diminishes the true value of diversity, equity of inclusion by trivializing it. https://t.co/NfcI5VLODi

— Jeffrey Flier (@jflier) November 10, 2018

We know that elite institutions like the one Flier was in (partial) charge of rely on irrelevant status markers like private school education, whiteness, legacy, and ability to charm an old white guy at an interview.

Harvard's discriminatory policies are becoming increasingly well known, across the political spectrum (see, e.g., the recent lawsuit on discrimination against East Asian applications.)

It's refreshing to hear a senior administrator admits to personally opposing policies that attempt to remedy these basic flaws. These are flaws that harm his institution's ability to do cutting-edge research and to serve the public.

Harvard is being eclipsed by institutions that have different ideas about how to run a 21st Century institution. Stanford, for one; the UC system; the "public Ivys".